FRANÇA, Fabiano Franco [1]

CHIAMULERA, Felipe [2]

BARBOSA, Daniel de Sá [3]

CAMPOS, Helnatã Duarte [4]

BORGES, Davi de Souza [5]

CORDEIRO, Jafé Praia Lima [6]

THOMÉ, Ygor Aroucha [7]

FRANÇA, Fabiano Franco; et.al. The social profit of the Free Zone of Manaus to the Southeast of Brazil, direct jobs generated in the year 2016. Multidisciplinary Scientific Journal. Edition 06. Year 02, Vol. 01. pp 620-635, September 2017. ISSN:2448-0959

SUMMARY

Social Profit is a mirror of the social balance of private companies in the public sector, so, in this study, the social responsibility derived from the Zona Franca de Manaus model, which is administered by SUFRAMA – Federal Autarchy linked to the MDIC, responsible for the analysis of the concession and fiscalization of fiscal incentives granted by the Federal Government. The effects of the products encouraged by Law No. 288 of 1967 on the generation of direct jobs in the Southeast from the production of these states aimed at the market of the Western Amazon and Amapá were analyzed. We have verified that the states of Southeast Brazil benefit from the generation of 78,762 direct jobs from the Public Policy of Tax Incentives to the Zona Franca Project in Manaus. At the end of the study it is concluded that the tax incentives granted in the Manaus Free Trade Zone do not only generate benefits for its area of operation, they also bring positive externalities for the whole of Brazil.

Keywords: Fiscal Incentives, Free Trade Zone of Manaus – ZFM, Production, Direct Employment.

1. Introduction

Social Profit is a tool for transparency, management and valuation, using indicators in the elaboration of a Social Balance adequate to the Public Sector in which the results of actions are measured in benefit to society.

In this context, an approach to Social Profit generated by SUFRAMA – Superintendence of the Manaus Free Trade Zone – Federal Autarchy, which administers the tax incentives referred to in Decree-Law No. 288, of February 28, 1967, will be carried out.

SUFRAMA has as its motto the regional development that is part of the Manaus Free Zone, so its institutional mission is confused with that of the model itself: "promote regional economic development through generation, attraction and consolidation of investments, supported by education, science, technology and innovation, aiming at national integration and competitive international insertion ".

The motivation for such research stems from the following points:

- There is scant research on the subject. It is therefore an unpublished research for literature.

- The regional development model of the Manaus Free Zone is challenged by other entities of the Federation that are not directly influenced by tax benefits. At this point, the following question is asked: Although the tax benefit is given to the Western Amazon region, do the other regions of the Brazilian State suffer positive impacts from this policy?

Therefore, the main objective of this study is to quantify the direct relationship of direct jobs generated through the production of products in the Southeast states with tax incentives in the Manaus Free Trade Zone.

In order to reach the proposed objectives, a bibliographic research was carried out as a methodological resource, based on the detailed analysis of materials already published in the literature and scientific articles published in the electronic medium. In addition, a specific calculation methodology was used to reach the answers to the questions proposed in the article in question.

2. THEORETICAL REFERENCE

The literature review developed to support the analysis of this work is organized in the following subsections: the Zona Franca model of Manaus with exposure of the tax incentives covered and the concept of Social Profit.

2.1 MANAUS FREE ZONE

Idealized by Law No. 3,173, dated June 6, 1957, and designed by Decree-Law no. 288/1967, the Manaus Free Trade Zone (ZFM) was created with the aim of boosting the economic development of Western Amazonia[8] and Amapá, through tax incentives. Thus, the tax policy in force in the Manaus Free Trade Zone is differentiated from the rest of the country, offering locational incentives, aiming at minimizing Amazonian costs (SUFRAMA, 2017).

In this sense, the ZFM is defined in art. 1 of the Decree-Law in comment as:

[…] a free trade area for import and export and special tax incentives, established with the purpose of creating in the interior of the Amazon an industrial, commercial and agricultural center endowed with economic conditions that allow its development, in the phase of local factors and the great distance , which are the consumer centers of their products (BRASIL, 1967).

According to Bispo (2007), among the fiscal and extra-fiscal incentives granted to the enterprises installed in the model, the following are the tax incentives imposed on: Importation Tax (II), the Tax on Industrialized Products (IPI) and the Tax on Circulation of Goods and Services (ICMS).

With regard to fiscal incentives within the competence of the Un[9]ion, Decree No. 288/1967, art. 7, paragraph 4, establishes the reduction rate of 88% in the II tax rate on the purchase of inputs for industrialization in the ZFM, provided that the Basic Productio[10]n Process (PPB) is complied with, excluding IT and land vehicles (BRASIL, 1967).

For computer goods and land vehicles, Paragraph 1 of the same article states that when industrialized in the ZFM, they are subject to the payment of the II of the same inputs, entering into the calculation of the tax by means of the coefficient of reduction of their rate, provided they meet level of local industrialization under its PPB (BISPO, 2007).

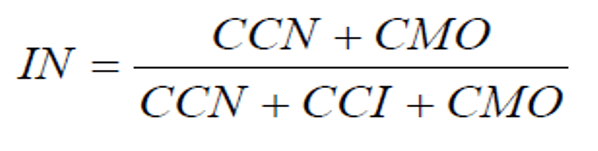

Algebraically, Bishop (2007) represents this coefficient with the following formula:

At where:

CCN = cost of national components: sum of the costs of national components represented by the sum of the values of raw materials, intermediate products, secondary and packaging materials, components and other inputs of domestic production;

CMO = direct labor cost: sum of the costs of labor and costs employed in the production process; and

CCI = cost of imported components: sum of values of raw materials, intermediate products, secondary and packaging materials, components and other inputs of foreign origin.

By this equation, it is possible to affirm that: the higher this index, the greater the share of national components used in the cost structure of the product, which results in a higher rate of reduction and, therefore, the lower the II to collect.

It should also be pointed out that the enjoyment of this incentive for the industrialization of informatics goods is conditioned to the counterpart of investments in Research and Development (R & D), which is dealt with in Law no. 8,387 / 1991, art. 2º, § 3º (BRASIL, 1991).

However, corroborating with the installation of the industrial center in the interior of the Amazon, according to the concept of the model, art. 3 of Decree-Law no. 288/1967 exempts from payment of II any merchandise that has the purpose of industrial installation and operation and services of any nature, otherwise said capital goods. In other words, an industry that will be installed in the ZFM, but that for this it is necessary to import machinery and equipment for the full operation of its manufacturing activity, the rate of the II incident of these imports will be 0% (BRAZIL, 1967).

A similar case is treated with the IPI, which, as can be observed in art. 9 of Decree-Law no. 288/1967, deprives the industrial process developed in the ZFM of the collection of this tax. Hence, any activity conceived in the model is exempt from IPI collection, provided that the stages of local industrialization are fulfilled under its PPB (BISPO, 2007).

It is also observed that in the case of informatics goods, the same criterion of the use of the incentives of II applies to the counterpart of investments in R & D.

Another major tax incentive granted in the model is related to ICMS, which, according to item II, art. 155 of the Magna Carta, competent to establish it in the States and the Federal District (BRAZIL, 1988).

In this sense, State Law No. 2,828, of September 29, 2003, through its art. 2, encourages industry in the state of Amazonas through credit stimulus, tax credit and deferral (AMAZONAS, 2003). To do so, within the scope of this article, it is worth highlighting the stimulus credit, as this is what most impacts the activity within the scope of the model being shown.

Thus, incentives for stimulus credit are granted by product group, arranged in art. 13 of the same Law, "which correspond to the product of the percentage application that the company has of its prod[…]uct, on the debit balance of the ICMS" (BISPO, 2007). Broadly speaking, the levels of stimulus credits are divided as follows:

- For intermediate goods, cleaning products, roasted and ground coffee, vinegar, cookies and biscuits, noodles and other pasta products, as well as virgin and engraved media, manufactured according to PPB, distributed from the Manaus Free Trade Zone, apply 90.25%;

- For printed circuit boards assembled for the production of audio and video apparatus, capital goods, industrialized consumer goods intended for food, agro-industrial and forest-based products, medicines, cosmetics and perfumery, using raw materials produced in the interior or originating from the regional flora and fauna, applies 75%;

- For the other industrialized consumer goods not expressed in the previous levels, 55% applies (AMAZONAS, 2003).

To qualify for the enjoyment of these stimulus credits, companies must meet at least four of the eleven criteria listed in § 1, art. 4 of State Law 2,828 / 2003. These criteria are considered by legislation to be important for the development of Amazonas (AMAZONAS, 2003).

In addition, art. 19 of the State Law in reference, establishes other criteria of requirements to justify the concession of this fiscal incentive, among them, it is emphasized the subsection XIII:

Collect financial contribution, on an irreversible and irrevocable basis, throughout the period of fruition of the incentives, observing the forms and conditions established in regulation:

a) to the Micro and Small Business Development Fund (FMPES), corresponding to 6% (six percent) of the stimulus credit, calculated in each ICMS calculation period;

b) in favor of the University of the State of Amazonas – UEA, corresponding to:

1 – 10% (ten percent) of the stimulus credit, calculated in each ICMS calculation period, when treating an industrial company benefiting from a 100% (stimulus) credit level;

2 – 1.3% (one and three tenth per cent) on gross sales, subject to deferral, when dealing with the operations set forth in art. 14. II[11];

3 – 1.5% (one and a half percent) of the stimulus credit, calculated in each ICMS calculation period, in other cases

c) to the Fund for the Promotion of Tourism, Infrastructure, Services and Development of Amazonas – FTI, in the amount corresponding to:

1 – 1% (one percent) on the value of raw materials, intermediate goods and packaging from other units of the Federation and acquired by the industries producing final goods, except in the event of the goods provided in art. 13, § 13, II,[12] III [13]and I[14]V;

2 – 1% on the gross revenue of the industrial enterprises benefited with a level of 100% (one hundred percent) of stimulus credit;

3 – 1% (one percent) on the gross sales related to intermediate goods with deferral referred to in item II of art. 14;

4 – 1% (one percent) on the value of raw materials, intermediate goods, secondary materials and packaging from other units of the Federation and acquired by industries producing final goods, except in the event of the goods provided in art. 13, § 13, II, III and IV;

5 – 2.5% (two and a half percent) on the value of the ICMS debit balance, calculated in each period, related to the incentive products with the benefit of additional stimulus credit, due to an agricultural enterprise located in the interior of the State.

6 – 1.5% (one and a half percent) on gross sales related to operations with concentrates, sweetener base for concentrates and beverage extracts, except for the deferred operations dealt with in item II of the caput of art. 14 (AMAZONAS, 2003).

Finally, the tax incentive on Income Tax for Legal Entities (IRPJ), granted to all areas of the Legal Amazon, stands out, through Provi[15]sional Measure No. 2.199-14, dated August 24, 2001, which , in short, in its art. 1, defines the reduction of 75% of the tax rate based on operating income, for a period of 10 years, starting from the calendar year of the beginning of the approval of incentive enjoyment (BRASIL, 2001).

There is jointly the hypothesis of the exemption of this tax, when it is a venture capital goods manufacturers, based on digital technologies, under the terms of § 1º-A of the article in question.

In view of the foregoing, in order to make use of the tax incentive granted in ZFM, interested companies must, through a technical-economic-financial project, demonstrate the feasibility of the joint venture to SUFRAMA, in order to obtain the advantages related to II and IPI, to the Government of the State of Amazonas, ICMS, and to the Superintendency of Development of the Amazon – SUDAM[16], IRPJ.

Therefore, it is necessary to emphasize that the present study has as an experiment the fiscal incentives granted by SUFRAMA, therefore, it is aimed at the effects caused in the Southeast region of Brazil arising from the IPI exemption and the reduction of the II.

2.2 SOCIAL PROFIT

For Karkotli (2002) the expression "social balance sheet" has been defined in several ways, but with little divergence as to the accountability of social actions. The definitions, therefore, have converged to the understanding that the social balance sheet is a set of economic and social information, whose purpose is the dissemination of information about the economic and financial performance of companies and their performance to the benefit of society .

According to Ozanan (2015), Social Profit is the quantification of the return and / or economy, for the benefit of society, of investments made as a result of the action of a governmental body, either directly, through the actions of control, regulation and control, or indirectly, through actions, ie, the commitment of the Public Sector (Public Companies, Autarchies and Mixed Economy Societies) with the adoption of an ethical standard of behavior, contributing to economic and social development. It is the Public Sector acting as a social agent in the development process.

Therefore, it is possible to perceive the social balance conceptualization, being constituted, above all, as a tool directed to the private sector. With regard to the concept of Social Profit, it is noted that at the time of the emergence of such a tool there were few approaches to evidence, in general terms, of the return of the public sector to society as a whole. Thus, in order to quantify the return that the public sector offers the society, studies were carried out by several public agencies. Among these studies, there was the emergence of the concept of Social Profit that we could observe previously.

In the present work it is demonstrated a methodology derived from the broad concept of Social Profit, in which intrinsic aspects of the organ in question were considered.

3. SOCIAL PROFIT, direct jobs generated in the southeastern states of Brazil, ATRAVÉS From the production of products with FISCAL INCENTIVES: METHODOLOGY FOR THE CALCULATION.

SUFRAMA, as already seen, has as its institutional objective the regional development of the Western Amazon and Amapá. For this reason, ZFM, through the municipality, offers tax incentives to the industries that are installed in its area of operation. These companies, in turn, buy several products from all the federative units of Brazil, stimulating and strengthening the national productive chain.

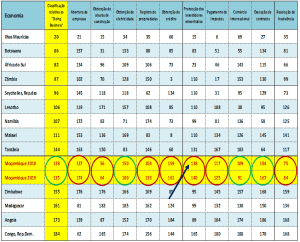

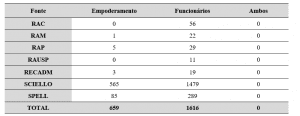

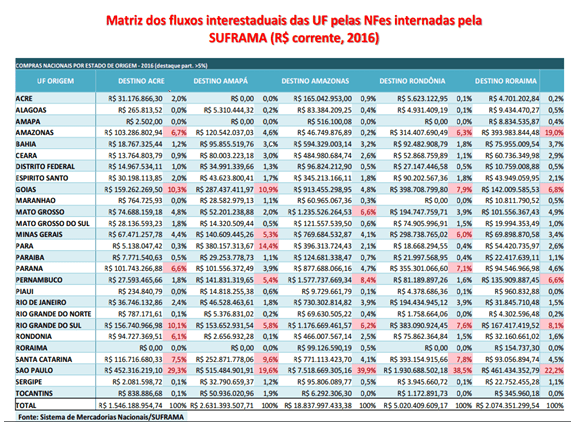

As informed by SUFRAMA's National Commodity System (Table 1), the industries installed in Suframa's area purchased only in 2016, from the Southeast region the amount of R $ 14.8 billion in products. This amount translates, in terms of the promotion of the Southeast productive chain, far beyond the sales of goods, as it also generates innumerable direct jobs.

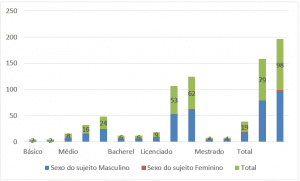

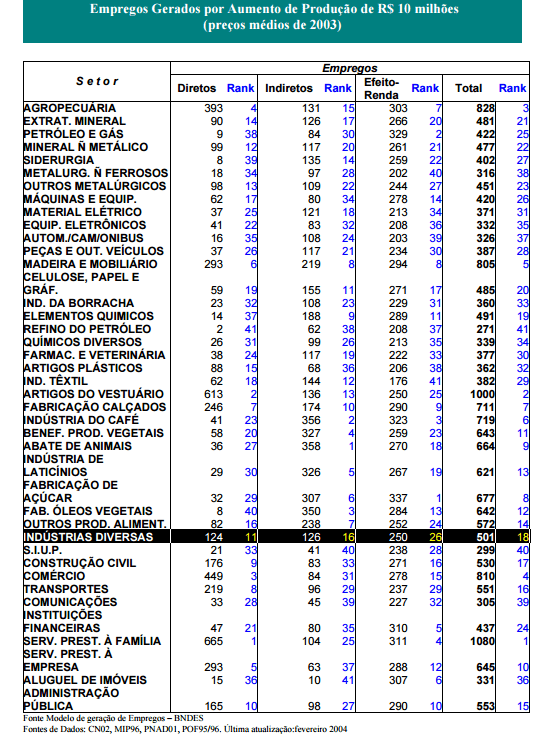

In order to reach the number of how many jobs are created due to the purchases of the SUFRAMA-stimulated industries, Table 2 of the Generation of Jobs of BNDES was taken into account. The sector chosen to carry out the calculations is that of Diverse Industries (in particular). This choice was made due to the large industrial park installed in the model.

In each line of this table, there is an estimate of the number of direct, indirect, income-effect and total jobs, generated by an increase of R $ 10 million in real sector production at average prices in June 2003 , updated in the year 2004.

The studies of direct employment estimates estimate that each R $ 10 million of increase in production generates the amount of 124 direct jobs in the Sector of diverse industries, so we can affirm that, according to the principle of proportionality, each R $ 1 million provides 12.4 jobs.

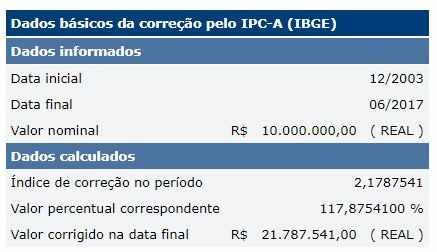

Due to the data in table 2 being from 2003, it is necessary to update it for the month of June 2017. Thus, taking into account the IPC-A (Consumer Price Index – Extended), which is calculated by IBGE (Brazilian Institute of Geography and Statistics) and is used by the COPOM (Monetary Policy Committee), it is concluded that the amount of R $ 10 million in 2003 would represent, in June 2017, the amount of R $ 21.78 million (Table 3).

After updating to each R $ 21.78 million in production generates the amount of 124 direct jobs in the various Industry sector, that is, using the principle of proportionality, each R $ 1 million of reais foments the amount of 5.7 jobs.

In this way, the methodology to be used is constituted by calculating proportionally the amount of sales invoices in comparison with the number of posts generated from the increase in production.

4. SOUTHEAST: REGION OF WHICH COMPANIES INCENTIVATED BY SUFRAMA MORE BUY

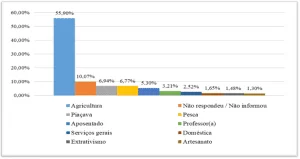

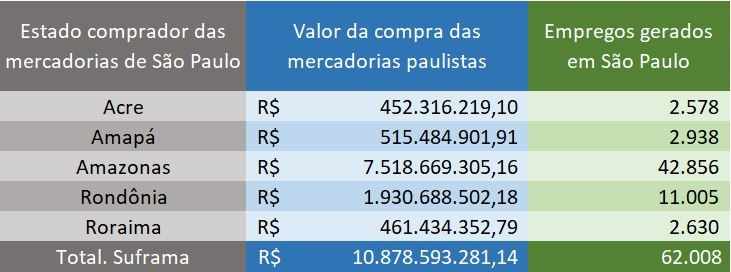

Of all the Brazilian states, São Paulo is the one that sells the most goods for trade and for the industries with fiscal incentives administered by SUFRAMA. The state of São Paulo sold only about R $ 11 billion to these companies in 2016, accounting for 36% of all domestic sales to ZFM.

The State of Rio de Janeiro sells more than R $ 1 billion in which it generates the maintenance of 6 thousand jobs in the year 2016.

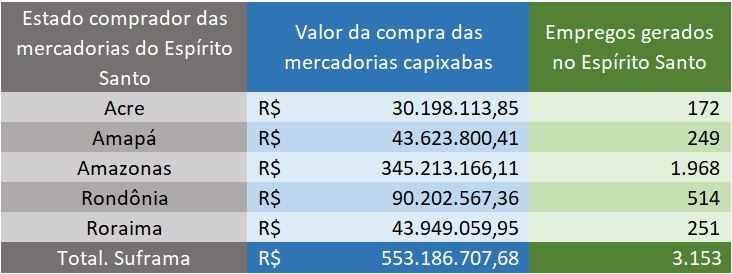

The incentive companies bought, in 2016, more than half a billion products of the State of Espirito Santo. These sales provided the generation of more than 3,000 jobs (Table 6).

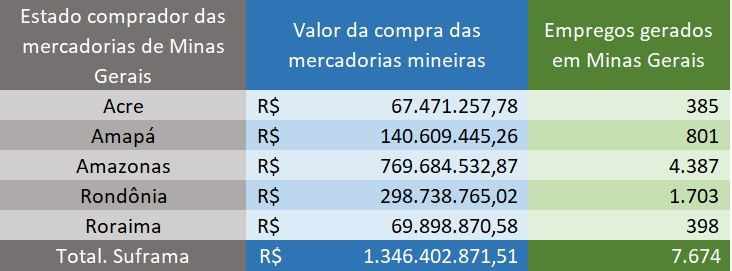

Minas Gerais sold to the incentivized companies R $ 1.3 billion in merchandise, just last year. With these sales, more than 7,600 direct jobs were fomented. (Table 7).

CONCLUSION

Social Profit is important to measure the importance of public institutions for society, after analyzing that, in contrast to fiscal incentives, SUFRAMA is responsible for the generation of 78,762 direct jobs in the Southeast region, with sales data for the year 2016 , therefore, it is verified that the ZFM model is feasible not only for the Western Amazon and Amapá, but also for the entire Southeast region of Brazil. We note the importance of public policies in the Democratic State of Law with the objective of economically and socially developing the Western Amazon region, extending employment benefits to all regions of Brazil, especially to the southeast region.

REFERENCES

AMAZONAS. State Law n. 2,828, dated September 29, 2003. Available at: <http://www.online.sefaz.am.gov.br>. Accessed on: 06 Jul. 2017.

NATIONAL BANK OF ECONOMIC AND SOCIAL DEVELOPMENT (BNDES). Jobs generated by production increase for R $ 10 million (2003 average prices). Available at: <http://www.bndes.gov.br>. Accessed on: 8 Sept. 2017.

BISPO, Jorge de Souza. Creation and distribution of wealth in the Manaus Free Trade Zone. Sao Paulo. 2009. Thesis (Doctorate) – University of São Paulo.

BRAZIL. Constitution (1988). Constitution of the Federative Republic of Brazil. Available at: <http://www.planalto.gov.br>. Accessed on: 20 jun. 2017.

______. Decree-Law no. 288, of February 28, 1967. Available at: <http://www.planalto.gov.br>. Access: Jul 11 2017.

______. Law no. 8,387, issued December 30, 1991. Available at: http://www.planalto.gov.br>. Access: Jul 11 2017.

______. Provisional Measure n. 2.199-14, of August 24, 2001. Available at: http://www.planalto.gov.br>. Access: Jul 11 2017.

BRASILEIRO INSTITUTE OF GEOGRAPHY AND STATISTICS (IBGE). National Extended Consumer Price Index IPC-A. Available at: <http://www.ibge.gov.br>. Accessed on: 7 Sept. 2017.

KARKOTLI, Gilson Rihan. Importance of Social Responsibility for Implementation of Social Marketing in Organizations. 2002. 98f. Dissertation (Masters in Production Engineering) – Post-Graduation Program in Production Engineering, UFSC, Florianópolis.

Oliveira, Rodrigo Otávio Ozanan. Course of Elaboration of Social Profit: Tool of Negotiation and transparency in the Public Sector. Rio de Janeiro: INMETRO, 2015.

Presidency of the Republic. Decree Law no. 288, of February 28, 1967. <http://www.planalto.gov.br/ccivil_03/decreto-lei/Del0288.htm

_______________. Decree Law no. 356, of August 15, 1968. <http://www.planalto.gov.br/ccivil_03/decreto-lei/Del0356.htm

_______________. New Estimates of the Job Generation Model. <https://web.bndes.gov.br/bib/jspui/handle/1408/9641

SUPERINTENDENCE OF THE FRANCA AREA OF MANAUS (SUFRAMA). Incentives. Available at: <http://www.suframa.gov.br>. Accessed on: 14 jun. 2017.

[1] Specialist in Public Administration from Universidade Cândido Mendes – UCAM and a graduate in Economic Sciences from the Federal University of Piauí – UFPI. He is a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Economist.

[2] Specialist in Project Management at the Mauricio de Nassau University Center and graduated in Mechatronics Engineering from the State University of Amazonas – UEA. He acts as a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Technical Administrative Analyst.

[3] Specialist in Administrative Law at the International Signorelli Faculty and a degree in Business Administration from Nilton Lins University. Serves as public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Administrator.

[4] Specialist in Public Administration from Cândido Mendes University – UCAM and graduated in Physiotherapy from Fundação Presidente Antônio Carlos – FUPAC. He acts as a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Technical Administrative Analyst.

[5] Specialist in Project Management by the University Center of Higher Education of Amazonas – CIESA and graduated in Economic Sciences from the University Center of the North – UNINORTE. He is a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Economist.

[6] Specialist in Public Administration from Universidade Cândido Mendes – UCAM and a graduate in Administration from the Federal University of Amazonas – UFAM. He acts as a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Technical Administrative Analyst.

[7] Specialist in Project Management by the University Center of Higher Education of Amazonas – CIESA and graduated in Economic Sciences from the University Center of the North – UNINORTE. He is a public servant of the Superintendence of the Manaus Free Trade Zone – SUFRAMA, in the position of Economist.

[8] It comprises the states of Amazonas, Acre, Roraima and Rondônia.

[9] The art. 153 of the Federal Constitution, determines the competence of the Union to institute some taxes, among them, are evidenced: on the importation of foreign products, on industrialized products and on income and earnings of any kind (BRASIL, 1988).

[10] Law No. 8,387, of December 30, 1991, art. 7, item II, paragraph 8, letter b, defines PPB as "a minimum set of operations in the factory, which characterizes the effective industrialization of a given product" (BRASIL, 1991).

[11] Exit of intermediary goods, when destined to the integration of productive process of industrial establishment equally incentivated.

[12] Portable cellular telephone terminals.

[13] Video monitor for computing and telephone handset combined with cordless handset.

[14] Computer and automation goods.

[15] It comprises the states of Acre, Amapá, Amazonas, Mato Grosso, Pará, Rondônia, Roraima, Tocantins and the western part of Maranhão.

[16] Federal authority linked to the Ministry of National Integration.