ORIGINAL ARTICLE

CHAGAS, Edgar Thiago De Oliveira [1]

CHAGAS, Edgar Thiago De Oliveira. Evaluation of real estate using artificial neural networks-systematic literature review. Revista Científica Multidisciplinar Núcleo do Conhecimento. 04 year, Ed. 04, Vol. 05, pp. 55-75 April 2019. ISSN: 2448-0959

SUMMARY

The real estate market is very important in the national economy because it reflects various aspects of society. This situation means that, in value and quality, the estimated value of the real estate market can be used as a basis for calculating housing needs. In this perspective, the results of the evaluation should be as accurate as possible, since the errors committed can be harmful to the majority of the population. The applicability of RNA and the evaluation of properties were studied. This is essential for the research literature and for the systematic review of the literature as a research method. From the systematic review, it is possible to analyze recent research on RNA in order to highlight predictive models, optimization algorithms, mainly related to the evaluation of properties. It can be concluded that the applications of RNA in the evaluation of properties need to fill the gaps in the literature.

Keywords: Artificial Neural network, systematic review, real estate evaluation.

1. INTRODUCTION

Depending on the amount of resources used in the operation, the real estate market is a very important part of the national economy. For research in this market, the calculation of financial assets applies to the housing demand of the foundation by means of a large-scale valuation of the estimated market value (PELLI NETO, 2006).

According to González (2008), the evaluation of housing production is a task that takes into account the particular characteristics and properties of normal market conditions. It is possible to reach the estimated value of the property on the market. It is considered normal to find a balance between the parties involved in the negotiations.

Hipólito (2007), there are several methods and patterns used in different countries for the evaluation of properties, based on the network of artificial neurons (RNA).

The aim of this study is to study the RNA in the literature and to understand the fields of application of the method for which the literature should be systematically evaluated. Seeks to systematically understand the subject and understand the quality and reliability of data search.

1.1 JUSTIFICATION

Due to the dynamic behavior of the real estate market, it is perceived the importance of valuing the property. The new evaluation method had to take into account the needs and characteristics of this activity, because the current technology has certain limitations and, therefore, requires the study of other methods.

According to Pelli Neto (2006), the use of artificial neural networks in the valuation of real estate offers good prospects, the results obtained so far show that technology and data can only be represented by a linear model that enhances the IT tools.

2. THE REAL ESTATE MARKET

2.1 INTRODUCTION

The real estate market has been at the center of the research of various public and private entities because of its importance in the national economy. In the market study, the large-scale valuation of the estimated market value is calculated based on housing needs, focusing on the use of financial resources. Another way to estimate the value of research is to understand the economic and social importance of this market. The evaluation of measurement errors or inaccuracies in the activity is not ideal (FERNANDES, 2003).

In addition to studying housing demand, it is also possible to use the model not only to evaluate the quality, but also to define general planning, economic feasibility studies and tax calculations for new housing projects belonging to the Company, especially IPTU and ITBI (GONZÁLEZ, 2002).

This chapter will focus on the analysis of the real estate literature, a brief history of the beginning and then a conceptual description of the real estate market, including the operation of tailor-made evaluation methods and process-based specifications. This chapter will define the market data comparison method, which consists of the valuation of properties of the most commonly used method.

2.2 REAL ESTATE MARKET

To begin with, it is important to define the concept of real estate market, unlike other markets.

2.2.1 WHAT IS REAL ESTATE MARKET?

The real estate market can be divided into different parts, such as apartments, houses, shops, offices, markets and cities (urban or rural), warehouses, car parks and other markets that they buy and/or sell (GONZÁLEZ, 2002).

The main factors affecting performance and other assets of the real estate market and other markets, such as the automotive market, household appliances and others, are long life, exclusivity, location and space, as well as that the intervention of municipal legislation in force. And federal (GONZÁLEZ, 2008).

The real estate market will have a longer useful life, difficult to measure because it is affected by the physical properties of the patterns and ends with the protection status. Given that the property over time has to perform maintenance and meet all standards, the actual age of the same family can benefit from the protection of the different state (HAYKIN, 2001).

Different is not different from the other internal and external characteristics of the property, the real estate is unique. However, some parts that have a production may be a coincidence, at least in their location or their position will be different, the real estate market is comparable to no other space in the production of the same well. In this sense, in many cases, determining the value of a property is not a trivial task that requires the use of scientific knowledge (HIPOLITO, 2007).

The real estate market is a dynamic mechanism of evolution over time, influenced by several factors, both of valuation and depreciation. The simultaneous and disorderly performance of different developers, contractors, builders and the public power itself led to this constantly changing market, which directly reflects the value of the property or transaction being provided (PELLI NETO, 2006). It remains to be said, it has been observed that real estate markets are an important part, in constant interaction and is responsible for the price of real estate.

2.2.2 BASIC COMPONENTS

The basic components of the real estate market are the commercialization of products, sales and interested parties related to the purchase. When there is a balance between these three components, the statistical research in the real estate market will produce good results. Obviously, ideally, there’s a lot of information. There are many vendors, many buyers and many products from different sources (DANTAS, 1998).

The mission of the evaluation Engineer is to describe the real estate market, emphasizing the degree of balance between its components. The more balanced the balance, the more intense the competition on the market and the fairer the price. However, there is no perfect and balanced competitive market. However, statistical studies should be avoided when dealing with extreme situations, such as Monopoly or oligopoly (PELLI NETO, 2006).

2.3 PRICE, COST AND MARKET VALUE

In point 3.44 of NBR 14,653, Part 1-general procedure, reference is made to the market price and the following definition: “in the current market conditions, knowingly and consciously negotiate the most probable amount of the ‘ asset on the date of registration. ‘ (NBR 14.653).

The most likely number of people who negotiate consciously and voluntarily does not necessarily correspond to the price at which the goods are traded or offered. Market value is the result of a mathematical modeling and/or statistical process. This data is collected on the capacity of similar characteristics at negotiated or proposed prices (REZENDE, 2003).

Therefore, the price and the reference value are different. Although “market value” refers to the most probable value of the goods, the “price” reflects the number of transactions in foreign currency or provides specific products. A different bid rating or transaction price is extremely common. This difference is not considered very important because, in this case, it may be necessary to resolve the problem to prove that the amount used is reasonable (SAMPAIO, 2007).

The cost of the product does not reflect the market value because the previous definition of market value is not always the most likely to combine the value of the transaction with its production cost. The market value may be less, equal to or greater than the cost of production (SAMPAIO, 2007).

2.4 BASIC METHODS

In general, the value of the goods can be determined according to three different basic methods (GONZÁLEZ, 2002):

• Income, which determines the value of goods derived from their economic life.

• Comparison based on the price of similar products in the market;

• Cost, based on direct and indirect costs of goods production;

In all three methods, the direct comparison to determine the value is the most appropriate and reliable in the market.

2.5 APPLICABLE METHODS

There are methods that can be used to assess the objective, availability, quality and quantity of information obtained during market valuation due to the nature of the goods to be evaluated (FERNANDES, 2003).

Depending on the specific standard use of ABNT, there are several methods to identify the value of the goods. In this work, the method used is a direct comparison of market data (GONZÁLEZ, 2002).

2.6 MARKET DATA COMPARISON

Part 2 of the NBR-14653 states that the method of comparing market data should be used preferentially. In general, the comparison method is used to determine the consumption of a particular item. The higher the value of the consumer goods, the greater the accuracy of the valuation. On the evaluation report is economical, it is necessary (NBR 14653).

It is important to measure the value of the object, which is used to visually compare similar objects with a known market value (called the comparative Process) (GONZÁLEZ, 2008).

Some providers require a price control, then set the average price of the practice and the final purchase decision based on the terms of payment of interest and the availability of financial management (GONZÁLEZ, 2008).

When using the comparison process, attempts are made to obtain the values that represent the objects to be evaluated on the basis of other similarities objects between them. The existing differences are weak or insignificant. As the understanding of all the objects available in a given market (population) is generally totally inaccessible, the average value gives an average estimate of all in the objects of the population (Haykin, 2001).

Obviously, the more uniform the population analyzed, the more homogenous the samples. Therefore, in search of a specific brand or model of zero, kilometer car, the person should compare prices, according to the collected samples can contain higher prices and other low and so close arithmetic average. This fact occurs because the cost of obtaining the product from the manufacturer is similar. Another major problem is the ease of obtaining a representative sample of the market, which is very useful for reliable conclusions on the average value in these cases (Hipólito, 2007).

On the other hand, by estimating the market value of housing production through the comparison process, the evaluators face great difficulties, especially if the population is considered very different, generating a heterogeneous sample. The products offered do not have a sufficiently standardized brand or model to make them uniform. In addition, they do not directly depend on production costs and often of harvesting. The location is linked to the social economy (PELLI NETO, 2006).

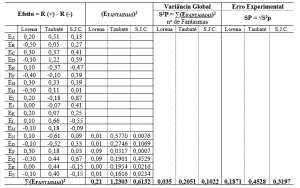

In both cases, changes in the sample appeared around their arithmetic mean. The difference is that, in a homogeneous sample of industrial products, this change is reduced, and the heterogeneous samples used as a basis for measuring the real estate market usually show a change in height around its arithmetic mean. This fact creates a great uncertainty in the conclusions about the overall average of the product. In fact, any randomly selected sample can contain an arithmetic mean of very different data. These differences between the data collected and the sample mean are a function of the physical differences between the data, socioeconomic factors and the random nature of the market (REZENDE, 2003).

The randomness always present in any market can be defined as the inherent subjectivity of a person who grants a price to a product that wants to be sold. It is up to the buyer to accept or not the price at the time of purchase. Therefore, it cannot be measured and consists of inexplicable errors or random samples (DANTAS, 1998).

In the sample of industrial products, the ratio of physical differences between the data is zero or almost, but it is extremely important in the sample of the real estate market, resulting in a heterogeneous sample. These physical differences are a function of the intrinsic and extrinsic characteristics of the real estate sector. To measure these differences, the collected data show similar characteristics of the real estate market. Therefore, to use this method, you must have a data set that can be compared. The comparison will be based on intrinsic and extrinsic characteristics, as described by the input, interpretation or independent variables (NBR 14653).

2.7 VARIABLE CONSTRUCTION STRUCTURE

Variables are intrinsic and extrinsic characteristics of the property. The value represents the number. It is important to observe the relationships between the variables selected to verify their dependencies (REZENDE, 2003).

In the evaluation project, the market price (supply or transaction) and the corresponding physical characteristics (area, façade, default location, parking spaces, etc.) should be considered as independent input variables, such as Location (financial index, etc.). Urban and polo), distance and time (the date on which the event occurred) (SAMPAIO, 2007).

The dependent variable can be specified based on the total price or unit price, usually in monetary units per square meter. The selection of the analysis of the data collected during the definition and the function of the model is selected to represent the real estate market. We selected the independent variable directly related to the characteristics of the research data (internal and external), as well as the tone of the diversity of the behavior of the real estate market in each region. Therefore, when a priori determines independent variables, it should be noted that this effectively affects and explains the changes in the price collected (NBR 14653).

3. ARTIFICIAL NEURAL NETWORKS

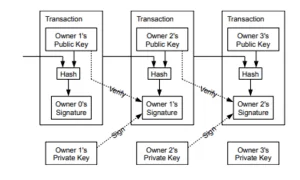

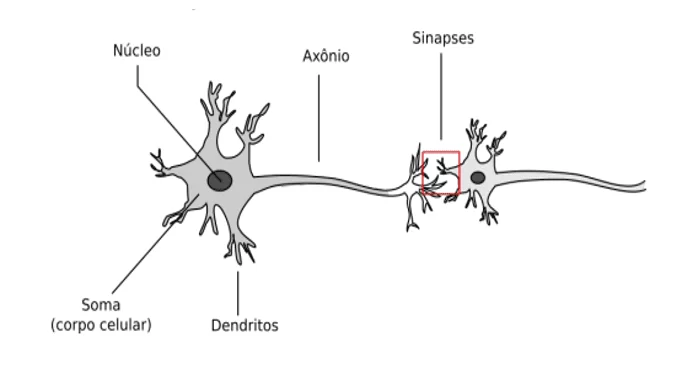

The RNAs are mathematical models inspired by the principles of biological neurons and brain structure (RUSSELL 2004, RONALDO 2005). A neuron is a brain cell whose main function is to collect, process and diffuse electrical signals. Each neuron consists of a cell body or Soma, which contains a cell nucleus, a series of arms called Dendrites and a single long arm called Axon (RUSSELL, 2004).

It is believed that the brain’s ability to process information comes mainly from the networks of these neurons. Communication from one neuron to another, to form a complete nervous system, is done through a synapse. Synapse is the region where two neurons come into contact, allowing the transmission of nerve impulses (RUSSELL, 2004).

Neural networks have the ability to perform distributed computation, tolerate noisy inputs, and learn. Like the human brain, a neural network is based on learning, that is, it stores the knowledge acquired based on learning and makes it available for making decisions about the problem (RUSSELL, 2004).

The resolution of RNA problems is very interesting because its intrinsic representation and its parallelism, inherent in architecture, give better results than the classic models. The ability to learn through examples and generate the information obtained is undoubtedly the main attraction of problem solving by means of RNA (BRAGA, CARVALHO and LUDERMIR, 2000).

3.1 THE BASIC CONCEPT

RNA is a system of computational power through learning and generalization (BRAGA, CARVALHO and LUDERMIR, 2000). In turn, generalization is associated with the ability of these networks to provide a consistent response to data that is not presented during the processing and training phase.

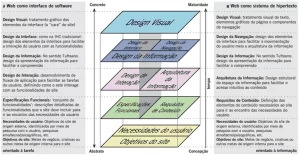

RNA will be very simple by the structure with the elements of treatment, inspired by the action of biological neurons, the connection between these elements of treatment, characterized by each connection in the network, is associated with a weight, representing the weight interaction or Coupling force between the elements of treatment and the fact that they are excitatory or inhibitory by nature (HAYKIN, 2001).

The use of artificial neural structures, where information is processed and stored in parallel and through a complexity distribution of relatively simple RNA processing components. These elements may be responsible for the input of information per layer (input layer)-corresponds to the argument used in the real estate market, the processing of this information (intermediate layer) and the results generated (output layer)- corresponding to the dependent variable and total units), for further promotion (GONZÁLEZ, 2008).

The biological neuronal model consists of a relatively autonomous cellular network, each with limited processing capacity. The units are connected by connections, each having an associated weight corresponding to the effect of the unit in the output signal processing. The positive weight corresponds to the factor of increase of the input signal and the negative weight corresponds to the inhibition factor (BRAGA, CARVALHO and LUDERMIR, 2000).

This model typically has a set of input units through which the information is transmitted to the network and a set of output units that display the output signals from the network as well as a set of intermediate units. A collection of neurons is very powerful in terms of information processing. Conceptually, RNA can be considered as a mathematical model similar to the structure of the human brain and able to learn from subsequent generalizations (GONZÁLEZ, 2008).

3.2 NATURAL NEURONS

The human nervous system is responsible for making decisions and adapting the body to the environment. This function is provided by continuous learning. The system consists of cells responsible for its function. There are about 10 billion neurons in the human brain and about 60 trillion neural connections among themselves (HAYKIN, 2001).

These cells receive, produce and provide stimuli to the brain. Neurons are defined by cell membranes, which possess certain critical properties for the body’s cellular function, such as extended filaments, dendrites and axons (BRAGA, CARVALHO and LUDERMIR, 2000). The neurons are defined in the received signal, capable of transmitting information through dendrites and polarized cells. When excited, neurons transmit information to other neurons through pulses called action potentials. These signals propagate through the cell axons in the form of waves and are converted into chemical signals in the synapses.

Biological neurons can be considered basic computational devices of the nervous system, composed of many inputs and outputs. The entrance is formed by a synaptic connection that connects the dendrites to the axons of other nerve cells. The signals that arrive through these axons are electrical impulses called nerve impulses or potential pulses of action and constitute information generated by neural processing in the form of a neural impulse output in their axons (GONZÁLEZ, 2008).

Depending on the signal sent by the axon, the synapse may be excitatory or inhibitory. The excitability of the connection helps to create nerve impulses in the exit axons, while the inhibitory synapses act in the opposite direction (BRAGA, CARVALHO and LUDERMIR, 2000).

The basic characteristics derive from the knowledge of the structure and behavior of natural neurons, which are used to create models of artificial neurons simulating real neurons. These artificial neurons are used to form RNA, consisting of its main processing elements (GONZÁLEZ, 2008).

Figure 1 shows a model of human neuron.

Figure 1 – Natural neuron

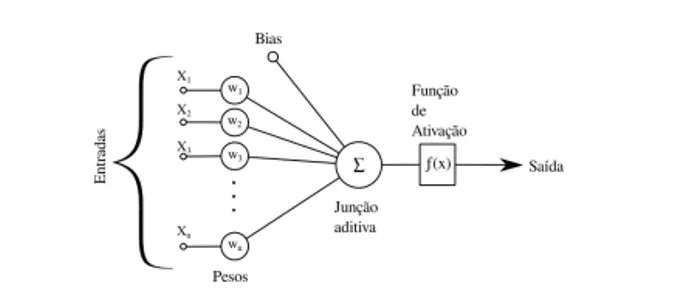

3.3 ARTIFICIAL NEURON

Braga, Carvalho and Ludermir (2000) describe the first artificial model of biological neuron Warren McCulloch and Walter Pitts in 1943. This model was a simplification of what was known in the time of biological neurons. His mathematical description gave a model with n inputs that received the values X1, x2,…, xn and a single output Y. To represent the behavior of synapses, the inputs of the neurons have coupled weights w1, W2,…, wn, whose values may be positive or negative. The activation of the neuron is performed by the activation function, which is responsible for generating the Y output of the neuron from the sum of the xiwi values.

New artificial models, more attractive from the neurological point of view, incorporate many of these dynamic characteristics of biological neurons. However, despite numerous simplifications in the model description of McCulloch and Walter Pitts, these models, when interconnected as an artificial neural network, have a high computing power, the solution of the major complex problems (BRAGA, CARVALHO, LUDERMIR, 2000).

Figure 2 represents an artificial neuron model.

Figure 2 – Artificial Neuron

3.4 ACTIVATION FUNCTIONS

The activation function is responsible for generating the Y output of the neuron from the values of the weight vectors w and input x. The activation function is designed to meet two aspirations. First, we want the reader to be active (close to + 1) when the correct inputs are received and inactive (close to 0) when the wrong entries are received. Second, activation should be nonlinear for nonlinear problems, otherwise the entire network will collapse (RUSSELL, 2004).

3.5 RNA TOPOLOGIES

The different topologies of neural networks are essentially divided into two classes: non-recurring or direct and recurrent. Non-recurring RNAs are those that do not return information from their outputs to their inputs and therefore are also lacking in memory. Recurring RNAs use their outputs to re-establish their own inputs, thus forming a dynamic system that can achieve steady state, display oscillations or even chaotic behaviors. Recurring networks can support short-term memory (RUSSELL, 2004).

Non-recurring RNAs are stratified and can be formed by one or more layers. Multilayer neural networks contain a set of input neurons, an output layer, and one or more hidden layers. The input layer of the network distributes only the input models, the hidden layer generates an internal encoding for the input models, which is then used by the network output layer, which presents the final result of the processing of the input model. Network (RONALDO, 2005).

3.6 LEARNING

One of the most important features of artificial neural networks is its ability to learn through examples (Braga, Carvalho and LUDERMIR, 2000). The learning or training stage consists in updating the synaptic weights to acquire knowledge from the data (RONALDO, 2005). The training procedures that enable RNAs to learn can be grouped into two main paradigms: supervised learning and unsupervised learning (BRAGA, CARVALHO, LUDERMIR, 2000).

A) Supervised learning: Supervised learning involves learning a function from examples of inputs and products. This necessarily implies the existence of an external supervisor or teacher in charge of stimulating network inputs using input models and observing the output calculated in the same way, comparing it to the desired output (BRAGA, CARVALHO, LUDERMIR, 2000).

b) Unsupervised learning: Unsupervised learning does not require a target vector for outputs and does not make a comparison to determine the optimum response. There is no external teacher or supervisor to accompany the learning process. Only input models are available for the network and the existence of regularities in this data allows for learning (BRAGA, CARVALHO, LUDERMIR, 2000).

3.7 BACKPROPAGATION ALGORITHM

Reverse propagation is the most popular supervised training algorithm. Uses input pairs (x, yd) To adjust network weights using an error correction mechanism. Training takes place in two phases; the downstream phase turns off the output of a certain input pattern and the rear footstool updates the ridges of their connections depending on the desired result and the output provided. (Braga, Carvalho, LUDERMIR, 2000).

The next step includes the following steps:

1. The input is presented to the network and the output of the neurons of the first layer C1 is calculated.

2. The outputs C1 are inserted in the next layer and the output is calculated. This process is repeated up to the Ck output layer.

3. The outputs produced by the neurons are compared with the desired outputs and the corresponding error is calculated.

The rear stage comprises the following steps:

1. The Ck output layer error is used to directly adjust its weights.

2. The errors of the CK output layer neurons are propagated to the previous Ck-1 layer.

3. The calculated errors for the Ck-1 neurons are used to adjust their weights.

4. The process is repeated until the weights of the C1 layer are adjusted.

4. ARTIFICIAL NEURAL NETWORKS IN THE VALUATION OF REAL ESTATE

Recently, most of the professionals involved in evaluation engineering are not yet aware of this approach. However, some researchers have affirmed the importance of this new concept, conducting research in this area and promoting actually accepting the artificial neural network. 8.2.1.4.3-scientific treatment called the following: “Whatever the model used to predict market behaviour and training value, they should explain and test the appropriate assumptions, take corrective measures such as neural networks Artificial, regression and envelope analysis of spatial data can be applied to evaluation engineering, provided they are reasonable perspective. and contained in (GONZÁLEZ, 2008).

Artificial neural networks represent a technology whose origins exist in many disciplines such as neuroscience, mathematics, statistics, physics, computer science and engineering. The application of RNA can be used in different fields, such as modeling, time series analysis, pattern recognition, signal processing and control. An important function of this technology is to control data capture (HAYKIN, 2001).

In the different definitions of artificial neural networks, all have elements considered fundamental: neurons, architecture and learning. Neurons are the basic computer unit of the network. Architecture is the connection structure between neurons. Learning is a process of adjusting a network to calculate a particular function or perform a particular task (FERNANDES, 2003).

Research on artificial neural networks is relatively new. Currently, there is no technical book that teaches to completely solve the RNA and its application in the evaluation project. However, several articles were published in Congresses dedicated to this technology and focused on technical evaluation. The application of the results and conclusions of these studies supports the method, such as NBR 14653, real Estate valuation, Part 2, in recognition of the scientific method (PELLI NETO, 2006).

In general, Haykin (2001) defines a neural network as a machine to simulate the way the brain performs a specific task or function of interest, through its network of electronic components run or that simulate a computer program. Braga, and Ludermir Carvalho (2000), an artificial neural network is a parallel distributed system composed of neurons (processing units), which performs a calculation of the mathematical function nonlinear or linear. The arrangement of neurons is given in one or more interconnection layers by a large number of unidirectional (regular) connections with associated weights, and the knowledge represented in the model is stored in the processing unit by weighting the Entries. This network mechanism is similar to the biological neuronal structure of the human brain.

The learning process is provided by a learning algorithm that can change the weight of the network neatly to achieve the objectives of the project (Haykin, 2001).

For Rezende (2003), the artificial neural network is a learning process associated with the ability of the network to adjust its parameters based on interaction with the external environment. The process is interactive to improve network performance to the point of interaction with the media. Performance is the criterion that determines the quality of the model and the training stop point is pre-defined by the learning parameters. According to Rezende (2003), generalization is related to its ability to provide consistent responses to data not provided during the training phase. Well, we can say that the learning process and the generalisation are coherent.

Braga, Carvalho and Ludermir (2000) Also emphasize the importance of this ability to learn and generalize neural networks, reflecting positively resolving the problem, improving performance.

As for the neural network structure, we are trained artificial neural structures in which the processing and storage of data is in parallel and distributed by simple elements of the process. The provision of these elements is responsible for capturing basic information such as real estate market (input layer) and information processing. These are dependent variables-the price (output layer) is then generalized (PELLI NETO, 2006).

According to Pelli Neto (2006), the number of inputs and outputs depends on the amount of input and output data, and the number of neurons in the intermediate layer depends on the complexity. When the number of neurons in the middle layer is very high, unexpected results, called incremental costs occur when the artificial neural network defines more neurons than the training requires (PELLI NETO, 2006).

Presented in the single input layer of the learning mode of the artificial neural network, is directly mapped to a set of output modes of the network, that is, that limits the capacity of the network (FERNANDES, 2003).

5. SEARCH METHODS

The research method used consisted of a systematic review of the literature. The objective was to critically analyze the theme of the artificial neural network and its relation with the evaluation of properties in order to use scientific methods. The systematic review includes a research method using the literature as a data source, applying explicit and systematic research methods and combining critical information on evaluation and selection (SAMPAIO and MANCINI, 2007).

Systematic reviews use clear methods and systems to answer clearly identified questions in order to identify, critically select and evaluate relevant research, and to collect and analyze the research data contained in the evaluation (SAMPAIO E MANCINI, 2007).

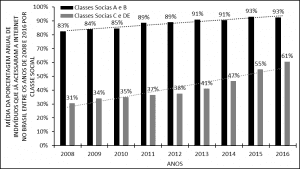

The systematic review process begins with the definitions of the object study through keyword research, such as artificial neural networks and real estate assessment to better understand the purpose of the application. Subsequently, the database was identified according to the subject of the study, Google scholar was used. In the initial search it was used as keywords “artificial neural network” and “valuation of real Estate”, presenting 286 results.

The sample was synthesized through the use of an alignment of keywords in the filter, comparison of titles, alignment of the summary and analysis of samples farther from the full text. It was considered the articles on the evaluation of real estate and optimization of use, through literature reviewing articles, considering the most cited and most recent articles. Thanks to this collection, RNA research has progressed. The recent growth in this area can be seen through the comparison between 2010 and in the last three years, from 2016 to 2018, in which there was an increase of 54% in the first three years.

From the database, the keywords used in the article and its references were analyzed. The tools used were the VOSviewer, using mapping and visualization techniques.

Through the analysis of the visualization of the network, it was possible to visualize the consultations involving the RNA. Some recent studies indicate that predictive models of optimization have mainly involved the valuation of properties.

6. Conclusions

Understanding its qualitative and quantitative analysis of the real estate market plays a key role in the development of real estate assessments. It was possible to achieve a general market analysis with the evaluator, a scientific approach to guide his work, coring the most relevant attributes with the research and minimizing the errors of estimation.

The Brazilian literature, specializing in the valuation of real estate, with little focus on the real estate market, produces no book or instructional materials for the research, detailing the construction of research and sampling methods, and the definition of variables as the data packet algorithm.

Therefore, according to a systematic review of the literature, it was data from segments to generate multiple sub and achieve satisfactory results. However, work is usually done based on the knowledge and structure of the real estate market.

7. BIBLIOGRAPHICAL REFERENCES

ASSOCIAÇÃO BRASILEIRA DE NORMAS TÉCNICAS (ABNT). NBR 14653-1 – Procedimento geral. Rio de Janeiro: 2004.

ASSOCIAÇÃO BRASILEIRA DE NORMAS TÉCNICAS (ABNT). NBR 14653-2 – Imóveis urbanos. Rio de Janeiro: 2004.

AZEVEDO, Lucas Pereira de. (2016). APLICAÇÃO DE REDES NEURAIS ARTIFICIAIS NO PROCESSO DE ORQUÍDEAS DO GÊNERO CATTLEYA. Disponível em:

BRAGA, A. P. CARVALHO, A. P. L. F., LUDERMIR, T. B. Redes Neurais Artificiais: Teoria e Aplicações. Rio de Janeiro: RJ – Livros Técnicos e Científicos, 2000.

DANTAS, R. A. Engenharia de Avaliação: Introdução à Metodologia Científica. São Paulo: Pini, 1998.

FERNANDES, A. M. R. Inteligência Artificial: Conceitos Gerais. Florianópolis: Visual Books, 2003.

GONZÁLEZ, M. A. S. Descobre o conhecimento de avaliação de imóveis de aplicativos de banco de dados e inteligência artificial. Tese (Doutor em Engenharia Civil) – Programa de pós-graduação em engenharia civil, UFRGS, Porto Alegre, 2002.

GONZÁLEZ, M. A. S. Real Estate e avaliação de método profissional. San Leopoldo, 2008:

HAYKIN, S. Rede Neural: Princípios e Prática. 2. ED. Porto Alegre: Bookman, 2001.

HIPÓLITO, E.C. Métodos e padrões utilizados em avaliações imobiliárias por diferentes países. Monografia – Faculdade de Engenharia de Arquitetura, UFMG, Belo Horizo nte, 2007.

PELLI NETO, A. Redes neurais artificiais aplicadas à opinião pública – estudo de caso em Belo Horizonte. Tese (Mestrado em Engenharia Elétrica) – Graduada em Engenharia Elétrica pela UFMG, Belo Horizo nte, 2006.

REZENDE, S. O. Sistemas inteligentes: conceitos básicos e aplicações. Barueri: Manole, 2003.

RONALDO, E. Data mining: um guia prático. 1. ed. Rio de Janeiro: Campus, Elsevier, 2005. ISBN 85-352-1877-7.

RUSSELL, P. N. S. Inteligência Artificial: tradução da segunda edição. 2. ed. Rio de Janeiro: Editora Campus, 2004. ISBN 85-352-1177-2.

SAMPAIO, R. F. MANCINI M. C. Estudo de Avaliação Sistemática: Orienta a inteligência abrangente das evidências científicas. Revista Brasileira de Fisioterapia, v. 11, n. 1, p. 8 a 8 de agosto de 2007.

[1] Bachelor of Business Administration.

Submitted: April, 2019

Approved: April, 2019