ORIGINAL ARTICLE

WATAYA, Roberto Sussumu [1], FRAUCHES, Patricia [2], BERGAMO, Andressa Ferreira [3]

WATAYA, Roberto Sussumu. FRAUCHES, Patricia. BERGAMO, Andressa Ferreira. Personal finances in the palm of your hand: an experience report. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 05, Ed. 07, Vol. 05, pp. 109-124. July 2020. ISSN: 2448-0959, Link de acesso: https://www.nucleodoconhecimento.com.br/technology-en/personal-finances, DOI: 10.32749/nucleodoconhecimento.com.br/technology-en/personal-finances

SUMMARY

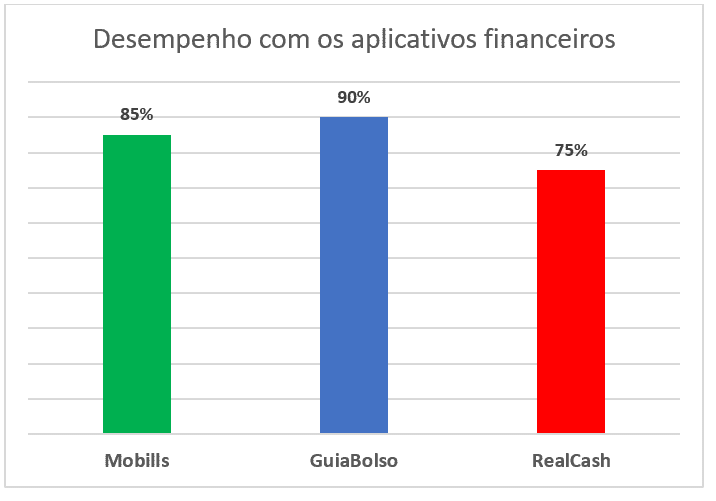

The Projeto Gestão Financeira na Palma da Mão, was elaborated aiming to raise awareness of the theme of finance for undergraduates of theCentro Universitário Adventista of São Paulo campus São Paulo – UNASP / SP, and the surrounding community, because it is understood that it is a very important theme for the future of these young university students. The aim of this study was to train individuals more aware and responsible about the use of money, providing a change in behavior and financial attitudes in order to obtain effective results in social and professional life. This study presented the results of the ninth edition of the 2018 project, which began in 2010, data were collected at UNASP/SP. The activities consisted of lectures on the theme in question and application of activities aimed at raising awareness and knowing how their financial health is, in addition, the Mobills, GuiaBolso and Realcash applications were used, allowing participants to “get to know” and become familiar, and then choose one of them, as a tool to control their personal finances. The performance “in degree of ease” of the participants with the applications had the following results with Mobills 85%; GuiaBolso 90% and RealCash 75%, from this result the GuiaBolso application was the highlight for the participants. Thus, we can affirm that most of the students completed the seven stages satisfactorily. For the final considerations, we can affirm that financial education combined with technological resources with own applications, resulted in a significant awareness of young people seeking greater knowledge about finance, in order to be able to make better choices related to money, in the short, medium and long term.

Keywords: Financial Education, finance applications, Unasp.

1. INTRODUCTION

In academic life, the profile of the young university student is characterized by the immediacy and speed in the search for information, through different types of electronic media. Thus, people need to interact with the new social configurations, which directly influence personal relationships, the work environment, professional and social life. Technological advances and today’s society promote a more immediate and consumerist society in the face of the large number of offers and facilities for acquisition and consumption. This context requires the population to take a more critical and conscious approach to choices, definitions of goals and priorities in the various issues of life, and especially in the financial organization (PRADO, 2015).

In addition, financial education promotes in individuals a safer, more assertive posture and a more integrated citizen. Thus, with this study, it seeks to show the importance of personal finances to prepare citizens to achieve a healthy financial stability, whose condition enables to carry out short- and long-term planning, and also to improve the school performance of these young undergraduates.

Starting in 2010, the project is in its tenth edition, and the data for the period 2019 are presented in this report. In the context in which Brazil lives, with a large proportion of young people without paid work, and the share of young employees are “sinking” increasingly into debt, compromising a quiet and safe retirement.

In this context, the general objective of this study was to train more conscious and responsible individuals regarding the use of money, providing a change in behavior and financial attitudes in order to obtain effective results in social and professional life. And the specific objectives were: to enable young people and adults/family through educational process, new knowledge and practical tools for financial autonomy.

This study is divided into six sections, starting with this Introduction, in the second section Related Papers, then Financial Education, in the third section theProjeto Gestão Financeira na Palma da Mão. In the fifth section the Data Analysis and finally the sixth section, the Final Considerations.

2. RELATED WORKS

Among the works used to help understand the concept of financial education, we highlight the following scientific works, starting with Barbosa, Sena, Cardoso, Vieira Sá and Costa Filho (2017), they made a study on Personal Finance with students of the Administration course of a Public IES, and the objective of the research was to know the financial behavior of the students of Administration of a public IES in relation to Personal Finance.

In this same line of reasoning, Medeiros and Lopes (2014) researched the financial knowledge of the undergraduates of the Accounting Course in a municipality in the state of Rio Grande do Sul. And the objective of this work was to analyze the behavior of this group on the subject of personal finance.

Working on the same theme, Andrade and Lucena (2018), did a work to verify the relationship between the level of financial education of different academic groups with the individual characteristics and financial behavior of these students.

Under a perceptual bias, Silva, C. L. and Silva, J.G. (2019) Financial Education and Consumer Behavior: a study with young people from Ituiutaba/MG. The study aimed to verify whether the level of financial education of young people influences their decision-making process of buying smartphones.

The authors compare, Vieira, Costa and Fraga (2015) worked on the theme of default, and the objective of these authors was to identify the reasons that led them to these situations, and what solutions did they find?

We highlight two books, the first by Kiyocera and Lechter (2000), which believes that schools should teach students to have sufficient knowledge for financial autonomy. For the context described by the authors, young people receive an allowance and credit card, without worrying about the wise use of money. That way, they act according to the pressure of the group, buy the latest generation smartphone, designer clothes and so on. In this context, the authors work on the book Pai Rico e Pai Pobre, where the first teaches his children to think about valuing their money, while the second, for fear of risks, prefers silence on the subject.

The second book “Me Poupe”, by the author Nathalia Arcuri who works on the phobia caused by money, a fact that nullifies people’s relationship with this theme: money. And as proposed in her book she suggests the ten steps to successful financial life. It also helps identify the problems and addictions that block their enrichment and find the path to success (ARCURI, 2018).

We will highlight only one video (2019), where two rappers and an economist, work with the young women from the periphery, focusing on demystifying the financial market (EXAME-ABRIL[4], 2019).

3. FINANCIAL EDUCATION

In this study, we will adopt the concept of “financial education” the same used by the OCDE – Organização para Cooperação e Desenvolvimento Econômico, which states, ”

financial education is the process by which individuals and societies improve their understanding of financial concepts and products, so that, with information, training and guidance, they can develop the values and skills needed to become more aware of the opportunities and risks involved in them and then be able to make informed choices, know where to seek help and take other actions that improve their well-being. Thus, contribute more consistently to the formation of responsible individuals and societies committed to the future (PREVIC, s/d).

The theme Financial Education as proposed in this project, seeks an improvement in the quality of life of young undergraduates in the present and in the future, thus providing material security necessary to achieve a comfortable life and coated with guarantees in cases of emergencies and unforeseen events. This study is not only about making savings, cutting spending, learning to save and valuing money, which for good finance management it is necessary to know about finances, because otherwise the incorrect administration of financial resources may incur the biggest financial crisis.

Faced with a reality, where the country’s economic policy has not been corresponding to expectations that there would be consolidation in the process of economic recovery, and with optimistic prospects of consumers. Despite lower interest rates and inflation within the target, and unemployment is still high, it inhibits household spending capacity[5]. In addition, a survey conducted by the Confederação Nacional de Dirigentes Lojistas – CNDL in conjunction with SERASA – Serviço de Proteção ao Crédito showed that the volume of defaults increased 0.9% in the first half of 2019 compared to the same period of 2018 (CNDL, 2019).

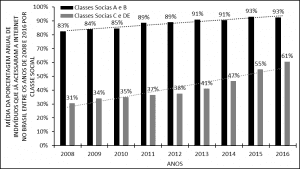

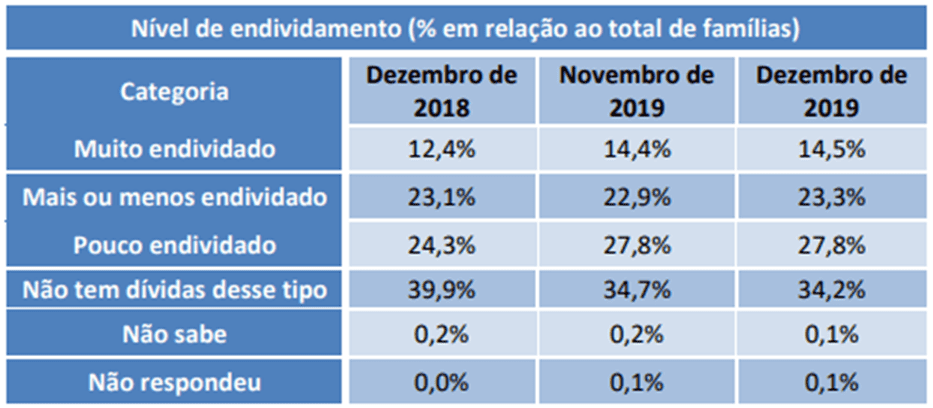

Also in this same line of reasoning, the Confederação Nacional do Comércio de Bens, Serviços e Turismo (CNC), which is a trade union entity of one of the main sectors of the economy of Brazil, which together these categories account for about ¼ of the Produto Interno Bruto – Brazilian PIB and generate approximately 25.5 million direct and formal jobs. The CNC, has done research that diagnoses the financial health of Brazilian families, and PEI[6] (2019) according to Table 1, we verified the level of indebtedness in % in relation to the total of families.

Table 1 – Level of household indebtedness

In this table, we noticed that the proportion of families who declare themselves very indebted had an increase, between November 2019 and December 2019, of 14.4% of the total families. And in the annual comparison, December 2018 to December 2019, increased 2.1%, and even in this period, the portion that declared “to be more or less indebted”, increased from 23.1% to 23.3%, and finally the little indebted portion went from 24.3% to 27.8%, an increase of 3.5%.

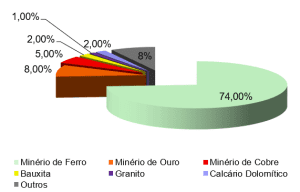

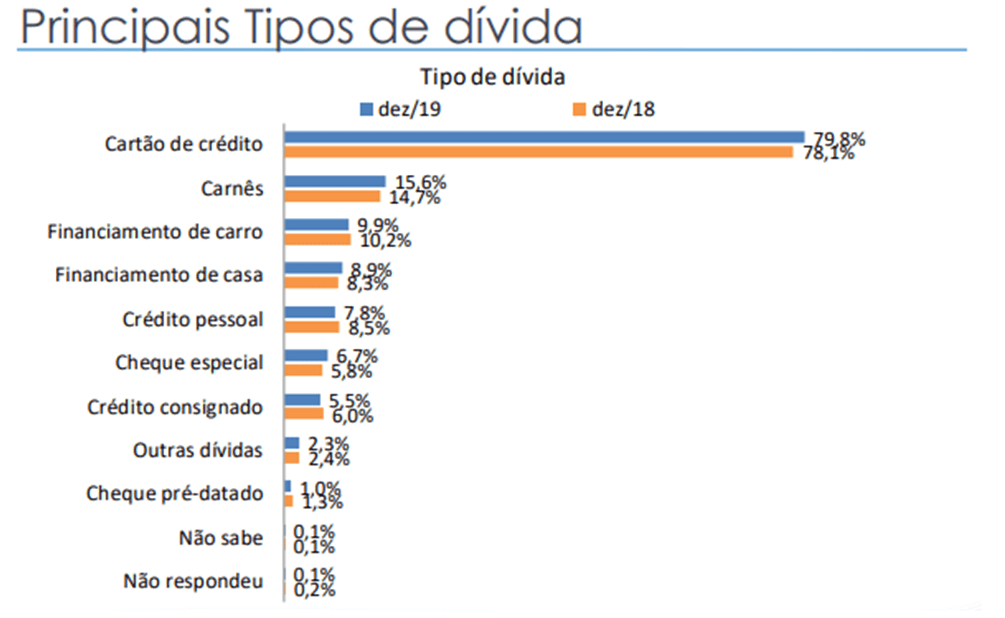

Figure 1 – Main types and debts

[/caption]

In graph 1 – on Types of debt, the survey shows that it increased in December 2019, reaching 79.8% for credit card debt; o Overdraft 6.7%; Pre-dated check 1.0%; Payroll Credit 5.5%; Personal Credit 7.8%; Carding 15.6%; Car Financing 9.9%; House Financing 8.9%; Other debts 2.3%. According to the research, the upward trend in indebtedness is associated with the expansion of the consumer credit market, and the recent improvement in the labor market mainly in formal employment, together with the reduction of interest rates and the reduction of the cost of credit.

4. FINANCIAL MANAGEMENT PROJECT IN PALM

In Brazil, we see in our consumer society, a real fratricidal battle, as if it were not enough to pay lag, the high cost of living we still face the pressure of consumerism generated by capitalist society, which impels us to buy even when there are no resources, through credit card, special checks and indebtedness with the financial ones, thus leading us to , to an imbalance in personal and family finances.

What is really behind this imbalance is the lack of financial education. We don’t learn to live up to the income we can generate. The concern with the quality of life of our society is an important part of the project that a group of students of the Accounting Courses; Science/Computer Engineering and Technology in Analysis, proposes to perform for the academic community.

Thus, like countless workers, the young people and adults of our society walk around with the difficulties generated by the economic crisis. These difficulties can generate anxiety, deconcentration, low productivity, accidents in service, etc.

In our daily coexistence with these people in the communities, many complain that the salary has failed to cover the monthly expenses. These complaints can be indicators of their difficulty in living according to the income they can generate, creating a vicious circle and instead of these people presenting a proactive attitude, increasing income or reducing spending, starts to complain about their salary and the government.

In view of these problems faced by young people and undergraduates, they reflect the harsh reality resulting from the lack of knowledge, financial disorganization, stress caused by indebtedness, among others, which led us to propose this study.

4.1 EXPERIENCE

The Centro Universitário Adventista of São Paulo (UNASP/SP[7]), aware of its role in the Neighborhood of Capão Redondo supports this initiative to promote financial education for its students, who need to learn their concepts that help in the use of their available resources in an appropriate way, and rationally to make the best choices with their rich money, thus ensuring the future and being prepared for emergencies and assisting in achieving life’s goals.

This project lasted from April to December 12, 2018, and was carried out in person, in room 14A of the University building of UNASP Campus São Paulo. It was held in the form of practical classes, using Smartphone with Android with Finance applications, for eight months, totaling 20 (twenty) Sundays, resulting in 60 (sixty) hours classes. During this period, the following contents were contemplated.

Step-1 – The Budget of a Family; Brazilian: Reasons to study; Personal Finance and Technology;

Step-2 – Financial Crises: how to get away from them? Knowing the Expenses, Tips and how to make your Financial Control. Working with Mobile Device- App-1: Mobills[8]

Step-3 – Family Budgets: pattern changes. The secret of success: Plan- step by step for your planning; Working with Mobile Device- App-1: Mobills

Step-4 – Do you know how much you spend? Changing the present and building the future: financial crisis- how to overcome the financial crisis? Caution: reasons that lead us to indebtedness; Working with Mobile Device- App-1: Mobills

Step-5 – Is spending too much a disease? How to work with “compulsion to spend?”; Working with Mobile Device- App-2: Guia Bolso[9]

Step-6 – Getting to know the Banks: Santander, Bradesco, Itaú, BB etc. Teach your kids how to raise money. Working with Mobile Device- App-2: Guia Bolso

Step-7: Technological Practices: Spreadsheet and free software: Realcash.

This study was an experimental and exploratory work, based on the quantitative and qualitative method. The sample consisted of 160 students of both sexes, who applied to participate in the study. To participate in this project, the prerequisite was to be a university student.

The candidates were interviewed by the project coordinator to diagnose the reason for their interest, the degree of financial knowledge, evaluate and select, altogether there were 150 university students who participated in the research. The other 10 candidates gave up because the project took place on Sundays.

5. DATA ANALYSIS

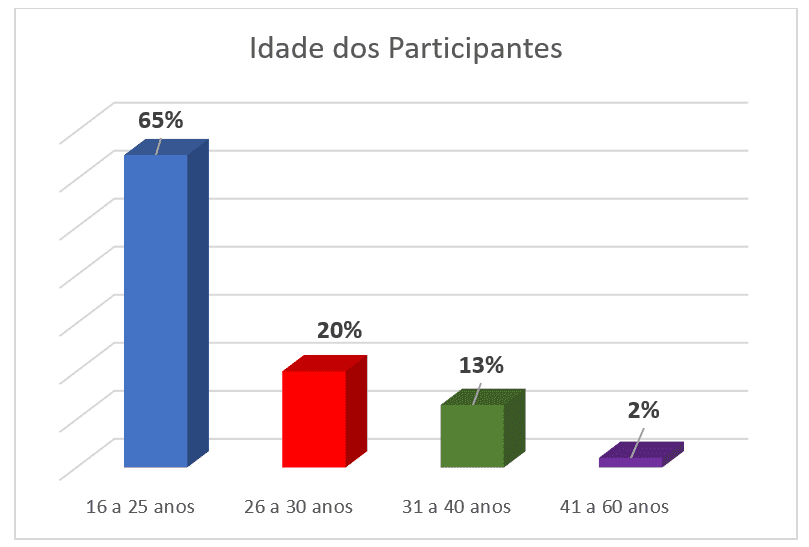

As a result of the interviews given to the coordinator, the profile of the students who participated in the project was constructed, graph 2- Age of the participants. We perceived the predominance of a young group, distributed as follows: 65% in the age group from 16 to 25 years; 20% from 26 to 30 years; 13% from 31 to 40 years and only 2% from 41 to 60 years.

Graph 2- Age of Participants

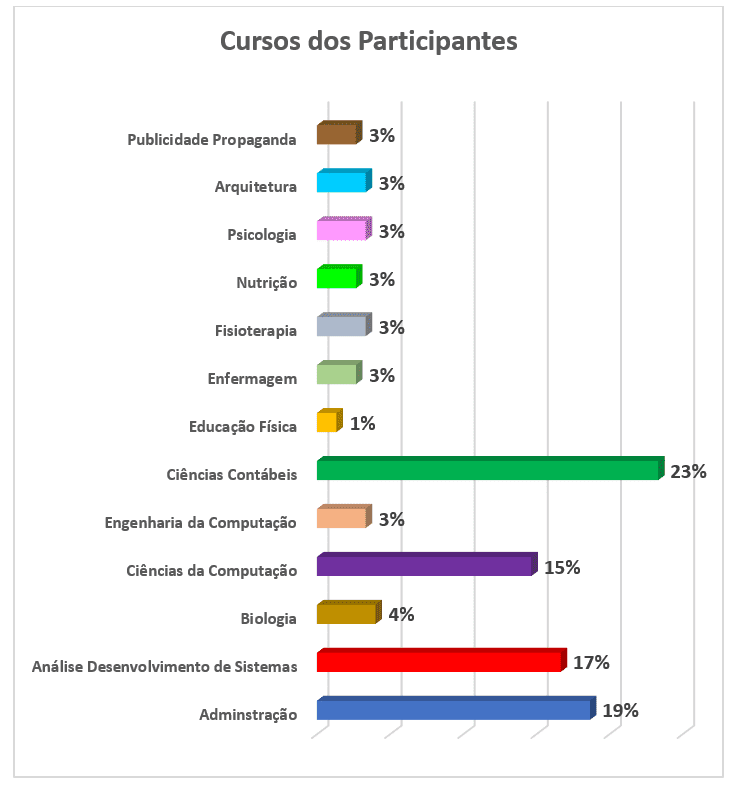

Next, we will know the predominance of the participants’ courses through graph 3. The participation of students for courses had this behavior: 23% of the Accounting Course; 19% Administration; 17% of the Course of Systems Analysis and Development; 15% Computer Science; 4% Biology and 3% for each of the following seven courses: Advertising and Advertising, Architecture, Psychology, Nursing, Nutrition, Physiotherapy, Computer Engineering; and finally with 1% Physical Education.

Graph 3- Participants’ Courses

[/caption]

The development of the stages of the project were the responsibility of the coordinating teacher and also of the volunteer monitors, altogether there were 12, where each one sought to do the best to achieve the objectives established by the project. This work also had the participation of the pastor of the campus, for the moments of reflection of 15 minutes.

The purpose of this work was to describe the curricular practice based on the Projeto Gestão Financeira na Palma da Mão, which focused four points on financial education, 1) To enable young people and adults/family through an educational process new knowledge and practical tools for the responsible self-management of their family’s finances, thus promoting the increase of their well-being and quality of life. 2) Sensitize people/families through an educational process to optimize their financial life; 3) To experience new attitudes and behaviors in the restructuring of dysfunctional financial patterns; 4) Increase productivity and reduce the problems generated from financial uncontrollableness.

The results of the project referring to the eight months of work and the development of the seven stages of programmatic content, was considered good, although the period of the course was considered short by the participants, despite the twenty Sunday meetings. The participation of the students in this study was marked by the importance in the contents presented, and the result of their performances is shown in graph 3.

Graph 4- Performance with financial applications

[/caption]

In Graph 4, we observed synthesized data referring to the activities of the participants in a period of eight months of expository class followed by practice, using the Smartphone with the applications. The performance “in degree of ease” of the participants with the applications had the following results with Mobills 85%; GuiaBolso 90% and RealCash 75%. From this result, the GuiaBolso app was the highlight for users. Finally, we can affirm that most of the students completed the seven-stage studies satisfactorily.

6. FINAL CONSIDERATIONS

The project served for the participants and all those involved to have a theoretical-practical deepening in matters about financial education, that is, “Gestão Financeira na Palma da Mão”. After completing this project, it was possible to conclude that its realization took place satisfactorily and highlights its importance, because this theme is current and of extreme need not only to university students, but society in general.

Even in a circle of students, we realize how they face with many difficulties the best way to manage their finances, and the reflection of this is a large number of indebted, so this project that focuses on financial education becomes indispensable to all. Thus, we can ensure that financial education helps to intelligently manage financial resources, and also to improve living conditions, ensuring a peaceful future, having more security in emergencies and also in the achievements of dreams. On the other hand, the financial imbalance affects the whole family, causing situations of stress, family disagreements and in some cases with a tragic end.

Finally, this financial education project combined with technological resources with its own applications, resulted in a demand of young people in search of greater knowledge in order to be able to make better choices related to money, in the three types of term: long, medium and short. Thus, the initiative of the Accounting Course with the support of UNASP/SP in implementing this extension project is important, and the objectives have been achieved. The methodology and content addressed had a positive result and a large number of participants, as they provided most of them with solid and sufficient knowledge for good financial management.

REFERENCES

ANDRADE, J.P.; LUCENA, W.G.L. EDUCAÇÃO FINANCEIRA: uma análise de grupos acadêmicos. 2018. Disponível no site: periodicos.pucminas.br/index.php/economiaegestao/article/view/10121. Acesso em 21/06/2019.

ARCURI, N. Me Poupe: Dez passos para nunca mais faltar dinheiro no seu bolso. São Paulo: Editora Sextante, 2018.

BARBOSA, C. P.; SENA, R, R.; CARDOSO, E.A.M.; VIEIRA SÁ, L.Y.B.; COSTA FILHO, J.P. FINANÇAS PESSOAIS: um estudo com alunos do curso de Administração de uma IES Pública. Disponível no site: http://oldror.lbp.world/UploadedData/2953.pdf acesso em 20/06/2019.

CAMPARA, J.P.; VIEIRA, K.M.; COSTA, V.M.F.; FRAGA, L.S. Dilema dos Inadimplentes: antecedentes e consequentes do “nome sujo”. 2015. Disponível no site: https://www.redalyc.org/pdf/4717/471755315006.pdf acesso em 22/06/2019.

CNDL. Confederação Nacional dos Dirigentes Lojistas. Inadimplência do consumidor desacelera e cresce 0,9% no primeiro semestre de 2019, aponta indicador CNDL/SPC Brasil. 2019. Disponível no site: https://site.cndl.org.br/inadimplencia-do-consumidor-desacelera-e-cresce-09-no-primeiro-semestre-de-2019-aponta-indicador-cndlspc-brasil/ Acesso em 10/09/2019.

EXAME-ABRIL. Canal no YouTube ensina a educação financeira para jovens da periferia. 2019. Disponível no site: https://exame.abril.com.br/seu-dinheiro/canal-no-youtube-ensina-educacao-financeira-para-jovens-da-periferia/ Acesso em 04/12/2019.

KIYOCERA, R.; LECHTER, S.L. Pai Rico Pai Pobre: o que os ricos ensinam a seus filhos sobre dinheiro. 24ª ed. Rio de Janeiro: Editora Campus, 2000.

MEDEIROS, F.S.B.; LOPES, T.A.M. FINANÇAS PESSOAIS: um estudo com alunos do curso de Ciências Contábeis de uma IES privada de Santa Maria/RS. 2014. Disponível no site: www.portaldeperiodicos.unisul.br/index.php/EeN/article/view/1966. Acesso em 20/06/2019.

PEIC – Pesquisa de Endividamento e Inandimplência do Consumidor. 2019. Disponível no site: http://www.cnc.org.br/editorias/economia/pesquisas/pesquisa-de-endividamento-e-inadimplencia-do-consumidor-peic-3 Acesso em 05/01/2020.

PRADO, A.B. Educação Financeira: a visão de jovens universitários sobre finanças familiares. 2015. Disponível no site: https://tede2.pucsp.br/bitstream/handle/1135/1/Andre%20Brisola%20Brito%20Prado.pdf acesso em 12/09/2019.

PREVIC, Superintendência Nacional de Previdência Complementar. O que é Educação Financeira. s/d. Disponível no site: http://www.previc.gov.br/regulacao/educacao-previdenciaria/educacao-financeira-e-previdenciaria/o-que-e-educacao-financeira. Acesso em 11/09/2019.

SILVA, C.L.; SILVA, J.G. Educação Financeira e o Comportamento do Consumidor: um estudo de caso com jovens de Ituiutaba/MG. 2019 Disponível no site: https://repositorio.ufu.br/bitstream/123456789/23578/3/EducacaoFinanceiraComportamento.pdf. Acesso em 21/06/2019.

APPENDIX – FOOTNOTE REFERENCES

4. To know, follow the video link https://exame.abril.com.br/seu-dinheiro/canal-no-youtube-ensina-educacao-financeira-para-jovens-da-periferia/

5. José Cesar da Costa- President of the National Confederation of Shopkeepers

6. PEI – Pesquisa Nacional de Endividamento e Inadimplência do Consumidor, is calculated monthly by CNC since January 2010. Data are collected in all state capitals and the Federal District, with about 18,000 consumers. From this information collected, important indicators are calculated such as percentage of indebted consumers, Percentage of consumers with overdue accounts, Percentage of consumers who will not be able to pay their debts, Debt Time and Income Commitment Level (PEI, 2019).

7. UNASP/SP is located 9 km from Santo Amaro and 23 km from downtown São Paulo, its address is Road from Itapecerica, no 5859, Jardim IAE in the neighborhood of Capão Redondo, subdistrict of Santo Amaro, southern region of the city of São Paulo.

8. Mobills is one of the most complete personal finance applications. The app features several tools to provide spending control for your user. Mobills is ideal for those who want to replace spreadsheets with a much more intuitive and easy-to-use tool. The app features many features and allows great agility in recording your monthly and daily expenses. With the goal of easy gearing while reading data, the app offers interactive charts and also features synchronization with your credit card, allowing you to easily track earnings and expenses during the month. It is a Freemium whose paid version is in monthly subscription format. A gift for you, use the code TOPINVEST20 and get 20% off the Mobills subscription; Free the app already performs annual and monthly comparisons of spending indicating exactly in which category the user spent more than it should. In addition to IOS, Android and Windows Phone Mobills is also available on the web. The information you register on it is automatically synced to the cloud to keep the platform up to date if you want to see it on your PC or notebook. Available on the website: https://www.topinvest.com.br/aplicativos-de-financas-pessoais-os-7-melhores/ access on 15/01/2018.

9. GuiaBolso is an application with a good differential that is the fact of connecting with your bank accounts. Oh, don’t worry about the security of the app because your security level is very high and your accounts won’t be stolen by third parties. The app offers banking security and has more than 3 million users in Brazil. The Pocket Guide can be used for 3 purposes: Automatic financial control; Loans made at the lowest possible interest; Radar over CPF; The financial control of the application allows the user to better control their finances and allows better planning of their future accounts. In the app there is the GuiaBolso loan function in which you can find, hire and track in a 100% virtual way the best loan offers made available by financial institutions. There you find personal loans with interest from 2.8% per month (attention, do not take loan without first reading the article on the types of credit for individuals). This app is 100% free available for iOS and Android. It comes second in the list of the best personal finance apps precisely for its extra functions of tracking the CPF and finding the best possible loans. Available on the website: https://www.topinvest.com.br/aplicativos-de-financas-pessoais-os-7-melhores/ access on 15/01/2018.

[1] PhD in Education Curriculum PUC / SP; Master in Education USF – Bragança Pta; Mestre Educação Curriculum PUC / SP; Bel Direito UBC – Mogi das Cruzes / SP; Computer Network Technologist – UNASP / SP campus SP; Internet Systems Technologist- UNASP / EC- Campus Engenheiro Coelho / SP. Degree in Mathematics – UNASP / SP – campus SP.

[2] Master in Accounting Sciences – Álvares Penteado School of Commerce Foundation – FECAP.

[3] MBA Specialist Risk Management and Compliance – Faculdade Trevisan- São Paulo / SP.

Sent: June, 2020.

Approved: July, 2020.