ORIGINAL ARTICLE

MARZZONI, David Nogueira Silva [1], SILVA, Antônio Wairan Ferreira da [2], OLIVEIRA, Epaminondas de Azevedo [3]

MARZZONI, David Nogueira Silva. SILVA, Antônio Wairan Ferreira da. OLIVEIRA, Epaminondas de Azevedo. Management of Accounting Information as a Subsidy to Decision-Making Processes. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 06, Ed. 03, Vol. 09, pp. 160-175. March 2021. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/accounting/accounting-information

ABSTRACT

The objective of this research is to analyze the use of accounting information by entrepreneurs from Rondon do Pará / PA. Because through these reports, managers can make decisions and reduce the risks inherent in the business. In this sense, a study was carried out to verify how accounting information influences decision-making. The methodology used to carry out the research was developed through the application of a questionnaire composed of open and closed questions for data collection. For the study, a random sample of 20 micro-companies from a universe of 181 companies was used, according to data from the Chamber of Shopkeepers of Rondon do Pará / PA. It was found that most enterprises have more than 5 years of activity in the market, proving to be established companies in the trade. It was also verified the degree of relevance given to reports coming from accounting and that many managers, despite considering these reports to be important for economic issues, rarely use this information in the management decision-making process.

Keywords: Accounting information, Microenterprise, Accounting.

1. INTRODUCTION

In an increasingly competitive scenario in the business environment, information becomes an indispensable tool for companies, being something of fundamental importance for the organization of the enterprise aAccounting information, Microenterprise, Accountingnd its maximization in a productive way.

Daily, organizations are subjected to a quantity of data and information that requires specific administration (BEUREN, 2000). Managers at all times need to make essential decisions in relation to the business and know how to work with this information to deal with problems effectively and at the same time gain prominence in the market, this fact is transformed into something complex, requiring attention from managers.

As Carvalho and Nakagawa (2004) rightly states, it can be said that accounting is the science responsible for measuring the entity’s equity, so it is clear that its main objective is to generate structured and reliable information for its users about the company, not it is an exaggeration to state that accounting has the function of supplying data managers in order to generate relevant information that applied efficiently enable users to achieve their objectives based on accounting reports.

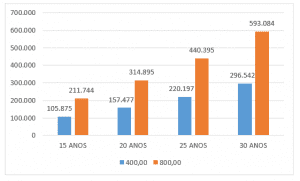

In Brazil, Micro and Small Enterprises (MSEs) play an extremely important role in the country’s economy. According to SEBRAE Mato Grosso (2014), there are about 9 million MSEs in Brazil, which correspond to 27% of the Gross Domestic Product (GDP), a percentage that has been evolving in recent years, thus, it appears that small companies are the main generators of wealth in the Brazilian trade.

For Baty (1994), small companies contribute significantly to collective development, contributing to the growth of the social and economic body, given the amount of jobs generated by these entities.

According to Stroeher (2005), micro and small companies require differentiated attention in relation to management, as they have a typical framework with inherent situations that make them different from large companies, such as tax aspects, specific labor and issues related to accounting and finance.

Despite having great socioeconomic importance, MSEs have a high mortality rate in the first five years of life, often due to the lack of effective management by managers. For Marzzoni and Souza (2020) the absence of consensus regarding the accounting opinion, reduces the importance of the statements in mere tax obligations, instead of serving as a support tool for management. Therefore, it is possible to notice the lack of managers in relation to effective counseling by accountants.

Stroeher and Freitas (2006) affirm that the accounting reports hardly serve as an aid in business years, they are considered in most cases as tax obligations, classified as mandatory expenses.

This work aimed to identify the use of accounting information by entrepreneurs in the city of Rondon do Pará / PA. Therefore, there is an evident need for discussion on the topic, given its current nature and mainly due to the relevance of research related to the accounting information used for management decisions.

Given the above, the study seeks to answer the following question-problem: How do businesspeople from Rondon do Pará make use of accounting information as a basis for the decision-making process?

The article consists of five sections. After this introduction, the literature review is presented, which addresses aspects related to accounting information, attributes of accounting information and company accounting office management aspects. The third section contemplates the research methodology. The fourth deals with data analysis. On Thursday, the conclusion is presented.

2. THEORETICAL FOUNDATION

2.1 ACCOUNTING INFORMATION

Based on the double-entry method for controlling and studying assets, accounting aims to measure and allocate resources based on the accounting information evidenced through financial statements, explanatory notes, reports, books or any other means used by the professional or provided for in the legislation.

According to Marion (1988), accounting is of paramount importance to assist in decision making within a company, since through it are collected pecuniary data about the entity, materialized through reports, which in a way will influence management .

Simon (1970) comments that accounting information has become a tool of fundamental importance that the administrator has to examine his work. The main sources of accounting information are the financial facts recorded in an enterprise, the accounting professional has the role of observing such events and compiling them to present this information through accounting reports.

As Oliveira, Müller and Nakamura (2000) rightly states, in addition to creating information, accounting elucidates equity events, so you can plan subsequent exercises, perform analyzes, control, among other purposes related to management.

The accounting information is divided into the reports in groups of “accounts”, classified as costs, income and expenses that a company may have. Sometimes this grouping can cause confusion, something that many managers do not realize when analyzing the accounting reports, causing errors in the statements.

If accounting information, on the one hand, can be considered relevant in managerial decision-making, many users are unable to assimilate this information evidenced in the reports because they are unaware of the concept of many terms used in these statements (MOREIRA et al. 2013).

For Beuren (2000) the biggest information challenge is to instruct the enterprise’s managers to achieve their goals within the organization, knowing how to deal with this information is essential for business success.

Thus, Atkinson et al. (2000) say that the function of accounting is to produce information that will contribute to decision making in a timely manner. Most managers do not make decisions related to management based on accounting information precisely because of the lack of understanding of the advantages that this information could bring in the management of the company, with this it is clear that many managers consider accounting only as an expense of a fiscal nature , without adding value to the enterprise (LIMA et al. 2004).

Thus, accounting to achieve its function of bringing adequate information to its users, so that they make fundamental decisions related to management, must present some basic characteristics, such as being clear, complete, relevant, integral, useful, dignified, and with a focus on management. of the enterprise.

2.2 ATTRIBUTES OF ACCOUNTING INFORMATION

The accounting information, in particular those explicit in the financial statements, especially those of a fiscal nature, should provide a reasonable view of the company and satisfactorily meet the purposes of its users. For this information to be consolidated, it needs to have some characteristics, such as reliability, timeliness, comprehensibility and comparability, in addition to being relevant and reliable.

For Paulo (2002), these characteristics can be primary and secondary to valid information, considering an integral exception, that is, cost benefit analysis of the information, the comprehensibility being characteristics of the user assuming that he has some knowledge of accounting and follow-up of the entity, on a scale that qualifies it to understand the information present in the statements, in the hypothesis that guarantees to analyze them with the necessary depth.

The concreteness of information as a line of authentication, which is materiality, as a primary characteristic there is reliability and relevance and as secondary characteristics we have comparability, consistency and uniformity.

Materiality symbolizes a permeable concept in relation to characteristics, mainly of reliability and relevance. With this, information becomes essential for the business administrator, when it makes a difference for business management, being able to validate or correct perspectives (STROEHER and FREITAS, 2006).

According to CPC 00 (R1) (2011), the reliability or reliable representation of the information is based on the accuracy, legitimacy and completeness of the documents. Santos (1998) states that comparability exerts interaction with reliability and relevance, thus collaborating for the application of information in an efficient manner.

Comparability involves consistency and uniformity, allowing the user to understand the improvement over time, in the same enterprise or several entities, using the same procedures in the periods as a reference (PAULO, 2002).

According to Santos (1998), the selection of the effective union of information quality is subject to the user’s need, that is, information relevant to one user may not be relevant to another, it depends on who analyzes it. Accounting in its purpose of instructing is unable to answer the perspectives of each manager profile, it is coerced to provide a trivial set assuming that most of the users of the information are useful.

2.3 ACCOUNTING OFFICE AND THE MANAGEMENT ASPECTS

Flippo and Musinger (1970) state that part of the managers exercise their activities limited by the amount of materials (data) available due to their agility in accessing them and especially their ability to examine them. The good performance of a manager is related to his competence in using information, in the essence and quality of his decisions.

Entrepreneurs are more attentive to information related to tax issues, always looking for ways to avoid the tax burden and forgetting aspects such as control, planning, logistics and other points related to management.

Oliveira, Müller and Nakamura (2000) affirm that in most companies considerable distortions occur in the financial statements motivated mainly by taxation factors, transforming the accounting information in documents that do not add any value to the administration, something manifested particularly in small companies. postage.

For Carvalho and Nakagawa (2004) most of the financial statements declared in this way are in a cast, in addition to being highly influenced by tax laws, a fact that makes it difficult to present the necessary managerial information. Still for the authors, another factor that hinders its elaboration process is the diversity of users.

Albuquerque (2004) observed that a large part of management decisions are made based on the experience and guess of the managers, and not on a detailed analysis of the financial and market information. Thus, it would be up to the accountant to establish an approach, participate and learn more about the daily business of his clients, demonstrating with conviction the relevance of accounting for quality business management.

In this context, further studies on the topic are justified, since it becomes clear the need for an accounting support that can help managers to make their decisions based on the reality of their business. In a way, micro and small companies are poorly studied, as well as their process of generating and using information for decision making, the importance given to Accounting and the way they are managed.

3. METHODOLOGY

As for the methodology, the present study is characterized as a descriptive research for seeking to describe and present a vision of the use of Accounting to support managerial decisions in micro-enterprises in the city of Rondon do Pará.

Regarding the approach to the problem, it is identified by a quantitative character, as it addresses the opinion of micro and small entrepreneurs regarding the importance of accounting information and the degree of its use in their daily processes, through questions that evaluate, in general, the profile and their perception of the management benefits that can be obtained with the use of accounting information to support decisions.

With regard to procedures, the present study is characterized by field research, which aims to describe phenomena, profiles or characteristics of a group of individuals, which in this case is the micro business sector in Rondon do Pará / PA.

The study population in question is the micro business sector in the city of Rondon do Pará. As for the data analysis procedures, the questionnaires will be tabulated in Excel software, showing through descriptive statistics.

3.1 SAMPLE DELIMITATION

The scope of the study is the micro-enterprises operating in commerce in the city of Rondon do Pará, located in the southeast of the state of Pará. At first, information was obtained regarding the number of micro-companies existing in the city from the Chamber of Business Managers of Rondon do Pará ( CDL), which indicated that there are about 181 microenterprises in the city, so a random sample of 20 companies was chosen.

3.2 DATA COLLECTION

Regarding data collection, a field research was carried out through a questionnaire composed of 8 open and closed questions, applied personally in each company. In addition to information passed directly by the managers who were willing to discuss more about the research theme, thus helping with more clarity in the analysis.

4. ANALYSIS OF RESULTS

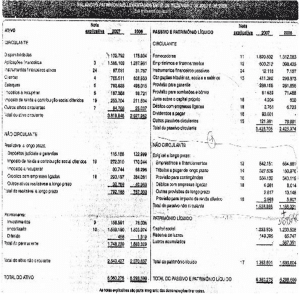

The sample was composed of companies classified as micro-companies based on the information provided by the CDL in the city of Rondon do Pará / PA, the data in Table 1 shows the time of activity of the companies in the sample, showing the frequency in relation to the 20 companies interviewed. .

Table 1 – Time of operation of the company

| Time | Frequency | % |

| From 1 to 3 years old | 3 | 15 |

| From 4 to 6 years | 1 | 5 |

| From 7 to 9 years | 3 | 15 |

| 10 years or more | 13 | 65 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

It is observed that there are 13 enterprises with 10 years or more of experience in commerce, indicating a frequency of 65% in relation to the sample, thus demonstrating a considerable percentage of companies that managed to establish themselves in the market.

A reasonable number of new ventures between 1 and 3 years is also perceived, representing 15% of the research sample when compared to the research carried out by Boas and Morais (2014) in Tangará da Serra-MT who observed a percentage of 22.5 % of establishments between 1 to 3 years.

With regard to the reports provided by Accounting, a multiple choice question was asked, with the possibility of checking more than one alternative, in order to analyze which reports are being offered by accounting and after analyzing the questionnaires, the following results were obtained according to data in Table 2.

Table 2 – Reports received from accounting – Year 2019.

| Report | Frequency | % |

| Balance Sheet, Balance Sheets, Cash Flow, Income Statement | 8 | 40 |

| Tax and Labor Reports | 15 | 75 |

| Goods Incoming / Outgoing, Revenue and Payments Reports | 10 | 50 |

| Information passed directly from the accountant | 5 | 25 |

| Others | 5 | 25 |

Source: Prepared by the authors (2020).

It should be noted that the tax and labor reports are the most provided by accounting with a percentage of 75%, followed by the entry / exit of goods, sales and accounts payable reports with around 50% and finally 40% of the interviewees stated receive cash flow statement, balance sheet, balance sheets and income statement.

The percentages are significant if we take into account the studies carried out by Boas and Morais (2014) that found that 24% of managers received the balance sheet, 19% the cash flow statement and 10% the balance sheet.

Asked about the relevance of accounting information in the company’s management process, 90% of respondents attributed it as important for making economic-financial decisions, as shown in Table 3.

Table 3 – Importance of accounting reports for business management

| Alternatives | Frequency | % |

| Yes | 18 | 90 |

| No | 2 | 10 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

This corroborates with the study carried out by Freitas (2017) in Sant’Ana do Livramento, revealing that most managers consider accounting reports to be fundamental for the management decision-making process.

When assessing which resources are used most frequently related to management issues, the following results were found according to Table 4. For this purpose, a multiple choice question was asked with the possibility of marking more than one option.

Table 4 – Resources are used more frequently for decision making

| Resources | Frequency | % |

| Market research | 12 | 60 |

| Excel Spreadsheets | 6 | 30 |

| Database | 4 | 20 |

| Internet | 5 | 25 |

| Accounting Reports | 3 | 15 |

| Experience | 14 | 70 |

| Intuition | 4 | 20 |

Source: Prepared by the authors (2020).

The research points out that 70% of managers make decisions based only on their experience to manage the business, then the market research is indicated with 60% as the most used in management, which states the study by Moreira et al. (2013) in which they surveyed 146 companies in the city of Teófilo Otoni-MG, and observed the same results in which a large percentage of respondents manage their businesses based on their experience and market research as the main resources to deal with everyday situations .

Thus, it appears that the managers do not understand the financial statements in the best possible way, since despite considering them important for business management, they do not use them frequently in the management of the enterprise (KOS et al., 2014).

Only 15% of managers periodically use accounting reports as a subsidy for decision-making, a worrying frequency when compared to the research carried out by Boas and Morais (2014) who observed that 76% of entrepreneurs use accounting statements to support management issues .

In contrast, the data corroborate the research by Rebouças et al. (2017) conducted in the city of Mossoró-RN, in which 17% of the interviewees stated that they use accounting reports with regard to business management.

Regarding the interviewees’ perception about which area the accounting information has greater representativeness and prominence, an open question was asked, thus giving the interviewee more autonomy to reflect on the question, the following results were verified, as shown in Table 5.

Table 5 – Area where accounting information is most useful

| Area | Frequency | % |

| Tax and Labor | 16 | 80 |

| Management control | 3 | 15 |

| General Reporting | 1 | 5 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

It appears that 80% of managers declared the tax and labor sector as the area in which accounting information has greater relevance, than according to Moreira et al. (2013) this occurs due to a lack of understanding on the part of managers of the potential management support that accounting can have.

It appears that 15% agree that the financial statements are more useful in making decisions and issues associated with management, contrary to the research carried out by Boas and Morais (2014) in which 87% claimed that accounting information is important for administrative management . Finally, 5% consider accounting information crucial in all sectors of the institution.

About continuing the contract with your accountant if the collection of taxes and social contributions was simplified so that the accountant’s assistance was not necessary to calculate them, as shown in Table 6.

Table 6 – Willingness to maintain with accounting services

| Alternatives | Frequency | % |

| Yes | 12 | 60 |

| No | 8 | 40 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

The survey proves that 60% of the interviewees would remain with the service contract with the accountant and 40% would not maintain the services if they simplified the collection of taxes and contributions, indicating that some entrepreneurs see the figure of the accountant as the professional in charge of fulfilling their obligations. of a legislative nature.

Then it was asked if the managers would be willing to overpay the accountant if he offered reports in order to improve the company’s performance, following data according to Table 7.

Table 7 – Availability to hire an accounting adviser

| Alternatives | Frequency | % |

| Yes | 14 | 70 |

| No | 8 | 30 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

Many managers stated that they would be willing to overpay if the accountant provided reports that would bring benefits to management, totaling 70% of respondents, an expressive amount, demonstrating that many entrepreneurs are interested in a service beyond the traditional on the part of the accounting offices, and about a third said they would not overpay the professional for these services.

Proving the study by Brandão and Buesa (2013) in the city of Vargem Grande Paulista that found that 70% of the respondents fully agree that consulting is a fundamental tool in business management and that consulting with traditional services facilitates the company’s performance.

Finally, when asked which professional would hire to measure the company’s performance and manage it, an open question was asked, giving more answers to the interviewees, results were obtained as shown in Table 8.

Table 8 – Professional that the company would hire to evaluate and control its performance

| Professional | Frequency | % |

| Administrator | 10 | 50 |

| Economist | 3 | 15 |

| Counter | 3 | 15 |

| Employee | 1 | 5 |

| Didn’t Know | 3 | 15 |

| Total | 20 | 100 |

Source: Prepared by the authors (2020).

It can be observed that in the interviewees’ conception, 50% indicate that an administrator for such a function would be the most suitable, and only 15% would assign this function to an accountant, thus, according to Moreira et al. (2013), the accounting professional is not known as a professional who produces useful information for business management, that is, the perception that one has about the accounting professional is mainly related to services that aim to fulfill the needs of the tax authorities.

5. FINAL CONSIDERATIONS

The study sought to analyze how entrepreneurs and managers of micro companies in the city of Rondon do Pará / PÁ are using accounting information for decision making and the importance attributed to these statements.

As for the general objective, it is possible to verify the interviewees’ understanding regarding accounting and accounting reports and that some of these managers use certain statements for business control, he also found out which reports are delivered by the accountant with greater consistency.

It appears that the accounting offices do not offer support beyond conventional service, which could be a differential, given the considerable percentage of managers based on their knowledge, being a doubtful source to guarantee continuity in the market.

Another interesting point was that some interviewees were unable to answer which professional they would hire to assess the company’s development, revealing the lack of assistance to these entrepreneurs.

Thus, it is evident that accounting offices in addition to traditional services need to provide customers with an advisory service, seeking to meet this specific need.

Regarding the limitations, the survey covered only micro-enterprises in the retail trade of Rondon do Pará / PA, excluding the other segments, there was also a lot of difficulty with regard to data collection, the questionnaires were applied personally for the purpose of better filling and even so there were difficult occasions with resistance on the part of the interviewees, however it was possible to finish the research efficiently. For future studies it is advisable to cover the range of segments for the purpose of comparison between sectors and business size.

REFERENCES

ALBUQUERQUE, A. F. Gestão estratégica das informações internas na pequena empresa: estudo comparativo de casos em empresas do setor de serviços hoteleiro da região de Brotas. 2004.

ATKINSON, Anthony A. et al. Contabilidade gerencial. São Paulo: Atlas, 2000.

BATY, G. B. Pequenas e médias empresas dos anos 90: Guia do Consultor e do Empreendedor. São Paulo: Makron Books do Brasil, 1994.

BEUREN, I. M. Gerenciamento da informação: um recurso estratégico no processo de gestão empresarial. 2.ed. São Paulo: Atlas, 2000.

BOAS, R. G. V.; MORAIS, M. Í. Informação contábil nas micro e pequenas empresas: uma pesquisa de campo na cidade de Tangará da Serra- MT.2014. Disponível em:<http://periodicos.unemat.br/index.php/ruc/article/view/283>. Acesso em 29 de Novembro de 2019.

BRANDÃO, E. A. C.; BUESA, N. Y. O Papel do Escritório Contábil Consultoria versus Serviços Tradicionais Estudo de caso em Empresas de Vargem Grande Paulista. Revista Eletrônica Gestão e Negócios – Volume 4 – nº 1, 2013.

CARVALHO, A. M. R.; NAKAGAWA, M. Informações contábeis: um olhar fenomenológico. In: Congresso Brasileiro de Contabilidade, 17. 2004, Santos. Resumos… Brasília: Conselho Federal de Contabilidade, 2004.

COMITÊ DE PRONUCIAMENTO CONTÁBIL (CPC 00(R1)). Estrutura Conceitual para Elaboração e Divulgação de Relatório Contábil-Financeiro. PRONUNCIAMENTO CONCEITUAL BÁSICO (R1), 2011.

FLIPPO, E. B.; MUSINGER, G. M. Management. 5. ed. Boston: Allyn & Bacon, 1970. HORNGREN, C. T.; SUNDEM, G. L; STRATTON, W. O. Contabilidade Gerencial. 12. ed. São Paulo, Prentice Hall, 2006.

FREITAS M. B. Informações Contábeis e Financeiras em Microempresas: A Visão de Gestores da Indústria de Confecção em Sant’Ana do Livramento. 2017. Disponível em<http://dspace.unipampa.edu.br/bitstream/riu/2081/1/Matheus%20Brasil%20Freitas.pdf>. Acesso em 29 de Novembro de 2019.

KOS. S. R. et al. Compreensão e utilização da informação contábil pelos micro e pequenos empreendedores em seu processo de gestão. Revista Universidade Estadual Maranhão. vol. 11, n. 13, 2013, p. 113-149 2014. Disponível em:<http:///periodicos.uem.br/ojs/index.php/Enfoque/article/download/21069/14032>. Acesso em: 08 de Dezembro de 2018.

LIMA, M. R. S. et al. Uma contribuição a importância do fluxo de informações contábeis no processo decisório das micro e pequenas empresas: uma pesquisa realizada na cidade de recife no estado de Pernambuco. In: Conferencia Internacional de Empreendedorismo Latino Americana. 2004

MARION, J. C. Contabilidade empresarial. 3.ed. São Paulo: Atlas, 1988.

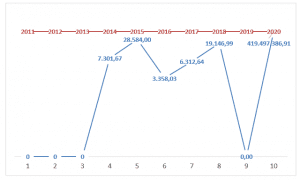

MARZZONI, David Nogueira Silva; SOUZA, Eliana Maria de. Analysis of the financial statements: A comparison of Odebrecht before and after the Lava Jato Operation. Research, Society and Development, Itabira, v. 9, n. 7, p. e64973874, apr. 2020. ISSN 2525-3409. Available at: <https://rsd.unifei.edu.br/index.php/rsd/article/view/3874>. Date accessed: 21 may 2020. doi:http://dx.doi.org/10.33448/rsd-v9i7.3874.

MOREIRA, Rafael de Lacerda et al. A importância da informação contábil no processo de tomada de decisão nas micro e pequenas empresas. Revista Contemporânea em Contabilidade, vol. 10, n. 19, 2013, p. 119-140. Disponível em:<http://www.redalyc.org/articulo.oa?id=76226206007>. Acesso em 16 de jan. de 2020.

OLIVEIRA, A. G.; MÜLLER, A. N.; NAKAMURA, W. T. A utilização das informações geradas pelo sistema de informação contábil como subsídio aos processos administrativos nas pequenas empresas. 2000.

PAULO, E. Comparação da estrutura conceitual da contabilidade financeira. 2002. Dissertação (Mestrado) – Convênio Universidade de Brasília/Universidade Federal da Paraíba/Universidade Federal de Pernambuco/Universidade Federal do Rio Grande do Norte. João Pessoa, Paraíba, Brasil.

PORTAL SEBRAE. Micro e pequenas empresas geram 27% do PIB do Brasil. 2014 Disponível em <http://www.sebrae.com.br/sites/PortalSebrae/ufs/mt/noticias/micro- epequenas-empresas-geram-27-do-pib- dobrasil,ad0fc70646467410VgnVCM2000003c74010aRCRD>. Acesso em 27 de Jan de 2019.

REBOUÇAS, L. S. et al. Utilização da informação contábil no processo de gestão dos micro e pequenos empreendedores da cidade de Mossoró-RN. CONTABILOMETRIA Brazilian Journal of Quantitative Methods Applied to Accounting, 2018.

SANTOS, E. S. Objetividade x relevância: o que o modelo contábil deseja espelhar. Caderno de Estudos Fipecafi, São Paulo, Fipecafi, v.10, n.18, p.1-16, maio/ jun./jul./ago. 1998.

SIMON, H. A. Comportamento administrativo. 2.ed. Rio de Janeiro: FGV, 1970.

STROEHER. A. M. Identificação das características das informações contábeis e a sua utilização para tomada de decisão organizacional de pequenas empresas. Ed. Saraiva 2005.

STROEHER, A. M.; FREITAS, H. Identificação das necessidades de informações contábeis de pequenas empresas para a tomada de decisão organizacional. In: III Congresso Internacional de Gestão da Tecnologia e Sistemas de Informação – CONTECSI, 3. São Paulo, 2006.

[1] Ongoing master’s degree in Public Administration. Specialist in Public and Tax Management. Graduated in Accounting Sciences. Graduated in Administration.

[2] Graduating in Law.

[3] Bachelor of Science in Accounting.

Submitted: May, 2020.

Approved: March, 2021.