ORIGINAL ARTICLE

JOSÉ, Yoby Ricardo Caetano [1]

JOSÉ, Yoby Ricardo Caetano. Management of bad debts in Mozambican financial institutions: case study in BCI, Standard Bank, Letshego and Ecobank, Nampula province, 2015-2019. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year. 07, Ed. 05, Vol. 03, p. 158-180. May 2022. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/business-administration/management-of-bad-debts

ABSTRACT

The existence of bad debt represents weakness on the part of the Financial Institution (FI) in managing its assets. For this reason, these organizations look for mechanisms to minimize the risk of losing the capital loaned to their clients. In view of this, the present study aims to answer the following question: how did financial institutions in Mozambique, specifically in the province of Nampula, manage non-performing loans in the period 2015-2019? The general objective of this article is to demonstrate how some financial institutions in Mozambique, that is, in the province of Nampula, managed the non-performing loans linked to them in the period 2015-2019. In methodological terms, a qualitative approach was followed, seeking the perception of the FIs about this phenomenon. For data collection, semi-structured interviews were carried out. As for the objective, the research was descriptive and exploratory, as the intention is to know and deepen the phenomenon of bad debts in these specific institutions. In terms of procedures, it represents a case study insofar as it addresses a specific and qualitatively little explored aspect at the academic level in Mozambique. The subjects of this research were selected through the criterion of accessibility due to restrictions imposed by most financial institutions. In this context, the 4 participants who took part in this study were chosen based on the researcher’s network of relationships. The main results and conclusions of the research show that there are natural and administrative factors in the origin of bad debts, however, banks have been developing several actions to mitigate the occurrence of these credits, from controlling risk factors to the use of prudential indicators imposed by the Central Bank.

Keywords: Loan, Bad Credits, Financial Institutions.

1. INTRODUCTION

In Menacho’s (2020) view, the existence of non-performing loans constitutes an obstacle to economic growth, as it acts directly on monetary policy as banks are forced to reduce the supply of credit and increase the cost of capital.

In the case of Mozambique, the evolution of non-performing loans between 1996 and 1997 was 1214%, reflecting a very high level of growth and poor asset quality in some financial institutions in the country (MATULE, 2001). Between 2015 and 2016, we again see a scenario that is still worrying, bad loans increased by 66%, from 10.6 to 17.6 billion meticais due to the inability of companies and individuals to meet debt service (LUSA , 2017).

The ratio that measures the level of non-performing loans represents a basic instrument to assess the financial health of commercial and investment banks, and is also used as the main measure of credit risk in the banking system (KJOSEVSKI et al., 2019).

In Mozambique, the average non-performing loan ratio of 19 banks analyzed exceeded the limit of 4% (average observed in 2015 and previous years), jumping to an average of 5.4% in 2016 and 8.4% in 2017, according to the Mozambican Banking Association (AMB, 2018).

According to Caiado (1998), the implications of non-performing credit have a negative impact insofar as the institution’s operating cost increases with the mandatory provision for this purpose. This fact can also translate into a decrease in the institution’s level of profitability or a reduction in its ability to manage its assets. Likewise, an increase in non-performing loans may mean that the financial institution is weakened, or even that the ability of economic agents to generate income and savings has decreased.

In the case of “Nosso banco” and “Moza Banco”, the intervention of the Central Bank between 2016 and 2017 demonstrated that the financial crisis to some extent affected our banking system. These banks had a solvency ratio below the minimum required by law (8%), low capitalization and liquidity problems. Therefore, the Central Bank’s monitoring of the management of these two banks culminated in the closure of the first and a change in the management of the second (MATIAS, 2016; LUSA, 2017).

This event led the Bank of Mozambique (BM) to adopt a series of measures to control the economy, and in June 2018 it reduced the MIMO rate (the Central Bank reference rate in Mozambique), and December 2018 lending and deposit facility rates. (BM, 2018).

Considering what was described in the above paragraphs, this article is supported by the following research question: how did financial institutions in Mozambique, specifically in Nampula province, manage bad debts in the period 2015-2019?

To address the guiding question of this investigation, a general objective was defined, which consisted of demonstrating how some financial institutions in Mozambique, that is, in the province of Nampula, managed the non-performing loans linked to them in the period 2015-2019.

Specifically, to meet the general objective of the research, the following specific objectives were outlined: classify credit in order to understand when it is considered bad, distinguish the factors that determine its origin and the actions taken by financial institutions to face this phenomenon.

Within the scope of its structuring, in order to better understand the subject, some relevant concepts were distinguished, the factors that determine bad credit and the methods of credit analysis.

2. CREDIT

2.1 CREDIT INSTITUTION

According to Notice No. 9/GBM/2018 of the Bank of Mozambique (BM, 2018), a credit institution refers to a company whose activity consists of capturing deposits or other repayable funds, in order to apply them in your favor by granting credit.

In the case of Mozambique, there are numerous credit institutions, from commercial and investment banks to microfinance institutions. These institutions submit to the Central Bank (Banco de Moçambique) which is the entity responsible for managing monetary policy and regulating the financial system. He is the state and commercial banker par excellence. Credit concessions occur through a contract between the financial institution and the borrower (AMB, 2018).

2.2 CONCEPT OF CREDIT VS BAD CREDIT

Also under the terms of subparagraph f of art. 3 of Notice No. 9/GBM/2018, is distinguished as the total amount of credit agreements with the maximum limit or the total of amounts made available by the credit institution to its customer(s) (BM , 2018).

It is important to point out that this last aspect is taken into account when the FI intends to assess the customer’s total debt at times when it decides to proceed with the execution of guarantees, or even the concept proves to be central in the process of assessing the customer’s exposure for the purposes of credit restructuring.

Regarding the classification, Gabgub (2009 apud CHAVES, 2016) argues that credit becomes bad debt when it no longer has a return (interest and capital) after 90 or more days of maturity, or when there is no payment of installments up to six months after expiration.

At first, we can see that the failure to pay the installments for a period equal to or greater than 90 days may give rise to bad debt if we also consider that all alternatives for charging the customer have been exhausted.

3. EVOLUTION OF BAD CREDIT IN MOZAMBIQUE

According to the BM (2018), the Non-Performing Loan (NPL) is a ratio that measures the volume of non-performing loans over total credit granted to its customers. This ratio assesses the bank’s ability to manage its financial assets, therefore, the financial institution that has high values in this index has low profitability and is obliged to put a provisional amount to cover possible loan losses.

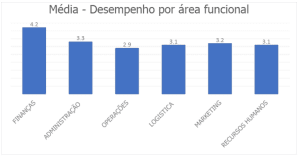

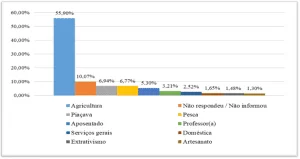

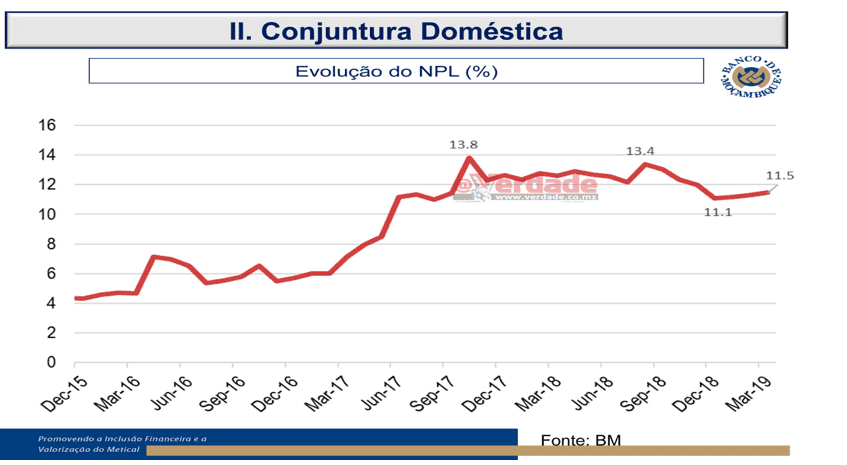

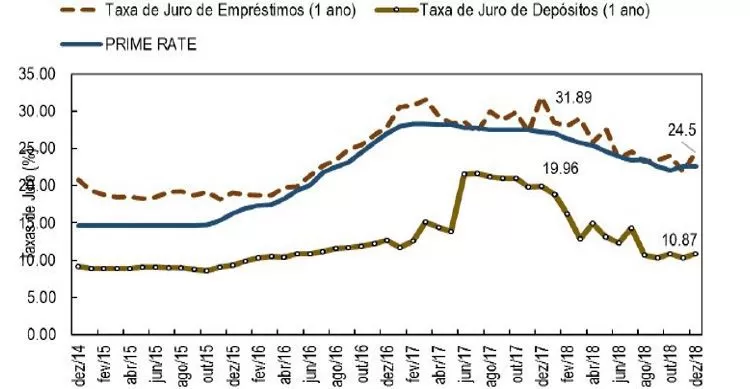

Figure 1: Evolution of NPL (NPL)

Figure 1 illustrates that the trend of NPLs in Mozambique in the last 5 years has been increasing, with the highest peak at the end of 2017 and 2018. According to the BM (2018), factors such as the exchange rate and inflation constituted the main influencing forces in this process.

4. POTENTIAL DETERMINING FACTORS OF BAD CREDIT

4.1 EVOLUTION OF DOMESTIC INTEREST RATES

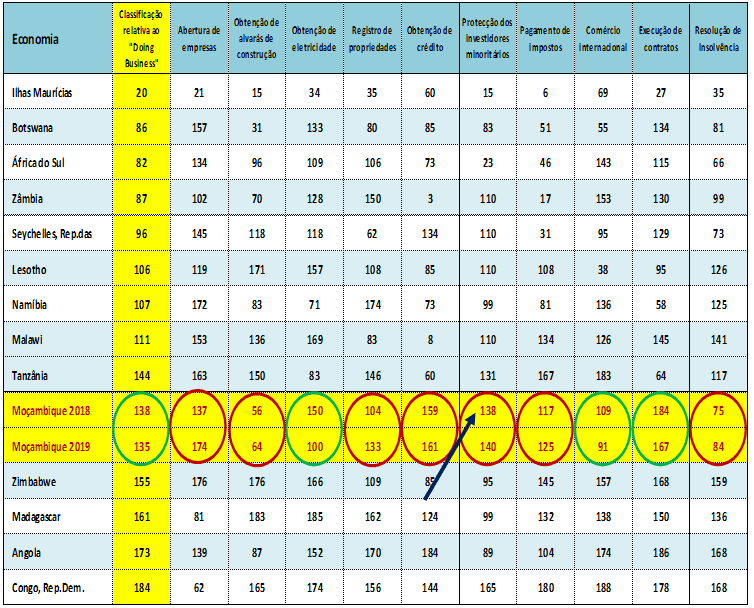

The interest rate is a determinant of the cost of capital and can eventually act as one of the determinants of the borrower’s default on obligations (POPOSKA, 2015; CHAVES, 2017). In the case of Mozambique, through the graph below, we can observe the behavior of the interest rate on loans over 5 years.

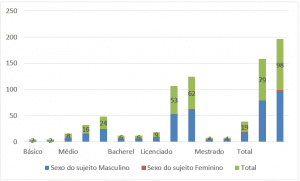

Figure 2 – Evolution of domestic interest rates

Figure 2 shows how the interest rate on loans evolved between 2014 and 2018, with the average interest rate on loans granted reduced to 24.50% in December 2018, after 31.89% a year earlier (BM , 2018).

Em 2017, os empréstimos e adiantamentos do setor bancário diminuíram em 16% devido a vários fatores, tais como: a fraca disponibilidade do bom crédito no mercado, altas taxas de juro praticadas no país que inibiram potenciais clientes de empréstimos, baixas taxas de crescimento económico, sendo que em 2017 atingiu-se a fasquia de 3,7%, aliado a isto está a desvalorização da moeda nacional face ao dólar e o aumento do nível de crédito malparado, causado pela difícil situação econômica do país (KPMG; AMB, 2018 p. 14)

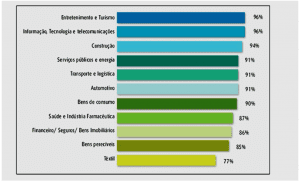

4.2 EXCHANGE RATE AND INFLATION

The increase in the exchange rate in 2016 resulted in high costs in the acquisition of goods and services from abroad and also contributed to the increase in the inflation rate. This last variable had a negative influence on the purchasing power of economic agents, as a result, companies had their cost structure negatively affected and those that had taken out credits had a higher risk of default (BM, 2016; INSTITUTO NACIONAL DE STATÍSTICA, 2017). As a result, Mozambique recorded a drop of 2 places in Doing Business in terms of obtaining credit (see table 1). There was a retraction on the part of the financial sector because in the risk assessment process the financial rating agencies rated our economy at the lowest level (CCC), which meant that the risk of investing in Mozambique was greater. (Verbal Information)[2]

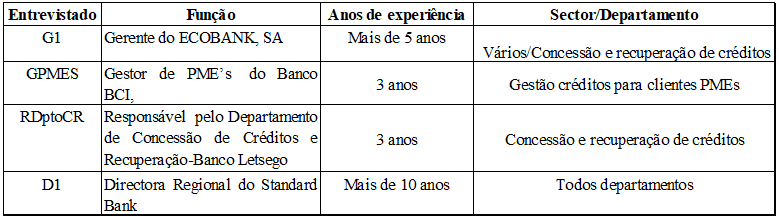

Table 1 – Ranking of the Mozambican Economy in Doing Business (2019)

5. ECONOMIC-FINANCIAL ANALYSIS OF THE CREDIT OFFER

The analysis of the credit supply derives from the need to ensure that FIs do not cause losses that, consequently, can lead to insolvency or even bankruptcy. In this context, Cardoso Júnior and Keflen (2015) essentially distinguish two types of analysis: subjective and through financial statements.

5.1 SUBJECTIVE ANALYSIS

Regarding this type of analysis, one of the methods traditionally adopted by Financial Institutions in credit assessment is the 5Cs. This consists of collecting essential information to decide whether or not to grant credit to the customer. (CARDOSO JÚNIOR and KEFLEN, 2015)

Several authors (CARDOSO JÚNIOR and KEFLEN, 2015; NEVES and Deus, 2015; GITMAN, 2004) define the five C’s in the following sequence:

- Character: represents the customer’s history with regard to fulfilling obligations to the bank;

- Capacity: refers to the ability to pay the credit requested by the customer, evaluated based on an analysis of the financial statements, emphasizing the cash flows available for the payment of debts”;

- Capital: constitutes the volume of the customer’s debts in relation to its equity;

- Collateral (collateral): represents the volume of assets that the customer has available to use as a credit guarantee. The greater the pool of available assets, the greater the possibility of the company recovering funds if the client cannot honor the due installments;

- Conditions: the current general and sectoral economic conditions and any special conditions linked to a specific condition.

5.2 ANALYSIS OF FINANCIAL STATEMENTS

In the view of (CARDOSO JÚNIOR and KEFLEN, 2015; GITMAN, 2010), two initial techniques can be adopted for the analysis of financial statements, namely:

a) Vertical analysis: which has as a reference the total assets and liabilities of the balance sheet or the gross income of the income statement. With this reference we will calculate the weight of each account on the total assets and liabilities or on the total income in the income statement.

b) Horizontal analysis: in which the variation occurred in each account of the income statement is calculated. In this analysis, the evolution of the balance sheet account or the income statement from one period to the other will be calculated.

5.3 OTHER FORMS OF CREDIT ANALYSIS

We can see that in addition to the first two, Sanches et al. (2018), illustrate other forms of credit assessment that allow predicting possible default situations, with emphasis on 3 models:

5.3.1 KANITZ MODEL

According to Kanitz (1974 apud SANCHES et al., 2018), this model is used to calculate the insolvency value. We can assume that it is used to assess whether a company is going bankrupt or not. In mathematical terms, the so-called Kanitz thermometer can be represented by the following formula:

Where: RP – Return on Equity; LG – General Liquidity; LS – Dry Liquidity; LC – Current Liquidity; GE – Degree of Indebtedness.

Therefore, regarding the results, it can be said that: positive values indicate that the company is in good financial situation, if the result is less than -3, it means that the company is in a situation of insolvency and that it may lead to bankruptcy. Finally, between -3 and 0 it is considered a penumbra region in which some precautions must be taken to effectively avoid going into insolvency.

5.3.2 ALTMAN MODEL

Kanitz (1974 apud SANCHES et al., 2018) also mentions the Altman model that shows that the risk of insolvency can be calculated using the following formula:

where it is assumed that:

- X1 – Current Assets-Current Liabilities/Total Assets;

- X3 – Reserves and Suspended Profits/Total Assets;

- X4 –Shareholders’ Equity/Total Liabilities;

- X5 – Sales/Total Assets.

“The result criterion used by Altman was: companies with index ![]() solvent companies that can continue with their operations are classified, while companies with an index

solvent companies that can continue with their operations are classified, while companies with an index ![]() are classified as insolvent companies that have serious financial problems.” (KANITZ, 1974 apud SANCHEZ et al., 2018).

are classified as insolvent companies that have serious financial problems.” (KANITZ, 1974 apud SANCHEZ et al., 2018).

5.3.3 PEREIRA MODEL

In the model adopted by Pereira Silva, the variables used to calculate the company’s solvency are obtained from the balance sheet and the income statement (SANCHES et al., 2018).

According to Sanchez et al. (2018) the formula suggested by Pereira Silva is as follows:

Whereas:

- X1 = Discounted Duplicates/Duplicates Receivable;

- X2 = Ending Inventory/Cost of Sales;

- X3 = Suppliers/Sales X4 = Average Inventory/Cost of Sales;

- X5 = (Operating Profit + Financial Expenses) / (Total Assets – Average Investment);

- X6 =Total Liabilities/(Net Profit + 10% Average Property + Debt Balance of Cor. Monet.).

In terms of results, we can consider the following: if Z is greater than 0, the company is solvent, however if Z is less than 0, the company is insolvent.

Notwithstanding what has already been mentioned, today we are witnessing an increasingly modernized credit assessment with the use of econometric models to predict possible losses that may occur due to default.

Given this fact, Caouette et al. (1998 apud MUIAMBO, 2011, p. 22-23) highlighted that:

Os modelos econométricos mais adotados para gestão de risco são: logit, um modelo que assume que a probabilidade cumulativa de perda de um empréstimo esteja entre 0 a1, e que a probabilidade de perda seja logisticamente distribuída, e modelo probit (um modelo que assume que a probabilidade de perda de um empréstimo esteja entre 0 a 1, e que a probabilidade de perda tenha uma distribuição normal, assim sendo, ambos modelam a probabilidade de inadimplência ou o prêmio de inadimplência.

5.4 RISK ANALYSIS

Regarding risk analysis, it can be said that banks are constantly exposed to credit, market and liquidity risk. (BCI, 2017; CARDOSO JÚNIOR and KEFLEN, 2015)

Credit risk is the probability that the counterparty will not be able to honor the payments due to incapacity or for another mentioned reason (BCI, 2017). In the light of BCI’s financial report (2019, p. 29), “the specific analysis of credit operations follows the principles and procedures established in the General Credit Regulation to establish the risk profile, essentially through the evaluation of the following indicators”:

- Incidents and defaults, liens or debts to the tax authorities and social security;

- Limits of exposure to Credit Risk, current indebtedness capacity and assessment of the forecast capacity of debt repayment. In the case of private customers, the credit limit and the assessment of the predictive capacity to repay the debt is based on the calculation of the effort rate or the estimate of the value of savings of the proponents, guarantors and/or guarantors;

- Value, robustness and liquidity of real and/or personal guarantees to cover the credit and the consequent mitigation of the associated risk in the event of execution due to default.

Market Risk: which has its origin in the variation in the values of assets and liabilities due to changes in market prices and rates (such as interest, shares, currency quotations and commodities prices), and in the correlation between these variables and their volatilities BANCO INDUSVAL and PARTNERS (BI and P, 2010).

Liquidity Risk: which actually occurs due to possible distortions between payments and receipts that may affect the ability to fulfill one or more obligations. It also stems from the inability to acquire sufficient capital to honor its short, medium and long-term commitments in sufficient volume for a position, thus affecting the price of their value (BCI, 2017; BI and P, 2010).

6. METHODOLOGICAL PROCEDURES

The study was carried out in 4 commercial and investment banks, located in the city of Nampula, that is, in the North of Mozambique, also involving 4 participants with experience in granting and controlling credit, whose profile is described in table 1.

Regarding the research methodology, the approach adopted was qualitative, descriptive and exploratory. Therefore, as a procedure, we sought to discuss the phenomenon of bad debts, using the perception of FIs, theoretical and empirical literature.

With the adoption of the qualitative method, it was not necessary to resort to statistical procedures for the treatment of the data obtained.

Based on the view of Richardson et al. (2010), the qualitative approach to a problem is justified when essentially we intend to understand a problem of a social nature, and the adoption of measurement methods and quantitative analysis is not imperative.

Regarding the procedure, the research is a case study, which:

According to Gil (2014), it implies a deep and exhaustive exploration of one or a few objects as a way of obtaining greater knowledge about oneself.

Yin (2005, p. 32), adds that “a case study, being an empirical investigation, investigates a contemporary phenomenon within its context, especially when the boundaries between the phenomenon and the context are not clearly defined.”

As a way of responding to the research objectives, the data collection process implied the adoption of some techniques such as: the interview and document analysis.

The type of interview adopted in the research process was semi-structured, as it allowed exploring more issues beyond those provided for in the script, and obtaining greater sensitivity from the participants regarding certain aspects related to bad debt.

Domingues and Neves (2007) argue that the semi-structured interview allows the collection of objective information, and more than that, it allows capturing the subjectivity existing in values, attitudes and opinions.

Associated with the interview, empirical research was used on non-performing loans where it was possible to analyze: studies related to the theme, reports from the Central Bank, commercial banks and AMB.

Survey respondents were selected based on accessibility criteria due to restrictions imposed by most financial institutions. Therefore, the four participants were selected taking into account the researcher’s network of relationships and relevant information that they could provide.

According to Vergara (2010), the accessibility criterion consists of selecting research subjects based on the ease of access to them.

Data analysis was supported by the technique of analyzing the contents obtained from the interviews, and document analysis, which were grouped into categories and subcategories. Therefore, in this process, the content analysis grid was used as a tool, composed of categories, subcategories, and recording units.

The content analysis technique “consists of the theoretical interpretation of the categories that emerge from the researched material, even though these categories may have already been defined a priori according to some theory preferred by the researcher” (APPOLINÁRIO, 2012, p. 165).

Content analysis is regularly adopted for the treatment of qualitative research data, it has been used in the field of administration, psychology, advertising and others (MINAYO, 1994; MOZZATO and GRZYBOVSKI, 2011).

7. RESULTS AND DISCUSSION

As mentioned in the previous point, the content analysis technique was used for data analysis, and for its systematization, these data were classified into categories and subcategories. From this perspective, we can observe exactly how financial institutions respond to questions related to the topic.

7.1 PROFESSIONAL PROFILE OF RESEARCH INTERVIEWEE

Data referring to survey respondents reveal that all of them have at least three years’ experience in credit management, with 50% having more than 5 years of experience.

Table 1: Professional Profile of Research Respondents

7.2 CREDIT CLASSIFICATION AS MISSING

Based on the assumption of the interviewees, we can see that there is a condition to consider that the credit granted to the customer has become bad debts, but there is no consensus on the correlation with time:

The minimum period to be taken into account to consider that the credit is bad debt is 90 days (GPMES, 2019).

When the debt collection alternatives are exhausted, that is, even if 90 days have not passed, we assume the existence of bad debts in the portfolio (G1, 2019).

RDptoCRC (2019) considers that the lack of payment within 90 days gives rise to overdue credits or installments and not necessarily bad debts, and also classifies them into five types:

- Type 1 – Credit card credits;

- Type 2 – Long-term credits (paid without delay);

- Type 3 – Long-term credits (1 month overdue);

- Type 4 – Long-term credits (60 to 90 days overdue);

- Type 5 – Long-term credits over 90 days (non-performing).

Returning to the view of Gabgub (2009 apud CHAVES, 2016), credit becomes bad debt when it no longer has a return (interest and capital) after 90 or more days of maturity, or when there is a lack of payment of installments up to six months later your due date.

Analyzing the results and the perception of the authors mentioned above, we can see that the failure to pay the installments for a period equal to or greater than 90 days may give rise to bad debt if, in the same way, we consider that all the alternatives for charging the customer have been exhausted as suggests the G1.

7.3DETERMINING FACTORS OF BAD CREDIT

7.3.1 LOAN INTEREST RATES

Regarding this point, the participants answered the following: despite the slowdown in loan interest rates between 2018 and 2019, NPLs showed levels considered still high compared to the same periods of the years 2015 and 2016. (GPMES, 2019)

Em 2017, os empréstimos e adiantamentos do setor bancário diminuíram em 16% devido a vários fatores, tais como: a fraca disponibilidade do bom crédito no mercado, altas taxas de juro praticadas no país que inibiram potenciais clientes de empréstimos, baixas taxas de crescimento económico, sendo que em 2017 atingiu-se a fasquia de 3,7%, aliado a isto está a desvalorização da moeda nacional face ao dólar e o aumento do nível de crédito mal parado, causado pela difícil situação econômica do país (KPMG; AMB, 2018 p. 14)

The fact is that even with this drop in loan interest rates, NPLs continue to show an increasing trend in subsequent years compared to the same periods in 2015 and 2016, as shown in Figure 1 (NPL Evolution).

7.3.2 EXCHANGE FLUCTUATION AND INFLATION

According to the interviewees, the increase in the exchange rate meant that companies importing production equipment had to spend more capital for their acquisition, also causing an increase in operating costs, and as a result small and medium-sized companies began to face difficulties in meeting the installments to be paid to the banks. (G1; GPMES; D1, 2019)

From 2016 to 2017 there was one of the biggest exchange rate fluctuations in the financial market, where the 1 usd, which corresponded to roughly 31.5 meticais, became worth about 70 meticais. In 2018 and 2019 there was a slowdown in the exchange rate, with the metical appreciating against the dollar, with each unit costing MZN 62.00. Currently, the dollar has again registered a variation of approximately 13%, further aggravating the depreciation of the national currency (AMB; KPMG, 2019).

As Mozambique is a country with a trade deficit, the increase in the exchange rate resulted in high costs in the acquisition of goods and services from abroad.

As a result of this scenario, Mozambique registered a drop of 2 places in the Doing Business in terms of obtaining credit. There was a retraction on the part of the financial sector, as in the risk assessment process, rating agencies rated our economy at the lowest level (CCC), which meant that the risk of investing in Mozambique was greater (BANCO MUNDIAL, 2019).

7.3.3 ADMINISTRATIVE AND NATURAL FACTORS THAT INFLUENCE NARROWED CREDIT

In addition to the exchange rate fluctuation, interviewees G1 and D1 (2019) also highlighted some determining factors of bad debt, classifying them as administrative and natural (Table 2):

Table 2: Administrative and natural factors of non-performing loans

| Order | Bad credit determinants |

| Administrative | § The Bank’s recklessness in credit analysis; § Change in the effort rate from 30% to 40%; § Deviation from the application of the financing received by the client; |

| Natural | § Violation of the principle of good faith; § Deaths, that is, natural factors; § Social Factors (family problems); § Natural disasters (cyclones IDAI and KENNETH); |

Source: own authorship based on respondents’ responses (2020).

One of the interviewees reports that around 2016-2017, the bank had a significant volume of non-performing loans in its portfolio, with emphasis on arrears, lack of profitability in the business, change of bank domicile, and unemployment (RDptoCR, 2019).

In the interviewees’ reports, it is noticeable that several factors have contributed to the growth of non-performing loans, from those that can be controlled by the bank, and factors that derive from market[3] and liquidity[4] risks.

7.4 ACTIONS TAKEN BY FINANCIAL INSTITUTIONS IN MITIGATION OF NON-PERFORMED CREDIT

According to the interviewees, the FIs have adopted a series of measures to minimize the occurrence of non-performing loans, as follows:

Table 3: Mitigation Actions for Bad Credit

| Interviewee | Non-performing credit mitigation actions |

| G1, GPME’s | In the first instance, the bank proceeds with an assessment of the risk of granting credit to the customer through document analysis. This actually involves checking the evolution of the bank account balance and/or financial statements. |

| GPME’S, RDptoCRC | If there is any delay in the payment of installments, between 30 to 60 days, calls are made to the customer in order to request him to renegotiate the contract. |

| G1 | Some FIs have joined credit insurance as a precautionary measure; Refinancing of credits in an attempt to leverage the debtor company; Reduction in the level of financing Hiring factoring companies to manage bad debts; Sale of debt to another bank that buys it to secure one more customer in its portfolio; Exchange of holder when there is a guarantor. |

| GPME’s | After 90 days, a coercive collection begins, and the debt can be restructured in agreement with the customer. |

| G1,GPME’s, RDptoCRC) | In parallel with the enforced collection, the FI must set up provisions for possible impairment. |

| G1,GPME’s, RDptoCRC) | Debt cancellation through the execution of guarantees (write-off) |

Source: Own authorship based on interview results (2020).

With regard to the first measure to mitigate bad debts, Cardoso Júnior and Keflen (2015) suggested that an assessment of credit risk be made based on two types of analysis: subjective and through financial statements.

For the analysis of financial statements, Gitman (2010) highlighted that two important techniques can be applied:

c) Vertical analysis: which has as a reference the total assets and liabilities of the balance sheet or the gross income of the income statement. With this reference we will calculate the weight of each account on the total assets and liabilities or on the total income in the income statement.

d) Horizontal analysis: in which the variation occurred in each account of the income statement is calculated, in this analysis the evolution of the balance sheet account or the income statement from one period to the other will be calculated.

Sanches et al. (2018), illustrated other forms of credit assessment that allow predicting possible default situations, with emphasis on quantitative models.

In the results obtained from the research, we can see that the FIs proceed with the assessment of credit risk using the inspection of the customer’s balance, financial statements, interaction with the customer, but they do not mention the use of quantitative models for this purpose.

8. FINAL CONSIDERATIONS

The present research had as general objective to demonstrate how some financial institutions in Mozambique, that is, in the province of Nampula, managed the non-performing loans linked to them in the period 2015-2019.

Regarding the classification of the credit as bad debt, it was concluded that it adopts this designation when its maturity exceeds a period of 90 days, however, there are exceptional cases in which the FIs are definitely unable to collect the debt (deaths, bankruptcy declared in concordats) and in this way the credit can be classified as bad debt in a shorter period of time than previously mentioned.

The survey results showed that the reasons that led to an increase in NPLs in Nampula during the period in question were: the increase in the interest rate; increase in the exchange rate, with the dollar rising from 31 MT/dollar to approximately 70 MT/dollar, significantly altering the financial cost for economic agents.

Likewise, the increase in the inflation rate in the last 4 years contributed to the problem in question, as, as a consequence, the price of products and services increased, putting pressure on the operating costs of the FIs. Some natural and administrative factors also contributed to this effect, such as bad faith on the part of the client, social problems, natural disasters and errors of assessment on the part of the creditor.

Finally, answering the guiding question of the research, which is: how did financial institutions in Mozambique, specifically in the province of Nampula, manage non-performing loans in the period 2015-2019, it is concluded that in the context of the management of non-performing loans, the FIs in question, sought to carry out a risk assessment before granting the credit, set up provisions when there were signs of non-payment of installments, made calls to customers in order to request them to renegotiate the contract, have enforced collection when all possibilities for negotiation with the customer, and opted for credit refinancing, reduction of the financing level, hiring companies to manage and recover bad debts (factoring), sale of debt to another bank that buys to guarantee another customer in its portfolio, exchange of debt holder and ultimately its cancellation.

REFERENCES

AMB. ASSOCIAÇÃO MOÇAMBICANA DE BANCOS. Pesquisa sobre o Setor Bancário. Moçambique: Maputo, 2018. Disponível em: http://www.amb.co.mz/index.php/publicacao/pesquisa-do-sector-bancario/77-pesquisa-do-sector-bancario-2018-1/file Acesso em: 25 de set. de 2020.

BANCO MUNDIAL. Doing Business: Comparando a Regulamentação de Negócios para Empresas Nacionais em 10 províncias com 189 outras Economias. Washington, DC, 2019. Disponível em: https://www.doingbusiness.org/content/dam/doingBusiness/media/Miscellaneous/SubNational/Doing-Business-em-Mo-ambique-2019_Pt.pdf Acesso em: 23 de nov. de 2019.

BM. BANCO DE MOÇAMBIQUE. Relatório Anual: Situação Macroeconómica. Maputo, 2018. Disponível em: http://www.bancomoc.mz/fm_pgTab1.aspx?id=106 Acesso em: 20 de dez. de 2019.

BM. BANCO DE MOÇAMBIQUE. Taxas de Câmbio Praticadas pelos Bancos Comerciais nas Transações com o Público referentes ao dia: 1.02.2016. Maputo, 2016. Disponível em: https://www.bancomoc.mz/Files/TCIB/ZCAM102_02122016.pdf Acesso 8 de Março de 2022.

CAIADO, Aníbal Campos. Gestão Bancária. Lisboa: Editora Internacional, 1998.

CHAVES, Arnaldo Wilson Pereira. Determinantes do Crédito Malparado nos Bancos Comerciais Angolanos: Uma Análise dos Factores Macroeconómicos e Específicos do Sector Bancário no período de 2010-2015. 2017. Dissertação (Mestrado em Gestão de Empresas) – Departamento de Ciências Económicas e Empresariais, Universidade Autónoma de Lisboa, Lisboa, 2017. Disponível em: https://repositorio.ual.pt/bitstream/11144/3219/1/Disserta%c3%a7%c3%a3o%20de%20Mestrado%20-%20Wilson%20Chaves%20Vers%c3%a3o%20Final%2018-06-2017.pdf Acesso em: 29 de set. de 2020.

DE CARVALHO, Paulo Viegas. Fundamentos da Gestão de Crédito: Uma contribuição para o valor das Organizações. Lisboa: Sílabo, 2009.

DOMINGUES, Clayton Amaral, NEVES, Eduardo Borba (Org). Manual de Metodologia de Pesquisa Científica. Rio de Janeiro, 2007.

GIL, Antonio Carlos. Métodos e técnicas de pesquisa social. 6ª ed. São Paulo: Editora Atlas. 2014.

GITMAN, Laurence. Princípios de Administração Financeira. 10 ed. São Paulo: Editora Pearson Addison Wesley. 2010.

INE. INSTITUTO NACIONAL DE ESTATÍSTICA. Índice de Preços do Consumidor: Quadros, Dezembro de 2016. Maputo, 2016. Disponível em: http://www.ine.gov.mz/estatisticas/estatisticas-economicas/indice-de-preco-no-consumidor/quadros/nacional/ipcmocambique_quadros_dezembro16.xls/view Acesso em 8 Março de 2022

KJOSEVSKI Jordan, et al. Bank-specific and macroeconomic determinants of non-performing loans in the Republic of Macedonia: Comparative analysis of enterprise and household NPLs. Economic Research-Ekonomska Istraživanja. v. 32, pp 185-1203, 2019. Disponível em: https://www.tandfonline.com/doi/pdf/10.1080/1331677X.2019.1627894 Acesso em 28 fev. de 2022

LUSA. Crédito malparado no setor bancário de Moçambique aumentou 66% – Estudo 5 de Dezembro de 2017. Diário de Notícias. Portugal, 5 de Dez. 2017. Disponível em: https://www.dn.pt/lusa/credito-malparado-no-setor-bancario-de-mocambique-aumentou-66—estudo-8963830.html Acesso em 22 de fev. de 2022

MATULE, Ivone António Pelembe. Crédito Malparado em Moçambique: Dimensão, Causas e soluções. Monografia (Licenciatura em Economia) – Faculdade de Economia, Universidade Eduardo Mondlane, Moçambique, 2001. Disponível em: http://monografias.uem.mz/bitstream/123456789/947/1/2001%20-%20Matule%2C%20Ivone%20Antonio%20Pelembe.pdf. Acesso em 18 de jan. de 2022

MATIAS, L. Em Moçambique o “Nosso Banco” Encerrou as Portas. DW, Maputo, 14 Nov. 2016. Disponível em: https://www.dw.com/pt-002/em-mo%C3%A7ambique-o-nosso-banco-encerrou-as-portas/a-36393038. Acesso em 22 de fev. de 2022

MENACHO, Teófilo Pereira. Crédito Malparado: Determinantes, Impactos e Prevenção (Mestrado em Contabilidade e Finanças) – Faculdade de Economia, Universidade de Coimbra. Portugal, 2020. Disponível em: https://eg.uc.pt/bitstream/10316/94683/1/Cr%C3%A9dito%20Malparado%20-%20Determinantes%2C%20Impactos%20e%20Preven%C3%A7%C3%A3o.pdf Acesso em 18 de fev. de 2022

MOZZATO, Anelise Rebelato; GRZYBOVSKI Denize. Análise de Conteúdo como Técnica de Análise de Dados Qualitativos no Campo da Administração: Potencial e Desafios. v. 15, nº4, p. 731-747, 2011. Disponível em: http://www.scielo.br/pdf/rac/v15n4/a10v15n4.pdf. Acesso em: 28 de Abril de 2020.

MOÇAMBIQUE. Banco de Moçambique. Aviso n°9/GBM/2018, de 29 de Outubro de 2018. Determinação do rácio entre o valor do empréstimo e o valor do bem dado como garantia (Ltv) e do rácio entre o montante do serviço da dívida e do rendimento do cliente (Dti). Disponível em: http://www.bancomoc.mz Acesso em: 17 de jan. de 2019.

MUIAMBO, Titos Albino Muchite. Gestão de Risco de Créditos: Caso do Banco Comercial e de Investimentos,SA. Monografia (Licenciatura em Economia) – Faculdade de Economia, Universidade Eduardo Mondlane, Moçambique, 2011. Disponível em: http://monografias.uem.mz/bitstream/123456789/599/1/2011%20%20Muiambo%2C%20Titos%20Albino%20Muchite.pdf Acesso em: 18 de agost. de 2020.

NEVES, Marcela Bianca de Almeida, DEUS, Cristian Fabian. Concessão de Crédito. 2015 Disponível em: http://fait.revista.inf.br/imagens_arquivos/arquivos_destaque/8bBzdOEsBU2RhO7_2017-1-17-19-12-3.pdf. Acesso em: 27 de jul. de 2020.

SANCHES, Vander Lúcio. et al. Análise de crédito: Instituições financeiras minimizam os riscos de inadimplência por meio da análise de crédito. Revista Científica Multidisciplinar Núcleo do Conhecimento. ano 3, v.9, pp. 127-151, 2018.

VERGARA, Sylvia Constant. Projetos e relatórios de pesquisa em administração. 12. ed. São Paulo: Atlas, 2010.

APPENDIX – FOOTNOTE

2. News provided by Salimo Vala, CEO of the Mozambique Stock Exchange, lecture on Capital Markets, in Mozambique, at Unilúrio Business School, 2 November 2018.

3. The depreciation of the national currency against the dollar, cyclones IDAI and KENNETH that devastated the central and northern regions of the country[emphasis by the author].

4. Liquidity Risk – occurs due to possible distortions between payments and receipts that may affect the ability to fulfill one or more obligations (BCI, 2017; BI and P 2010).

[1] Master in Business Administration, Graduate in Business Management. ORCID: 0000-0002-4518-4697.

Sent: September, 2021.

Approved: May, 2022.