ORIGINAL ARTICLE

SILVA, Bruno Campos Pinto [1]

SILVA, Bruno Campos Pinto. The Impacts of Covid-19 on the Digital Transformation of the Brazilian Automotive Sector from the Perspective of Consumers and Industry Executives. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year. 08, Ed. 06, Vol. 04, pp. 126-143. June 2023. ISSN: 2448-0959, Access Link: https://www.nucleodoconhecimento.com.br/business-administration/automotive-sector, DOI: 10.32749/nucleodoconhecimento.com.br/business-administration/automotive-sector

ABSTRACT

The aim of this article is to provide an analysis of the potential impacts brought about by the COVID-19 pandemic on the digital transformation process within the automotive industry, from the perspectives of both consumers and industry executives. Qualitative analysis was conducted in conjunction with exploratory research. This involved drawing upon a theoretical framework related to disruption, digital transformation, with a specific focus on the industry under study. The research also incorporated desk research using data collected from market studies, and an exploratory survey conducted online, involving 67 industry executives. The study analyzed both convergent and divergent factors from desk research and exploratory research to understand if the executives held the same perceptions as what had been explored and discovered within the theoretical framework and secondary data. One of the primary challenges in social research, including recent studies on innovation, is the complexity of human relationships and leadership within organizations in general. Researchers in the fields of Management and Innovation often struggle with reducing systemic complexity when attempting to comprehend how consumers and executives in a specific industry perceive reality. It becomes evident that, even in the absence of statistical correlations between variables, leaders perceive realities that drive their actions and reactions within their environment. Studies on this subject have been relatively underutilized in Brazil, both in practical and theoretical realms, regardless of the industry sector. This research could be applied to any industry, even those traditionally considered as non-innovative.

Keywords: Disruptive Innovation, Digital Transformation, Automotive Industry, Marketing, and Innovation.

1. INTRODUCTION

On March 13, 2020, the State of São Paulo declared a quarantine due to the new coronavirus (SANARMED, 2020). Brazil witnessed its major cities closing the doors of non-essential businesses and making every effort to restrict the movement of people in public and, especially, enclosed spaces. The automotive industry, like many others, was immediately affected by the pandemic. With its network of dealerships closed, factories quickly had to implement collective holidays and subsequently halt production due to a lack of demand caused by the lockdown.

Since 2019, Brazil had been undergoing a profound transformation in urban mobility habits and an acceleration in the digitalization of automotive consumers. Electric scooters, mobility apps (Uber, 99, among others), subscription services from rental companies, and even car-sharing initiatives were becoming part of everyday life. These changes had already been impacting the automotive industry, where increasingly digitalized consumers were altering their purchasing habits. In 2010, a typical automotive sector consumer visited 10 stores before purchasing a car, but by 2019, this number had dropped to 1.9 visits per purchase (THINK GOOGLE, 2019). Consumers from the millennial (born after 1980) and Gen Z (born after 1995) generations had a relationship with the product, the car, that was much more connected to mobility and didn’t place as much value on car ownership (TEIXEIRA, 2019).

The automotive market is one of the most traditional and conservative markets worldwide. Stakeholders took a long time to understand (and accept) the rise of digital as the primary channel for car purchase decisions (RODRIGUES, 2019). The efforts of the industry and its dealerships to digitize the way cars were sold often clashed with century-old practices and an extremely conservative culture (TEIXEIRA, 2014). However, in March 2020, with both sides waking up on the 16th to find their stores closed, digitization was no longer optional but a necessity for business survival. This study aims to research, through an exploratory study based on desk research and an exploratory survey with industry executives in the form of an online survey, to answer the following research questions: (1) What were the possible changes in the automotive consumer’s behavior, in terms of product purchase and use perspective, influenced or accelerated by the Covid-19 pandemic? (2) What were the possible impacts of the Covid-19 pandemic on the decision-making process of automotive industry executives regarding the digital transformation of the sector?

The importance of studying this topic lies not only in empirical research interest but also in the opportunity to bridge theory and practice, creating a connection to better understand the phenomenon. Tedlow (2008) studied how leaders in traditional industries, especially the automotive industry, struggled to adapt to the digital transformation movements occurring in their sectors. By collecting existing research on the subject, including articles related to the topic, the goal was to establish the foundation for the development of an exploratory questionnaire with industry executives, aiming to contribute to the topic with both theoretical and practical insights, focused on the Brazilian market.

2. THEORETICAL FRAMEWORK

The rise of mobility apps and the use of cars as a service (car subscriptions and car-sharing) brought a new dynamic to the sector. Sales growth in Brazil in 2019 was already heavily influenced by this urban mobility phenomenon (ABLA, 2019). However, the profile of app-based drivers was not the same as that of consumers buying new cars. With a stagnant economy and high unemployment, between 2018-2020, Brazil was fertile ground for informality to generate a large number of drivers for Uber and 99. These drivers, however, did not have the income to buy a new car (or even used cars that met the platforms’ requirements). They could, however, rent one to work (COSTA, 2019). Major rental companies (Unidas, Localiza, and Movida) quickly saw a business opportunity and launched special programs for these drivers, capturing a significant share of this market (O ESTADO DE SP, 2020). However, it was not just the lucrative market for app-based driver rentals that rental companies were eyeing.

In investment reports from Localiza (2019) and Movida (2019), it was clear that both had created a profitable used car sales business, capitalizing on the extra inventory generated by the demand from app-based drivers. Together, these two companies have nearly 400 used car stores in Brazil (2019), a network second only to General Motors and Volkswagen. Needless to say, by entering the car sales business, rental companies would be competing with automakers and their dealership networks.

On the consumer side, the digitization of the purchasing journey, with more information available on manufacturer and dealership websites, as well as a wealth of content on YouTube and specialized websites, has created a much more informed consumer (HAMILTON and CESPEDES, 2016). As the authors highlight, consumers are becoming increasingly less reliant on visiting a dealership, using the store visit primarily to finalize negotiations after conducting their research online. However, the only digital option for consumers to contact dealerships, until early 2020, was by filling out a form (known in marketing jargon as a “Lead”). Information about pricing, trade-in value, and maintenance was not always easy to find. E-commerce initiatives were still in their early stages in early 2020.

The Brazilian market, which was heavily concentrated in basic hatchbacks (cars priced up to R$ 90,000 in 2023 values), with low margins, still had nearly 50% of direct sales (to large fleets and rental companies) in 2019, which further squeezed automaker margins (ABLA, 2019) and put them under constant financial pressure. Brazil, with local production of leading global brands, entered the pandemic with 18 brands selling and manufacturing in Brazil. Brands like Ford, BMW, Audi, and Mercedes were already reevaluating their businesses in Brazil at the beginning of 2020, long before the pandemic became an issue (FENABRAVE, 2020).

2.1 THE EARLY IMPACTS OF COVID-19 ON THE INDUSTRY’S TRANSFORMATION

Faced with an extreme situation of store closures, executives from automakers and dealerships had no option but to accelerate digital transformation. Providing new channels to facilitate consumers and dealers connecting to do business became vital in the scenario that had been unfolding since March 2020. What was once a taboo in the industry, e-commerce, was now desired by both automakers and their dealers. Messaging channels, especially WhatsApp (from the Meta group), became a relevant sales channel, facilitating consumer access to the product (META FOR BUSINESS, 2022).

COVID-19 brought financial problems to the industry, causing a 32% drop in Brazilian production in 2020 (compared to a global average decline of 16%) and significant losses for automakers (MERCADO E CONSUMO, 2021). However, it wasn’t all bad news. Consumers, concerned about crowding and no longer willing to share transportation, increased their desire for a car. Market demand, however, returned strongly in the second half of 2020, resulting in strong sales numbers once again. This growth, however, would be hampered by a disruption in the global supply chain of inputs, which again hit the Brazilian industry hard in 2022, causing most factories to come to a standstill (JORNAL DA UNESP, 2023). However, none of this diminished the opportunity to capitalize on the short-term impacts that COVID-19 was causing on consumers, to accelerate digital transformation and bring back a consumer who was previously lost to the automotive industry.

The most challenging aspect to observe is the short-term effects of the pandemic on the Consumer Value Chain (CVC). CVC is defined as the set of activities that a brand or product establishes as part of the product or service purchase and usage journey (TEIXEIRA, 2019). Known as CVC and widely studied by Teixeira (2019), CVC takes some time to be affected. No recent research has been able to capture a significant change in consumers’ CVC that did not already exist before the pandemic. More digital behaviors, a desire for more online purchases, all of this existed before the new coronavirus.

At first glance, the response to the impacts of a global pandemic on consumers seems obvious: a pandemic that limits circulation in enclosed spaces, close contact between people, and encourages isolation would have a significant tendency to accelerate the digital transformation process in car purchases. Add to that the ascent of Generation Z (born after 1995) into consumer spending, a generation that grew up in a digitalized world. A recent survey by McKinsey & Company (2021) in the world’s top 10 automotive markets explored what Gen Z consumers expect when buying a car, with most showing no interest in conducting sales and aftersales for personal cars in person at dealerships, with half of the respondents not wanting any contact with salespeople.

On one hand, the consumer merely accelerated a process that was already happening, and COVID-19 may have expedited it by a few years. On the corporate side, however, it was a turning point. COVID-19 made most industry leaders realize that change is necessary. On the other hand, this change can be much deeper than just the digitalization of sales. However, if a successful e-commerce model were created for the automotive sector, it would break down a significant entry barrier into large markets, such as the Brazilian market, for new brands (LEASEPLAN, 2020). Today, Chinese brands look at Brazil and fear how to gain a foothold against established automakers with dealership networks of over 400 stores, but e-commerce could provide the initial volume for these brands to start their operations. Another noteworthy point is that disintermediation of sales facilitates negotiations with dealerships, reduces the size of stores, increases the sales margin, and mainly impacts the remuneration model of the frontline salesperson. Perhaps this is the biggest challenge of the model. Incentives, as we know, are a crucial factor for the success of any new endeavor.

2.2 HOW COVID-19 INFLUENCED TRADITIONAL AND CONSERVATIVE BUSINESS ORGANIZATIONS

If you were to visit any of the companies on the Forbes 100 list, you would likely find phrases on their walls like, “The consumer comes first,” “The consumer is at the heart of our strategy,” and the like. In reality, however, a very different perspective often emerges. Companies rarely respond to consumer desires; they often seek a compromise between what is best for them and what consumers might like. Disruption and new insurgent businesses often feed off these gaps. A startup is adept at challenging a strong and established traditional business, but it doesn’t do so directly in its core business. Instead, it targets a small gap, so small that executives and managers in leading market players disregard the opportunity. This phenomenon is called low-end disruption, and it occurs when established players tend to ignore these new entrants or may not even detect them. When they do, the newcomer is already serving a portion of the market and strengthening itself to compete in other segments, even in the lucrative core business (CHRISTENSEN, RAYNOR, MCDONALD, 2015).

Burrell and Morgan (1992) clarify why this happens in most businesses around the world. First, it’s necessary to understand how organizational structures are built. We must examine the two major actors on the corporate scene: the principal, who are the shareholders or owners of the companies, often represented by a board, and the agent, those who manage the business, a group formed by executives and managers. Logic would suggest that agents and principals would want the same thing, but Burrell and Morgan (1992) show that this does not happen in most companies. The authors demonstrate that agents use incentives to drive principals to deliver what they want. Incentives are known as bonuses, stock plans, sales commissions, and even career plans. This happens because the agent typically cares more about stock value and dividends, and as Burrell and Morgan (1992) show, the main KPIs (key metrics) for variations in these indices are EBIT (Earnings before interest and tax), ROI (Return on Investment), and FCF (Free Cash Flow). Incentives are usually tied to quarterly reviews of these financial targets. The principal, of course, wants the incentives, and the corporate machine starts working in a circular reference, always aiming for short-term financial metrics. The mix of incentives and conflicts between agents and principals creates executives who are always looking at the next quarter’s review, rather than thinking about the long term and the longevity of their businesses.

In addition to the microeconomic perspective presented in Burrell and Morgan’s work (1992), there is also the view of organizations and how they react to change. Among all existing theories, organizational paradigms seem highly applicable to this analysis. Burrell and Morgan (1992) published in their theory the study of how humans perceive reality (which, of course, includes organizations and the industry in which they operate) through aspects that cause reality (which the authors call “filters or glasses”) to vary depending on what we know about this reality. This makes it practically impossible to understand social complexity without expanding these “filters.”

3. METHODOLOGICAL APPROACH

3.1 RESEARCH APPROACH

Due to the recent nature of the topics covered, exploratory research with a qualitative approach was chosen for this work. Exploratory research provides an overall view of a specific phenomenon. This exploratory study will consist of desk research, an online survey with executives in the automotive industry (and their stakeholders), and the collection of sample evidence to help determine and understand the phenomena under study. This type of research is important because it can generate opportunities for the analysis of behaviors and needs of the objects of study (CRESWELL, 2012). Qualitative research does not aim to measure events through statistical data analysis techniques. Instead, data is obtained through direct contact between the researcher and the object of study (GRAEBNER, MARTIN, AND ROUNDY, 2012).

Research criteria must be treated with care to ensure that the findings are useful and applicable in both the empirical and practical fields. It is necessary for the researcher to base their analysis and conclusions on the interpretation of surveys and existing studies (desk research). Graebner, Martin, and Roundy (2012) advocate for the richness of qualitative research, even though it is sometimes limited by sample size: “Third, qualitative data is often rich and nuanced (WEICK, 2007). This allows qualitative data to capture details and mechanisms that are easily overlooked in quantitative data.” (GRAEBNER, MARTIN, AND ROUNDY. QUALITATIVE DATA: COOKING WITHOUT A RECIPE. 2012. P.3, Free Translation).

3.2 DESK RESEARCH

To begin understanding the extent of the potential impacts of Covid-19 on consumers and the sector as a whole, from a micro perspective, i.e., a specific segment of consumers and executives, we used two surveys conducted between 2020 and 2021 on the topic, directly or indirectly. The choice of desk research is based on the fact that the automotive sector and the pandemic had many studies published between 2020-2022. The use of secondary data to compose research requires curation to ensure that the sources are credible, unbiased, and have valid methodology. By choosing the research conducted by General Motors of Brazil and the multinational group Cox Automotive, the samples were detailed in their characteristics (according to the points below) to ensure not only the credibility brought by the two groups but also the statistical validity of the analysis (BASSOT, 2022).

Below is the detailed information about the two surveys:

(1) Customer Attitudes After the Quarantine – General Motors Brazil Research – 2020

Sample: 256 vehicle owners, internal GM base (AIOC), as well as 247 vehicle owners, external base (Vehicle Owners), and 102 people without cars, external base (non-vehicle owners).

Sample demographics:

Gender: 57% men and 43% women.

Age: 32% – 18-34, 57% – 35-54, and 11% – 55+.

Income: Up to R$ 4,000.00 – 7%, Between R$ 4,001 and R$ 8,000 – 34%, R$ 8,001 and R$ 12,000 – 33%, and over R$ 12,000 – 26%.

(2) Car buyer journey study – pandemic edition – Cox Automotive Group – 2021

Sample: 3,016 recent car buyers (2,010 new cars and 1,006 used cars)

Data Collection Date: between September 10 and September 22, 2020

Respondents: Buyers who made purchases between March and September 2020 and used the internet in the purchasing process (the complete survey is in the article’s annexes).

3.3 GENERAL MOTORS INTERNAL RESEARCH WITH BRAZILIAN CONSUMERS:

The General Motors research, conducted with 605 individuals (including Chevrolet customers, owners of competitor cars, and non-car owners) in November 2020, aimed to investigate the potential impacts of Covid-19 on consumer behavior regarding the product car. To explore certain aspects of consumer perception concerning recent changes in the market, General Motors focused on several aspects (GLOBAL SURVEY, 2021):

Safety and Mobility: The research sought to understand how the surveyed consumers commuted on a daily basis and how they wished to do so, investigating whether customers had altered their perception of mobility safety. Since the data collection took place between October and November 2020, during the second wave of Covid-19 in Brazil and worldwide, it was influenced by this context, and there was a clear bias towards consumers being cautious about public transportation and more inclined towards private transportation.

Purchase Process and Digitalization of the Consumer Journey: The research aimed to determine whether the consumer’s digitalization movement had accelerated during the pandemic and how receptive consumers were to e-commerce. Respondents appeared open to digital practices due to convenience, speed, and security. The research did not have pre-pandemic data for comparison.

Ownership vs. Car-as-a-Service: The research also investigated how consumers responded to different car purchasing models and contracting the use of a car as a service. There was a significant preference for alternative buying models, such as car subscriptions, annual rentals, or similar options. This increase was primarily observed among those who did not currently own a car.

Changes in Car Purchase Intent: Specifically for those without a car, the research examined whether there had been any change in the intention to purchase a car. Among the sample of those without a car, 77% of respondents stated that they intend to buy a car in the coming months. However, due to the data collection method, it is impossible to claim statistically that this is directly linked to the Covid-19 pandemic.

3.4 INTERNATIONAL RESEARCH ON CONSUMER JOURNEY ALTERATION DUE TO THE COVID-19 PANDEMIC BY COX AUTOMOTIVE GROUP:

The analyzed research (slides with all data in the APPENDICES) presented some very interesting and valuable data to understand consumer behaviors, now supported theoretically by data with valid sampling. The first interesting data point is the significant decrease in the time spent by consumers on purchasing a new car. According to the study, in 2020, consumers spent 5 hours and 34 minutes (compared to 6 hours and 44 minutes in 2019, pre-pandemic). This data is reinforced by the statement that 86% of consumers believe that the main function of digital in the purchasing journey is to reduce the time spent in the store. The three main reasons for expediting the purchase, as stated by buyers, were that the consumer had already decided what they wanted, had seen an attractive offer, or had been approached by the dealer with an attractive offer. Furthermore, 78% of new car buyers visited at least two websites for preliminary research, even though the majority had concerns about not finding the best price or incentive online. Although contradictory, 55% of consumers are more hesitant to visit dealerships, and 70% have reservations about participating in trade shows or auto shows.

The research also interviewed dealerships, and in this case, there is a growing fear of increased competition from companies like Carvana, Kavak, InstaCarro, and others as disruptors to the current business model of the dealers. Dealerships have invested heavily in reputation and customer service. The research shows a 10% sales growth correlated with dealerships that have a better reputation on social media, reviews, and customer care. A total of 69% of dealerships stated that they had added at least one digital step after Covid-19, and 74% reported an increase in digital usage since the start of the pandemic.

3.5 EXPLORATORY RESEARCH – AUTOMOTIVE INDUSTRY

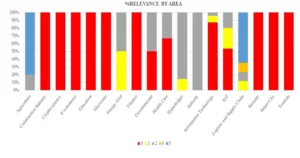

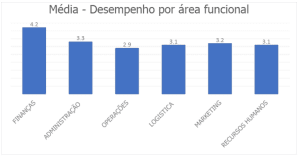

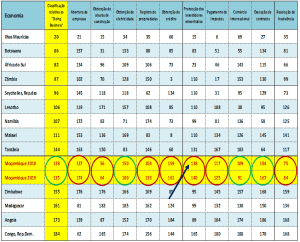

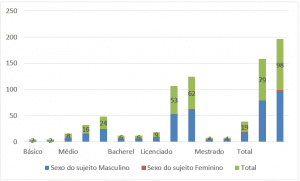

In an online survey with 67 executives who work directly or indirectly in the automotive industry, we explored the impacts of Covid-19 on the Brazilian automotive industry and sought to understand how the automotive sector perceives the reactions of its leaders to the accelerated phenomena since the beginning of the pandemic in 2020. Data collection took place between June and August 2022 (the link to the full survey is in the references). The sample is characterized in FIGURE 2 below:

FIGURE 2 – Characteristics of the sample in the exploratory research with executives in the automotive industry

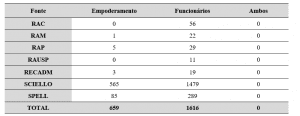

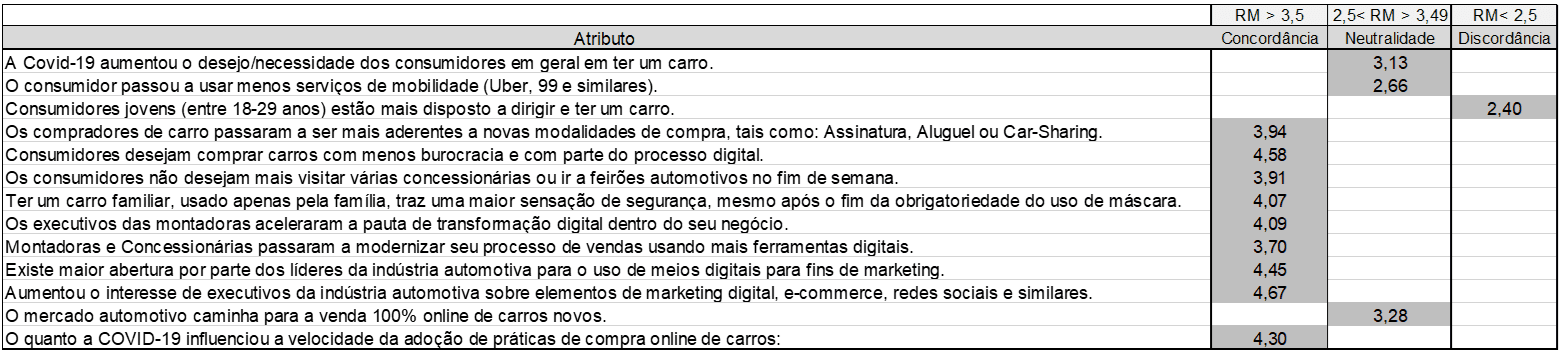

To organize the analysis of the responses, the Likert method was used, assigning a numerical value from 1 to 5 to each attribute to determine the level of agreement of the consumer. To determine levels of agreement and disagreement among the questions asked, we established the level of agreement based on the average rank, as exemplified in FIGURE 3 (MALHOTRA, 2001). Applying this calculation, FIGURE 4 shows the convergent, neutral, and divergent points.

FIGURE 3 – Example of RM (Average Rank) calculation

FIGURE 4 – Result of the average ranking by attribute

3.5.1 CONVERGENT POINTS ABOUT THE CONSUMER:

– 70% do not perceive any change in the demand of young people aged 18 to 29 to drive or purchase a car.

– 81% believe that consumers have become more receptive to mobility services such as car subscriptions, car-sharing, and the car-as-a-service model post-pandemic.

– 76% understand that consumers still consider the family car as the safest mode of transportation, even post-pandemic. However, this sentiment has not been transferred to the younger demographic (aged 18 to 29).

3.5.2 CONVERGENT POINTS ABOUT THE SALES AND MARKETING PROCESS IN THE AUTOMOTIVE INDUSTRY:

– Over 90% of the respondents consider it essential to reduce bureaucracy and make the car buying process more digitalized.

– 70% believe that traditional retail models need to be reevaluated.

3.5.3 CONVERGENT POINTS REGARDING AUTOMOTIVE MARKET EXECUTIVES AND LEADERS:

– 80% see that automakers and dealerships have accelerated digital transformation post-COVID-19.

– 90% of automakers and dealerships have adopted more digital tools.

– 90% have become more receptive to digital marketing practices.

– Nearly 100% agreed that the overall interest in e-commerce-like tools in the automotive industry has increased exponentially.

3.5.4 DIVERGENT POINTS AMONG RESPONDENTS:

– 56.4% of respondents believe that the market is moving towards 100% online sales.

– 50% of respondents claim that we are 3 years away from achieving 100% digital car purchasing, while 16.7% believe this timeframe is between 5 and 10 years.

– The overwhelming majority agrees that COVID-19 accelerated the adoption of car purchasing processes.

4. CONCLUSION

If the Brazilian (and global) automotive industry hadn’t faced a chronic production problem caused by a shortage of semiconductors and microchips, affecting 50 automakers (MERCADO E CONSUMO, 2021), we might have been able to see more clearly the direction of certain effects of Covid-19 on digital transformation and Consumer Value Chains (CVC). However, the shortage of products, the exponential increase in the exchange rate, contributed to a consecutive rise in car prices in Brazil. Additionally, there was an appreciation of used cars, which, for the first time in years, in 2022, were sold above the FIPE table, even without promotional incentives.

Given this, it’s complex to analyze whether current consumer behavior is solely a reaction to a specific moment that combined many variables. Like any statistical process, the more variables there are, the harder it is to isolate a single factor. In other words, isolating Covid-19 becomes challenging in certain aspects, with the most complex being the consumer value chain. To do this, we would need a baseline for comparison in all the research, both in desk research and qualitative research. To achieve statistically proven effects, regression analysis, correlation, and other analyses would need to be applied to demonstrate that the pandemic did, in fact, influence the variables that this research qualitatively hypothesizes.

One fact that can be concluded is that consumers are digitalized, and the pandemic merely consolidated this effect. It’s hard to imagine the automotive market reviving with traditional concepts like factory fairs or large promotions in shopping mall parking lots, gathering hundreds of people on weekends. Consumers, above all, have become accustomed to the convenience of solving problems digitally. If it’s possible to work from home through telecommuting, why can’t parts of the car purchasing process be digitalized as well? Consumers will become increasingly time-sensitive and will demand from automakers and dealers a simpler, digital, transparent, and faster process. Although it’s not possible to prove statistically that this was accelerated by Covid-19 with only the data collected in this research, at least we can see that the debate about digital transformation and e-commerce has increased among industry leaders. Future research may provide quantitative evidence of whether Covid-19 accelerated structural changes in the roots of the car buying and selling process. Another key point is that whoever discovers the right balance for automotive e-commerce will gain an advantage and attract more consumers, especially from Generation Z, potentially delaying (or defending against) the disruptive processes the industry faces from new sales and mobility models.

From the perspective of management and industry executives, the data collected in this research clearly reflects a functionalist paradigm, where the perception is that Covid-19 was the cause, accelerator, and even facilitator of various processes of digitalization and modernization in the sales and marketing journey. In other words, the managers themselves attribute a profound transformation in their sector to an external factor rather than attributing it to themselves, reinforcing the realist and deterministic dimensions within this paradigm (BURRELL AND MORGAN, 1992). The research showed a great deal of convergence between the two desk research studies (both quantitative) used and the qualitative research collected from the 67 industry executives in Brazil, demonstrating that the Brazilian market and its leadership are well aware of the reality and the changes happening in their sector. This should make it easier for them to respond to digital transformation and the active disruption in the sector, though we know that theory doesn’t always align with practice.

The fact that industry executives have different views on the influence of Covid-19 on digital transformation points to issues explored by Teixeira (2019) in his study on disintermediation and the consumer value chain. The author, in various sector analyses, including the automotive sector, suggests that consumer movements are rarely matched by industry leaders. Movie rental companies, particularly the giant Blockbuster, failed to realize that, despite being profitable, late fees were eroding the consumer value chain. The automotive industry needs to pay attention to car-as-service trends, strong in the US and Europe and growing in emerging economies like Brazil. Combined, electrification and car-as-service could reconfigure the entire value chain of the automotive sector. A recent study by KPMG and Automotive Now estimates that there are approximately 1,893 executives working directly or indirectly with the automotive sector. For a survey to have 95% accuracy and a 5-point margin of error, it should interview at least 320 industry executives. However, with only 67 interviews, the margin of error is 12 points, allowing for qualitative rather than quantitative validity. Future research, both quantitative and qualitative, in academia and practice, could shed more light on the subject.

REFERENCES

ABLA. Locadoras, Frotistas e Efeito Uber sustentam reação das montadoras. ABLA. ABLA. São Paulo, 2019. 1 p. Disponível em: https://www.abla.com.br/locadoras-frotistas-e-efeito-uber-sustentam-reacao-de-montadoras/. Acesso em: 31 ago. 2022.

BASSOT, B. Qualitative Desk-Based research: a practial guide to writing an excellent dissertation. Bristol University Press, v. 1, f. 1, p. 38, 2022.

BURRELL, Gibson; MORGAN, Gareth. Sociological Paradigms and Organisational Analysis: Elements of the Sociology of Corporate Life. Routledge, v. 3, f. 224, 448 p. 1992.

HAMILTON, J.; CESPEDES, F. V. Selling to Customers Who do Their Homework Online. Harvard Business Review, Boston, HBR.ORG, Reprint HQ2OOJ, March 2016.

CHRISTENSEN, C. M.; RAYNOR M. E.; MCDONALD, R. What is Disruptive Innovation?. Harvard Business School, Boston, v. 88, n. 1. p. 01-12, 2015.

COSTA, Daiane. Em um ano, Brasil ganha 200mil motorista de aplicativo de transporte e entrega. Jornal O Globo. Rio de Janeiro, p. 1 2019. Disponível em: https://oglobo.globo.com/economia/em-um-ano-brasil-ganha-200-mil-motoristas-de-aplicativo-de-transporte-entrega-23631984. Acesso em: 6 mar. 2020.

FENABRAVE. Internet ainda é canal inexplorado por montadoras. Fenabrave. Fenabrave. São Paulo, p. 1, 2020. Disponível em: http://www3.fenabrave.org.br:8082/plus/modulos/noticias/ler.php?cdnoticia=9275&cdcategoria=1&layout=noticias. Acesso em: 31 jan. 2020.

GLOBAL SURVEY, General Motors. Customer Attitudes After the Quarantine. 2020. 43 slides, 2021. Disponível em: http://www.generalmotors.com. Acesso em: 27 jun. 2022.

LEASEPLAN. A pandemia do Covid-19 mudou a indústria automotiva para sempre?. Jornal da Unesp. São Paulo, 2020. 1 p. Disponível em: https://www.leaseplan.com/pt-br/noticias/industria-automotiva-mudou-covid19/. Acesso em: 4 ago. 2022.

JORNAL DA UNESP. Crise de escassez de semicondutores prejudica desde setor automotivo até programas de aceleradores de partículas, e tem disputa econômica entre EUA e China como complicador. Revista Leaseplan. São Paulo, 2023. 1 p. Disponível em: https://jornal.unesp.br/2023/01/20/crise-de-escassez-de-semicondutores-prejudica-desde-setor-automotivo-ate-programas-de-aceleradores-de-particulas-e-tem-disputa-economica-entre-eua-e-china-como-complicador/#:~:text=Estudo%20da%20Associa%C3%A7%C3%A3o%20Nacional%20dos,na%20produ%C3%A7%C3%A3o%20brasileira%20de%20ve%C3%ADculos. Acesso em: 21 mai. 2023.

MALHOTRA, Naresh. Pesquisa de Marketing: uma orientação aplicada. Porto Alegre: Bookman, 2001.

MCKINSEY; COMPANY. How consumers’ behavior in car buying and mobility is changing amid COVID-19. Mckinsey Company. Boston, 2021. 1 p. Disponível em: https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/how-consumers-behavior-in-car-buying-and-mobility-changes-amid-covid-19. Acesso em: 2 out. 2021.

MERCADO E CONSUMO. Paralisação de produção por covid e falta de componentes afeta 50 das montadoras. Mercado e Consumo. São Paulo, 2021. 1 p. Disponível em: https://mercadoeconsumo.com.br/2021/04/08/paralisacao-de-producao-por-covid-e-falta-de-componentes-afeta-50-das-montadoras /. Acesso em: 3 fev. 2022.

META FOR BUSINESS. Auto Talks: Como a Mensageria está impactando a jornada do consumidor de automóveis. Meta for Business. São Paulo, 2022. 1 p. Disponível em: https://www.facebook.com/business/news/como-a-mensageria-esta-impactando-a-jornada-do-consumidor-de-auto-?ref=search_new_2#. Acesso em: 2 set. 2022.

O ESTADO DE SP. Locadoras e aplicativos puxam a venda de Automóveis. Estado de São Paulo – Economia. São Paulo, 2020. 1 p. Disponível em: https://economia.estadao.com.br/noticias/geral,frotistas-e-locadoras-puxam-venda-de-carros,70002808106. Acesso em: 1 jul. 2021.

PESQUISA EXPLORATÓRIA. Coleta de survey online de autoria própria com 67 respondentes. São Paulo – 2021. 15 p. Disponível em: https://docs.google.com/presentation/d/1ldgRS2YmnjXiuxmelWvyVJ-QIAndsHA0/edit?usp=sharing&ouid=117183384205877570030&rtpof=true&sd=true. Acesso em: 15 jun. 2023.

RELATÓRIO DE INVESTIDORES LOCALIZA. Portal de Investidores Localiza. Localiza – Relação com Investidores. Belo Horizonte, 2020. 75 p. Disponível em: https://s3.amazonaws.com/mz-filemanager/08f327aa-e610-4d9d-b683-8ff0f7caae07/2643c1d1-556d-4af2-8261-43cc966e00b9_Earnings%20Release%203T19%20portugues.pdf. Acesso em: 5 ago. 2022.

RELATÓRIO DE INVESTIDORES MOVIDA. Portal de Investidores Movida. Movida – Relação com Investidores. São Paulo, 2020. 77 p. Disponível em: https://s3.amazonaws.com/mz-filemanager/437bf607-6e35-4ac9-973f-608b2497e42d/aaf64fdb-4f5f-48d2-b662-6ec06c19126d_MOVIDA_ITR_3t19.pdf. Acesso em: 28 jul. 2020.

RODRIGUES, Alzira. Presidente da Anfavea diz que venda direta veio para ficar: Dirigente recomenda aos concessionários que repensem o negócio. Auto Indústria. São Paulo, 2019. 1 p. Disponível em: https://www.autoindustria.com.br/2019/07/04/presidente-da-anfavea-diz-que-venda-direta-veio-para-ficar/. Acesso em: 29 jan. 2023.

SANARMED. Linha do tempo do Coronavírus no Brasil. Sanar. São Paulo, 2020. 1 p. Disponível em: https://www.sanarmed.com/linha-do-tempo-do-coronavirus-no-brasil. Acesso em: 25 jun, 2023.

TEDLOW, Richard. Leaders in Denial. Harvard Business Review, Boston, v. 45, n. 2 p. 01-07, 2008.

TEIXEIRA, Thales S.; PIECHOTA, Greg. Unlocking the Customer Value Chain: How Decoupling Drives Consumer Disruption. Currency, v. 2, f. 176, p. 352, 2019.

TEXEIRA, Thales. The Decoupling Effect of Digital Disruptors. Harvard Business Review, Boston, v. 15, n. 31. 13 p, 15 05 2014.

THINK GOOGLE. Customer s in the micro-moment: What it means for auto brands. Think Google. Palo Alto, p. 1, 2019. Disponível em: https://www.thinkwithgoogle.com/marketing-resources/micro-moments/auto-brand-mobile-micro-moments/. Acesso em: 2 fev. 2023.

[1] PhD candidate at EAESP-FGV in Business Administration. Master’s degree from EAESP-FGV in Business Administration. Postgraduate (specialization) in Marketing from the Pontifical Catholic University of Rio de Janeiro. Bachelor’s degree in Social Communication – Advertising and Publicity from the Federal University of Rio de Janeiro. ORCID: 0000-0002-6951-1760. Currículo Lattes: https://lattes.cnpq.br/4169477701972941.

Sent: May 23, 2023.

Approved: June 22, 2023.