REVIEW ARTICLE

LIMA, Alessandra Marques [1]

LIMA, Alessandra Marques. Optimization of Compliance and Mitigation of Accounting Frauds in American Organizations. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 08, Ed. 07, Vol. 06, pp. 118-133. July 2023. ISSN: 2448-0959, Access Link: https://www.nucleodoconhecimento.com.br/business-administration/optimization-of-compliance, DOI: 10.32749/nucleodoconhecimento.com.br/business-administration/optimization-of-compliance

ABSTRACT

It is through fraudulent accounting records that organizations’ annual results invariably lead directors and stakeholders to substantial losses, if not bankruptcy. The literature shows that financial frauds result from improper accounting entries, stemming from the bad intentions and greed of corrupt individuals in top management positions in various businesses. These individuals choose to engage in conduct that harms entire groups composed of companies, workers, and investors, affecting their credibility and integrity in their industry and also impacting professionals in the fields of accounting and auditing. In order to prevent financial frauds, organizations must take preventive measures by adopting good practices in Corporate Governance through the implementation of effective compliance actions, establishing specific and effective objectives among internal controls, and avoiding risks and accounting practices that may negatively impact the organizations. This original article, prepared through bibliographic research, aims to demonstrate that compliance actions contribute to the mitigation of fraud when properly applied in administrative and organizational processes. As a result, it was found that adopting compliance measures within the organizational system is not enough without regular verification of its effectiveness by administrators and managers.

Keywords: Compliance, Compliance Optimization, American organizations, Accounting frauds.

1. INTRODUCTION

“Accounting is a tool used by companies to generate reliable and consistent information” (RAMOS, 2015, p.7). Numerous financial scandals have been reported at intervals that surprise auditors, entrepreneurs, managers, and government officials, leading them to seek effective solutions to combat unethical and corrupt practices (SILVA, 2007). Over the past 25 years, dozens of accounting and financial frauds of gigantic proportions against American companies operating in various fields of activity have been widely publicized by the global media (GARA, 2015).

According to Nepomuceno (2002, p.1), many frauds in American companies have emerged in recent decades due to four main factors: loss of market competitiveness combined with low industrial productivity; an arms race fueled by the Cold War and the consequent expansion of the oligopolistic model; the third factor arises from “the involvement of independent audit firms with the top management of mega-corporations (“management by the numbers”); and the last factor is the veiled permissiveness of self-regulatory institutes for accounting standards and the accounting profession.”

Schussler and Treter (2020, p.3) state that accounting frauds are confused with “the practices of ‘creative accounting,’ which is a manipulation of the entity’s financial reality, that is, it involves ‘masking’ its results in order to favor its interests.”

The Association of Certified Fraud Examiners (ACFE) Nations Report, as cited by Kodja (2023), shows that “most occupational fraudsters are first-time offenders with clean professional records. Approximately 87% have never been charged or convicted of a fraud-related offense, and 84% have never been disciplined for fraud-related conduct.” The same report also reveals that 42% of the 3,000 executives surveyed in EY’s Global Fraud Survey admitted they could compromise ethics to achieve financial goals in the organizations’ interest.

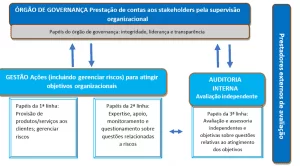

Given the growing complexity of managing large organizations and aiming to regain competitive advantages in their market, corporate governance best practices emerge to help dissolve internal conflicts between owners and their administrators. These are ethical practices that meet the financial market’s need for reliable accountability to their internal audience (administrators, managers, and stakeholders), as well as external investors. In conjunction with Corporate Governance, compliance actions emerge—a set of rules and protective actions against all types of fraud (REIS, 2020).

This original article, prepared using the bibliographic research method, aims to demonstrate that compliance actions contribute to the mitigation of fraud when properly applied in administrative and organizational processes.

2. ACCOUNTING AND FINANCIAL FRAUD

Financial frauds, when discovered, have already caused significant losses to organizations but could have been detected by serious auditing. Failures in accounting records are carried out through harmful practices, such as the existence of accounting entries to “underestimate debts, overestimate assets, underestimate expenses, and costs, and overestimate revenues” (SILVA, 2007, p.2).

Accounting frauds reveal the existence of immoral tendencies of certain leaders and/or employees who work in the production and verification of accounting records, leading organizations in the wrong direction. These are personal tendencies supported by Martins and Wisniewski (2019) when they refer to the studies of Jean Piaget and Emmanuel Kant on child development.

These teachings demonstrate that cognitive and personality development occur together, and at the age of 4, a person develops willpower, moral judgment, autonomy, human behaviors, and feelings. This is the phase when moral and/or immoral tendencies emerge in individuals (MARTINS and WISNIEWSKI, 2019).

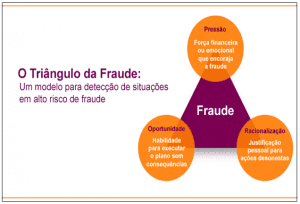

In this perspective, Corporate Governance emerges, whose practices aim to implement protective actions within organizations, promoting the mitigation of risks and personal actions of leaders and/or employees regarding frauds and acts of corruption. Gordon (2022) reports the words of Katharina Weghmann, who is a partner at Forensic & Integrity Services, Ernst & Young GmbH:

A integridade é um conceito difícil de definir, pois as empresas enfrentam diferentes dilemas éticos. Trata-se de tornar o intangível tangível, de se comprometer com a interdependência dos negócios e da sociedade, incorporando integridade à cultura e aos comportamentos da organização.

In the face of the growing volume of transactions, tools, and competitiveness brought about by globalization, Corporate Governance emerges to address the new managerial practices necessary for the smooth running of business. This involves hiring specialized professionals with the aim of reconciling ideas and practical actions, imparting greater impersonality to information analysis, and applying modern management and administration techniques (REIS, 2020).

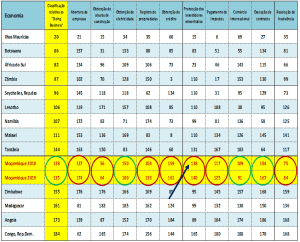

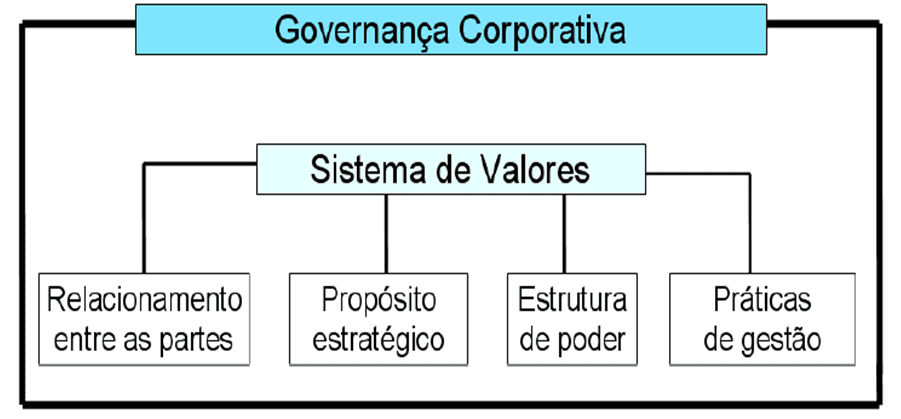

The integrity of administrative, financial, and accounting practices can be ensured through the adoption of these best practices, as illustrated in Figure 1.

Figure 1 – Corporate Governance Structure

Venturi and others (2019, p.38) detail Corporate Governance:

- Relationship between the parties: Management and legal practices aimed at minimizing conflicts between the executing agent (managers) and the principal agent (shareholders – owners).

- Strategic purposes: Mechanisms for defining and systematically reviewing business directives.

- Power structure: Explanation of business governance mechanisms, as well as the expectations that each party expects (or can expect from the other).

- Management practices: Operational and managerial resources oriented towards the achievement of business strategies, such as integrated management systems, including internal controls, as well as mechanisms for communication and disclosure of corporate information.

According to the Brazilian Institute of Corporate Governance (IBCG), there is a “set of fundamental commandments” recognized worldwide by international entities such as the Organization for Economic Cooperation and Development (OECD) and the United Nations (UN), civil society organizations regarding Governance Principles, referred to by Venturi and others (2019, p.35-6):

- Transparency: Information must be provided to those interested in the context of companies to comply with legal rules, but also by their desire and willingness for transparency in internal operations and accounting and financial records.

- Equity: Ensure equal and fair treatment for all parties interested in administrative and financial processes and information, especially with stakeholders.

- Accountability: “Governance agents must be accountable for their actions, taking full responsibility for their acts and omissions.”

- Corporate Responsibility: That all individuals involved in governance “ensure the sustainability of organizations, aiming for their longevity, incorporating social and environmental considerations into business and operations.”

3. REGULATION AND OVERSIGHT OF COMPANIES, FINANCIAL MARKETS, AND CAPITAL MARKETS IN THE US

Over time, regulation and oversight of companies, financial markets, capital markets, and all financial and accounting statements of organizations have developed in different countries (CAMARGO, 2017).

According to Venturi, Silva, and Pinho Filho (2014, p. 36), it is the responsibility of the accounting area “to understand the operational, market, and normative context of organizations so that the accounting and auditing process is more assertive,” as established by the Brazilian Accounting Standard (NBC) TA 315 – Identifying and Assessing the Risks of Material Misstatement. The importance of accounting records for the proper administration of organizations, protecting them from financial fraud, is evident.

In response to various financial scandals in the United States, the Securities and Exchange Commission (SEC), an independent federal agency, was created in 1934 in the United States, responsible for regulating the capital market. The U.S. government found it necessary to tighten its legislation against the bad faith of different executives, enacting the Sarbanes-Oxley Act, signed into law in 2002 by the local congress (CAMARGO, 2017).

According to Venturi, Silva, and Pinho Filho (2019, p. 37), the Sarbanes-Oxley Act created “mechanisms and included rules, requiring foreign companies and subsidiaries, such as those listed on the U.S. stock exchange, to maintain a high level of transparency.”

The Sarbanes-Oxley Act includes severe penalties and criminal liability for managers and entrepreneurs involved in financial fraud. It was developed by Senator Paul Sarbanes, in partnership with Representative Michael Oxley, with the aim of preventing fraud and errors in financial statements, as in the scandals that affected different companies, including Xerox, Enron, Tyco, WorldCom, etc (CAMARGO, 2017).

The Sarbanes-Oxley Act “is not a set of business practices and does not specify how a company should store records. Instead, it defines which records must be stored and for how long” (CAMARGO, 2017).

In other words, the Sarbanes-Oxley Act aims to create and improve administrative and accounting controls to monitor risks related to Environmental, Social, and Corporate Governance (ESG), checking if compliance best practices are being followed, if they are reasonable and applicable in each situation, thus protecting the entire organization as well as stakeholders (OLIARI and DI CUNTO, no date).

Among the main articles (sections) of SOx are (CAMARGO, 2017):

- Section 302: Certification and verification of financial statements by the organization’s top management and their internal disclosure.

- Section 401: Publication of financial and accounting statements, including liabilities, obligations, and transactions.

- Section 404: Annual publication of reports on the scope and adequacy of the internal control structure and procedures for financial reporting, certified by the responsible accounting entity. This publication must be made using software specified by the Sarbanes-Oxley Act.

- Section 409: Requirement for urgent public disclosure of significant changes in financial position or operations, in language understandable to laypersons.

- Section 802: Imposes penalties such as fines and/or imprisonment, as appropriate. In cases of fraud involving “alteration, destruction, concealment, and/or facilitation of records, tangible objects, with the aim of obstructing, preventing, or influencing legal investigations,” imprisonment can be up to 20 years, in addition to fines. For cases in which accountants violate the rules for maintaining audit documents for 5 years, imprisonment can be up to 10 years.

- Section 906: Addresses criminal penalties for certifying fraudulent financial reports above $5 million, including fines and imprisonment of up to 20 years.

Since the Sarbanes-Oxley Act (SOx), all companies operating in the United States, whether American or not but holding shares with the SEC, became subject to the law. To that end, a board of auditors called the Public Company Accounting Oversight Board (PCAOB) was created, with the aim of “establishing quality control and auditing standards, as well as acting with ethics and independence in relation to inspection processes and the issuance of audit reports” (CAMARGO, 2017).

4. THE LARGEST FRAUDS IN AMERICAN ORGANIZATIONS

Farias (2023) described the recently discovered fraud within the Brazilian network, Lojas Americanas, to refer to the conception and business model of its managers: the companies Lemann and partners represented the “liberal bourgeois ideal of administration where the ends justify the means, as long as goals are met and results are achieved.”

This management model, that of the Garantia Culture, was copied by Banco Lemann, and like it, there were several other large-scale frauds over time, some of which were analyzed by Kodja (2023), Freitas (2018), and Matos and Rydlewski (2023), which are reported in this article:

- WorldCom: A giant American telecommunications company, through its executives, made improper accounting entries, understating costs, and inflating its assets by $11 billion (KODJA, 2023). Its internal audit identified approximately $3.8 billion in fraud because line costs were capitalized instead of being expensed, and its revenues were inflated with false entries (FREITAS, 2018). This fraud led to over 3,000 people losing their jobs and caused losses of approximately $180 billion to its investors (KODJA, 2023).

- Enron Corporation: Operating in the energy, commodities, and services sector, Enron made accounting entries to inflate its earnings to conceal uncollectible debts, resulting in losses of over $74 billion for its shareholders (KODJA, 2023). Enron had a workforce of 21,000 employees and reported revenues exceeding $100 billion in the year 2000. However, it filed for bankruptcy in 2001 when frauds violating legal accounting practices, including adjustments of $9 billion in results between 1999 and 2002, were discovered (MATOS and RYDLEWSKI, 2023).

- Waste Management: The largest waste collection and recycling company in the United States manipulated its accounting by making prolonged depreciation entries for assets, properties, facilities, and equipment, reporting gains of $1.7 billion. It was ordered to pay $457 million to its shareholders in a class-action lawsuit (KODJA, 2023).

- Tyco: A Swiss company specializing in security systems made accounting entries showing revenue of $500 million, projecting profits of $150 million for its managers. These illicit profits were diverted by recording unauthorized loans and fictitious sales of shares, accounted for as executive bonuses and benefits. As a result of a class-action lawsuit, it was ordered to pay $2.92 billion to investors (KODJA, 2023).

- Luckin Coffee: Based in China, fictitious sales were made to companies owned by its chairman, inflating its profits to $310 million and raising its stock from $20.00 to $50.00 (KODJA, 2023).

- Toshiba: The president and directors of the company authorized the systematic recording of costs related to infrastructure items (televisions, semiconductors, and laptops), only in the fiscal year following the current accounting year, inflating its profits by $1.22 billion (FREITAS, 2018).

- HealthSouth Corporation: A specialist in public health, headquartered in Birmingham, Alabama, was the subject of SEC investigations in 2003, revealing inflated profits of over $1.8 billion (FREITAS, 2018).

- American International Group (AIG): A multinational insurance company, AIG had “over 88 million customers in 130 countries.” Investigated by the SEC in 2005, a $4 billion accounting fraud was discovered (FREITAS, 2018).

- Lehman Brothers: One of the largest investment banks in the United States, with global operations, was investigated by the SEC in 2008, revealing a fraud hiding $50 billion in loans, accounted for as sales, related to toxic assets for banks in the Cayman Islands (FREITAS, 2018).

5. CORPORATE GOVERNANCE AND COMPLIANCE ACTIONS

According to Martins (2013, p. 2), the accounting records of financial transactions aim to “secure the entity’s assets, and consequently, expand its operations to all sectors of the company, thus allowing the collection of data through reliable elements.” It is these records, when transformed into financial statements, that enable an organization’s management to make decisions according to its needs and planning.

Corporate Governance consists of improving organizational processes, such as budgetary and financial management, encompassing four important aspects: transparency in financial statements, equity, accountability to management and investors (if applicable), and corporate responsibility (CAMARGO, 2017).

According to Venturi, Silva, and Pinho Filho (2019, p. 35), Corporate Governance is based on pillars composed of management practices of mechanisms and management systems adopted to achieve organizational objectives, including strategic, tactical, and operational ones defined by management. Corporate Governance must define actions that integrate risk management, compliance, internal controls, and accounting areas to inhibit risks in environments and accounting practices that can impact organizations.

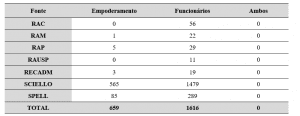

According to Santos et al. (2012, p.1), the compliance program should encompass formal control systems, codes of ethics, educational initiatives, ombudsmen, and whistleblower channels, combined with strong leadership.

Oliari and Di Cunto (no date) argue that investments in Corporate Governance promote the appreciation of companies’ stocks in the medium term. Although it requires higher costs for specialized professionals, the implementation of the governance process reduces risks for investors, provides greater transparency and balance to internal processes and accounting and financial records, and demonstrates greater corporate responsibility. It signifies greater involvement of executives.

6. EFFECTIVENESS OF COMPLIANCE MEASURES

Regarding accounting entries, different companies may be vulnerable to fraud, embezzlement, and misappropriation committed by those responsible for accounting and monitoring their documents and commercial and financial transactions (SILVA, 2007).

To deter such occurrences, managers and directors must establish preventive systems that allow for internal controls and audits, enabling monitoring, combating, preventing, and even correcting immediately, in addition to implementing an ethics code to which everyone is bound, in order to inhibit personal desires of potential “fraudsters” in their workforce (SILVA, 2007, p.3), given that, as a rule, responsibility falls on accountants and auditors.

In this regard, compliance practices must be applied appropriately, considering the tools of Information Technology (IT) designed for monitoring and storing reliable and trustworthy databases for daily commercial transactions (OLIARI and DI CUNTO, no date).

However, the frauds that have been reported may have bypassed compliance systems that were unable to identify them, as Kodja (2023) points out as “the disconnect between rules and practice,” which is the main factor in the continuation of fraudulent records. There are substantial investments in whistleblower hotlines, but the effectiveness of compliance rules remains compromised as organizations provide compliance training, with employees signing to acknowledge the rules, without conducting periodic assessments of this system or the effectiveness of the programs adopted.

According to Ramos (2015), the frauds that occurred were facilitated by internal control failures, which were also aided by internal and external auditors’ complicity, as well as the complete absence of “social and moral values on the part of corporate executives.”

Here, the ideas of Martins and Wisniewski (2019) regarding the studies of Piaget and Kant are associated with the data presented by Gordon (2022), who reports Jon Feig in the EY 2022 Global Integrity Report, arguing that “integrity is not an easy topic.” Gordon (2022) cites the same report to argue that Corporate Governance must refocus its focus to reinvent corporate integrity.

This idea arises for Gordon (2022) due to the responses obtained in the aforementioned report, in which 33% of respondents answered about the relevance of maintaining ethical standards as fundamental to the integrity of individuals and the organization, while 50% mentioned the importance of compliance with laws, regulations, and codes of conduct.

However, the report showed a willingness to act outside the rules when it came to senior interviewees within the organizational hierarchy, and thus, Gordon (2022) argues that “the integrity agenda rests on organizational intent and real behavior. A wrong decision for the right reasons is still a wrong decision if it fails on ethical values.”

In this sense, Kodja (2023) reports the study “Why Compliance Programs Fail — and How to Fix Them,” published by the Harvard Business Review, which defined that organizations must link strict compliance initiatives to specific objectives as a way to prevent misconduct and to detect potential damage and/or to align policies with laws and regulations. Adopt measures that effectively inhibit any fraudulent practices, based on metrics known to their employees, which are periodically verified to check their functioning.

7. CONCLUSION

The literature demonstrates that a culture of integrity within a company is something to be built upon, based on a set of ideas and practical actions, beyond the tools of Corporate Governance and even compliance, as financial frauds, when discovered, were initiated long before their detection.

There is a need for pragmatism regarding ethical behavior within companies, in the sense that the treatment given to their internal or external audience should be ethical and responsible, including from the choice of these partners.

Just as in the treatment of their employees, so that they are engaged in fulfilling the organizations’ mission, and also in compliance with the law through ethical and truthful records in their technological systems, which should ensure reliability in the information entered and rigor in the stages of periodic verification, ensuring all strategies of their interest.

These are a set of practical actions that should be regularly verified, also relying on the hiring of reputable employees who are not susceptible to committing frauds.

REFERENCES

CAMARGO, Renata Freitas de. Lei Sarbanes-Oxley: aprimorando a prestação de contas com a SOx. Treasy Planejamento e Consultoria. Mai.2017. Disponível em: <https://www.treasy.com.br/blog/sox-lei-sarbanes-oxley>. Acesso em: 17 maio 2023.

FARIAS, Adriana Medeiros. Da fraude contábil das Lojas Americanas à fraude educacional de Lemann e sócios. Brasil Fato 20 anos. Mar.2023. Disponível em: <https://www.brasildefators.com.br/2023/03/14/artigo-da-fraude-contabil-das-lojas-americanas-a-fraude-educacional-de-lemann-e-socios#:~:text=O%20escândalo%20da%20fraude%20contábil,Carlos%20Alberto%20Sicupira%20é%20fato>. Acesso em: 17 maio 2023.

FREITAS, Ricardo de. Os 9 maiores escândalos contábeis do mundo. Rede Jornal Contábil. Jun.2018. Disponível em: <https://www.jornalcontabil.com.br/os-9-maiores-escandalos-contabeis-do-mundo/>. Acesso em: 17 maio 2023.

GARA, Antoine. 10 maiores fraudes da história recente dos Estados Unidos. Revista Forbes. Set. 2015. Disponível em: <https://forbes.com.br/sem-categoria/2015/09/10-maiores-fraudes-da-historia-recente-dos-estados-unidos/>. Acesso em: 29 abr. 2023.

GORDON, Andrew. Visão focada ou imagem ampliada? EY Global Forensic & Integrity Services Leader. Jan.2022. Disponível em: <https://www.ey.com/pt_br/forensic-integrity-services/how-a-focus-on-governance-can-help-reimagine-corporate-integrity>. Acesso em: 17 maio 2023.

KODJA, Claudia. As 7 maiores fraudes contábeis do mercado. Corrupção nas empresas privadas destrói os negócios e afeta milhões de pessoas. Invest News Notícias sobre Economia e Investimentos. Jan. 2023. Disponível em: <https://investnews.com.br/colunistas/claudia-kodja/7-maiores-fraudes-contabeis-do-mercado/>. Acesso em: 17 maio 2023.

MARTINS, Pedro Luis Teixeira. Os controles internos e sua relevância na mitigação de erros e fraudes contábeis. Artigo [Graduação em Ciências Contábeis] apresentado à UFRGS. Jun. 2016. Disponível em: <https://www.lume.ufrgs.br/bitstream/handle/10183/148422/001001013.pdf?sequence=1&isAllowed=y>. Acesso em: 29 abr. 2023.

MARTINS, Maisa; WISNIEWSKI, Maurício. Governança Corporativa e Compliance: em busca do entendimento para a melhora no desempenho. XVII Jornada Científica dos Campos Gerais. Ponta Grossa, 23-25 out.2019. Revista IESSA. Faculdade Sant’Ana. Ponta Grossa, PR. Disponível em: <https://www.iessa.edu.br/revista/index.php/jornada/article/view/1551/464>. Acesso em: 29 abr. 2023.

MATOS, Fábio; RYDLEWSKI, Carlos. Caso Enron: relembre uma das maiores fraudes corporativas da história. Portal Metrópolis. Jan.2023. Disponível em: <https://www.metropoles.com/negocios/caso-enron-relembre-uma-das-maiores-fraudes-corporativas-da-historia#:~:text=Com%20uma%20dívida%20acumulada%20de,empresa%20que%20fazia%20as%20auditorias>. Acesso em: 17 maio 2023.

NEPOMUCENO, Valério. A queda da contabilidade gerencial e a ascensão da fraude contábil nos Estados Unidos. ResearchGate. Mar.2002. Disponível em: <https://www.researchgate.net/profile/Valerio-Nepomuceno/publication/273866700_A_queda_da_contabilidade_gerencial_e_a_ascensao_da_fraude_contabil_nos_Estados_Unidos/links/550eed710cf2752610a0043d/A-queda-da-contabilidade-gerencial-e-a-ascensao-da-fraude-contabil-nos-Estados-Unidos.pdf>. Acesso em: 29 abr. 2023.

OLIARI, Reinaldo; DI CUNTO, Leonardo. Criada há 20 anos, Lei Sarbanes-Oxley ganha destaque em um mundo cada vez mais voltado à agenda ESG. Deloitte Auditoria, Consultoria, Assessoria Financeira, Risk Advisory, Consultoria Tributária e Serviços. Artigo sem data. Disponível em: <https://www2.deloitte.com/br/pt/pages/audit/articles/lei-sarbanes-oxley.html>. Acesso em: 02 maio 2023.

RAMOS, Patrícia Keiko. Fraudes Contábeis: análise dos grandes escândalos corporativos ocorridos no período de 2000 a 2012. Monografia [Especialização em Auditoria Integral] apresentada ao Departamento de Contabilidade, do Setor de Ciências Sociais Aplicadas da Universidade Federal do Paraná. Curitiba, 2015. Disponível em: <https://acervodigital.ufpr.br/bitstream/handle/1884/51296/R%20-%20E%20-%20PATRICIA%20KEIKO%20RAMOS.pdf?sequence=1&isAllowed=y>. Acesso em: 17 maio 2023.

REIS, Gabriel Eccard Pimentel. Os impactos da interferência da governança corporativa na detecção de fraudes contábeis Rio de Janeiro 2020. Monografia [Graduação] apresentada à Faculdade de Administração e Ciências Contábeis da Universidade Federal do Rio de Janeiro (UFRJ). RJ, Jul.2020. Disponível em: <https://pantheon.ufrj.br/bitstream/11422/15129/1/GEPReis.pdf>. Acesso em: 02 maio 2023.

SANTOS, Renato Almeida dos, et al. Compliance e liderança: a suscetibilidade dos líderes ao risco de corrupção nas organizações. Einstein. v. 10, n.1, p. 1-10, 2012. Disponível em: <https://www.scielo.br/j/eins/a/KtNqFbyQ5XWsDvJ7TfbGC3w/?format=pdf&lang=pt>. Acesso em: 17 maio 2023.

SCHUSSLER, Cláudia de Araújo; TRETER, Jaciara. A linha tênue entre contabilidade criativa, ética profissional e fraude contábil. Trabalho [Graduação] apresentado ao Curso de Ciências Contábeis. Universidade de Cruz Alta. Cruz Alta, RS, 2020. Disponível em: <https://home.unicruz.edu.br/wp-content/uploads/2020/03/A-Linha-Tênue-Entre-Contabilidade-Criativa-Ética-Profissional-e-Fraude-Contábil.pdf>. Acesso em: 29 abr. 2023.

SILVA, Lino Martins da. Atuação dos contadores e auditores na descoberta e na apuração de fraudes: uma reflexão. Revista de Contabilidade do Mestrado em Ciências Contábeis da UERJ. Rio de Janeiro, v.12, n.1, p.1, jan./abr.2007. Disponível em: <http://www.atena.org.br/revista/ojs-2.2.3-06/index.php/UERJ/article/view/646/642>. Acesso em: 29 abr. 2023.

VENTURI, James Luiz; SILVA, Cláudia Alves da; PINHO FILHO, Lúcio Carlos de. Governança Corporativa: um diálogo entre a gestão de riscos, controles internos, compliance e a contabilidade. Revista Processus de Políticas Públicas e Desenvolvimento Social, [S. l.], v. 1, n. 2, p. 35–53, 2019. Disponível em: <https://periodicos.processus.com.br/index.php/ppds/article/view/167/168>. Acesso em: 17 maio 2023.

[1] Master’s student in Economics, postgraduate in Finance, and graduate in Administration and Accounting. ORCID: 0009-0006-2276-7765.

Submitted: June 1, 2023.

Approved: July 20, 2023.