ORIGINAL ARTICLE

ALMEIDA, Sulamita Gomes de [1]

ALMEIDA, Sulamita Gomes de. A brief analysis of investment alternatives. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year. 07, Ed. 08, Vol. 08, pp. 05-23. August 2022. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/accounting/investment-alternatives, DOI: 10.32749/nucleodoconhecimento.com.br/accounting/investment-alternatives

ABSTRACT

Bearing in mind the growing dynamism of the market, this article arose from the need to identify investments in the financial market that provide capital gain and profitability, as idle money does not change people’s economic situation. In this context, the following guiding question arose: what are the investment alternatives available in the Brazilian market that provide capital gain and profitability? In this way, the objective is to briefly report some investment alternatives, namely: public bonds, private bonds, shares, investment funds and savings. For this, the bibliographic review was adopted as a methodology. As a result, it was observed that saving allows the accumulation of unspent income. However, the investor who hopes to gain more value by making his resources available in the market should opt for other alternatives, such as government bonds, private bonds, shares and investment funds. However, although the earning alternatives are varied, in some of them, the exposure to risk is greatly increased, which constitutes a challenge for the selection of securities and other assets in which to invest. Finally, the analysis presented indicated that investment alternatives to obtain capital and profitability gains must observe certain premises, such as: investment liquidity; the calculation formula to decide in fraction of a second; the feasibility of acquiring or selling assets.

Keywords: Investments, Capital Gain, Profitability.

1. INTRODUCTION

In the financial system there are several markets. These markets are dynamic and are in constant interaction with each other. Carrete and Tavares (2019, p. 1), also highlights that “the financial market is reinventing itself, with a new set of rules, new actors, new tools”.

In this context, as an alternative to reduce equidistant points between repressed demand and personal reality, investments emerge as a means of saving money. Furthermore, a reflection brought by Hoji (2016, p. 1), reports that “people are prone to consumption, and one of the measures to control this innate desire is interest”, which is the reward for not immediately consuming.

According to Gitman and Joehnk (2005, p. 3) “an investment is simply any instrument in which available funds can be placed with the expectation that they will generate positive income and/or that their value will be preserved or increased”.

Pinheiro (2019) also characterizes investments as narrow and broad. Strictly speaking, investment is the application of capital in ways that increase productive capacity, they are called capital goods, such as: machines, equipment, production infrastructure. In a broad sense, it is the application of resources with the expectation of profit.

In view of the above, this article has as its guiding question: what are the investment alternatives available in the Brazilian market that provide capital gain and profitability? In this way, the objective is to briefly report some investment alternatives, namely: public bonds, private bonds, shares, investment funds and savings. For this, the bibliographic review was adopted as a methodology.

2. THEORETICAL REFERENCE

Financial education prepares individuals for financial planning, by setting goals and objectives to be achieved in the short, medium and long term (MONTEIRO and MONTEIRO, 2022).

In this context, with a view to studying some investments available in the Brazilian market that provide capital gains and profitability, it is necessary to understand the age range of market participants.

Gitman and Joehnk (2005), point out that the age group and the most selected types of investments are directly related to the investment profile. From 20 to 45 years old, it is sought to invest in securities that can offer a higher return, therefore supporting exposure to high risk. They are called “bold investors”. From 45 to 60 years old, agents have a moderate profile. In this age group, individuals seek to conserve resources that have been accumulated over time, accepting exposure to a small percentage of risk. The profile above 60 years old is of the conservative type, where safer investments are sought and available for use, such as: savings, interest-bearing current account and Bank Deposit Certificate (CDB)[2].

2.1 INVESTMENT

Investing is transferring resources to another person in exchange for a promise of future gain. It is called promise because uncertainty is one of the variables that affect markets. It is generated by the lack of control of information on invested capital that is in the custody of third parties (BODIE; KANE; MARCUS, 2014).

Furthermore, investment can be defined as the action of applying available resources in order to increase capital, that is, a return on the money invested. The act of investing takes place in the financial market (SANTOS et al., 2019).

Also, according to Giudicce and Extender (2017),

Em finanças, “investimento” também pode referir-se à compra de ativos financeiros (ações, letras de câmbio e outros papéis), caracterizando o chamado investimento financeiro. O principal objetivo do investimento financeiro é repor o valor de compra da moeda perdido com a inflação. Ele é divido em classes de ativos (renda fixa, renda variável, fundo de investimento, investimentos alternativos) que são classificados conforme o risco, e cada uma dessas classes de ativos são compostos por vários produtos financeiros: por exemplo, os produtos de renda fixa são os títulos do governo (Letra do Tesouro Nacional, Nota do Tesouro Nacional etc.), títulos de dívida de empresas (debêntures), título de dívida de bancos (Certificado de Depósito Bancário) etc.

2.2 THE FINANCIAL AND CAPITAL MARKET

Santos and Silva (2015) describes the financial market as being the composition of several markets: stock market, public bond market, interbank market of bank reserves, capital market, foreign exchange market, etc.

The emergence of the capital market fostered the operations of securities brokers and distributors. Most of these legal figures carry out brokerage and distribution operations in a segregated manner. For this reason, intermediation is very important to close deals between agents, as it provides the entire technological infrastructure for the purchase and sale of securities, allowing agents to operate independently and safely. It also significantly reduces risks in operations, since there is no need to physically move to carry them out, and the waiting time to complete the deal is insignificant (AMORIM, 2015).

Pinheiro (2019) refers to securities intermediation, term intermediation, insolvency risk intermediation and stochastic intermediation to meet the specific desires and circumstances of savers and investors. In this way, intermediation manages assets and liabilities, reducing liquidity, price and credit risks. In addition, you can request redemption of shares at any time, within the opening and closing hours of the stock exchange, which is where the transactions take place.

2.3 FINANCIAL ASSETS

Santos and Silva (2015, p. 3), divides financial assets according to the future flows of payments promised by issuers, namely: fixed income and variable income securities. Issuers of fixed income assets pay the amount promised by the issuer, regardless of any circumstances. Public fixed income assets are mainly represented by National Treasury Bills (LTN)[3] and National Treasury Notes (NTN)[4]. They may also have representation on the Treasury Direct platform. In addition, private fixed income assets are most represented by the Bank Deposit Certificate (CDB).

Francis (1991 apud GIUDICCE and ESTENDER, 2017), also highlights some asset classifications that are common in the financial market:

- Short-term fixed income assets: these assets pay pre- or post-fixed interest on a defined amount. Most of them, in Brazil, mature in one or a few months. Examples are: shares of fixed income funds, short-term federal government bonds (LTN, LFT, BBC etc.), savings accounts, CDB, commercial papers, among others;

- Long-term fixed income assets: represented predominantly by government and corporate debt securities for longer maturities, usually several years. Examples are: shares, debentures, National Treasury Notes, C-Bonds, among others;

- Variable Income Assets: are assets whose remuneration is not previously known or indexed. Examples are: stocks, options contracts, futures contracts in general, gold, dollars and other currencies.

2.4 ACTIONS

Law 6,404/1976 disciplines Corporations (SA)[5] and allows shares to be issued for trading in the securities market. In addition, the company’s registration with the Securities and Exchange Commission (CVM)[6] is required for the public offering of shares and other securities authorized by the CVM (BRASIL, 1976).

According to Carrete and Tavares (2019, p. 15), the CVM has the “objective of supervising, regulating, disciplining and developing the securities market in Brazil”.

The first issue of SA shares is placed on the primary market through securities distributors for previously subscribed institutional investors, according to the schedule of steps to be completed by the three participants in the operation: issuer, distributor and share subscriber ( SILVA, 2008).

In the secondary market, negotiations take place between investors who are interested in acquiring certain shares and investors who are willing to offer these shares. Among them are the stock exchange and brokers, in real time, providing stock quotes. The moment the price breakeven crosses the investors’ buy and sell orders, the order is executed by the broker (SILVA, 2008).

Therefore, the securities negotiated for the first time, between the SA and the subscribed investor in the public offering, occur in the primary market. The sale that occurs from this investor to another investor will take place in the secondary market.

3. INVESTMENT ALTERNATIVES

Next, we will briefly analyze, through some examples, the investment in: government bonds, private bonds, stocks, investment and savings funds.

3.1 PUBLIC TITLES

According to Vercelhese (2013), public bonds are bonds that have fixed income and promote the financing of the public debt. They have liquidity guaranteed by the National Treasury and can be: prefixed or post-fixed, short, medium or long term.

Accordingly, Cerbasi (2008, p. 141) states that:

Os chamados títulos da dívida pública são emitidos pelos governos federal, estadual e municipal com a finalidade de captar recursos e financiar as diversas atividades do orçamento público. Qualquer pessoa residente no Brasil pode comprar títulos públicos através do Tesouro Direto, um programa do Ministério da Fazenda que permite a negociação de títulos da dívida pública federal sem a necessidade de intermediários.

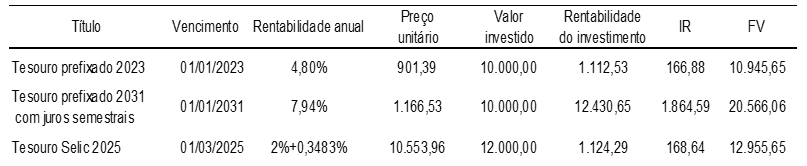

In this context, the table below demonstrates the profitability of some types of government bonds.

Table 1. Fixed income securities issued by the National Treasury

Based on the data in the table above, three cash flows were set up, based on the diagram proposed by Hoji (2016, p. 92), simulating the applicability of investments in government bonds in the form of prefixed Treasury, prefixed Treasury with semiannual interest and Selic Treasury.

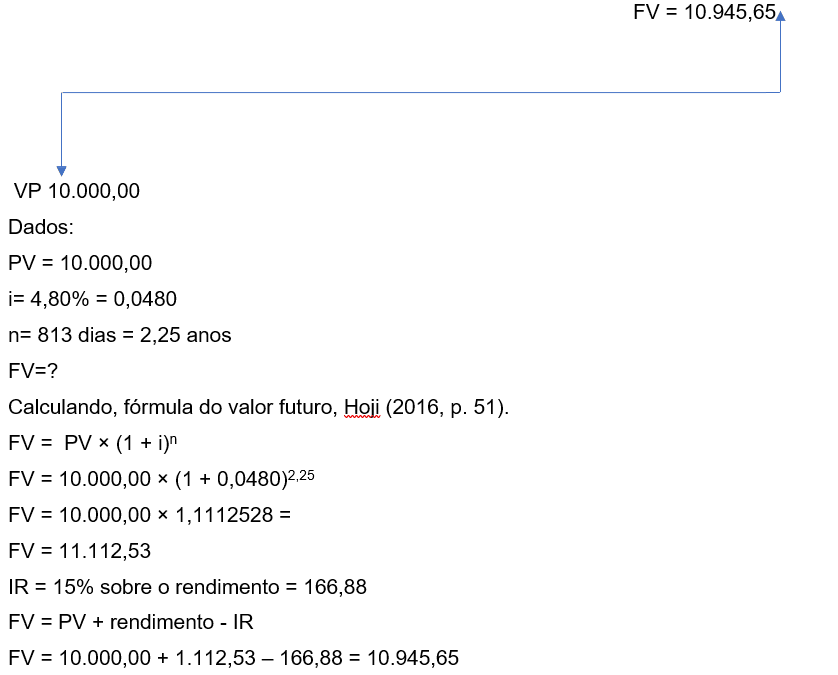

Example 1. Treasury prefixed

The calculation is based on a 360-day business year and 30-day month.

The investment appreciated by 11.12 percentage points in relation to the amount invested.

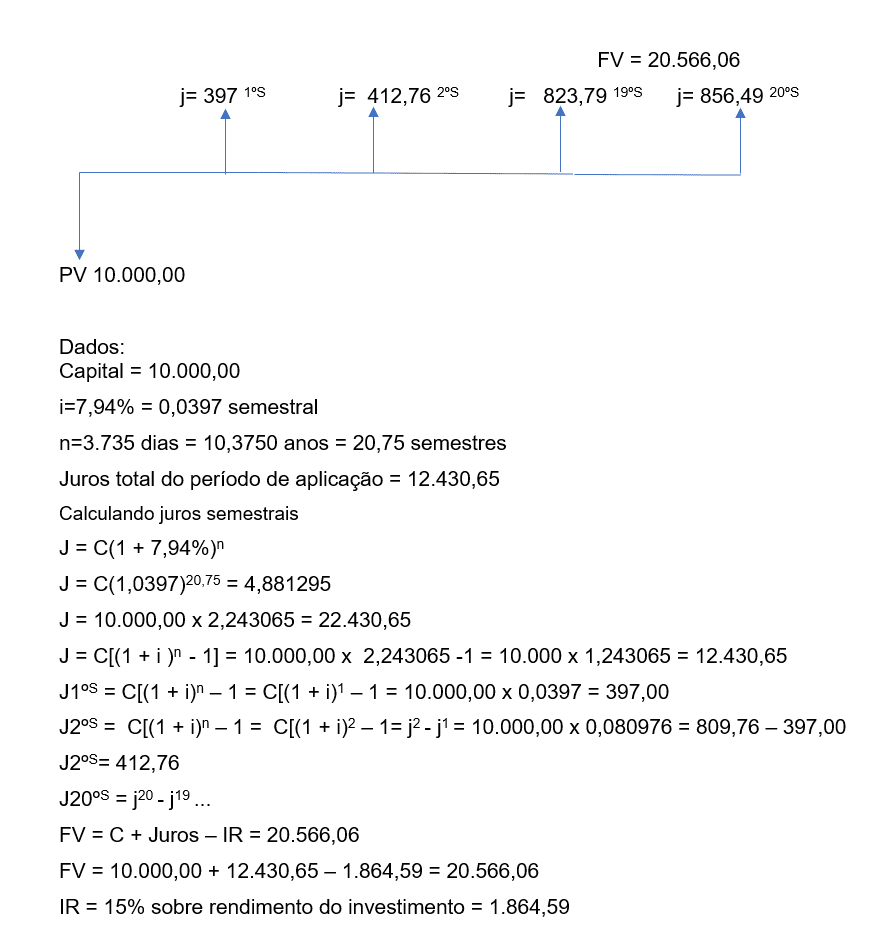

Example 2. Treasury prefixed with semiannual interest

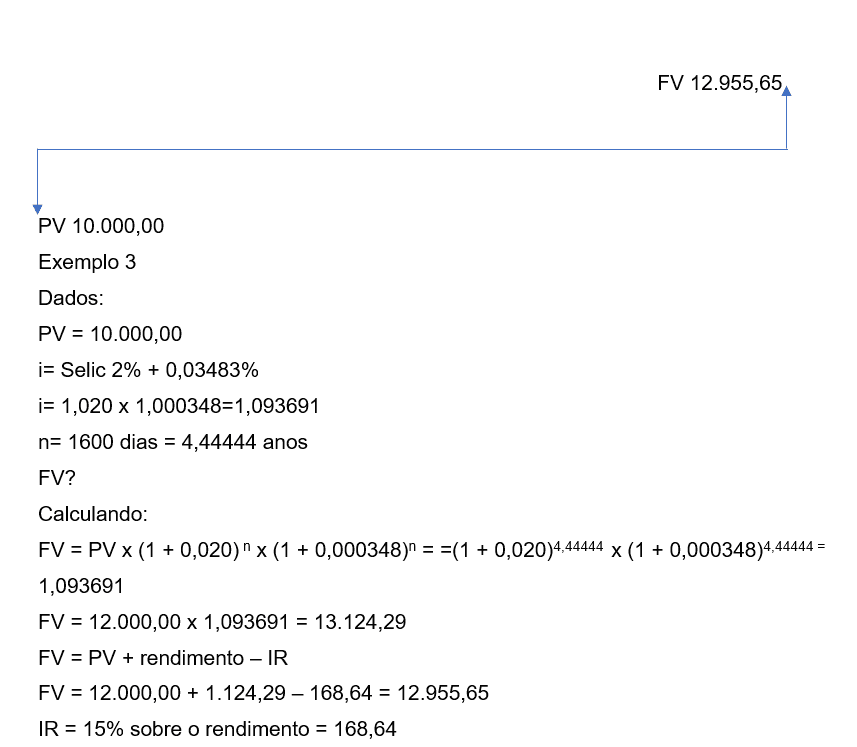

Example 3. Selic Treasury

The examples show that there is a difference in relation to the three interest rate indexes. The first case presents the fixed annual interest rate. The result of this is 15.78% positive in relation to the third case.

The second case has different characteristics, such as: high interest rate, semi-annual interest payments and a 10-year term. The third case presents the interest rate indexed to the Selic + with a percentage of 0.03483% per year. This last investment may not be attractive, as there is a risk of the Selic rate falling and the security not being able to be redeemed before maturity, which could cause losses.

3.2 PRIVATE TITLES

The Bank Deposit Certificate (CDB) is a private fixed-income security issued by the bank to raise funds in the financial market. In this modality, capital remuneration is offered with an interest rate indexed to the Interbank Deposit Certificate (CDI)[7] (PEIXOTO; ORTI and SANCHES, 2012).

The CDI is a certificate issued by the financial institution to its creditor for the resource taken, with a term of one day. Capital supply and demand among financial institutions determine the CDI rate that will be used to remunerate investments indexed to it. In this context, the greater the amount of capital offered, the lower the CDI rate (PEIXOTO; ORTI and SANCHES, 2012).

Berger (2015), classifies the CBD in prefixed and post-fixed. Being the prefixed, the one whose profitability is already known since the acquisition, and the post-fixed, the one that has the profitability according to the variation of the correction index (IGPM, TR, CDI), with the fixed interest rate.

The CDB can be redeemed at any time, however, it is recommended to observe the regressive IOF table, which eliminates the incidence after 30 days of application, and the regressive income tax table, which is levied at 15%, after 720 days of application (PEIXOTO; ORTI and SANCHES, 2012).

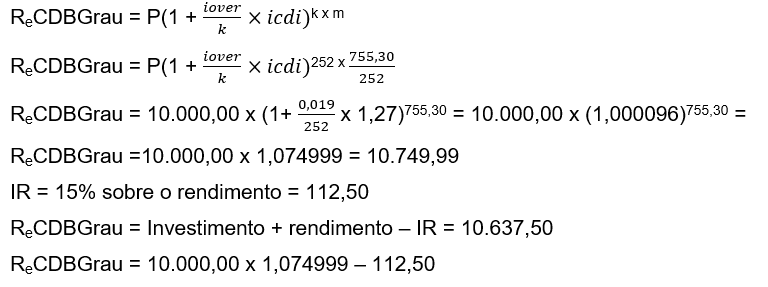

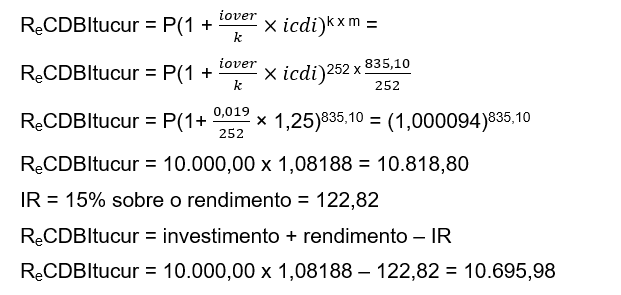

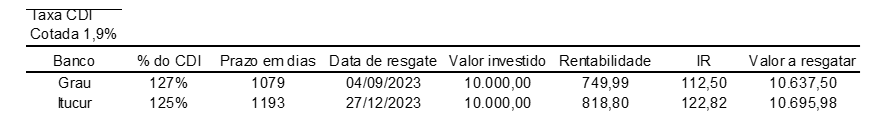

To exemplify and analyze this type of investment, the table below was prepared, which contains, as an example, Banco Grau and Itucur, with their respective information on the securities to be invested. For the calculations, the formula described by Samanez (2007, p. 7) was adapted, which helps to identify the profitability of the CDB.

Table 2. Private fixed income securities

Formula to calculate the profitability of the CDB, According to Samanez (2007, p. 7),![]() business days in the year x term business days / business days in the year.

business days in the year x term business days / business days in the year.

Formula adaptation:

m = period given to redeem the principal + interest

k = number of working days in the year

Re = profitability

Example 4. Investment in fixed income securities at Banco Grau

Example 5. Investment in fixed income securities at Banco Itucur

3.3 ACTIONS

According to Santos and Silva (2015), variable income assets are mainly represented by shares. Share is the smallest fraction of the company’s capital. Furthermore, only publicly traded companies registered with the CVM can issue them.

Its nominal value is established in the company’s bylaws, and the market value is the price at which it is being quoted (CARRETE and TAVARES, 2019, p. 221).

They can also be: ordinary, when they grant the shareholder the right to vote at the Shareholders’ Meeting; or preferred, which grant preference in receiving dividends (SILVA, 2008).

The decision to invest in stocks must be based on the investor’s profile, located at the securities brokerage, which is usually the bank where he has a checking account. This profile is addressed with questions based on percentages of risk that the subject would support given the volatility of his stock portfolio. Those who support minimal risk are considered conservative, those with greater risk are considered moderate and those with high risk are considered bold (GITMAN and JOEHNK, 2005).

Furthermore, having capital to invest does not mean making suicidal bets, but observing the market and analyzing the companies in which one intends to acquire shares (GITMAN and JOEHNK, 2005, p. 24).

When investing in shares, one can also consider the possibility of exemption from income tax on transactions with shares in a traded volume of less than BRL 20,000.00 per month. The brokerage fee, the custody fee of the Brazilian Company of Liquidation and Custody (CBLC)[8] and the stock exchange fee also apply to this. To attract investors, some brokers exempt the investor from all these fees.

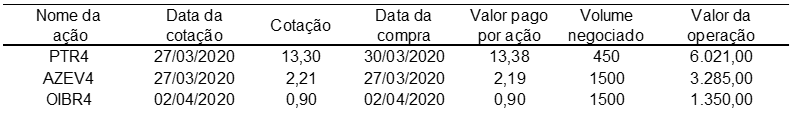

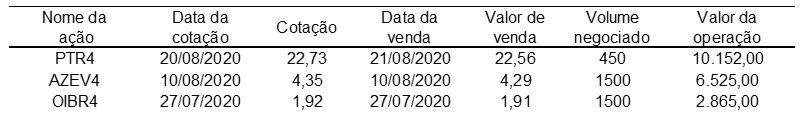

For example and analysis of this type of investment, the table below was prepared, which contains examples of strategies for acquiring and selling shares.

Table 3. Share acquisition strategy

Table 4. Stock selling strategy

Investment in stocks can provide high capital gain, if the investor is located in the line of appreciation of the asset, comparing with its own estimate in scenario of fall and rise of the asset. In the example shown above, it can be noted that PETR4 shares achieved, in 144 days, a capital gain corresponding to R$ 4,131.00 and a positive variation of 68.61%. The AZEV4 shares obtained, in 136 days, a capital gain of R$ 3,240.00 and a positive variation of 98.63%. While the OIBR4 shares reached, in 138 days, a capital gain of R$ 1,515.00 and a positive variation of 112.22%. In the end, the result of the investment in shares totaled R$ 8,886.00.

3.4 INVESTMENT FUND

The investment fund is constituted in the form of a condominium, where each newcomer has quotas, according to the established amount and the amount needed to join. Its objective is to offer investors the opportunity to diversify their investments through a well-structured portfolio that can reduce the risks of asset volatility, achieving balance between them and providing greater profitability to the shareholder. In addition, when investing in a fund, the shareholder will share with the other shareholders the risks to which he is subject (BODIE; KANE and MARCUS, 2014).

The fund’s portfolio is made up of various assets, both fixed income and variable income. The composition percentage is established according to the fund’s investment policy, seeking to reduce liquidity and market risk (RAMBO, 2014).

It is also worth emphasizing that this investment alternative requires a higher level of knowledge and maturity from the investor, mainly with regard to: the form of incorporation; the administration; the management; custody of the assets that make up the fund’s portfolio; incident taxes; and the risks to which they are subject throughout the future period to elapse (RAMBO, 2014).

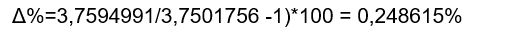

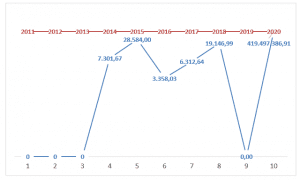

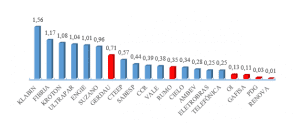

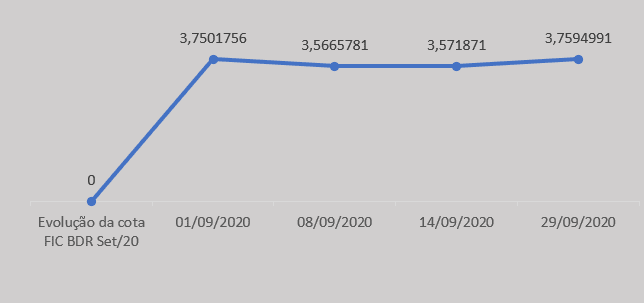

As an example, an analysis of a small sample of an Investment Fund in shares of an investment fund in shares BDR level 1 was carried out, carried out in September/20 and October/2020. It is noted that there was a drop in profitability and the appreciation of the share is much lower than expected on the first day, showing 0.25 percentage points in relation to the sampling period.

Graph 1. Evolution of the share of the FIC BDR Set. 20

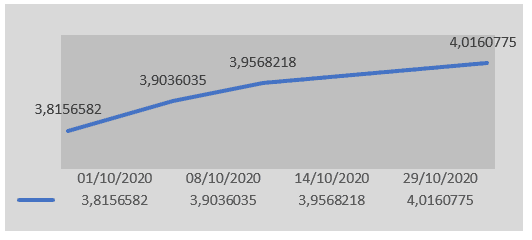

It can be seen that, in the sampling of Graph 2, the Fund showed profitability, reaching a share appreciation of 5.25 percentage points, as can be seen.

Graph 2. Evolution of the FIC BDR Out share. 20

3.5 SAVINGS

Savings is the oldest and most conservative way of keeping the part of income not consumed. It is the type of investment that offers real-time liquidity and the benefit of tax exemption (NUNES, 2018).

The risk of capital invested in savings is zero, as it is protected by the Credit Guarantee Fund (FGC)[9]. This fund is intended to compensate the investor in the event of bankruptcy or default of the intermediary financial institution. The investment protection guarantee is BRL 250,000.00 per CPF, even if there are other assets in the investor’s portfolio (NUNES, 2018).

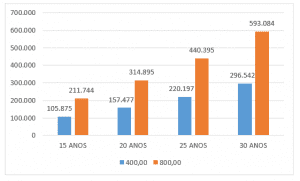

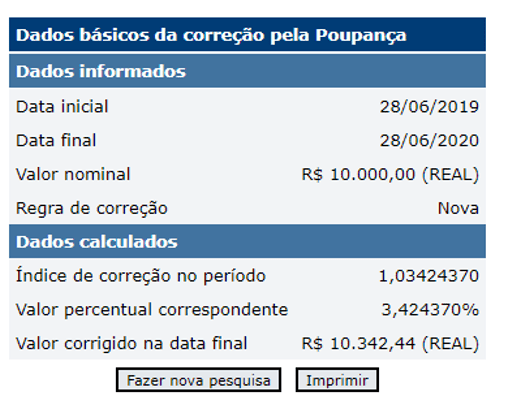

In order to exemplify this investment, below there is a simulation of investment in savings using the citizen’s calculator of the Banco Central do Brasil.

Figure 1. Simulation of investment in savings

Finally, it should be noted that there are other investment alternatives in the most varied financial assets and capital goods available in the financial market and, before carrying out this operation, it is necessary to carry out financial planning and evaluate the cost of money over time, observing the principle of continuity and seeking the continuous permanence of its operations, as well as using techniques for evaluating working capital and cash flows so as not to have to redeem investments before maturity and pay fees and taxes that directly affect income and capital gains.

4. FINAL CONSIDERATIONS

The research made it possible to identify some investment alternatives that provide capital gain and profitability, such as: government bonds, private bonds, stocks, investment funds and savings. Although there is a lot of information about markets and investment products, there are many existing gaps and distancing from practice, leaving investors completely at the mercy of brokers without being able to fully exercise their autonomy in selecting their investments.

In this context, this article aimed to briefly report some investment alternatives, namely: government bonds, private bonds, shares, investment funds and savings. In order to answer the proposed guiding question, it was found that savings is the oldest and most conservative way of saving the unspent part of income. However, there are also other investment alternatives, such as: public bonds, which are bonds that have fixed income and promote the financing of the public debt; private bonds (CDB and CDI), which are issued by banks to raise funds in the financial market or as a guarantee to their creditor for the borrowed funds; shares, which represent the smallest fraction of the company’s capital; and investment funds, which work based on quotas, with the objective of diversifying the investor’s portfolio.

Despite this, it is worth noting that in some of them, exposure to risk is greatly increased, which constitutes a challenge for the selection of securities and other assets in which to invest, and therefore it is necessary to take into account some assumptions, such as: the liquidity of the investment; the calculation formula to decide in fraction of a second; the feasibility of acquiring or selling assets.

Finally, it is proposed to encourage the academic environment to develop research to create simpler and more qualified formulas for application in the evaluation and measurement of investment risks.

REFERENCES

AMORIM, D. F. B. de. Aspectos históricos do mercado de capitais: a evolução do mercado financeiro no mundo e no brasil sob a perspectiva institucional, estrutural e funcional. Revista Científica Semana Acadêmica, ano 2015, Nº. 000078. Disponível em: https://semanaacademica.org.br/artigo/aspectos-historicos-do-mercado-de-capitais-evolucao-do-mercado-financeiro-no-mundo-e-no. Acesso em: 08 de agosto de 2022.

BODIE, Z.; KANE, A.; MARCUS, A. J. Fundamentos de investimentos. Tradução: Beth Honorato. AMGH Editora Ltda. 9° edição, 2014.

BRASIL. Lei n° 6.404, de 15 de dezembro de 1976. Presidência da República, 1976. Disponível em: http://www.planalto.gov.br/ccivil_03/leis/l6404consol.htm. Acesso em: 05 de agosto de 2022.

BANCO CENTRAL DO BRASIL. Calculadora do cidadão – Simulação de investimento em poupança. Banco Central Do Brasil, s.d. Disponível em: https://www3.bcb.gov.br/CALCIDADAO/publico/corrigirPelaPoupanca.do?method=corrigirPelaPoupanca. Acesso em: 28 Jun. 2020

BERGER, P. L. Mercado de renda fixa no Brasil: ênfase em títulos públicos. 1. ed. rev. Rio de Janeiro: Interciência, 2015.

CARRETE, L. S.; TAVARES, R. Mercado Financeiro Brasileiro. 1ª ed. Atlas, 2019.

CERBASI, G. Investimentos inteligentes: para conquistar e multiplicar o seu primeiro milhão. Rio de Janeiro: Thomas Nelson Brasil, 2008.

GITMAN, L. J.; JOEHNK, M. D. Princípios de investimentos. 8. ed. São Paulo: Pearson Addison Wesley, 2005.

GIUDICCE, T. L.; ESTENDER, A. C. O Processo de Análise de Investimentos Financeiros em Instituições Financeiras. Caderno de Administração, v. 1, 2017. Disponível em: https://revistas.pucsp.br/index.php/caadm/article/download/30867/25023/101486. Acesso em: 05 de agosto de 2022.

HOJI, M. Matemática financeira: didática, objetiva e prática. 1. ed. São Paulo: Atlas, 2016.

PEIXOTO, F. de J.; ORTI, P. G. D.; SANCHES, A. L. Análise da Necessidade e Periodicidade de Resgates para Aportes Periódicos Mensais em Cdb. IX SEGeT – Simpósio de Excelência em Gestão e Tecnologia, 2012. Disponível em: https://www.aedb.br/seget/arquivos/artigos12/26316211.pdf. Acesso em: 02 de agosto de 2022.

PINHEIRO, J. L. Mercado de capitais. 9. ed. São Paulo: Atlas, 2019.

MONTEIRO, E. O.; MONTEIRO, J. O. A educação financeira para o enfrentamento de crises econômicas. Revista Científica Multidisciplinar Núcleo do Conhecimento, ano 07, ed. 06, vol. 07, pp. 05-20, junho de 2022. ISSN: 2448-0959, Disponível em: https://www.nucleodoconhecimento.com.br/administracao/enfrentamento-de-crises, DOI: 10.32749/nucleodoconhecimento.com.br/administracao/enfrentamento-de-crises. Acesso em: 08 de agosto de 2022.

NUNES, P. E. O. Estudo sobre o perfil investidor dos estudantes do curso de ciências contábeis da Universidade de Caxias do Sul. Monografia (Graduação em Ciências Contábeis) – Universidade de Caxias do Sul. Caxias do Sul, p. 73, 2018.

RAMBO, A. C. O perfil do investidor e melhores investimentos: da teoria à prática do mercado brasileiro. Monografia (Graduação em Ciências Econômicas) – Universidade Federal de Santa Catarina. Florianópolis, p. 86, 2014.

SAMANEZ, C. P. Gestão de investimentos e geração de valor. São Paulo: Pearson Prentice Hall, 2007.

SANTOS, J. C. S.; SILVA, M. E. Derivativos e renda fixa: teoria e aplicações ao mercado brasileiro. São Paulo: Atlas, 2015.

SANTOS, M. E. do R. et al. O profissional da contabilidade no tratamento de investimento em ações, 2019. Revista Observatorio de la Economía Latinoamericana, abril 2019. Disponível em: https://www.eumed.net/rev/oel/2019/04/tratamento-investimento-acoes.html. Acesso em: 05 de agosto de 2022.

SILVA, P. M. de. Mercado de capitais: sistema protetivo dos interesses coletivos dos investidores e consumidores. Dissertação (Mestrado em Direito) – Universidade

de Ribeirão Preto – UNAERP. Ribeirão Preto, p. 165, 2008.

VERCELHESE, H. A. Aplicabilidade em títulos públicos federais: uma análise do Tesouro Direto. Monografia (Especialização em Gestão Pública) – Centro de Ciências Sociais e Humanas, Universidade Federal de Santa Maria. Santana do Livramento, p. 35, 2013.

APPENDIX – FOOTNOTE

2. Certificado de Depósito Bancário (CDB).

3. Letras do Tesouro Nacional (LTN).

4. Notas do Tesouro Nacional (NTN).

5. Sociedades Anônimas (SA).

6. Comissão de Valores Mobiliários (CVM).

7. Certificado de Depósito Interbancário (CDI).

8. Companhia Brasileira de Liquidação e Custódia (CBLC).

9. Fundo Garantidor de Crédito (FGC).

[1] Graduation in Accounting Sciences. ORCID: 0000-0002-3828-2969.

Shipped: December, 2020.

Approved: August, 2022.