FONTÃO, Henio [1], LOPES, Eloisa de Moura [2]

FONTÃO, Henio; LOPES, Eloisa de Moura. A Contingency Approach as a business strategy for the open innovation model. Multidisciplinary Core scientific journal of knowledge. 03 year, Ed. 05, vol. 01, pp. 68-76, may 2018. ISSN:2448-0959

Summary

The objective of this research was to analyze the influence of correlation of certain factors regarding technological profile of innovative companies on the return of the capital invested in innovation. The inferential statistical method, by means of techniques of design of experiments, from a factorial structure of unbalanced data. The survey sample was 70 innovative companies. In General, the results showed that some constraints lead companies to maximize your results with innovation. For example, when companies studied adopt open innovation systems at the same time, must maintain a rigid control of deadlines and budgets of new innovation projects. However, on the other hand, if companies do not adopt open innovation systems, then at least should do systematic research for new product development.

Keywords: Technological Profile, return on Capital invested in innovation, design of experiments, open innovation.

1. Introduction

As a condition for strategy formulation, Mintzberg, Ahlstrand and Lampel (2000) describe the contingency approach the Administration refers to the need of the companies compatibilizarem their resources, experience, capabilities and competencies to opportunities and threats of the external environment. In the external scenario, among other factors, has influence over organizations, technology. In this sense, it is important that companies meet and enjoy of your technological profile, and from the perspective of technology, technological profile is related to the expertise that the company acquires to strategically manage the technological innovation ( Saints; DOZ; WILLIAMSON, 2004; TIDD, 107 CHINESE FAMILY BUSINESSES, PAVITT, 2008; LEE, 2011).

The essence of innovation is in your technological compatibility, technical, social and economic standards of market acceptance and vice versa. Organizations that can manage these conditions, tend to dominate the business models that influence market behavior (ANDERSON; TUSHMAN, 1990).

For your nature, the processes of innovation are contingent, with high level of unpredictability and uncertainty about your performance, acceptance and return. On the other hand, the capitalization of knowledge and experience gives a cumulative innovation and evolution. These inhomogeneities in the behavior of the innovation cause important questions about the speed and costs of your generation, but also encourage the systematization and management of its processes as a means of technological domain. For Dosi (1991), these innovation strategies confer on companies ability to expand the rate of innovation and, consequently, technological domain (DOSI, 1991).

Despite the complexities and difficulties in managing technological innovation, the contingency approach on the technological profile of the enterprise should be adopted as a business strategy for the compatibility of the desired innovation (LEE, 2011).

In this research, it is considered as a primary requirement for an enterprise to evaluate your technology profile, turning it into an internal force for access to external sources of knowledge and innovation, an instrument developed from the compilation of 80 independent variables, which were adapted from the list-audit of innovation-by Tidd, 107 Chinese family businesses and Pavitt (2008).

Sample variables of this research were:

- the climate of support to new ideas;

- systematic research ideas for new products;

- open innovation;

- control of deadlines and budgets of new innovation projects;

- competitive intelligence.

In order to establish an inferential system for research, presents itself as the dependent variable – the return of the capital invested in innovation – as suggest Davila, Esptein and Shelton (2006). In this case, the hypothesis is that certain technological profile related variables significantly influence about the return of the capital invested in innovation. Therefore, the objective of this research was to analyze the influence of correlation of certain factors regarding technological profile of innovative companies on the return of the capital invested in innovation.

The inferential statistical method, by means of techniques of design of experiments, where the "observations" planned represented the "experiments". Montgomery (2004) States that the design of experiments is effective for business research. Other authors, such as: Lee (2011); Starkey, Aughton and Brewin (1997); Fontao and Lee (2010); Holland and Cravens (1973); FERRINI e Scarpa (2007); Fontão (2008) already use the design of experiments on research related areas systematically of business management.

2. Theoretical Foundation:

2.1 Technological profile, as a strategy for access to Innovation

One of the greatest challenges for managers in the formulation of strategies aimed at consolidating the technological domain is to systematize the processes for evaluation, selection, access, incorporation and/or mobilization of innovation. These processes can enable open innovation, which is a template, which, by your essence, already enables organizations to manage the innovation from the divisions of the internal and external environment (LEE, 2011).

Therefore, the likelihood of success of the processes of incorporation and expansion of the technological domain feature relationship directly proportional to external technology matching with the technological profile of the company (TIDD; 107 CHINESE FAMILY BUSINESSES; PAVITT, 2008; Saints; DOZ; WILLIAMSON, 2004; LEE, 2011).

For Santos, Doz and Williamson (2006) the definition of the technological profile of the companies includes some assumptions, such as:

- identification of technological needs of the enterprise;

- the need for technological profile, such as a company's strength increases as the radicalism of innovation;

- inflencia technological profile in the competitive strategies;

- not only the generic experience accumulated from a company, but, above all, focus on your essence (core business) are important in determining the technological profile;

- the technological profile best suited for an innovation or another, is defined as the accumulated experiences with the desired innovation processes.

The organization that manages access to sources of knowledge can increase your odds of innovation, in products, processes, services, etc.. However, on the other hand, this may incur increased costs of the entire innovation process. In theory, the decision of the technological profile must be assertive and companies need to persist in prospecting and access to pockets of knowledge, until the benefits exceed the costs of integration (Saints; DOZ; WILLIAMSON, 2006).

With so many elements involved in the process of innovation, access becomes necessary arising new models and strategies for access and the generation of innovations. Von Hippel (1986), Prahalad and Hamel (1990), Hamel (2000), Bovet and Martha (2001) state that is emerging the need for streamlined processes and ways to seek innovation, including the need for reconfiguration of the business.

Chesbrough (2003; 2007) with your model of open innovation to create manageable mechanisms in the process of exploration and innovation capitation. To Chesbrough (2003), firms must seek innovation in external sources, because, so they increase their percentage of innovations, but can also do new sets of technologies, in order to encourage the development of new products or develop new market segments.

Santos, Doz and Williamson (2004) claim that managers need to understand the factors that involve innovation in the world therefore seek innovations that are everywhere in the world is a rule rather than an exception. Companies need access and incorporate innovation, according to your own expertise.

A way to access innovation is the company meet its specific powers and essences, namely, your technological identity. As each company has your own identity technology, which, for your time, depends on their respective experiences, resources, capacities, among others (LEE, 2011).

It is expected that the company's technological capacity changes as she becomes more mature and experienced. Technological access, therefore, is a dynamic process which seeks a balance between technological profile, or better, the resources, the skills and competences of the company and the characteristics of the innovation in question. Another significant element is the ability of the company to show the value of joining the desired innovation, thus avoiding rejection of the Group and, consequently, minimizing the risks of incorporation (LEE, 2011).

In a judgment that the chronology of the technological innovations that administrative capacity is essential to overcoming the technical barriers and structural projects. Innovation is directly subject to the organizational competence and to sources of technical information. Therefore, the compatibility of the technological profile to external sources of innovation may define the success of the entire process of innovation of the Organization (Tidd, 107 Chinese family businesses and Pavitt, 2008).

3. Method and Research Techniques

The inferential statistical method, by means of techniques of design of experiments. The data, in unbalanced structure, were observed, following the quantitative factor analysis. Were established two levels of control in order to observe whether the change between levels caused significant differences on the dependent variable.

3.1 Population and sample

The population was 500 EBT ´ s-technology-based companies-operating in Brazil. However, the samples were bounded to the amount of 70 companies respondents, where each one of the respondents represented a note (experiment).

3.2 Research subjects and Informants ' profile

The choice of social subjects of research was carried out on the basis of the relevance of the experience of people with functions linked to innovation in technology-based companies, once, that for the effective management of innovation these elements are considered indispensable. After all, these professionals at different levels, have intrinsic knowledge about technological innovations in their organization, therefore, have the fundamental knowledge about the probabilistic behavior of the variables involved in the research and can respond with greater precision the matters highlighted in the data collection instrument.

3.3 dependent variable

In this research, the dependent variable is represented by the return of the capital invested in innovation and your respective valuation took place via structured questionnaire and closed, from indicators about the business objectives listed by Davila, Epstein and Shelton (2006). The values assigned for each of the respondents represented an observation (clinical trial).

The rationale adopted for assessment of dependent variables is based on the proposition that innovative organizations present affirmative responses and growing to meet the business objectives presented by Davila, Epstein and Shelton (2006).

3.4 independent variables

In order to select the independent variables, which were instrumental in identifying technological profile of the companies studied, categorized, from the list of Tidd, 107 Chinese family businesses and Pavitt (2008), the important elements for the identification of the technological profile of the companies.

The independent variables used to be instrumental in the identification of technological companies investigated identity, elementary and criticism were in the decision-making process specifically regarding the return of the capital invested in technological innovation. In this way the informants were able to measure each one of them through an elaborate scale in qualitative and quantitative approach.

80 factors were selected to be covered in the Group of the independent variables that impact the return of capital invested in technological innovation. These factors are part of the model of Tidd, 107 Chinese family businesses and Pavitt (2008) named audit of innovation. Therefore, the selection of these factors that defined the technological identity.

The universe of independent variables consisted of 80, factors which were subjected to statistical tests (f test) and from the findings, we identified the four most significant factors for maximizing variable dependent, IE: climate of support to new ideas; systematic research of ideas for new products; open innovation and control of deadlines and budgets of new innovation projects. It was subsequently selected a fifth variable-competitive intelligence-based conceptual assumption that this factor is significant for return on capital invested in technological innovation.

For each variable were imposed two distinct control levels, and low level represents that organizations do not adopt such practices and the high level represents that organizations adopt such practices. In this case, the application of practices and processes models described in each of the independent variables.

4. Responses and analysis: return of Capital invested in technological innovation

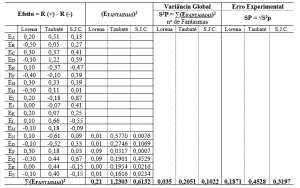

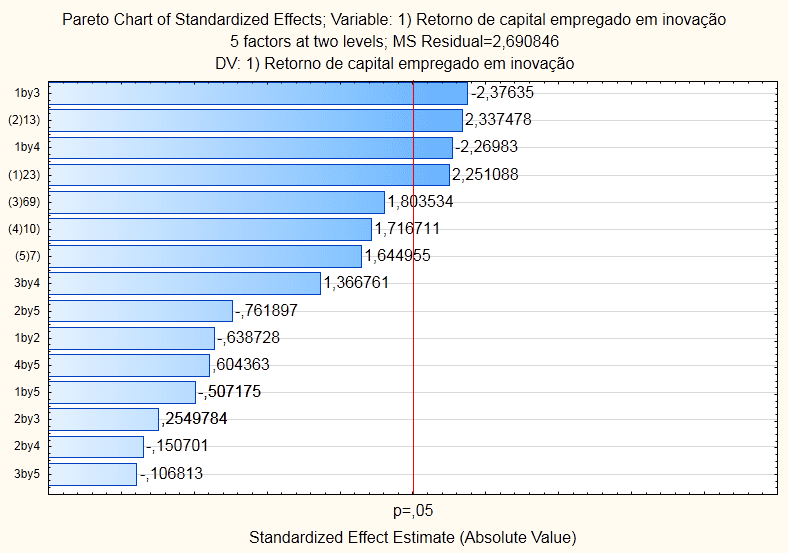

Arising from statistical calculations and in response to the significant factor test (climate of support for new idea) and (systematic research ideas for new products) were alone as significant and the factors (climate of support to new ideas) and (open innovation); (climate of support for new ideas and control of deadlines and budgets of new innovation projects) showed significance in second order interactions. As shown in Figure 01-Significance of the factors that impact the return of capital invested in innovation.

Have the variables (climate of support for new ideas and systematic research ideas for new products) as the most significant in isolation to return of capital invested in innovation, confirms the ideas of various authors, among them, Chesbrough (2003) ; Tushman and O'Reilly (1996), Tidd, 107 Chinese family businesses and Pavitt (2008), Yes, these authors claim that managers must encourage changes and provide environments that give support to new ideas and so do regular searches of ideas for new products.

For Birkinshaw and Gibson (2004) companies that emphasize performance management and social support create a climate favourable to employees feel free to achieve organizational objectives. Ratifies this idea, because the variable open innovation, in this model, shown interacting with climate of support for new ideas and the climate of support for new ideas, for your time, interacts with control of deadlines and budgets of new innovation project.

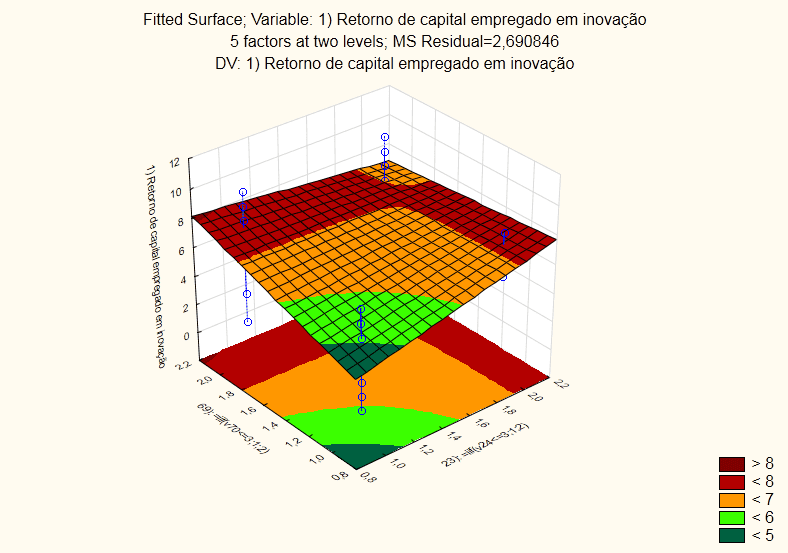

The following response surface analyses as a way to optimize the results obtained using the significance tests.

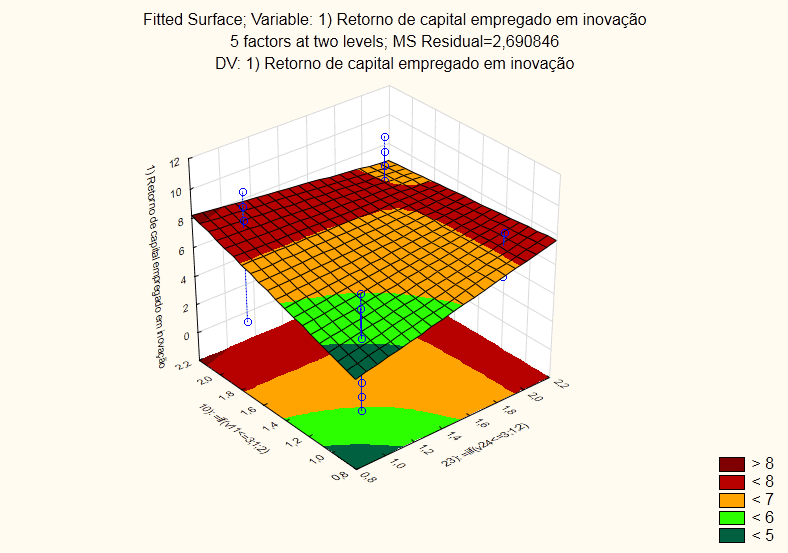

The interactions of factors (climate of support for new ideas and open innovation) are illustrated in Figure 02-response surface analysis for the interactions of the variables: climate of support for new ideas and open innovation.

In figures 02 and 03, the number 1 (low level) equates to the declination of the practices regarding the independent variables, while the number 2 (low level) is the victim of practices related to independent variables in the spotlight. In this sense, illustrative form, the intensity or amenity of dark red color represents greater or lesser significance of the factors at each level of control, respectively.

Figure 02 revealed that the interaction of the variables (climate of support for new ideas and open innovation) is significant for the dependent variable and the best adjustment of levels for the process is: maintain control in high level, for the variable open innovation and control low level, to the variable climate of support for new ideas.

Thus, it appears that this interaction, reveals that the company should use the concepts of open innovation for, optimally, the return of capital invested in innovation. This reply collaborates with Chesbrough studies (2008), which States that companies that seek to do research so "open", seek knowledge externally to increase and accelerate the achievement of results that add value to their business and maximize the return on capital invested in innovation.

For Gibson and Skarzynski (2008) the largest business opportunities can come from a company's assets and expertise with other organizations to generate new solutions. The author emphasizes that search strategies in the world of ideas and technologies that can be integrated with skills and organizational assets, help mainly to improve the return on capital invested in innovation.

The results obtained for the interaction between the factors (climate of support for new ideas and control of deadlines and budgets for innovation projects) are shown in Figure 03-response surface analysis for the interactions of the variables: climate of support for new ideas and control of deadlines and budgets for innovation projects.

Paying attention to the Figure 03 realizes that the best fit of the process suggests, from the interaction of two variables in question that companies must direct control of deadlines and budgets for new innovation projects, related inversely proportional support for new ideas.

In a way, these results confirm the opinion of authors such as: Christensen, Anthony and Roth (2007); Tidd, 107 Chinese family businesses and Pavitt (2008); Chesbrough (2008) and Davila, Esptein and Shelton (2006), since these ensure that organizations with an interest in innovation must assess and manage projects and deadlines for their innovations to avoid waste of time and capital.

Final Considerations

Focusing on the methodological and scientific proposals, it can be affirmed that the objectives of this research were met and, yet, the hypothesis that certain technological profile related variables significantly influence about the return of the capital invested in innovation was confirmed.

Once the open innovation models are complex and require high financial investments, an unexpected contribution in attractions, besides textual research pre, i.e. identified opportunities for businesses, such as micro and small companies, which commonly feature limitations to investment and costs on innovation processes. Yes, the results pointed to the significance of processes such as lower level of complexity to implementation and maintenance, such as support for new ideas.

In this constexto, some second order interactions (between two variables) suggest the return on capital employed in innovation, this is:

- If companies have consistent processes for control of deadlines and budgets for new projects of innovation, there's no need to invest in processes to support new ideas.

- on the other hand, the adoption of consistent models of open innovation, rule out the need for investments in processes to support new ideas. In these cases, revealing that the models of open innovation, by itself, covering research, development processes and support to new ideas.

Therefore, technological profile, leading to the maximization of the return on capital invested in technological innovation for the sample companies, includes open innovation systems at the same time, combined the hard deadlines and budget control of new innovation projects. However, a generic technological profile, for companies that cannot adopt open innovation systems, includes intensification of processes for systematic research and development of new products, as well as support for new ideas.

REFERENCES

ANDERSON, P.; TUSHMAN, m. l. discontinuities in Technological and dominant designs: the cyclical model of technological design. Administrative Science Quarterly, v. 35, n. 4, p. 33, 1990. 604 p.

BIRKINSHAW, j. GIBSON, c. Building ambidexterity into an organization. MITSloan Management Review, v. 45, n. 4, 2004.

BOVET, D.; MARTHA, j. network of value: increase profits using information tecnoloiga in the value chain, v. 45, n. 4, 2001.

CHESBROUGH, H. W. The era of open innovation. MITSloan Management Review. Cambridge, v. 44, n. 3, p. 35-41, 2003.

____________________. Why companies should have open business models. MITSloan Management Review. Cambridge, v. 48, n. 2, p. 22-28, 2007.

____________________. The new rules of P&D. series: results-oriented Management: implementing innovation. Rio de Janeiro: Editora Campus, p. 57-62, 2007.

____________________. The role of the University in the open innovation model. Jornal da Unicamp, Campinas State University, p. June 2008 23-29.

CHRISTENSEN, C. M.; ANTHONY, D. S.; Roth, and the future of innovation: using innovation theory to predict changes in the market. 1 Ed. Rio de Janeiro: Publisher Elsevier, 2007. 322 p.

DAVILA, T.; ESPTEIN, M. J.; SHELTON, r. Innovation that Works: How Gestionarla, Medirla y Obtener Real Benefit of Ella. Publisher Deusto, 2006. 324 p. DOSI, g. Una reconsideración de las condiciones y los del desarrollo models. UNA volucionista de la innovación perspective, el comercio and el growth. Latin American thought, n. 20, p. 167-191, 1991.

DOSI, g. Una reconsideración de las condiciones y los del desarrollo models. UNA evolutionary perspective de la innovación, el comercio and el growth. Latin American thought, n. 20, p. 167-191, 1991.

FERRINI, S.; SCARPA, r. Designs with a Priori Information for Nonmarket Valuation with Choice Experiments: a Monte Carlo Study. Journal of Environmental Economics and Management 53 (2007): 342-363.

FONTAO, h. design of experiments: application of a Lean Six Sigma Tool for enterprise management in small supermarkets, Retailers (MsC. Diss., University of Taubaté, 2008), http://www.ppga.com.br/mestrado/2008/fontao-henio.pdf

FONTAO, H.; LEE, m. e. application of Tool design of experiments in relationship Marketing: a study in retail. Brazilian Journal of Marketing, remark v. 9, no. 3 (September-December 2010): 137-160.

GIBSON, R.; SKARZYNSKI, p. Innovation priority No. 1: path to transformation in organizations. Rio de Janeiro: Editora Campus, 2008. 300, p.

HAMEL, g. Leading the Revolution. Boston, Harvard Business School Press, 2000.

HOLLAND, C.; CRAVENS, d. Fractional Factorial Experimental Designs in Marketing Research, Journal of Marketing Research 6 (August 1973): 270.

LEE, m. e. management of open innovation: model of access to technological innovation. Doctoral thesis, master's and Doctorate program at the University Nove de Julho, 2011. http://www.uninove.br. 2011.

Mintzberg, H.; Ahlstrand, B.; Lampel, j. Strategy Safari: a roadmap through the jungle of strategic planning, Porto Alegre, Bookman, 2000.

MONTGOMERY, d. Design and Analysis of Experiments. Wiley: Hardover, 2004.

PRAHALAD, C.; HAMEL, G. The core competence of the corporation. Harvard Business Review, may-june, 1990.

SANTOS, J.; DOZ, Y.; WILLIAMSON, P. Is your Innovation Process Global?, MITSloan Management Review, Cambridge, v. 45, n. 4, p. 31-37, 2004.

____________________________________. The Metanacional Challenge: how companies can Win in the knowledge economy. Dordrecht, Lisbon: Monitor Publisher, 2006. 256 p.

STARKEY, M.; AUGHTON, J.; BREWIN, r. Direct Marketing, Television Advertising, Process Controls, Design of Experiments, The TQM Magazine 6 (1997) 434.

TIDD, J.; 107 CHINESE FAMILY BUSINESSES, J.; PAVITT, h. management of innovation. Porto Alegre, Bookman Publishing, 2008. 600 p.

TUSHMAN, M.; O'Reilly c. a. Evolution and revolution: mastering the dynamics of innovation and change, California Management Review, v. 38 p. 8-30, 1996.

VON HIPPEL, e. Lead users: an important source of novel product concepts. Management Science, 32, no. 7, p. 791-805, 1986.

_______________. Democratizing innovation. Cambridge, MA: MIT Press, 2005.

[1] Faculty of Technology of Pindamonhangaba; Centre for research in economic and Sociology of organizations, Lisbon, Portugal

[2] Faculty of Technology of Pindamonhangaba