REVIEW ARTICLE

OJEDA, Nataly Luiza Nantes [1]

OJEDA, Nataly Luiza Nantes. Tax havens: Positive and negative aspects. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 05, Ed. 12, Vol. 03, pp. 69-80. December 2020. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/accounting/tax-havens

SUMMARY

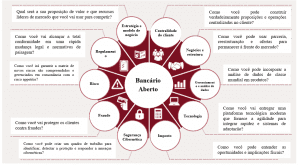

This article aims to unveil the Tax Havens and their increasing use, it is known that the operation has caused a drop in tax collection and, consequently, the blockade of the countries’ economic development. The objectives revolve around the analysis of positive and negative aspects, considering that there are those who take advantage of the benefits offered by tax havens, as well as those that are harmed by this practice, covering their concepts, users, going through a brief explanation of the capital flows in the world, the consequences of the increase in this type of transaction for the states. The methodology has a qualitative approach through exploratory research of a descriptive bibliographic nature in order to demonstrate the problems arising from the use of tax havens by individuals and legal entities. Much has been done to avoid the negative consequences of the use of tax havens through BEPS in conjunction with the ICRICT which formulate guidelines to be implemented to reduce erosion of the tax bases of the states, the negative aspects are characterized by the loss of state power to the promotion and continuity of basic services and the perishing of investments in public policies that combat social problems, such as hunger, unemployment, crime, health, education, among others. On the other hand, the term “tax haven” despite being commonly seen with a certain aversion by the media, society in general and countries, in a viewpoint there are positive aspects because its use is an operational tool of financial and commercial tax planning, the increase in profits it can create new business opportunities, and these businesses can generate more jobs and income for the poorest.

Keywords: tax havens, tax evasion, tax avoidance, BEPS, ICRICT.

1. INTRODUCTION

Tax havens are historically and mainly associated through television media, illicit capital, where it would be possible to hide financial resources from illegalities, but can also be used by billionaires and transnational companies to circumvent taxes and increase their fortunes in a perfectly lawful way.

Currently there are no effective ways to prevent individuals and legal entities from transfer profits to low-tax countries, since the international taxation system, which has been the same since the 1920s, is that 100 years ago the world has used the same regulatory standards.

In order to avoid the massive weakening in the collection of the states, the OECD and the G20 created a program that became known as BEPS (Base, Erosion, Profit, Shifting), allied to BEPS, there is also a group of experts that organized to monitor the debate on the international taxation and propose alternatives to the OECD model.

Having said that, this article aims to problematize the positive and negative aspects of the use of tax havens.

2. THEORETICAL REFERENCE

2.1 WHAT IS TAX HAVEN?

Tax havens are commercial areas free from tax collection or with rates close to zero on financial transactions, characterized by the absence of taxation, guarantees of bank secrecy and identity of investors, which makes them a perfect hiding place for individuals and legal entities wishing to omit their profits.

Such characteristics mean that countries that provide them have been historically associated, especially in television media, with illicit capital, where it would be possible to hide financial resources from crimes such as corruption and trafficking in drugs and people, without any questions, as taught (DE SÁ, 2016) “Tax havens are seen as an incentive for illicit activities, and in the study in particular , seen as an instrument for corrupt activities.”

In this regard, says the author “Tax havens are generally viewed with prejudice by people and even by the governments of some countries, including Brazil …” (DE MELLO, 2014), on the prejudice that surrounds the theme, there are those who enjoy the benefits offered by tax havens, as well as those who are harmed by this conduct, so say the authors (REIS and LOEBENS, 2019) “The biggest harmed are the States that lose the wealth generated in territories and lose their tax collection, and consequently it is also harmed the vast majority of the population of these States …” regarding the drop in revenue and, consequently, the blocking of the economic development of countries.

Given the definitions and their different aspects it is up to the search for identification of users, the financial transactions carried out in tax havens are made by individuals and legal entities “…Tax havens allow individuals and firms to hide information about their activities…” our griffin (SNF and GFI et al., 2015), represented by billionaires and transnational companies to circumvent taxes and increase their fortunes.

2.2 UNSELLING THE FLOW OF CAPITAL IN THE WORLD

As much as countries around the world have their own tax collection systems, there are international rules regulating the movement of money between countries, the problem is these such international standards have entered into force for about a century in markets much less globalized than those today, because of this there is a certain gap that has led to gaps and gaps in the rules governing capital transit , that is, money around the world.

Such loopholes in the legislation allow transnational and multimillion-dollar companies (individuals and corporations) to use tax or illegal maneuvers to hide gains and evade payment of taxes, and one of the main mechanisms for this is possible, is the existence and use of tax havens, given this scenario, international authorities are increasingly pressured to create a new international system of taxation , which is the same since the 1920s, so narrates (PRZEPIORKA, 2018) “… from the 1920s, it can be affirmed that the international taxation model developed from the works of Bruins, Stamp, Seligman and Eunadi…” was consolidated.

Currently there are no effective ways to prevent individuals and legal entities from transferprofits to low-tax countries, concludes the author (PRZEPIORKA, 2018) “Traditional connecting elements crystallized in the international legal system since the beginning of the 20th century no longer lend themselves to guiding international tax policies in the globalized environment.” Considering that over these 100 years, multinational companies have developed unprecedented expertise to make international fiscal pressure minimal, and continue in their maneuver to multiply their gains, the author DALMOLIN describes appalling data for measuring values:

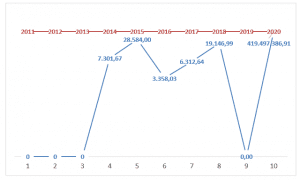

Recently, the Central Bank of Brazil (2018) released the census of Brazilian capital abroad. These data revealed that 60,301 people (55,757 individuals and 4,544 legal entities) have nearly one trillion dollars invested abroad (approximately 25% of GDP). (DALMOLIN, 2018).

In this context, the OCDE and G20 created a program that became known as BEPS (Base, Erosion, Profit, Shifting) MÉLO and PIMENTEL as described as:

Driven by the economic crisis of 2008, from which many developed countries have not yet fully recovered, the Organization for Economic Cooperation and Development (OCDE), together with the Group of 20 (G-20), launched in 2013 an Action Plan aimed at curbing the diversion of profits and erosion of tax bases, a program that came to be known as Base Erosion and Profit Shifting (BEPS). (MÉLO and PIMENTEL, 2016).

Translation means “… erosion of the base and profit transfer.” (NUNES, HALIK et al. 2017), its purpose is to combat capital flight and resume the collection capacity of countries.

2.3 BEPS AND ICRICT

In general terms, through BEPS, measures have been created that improve technical and administrative aspects, and above all increase the transparency of companies in the publication of their financial statements.

But even though the initiative was widely celebrated as a first step towards combating evasion, the answers still go away from concrete resolutions to the problem, it was from this observation that a group of fifteen experts organized to monitor the debate on international taxation and propose alternatives to the OCDE model, the association became known as ICRICT.

ICRICT is the Independent Commission for The Reform of International Corporate Taxation that aims to promote the debate on tax reform in societies at the international level through a discussion that is the widest and inclusive possible of international tax standards; consider reforms from the perspective of the global public interest rather than the national one; and seek fair, effective and sustainable tax solutions for development. Author’s Griffin (IJF, 2016).

The ICRICT committee brings together several experts as an example winner of the Nobel Prize in economics and former head of the world bank Joseph Stiglitz and the French economist and writer Thomas Piketty, this group proposes, for example, that the standards proposed by the BEPS, should be discussed and analyzed at the United Nations (UN) as a way of democratizing the debate on the subject in question.

This is due to the limited number of countries that developed the program ended up generating a subrepresentation of the interests of the poorest nations, for example, one of the clearest advances proposed in beps is the creation of legislation that forces multinational companies to disclose their financial statements country by country:

The Country-to-Country Declaration, established in Brazil through IN 1.681/16, is the result of international cooperation tied to the actions proposed under the BEPS Project (Base Erosion and Profit Shifting), coordinated jointly by the G-20 member countries and the OECD (Organization for Economic Cooperation and Development). (GO FURTHER, 2017).

The measure would simplify the supervision of possible tax maneuvers carried out by companies, i.e. greater transparency:

… using the existing discussion on tax cooperation and transparency practices that would allow the obtaining of relevant information that can increase the effectiveness of inspection activities, try to increase the limits imposed on tax avoidance. (BARRETO and TAKANO, 2016).

However, the proposal was eventually mitigated by two other clauses, the first establishes that only the country of origin of the multinational, will have access to accounting reports, without obligation to share the information with other countries, the second determines that only companies with annual profits greater than 750 million euros are required to disclose such data, let’s see :

Art. 4º The country-to-country entities resident in Brazil whose total consolidated revenue of the multinational group in the fiscal year prior to the fiscal year of the declaration, as reflected in the consolidated financial statements of the final controller, is less than:

I – R$ 2,260,000,000.00 (two billion, two hundred and sixty million reais), if the final controller is resident in Brazil for tax purposes; Or

II – € 750,000,000.00 (seven hundred and fifty million euros), or the equivalent converted by the quotation of January 31, 2015 to the local currency of the jurisdiction of residence for tax purposes of the final controller. (IN 1681/2016).

In practice this limits the supervisory power of the poorest countries and excludes about 90% of multinationals from the list of BEPS obligations.

On the other hand, the ICRICT argues that the real increase in transparency should extend this obligation to all companies that have resources in tax havens, and make the data accessible to all states, without any limitations, so describes “… require publication of country-by-country reports for all companies benefiting from state support.” (IJF, 2020).

The ICRICT also makes other proposals that seek to correct distortions in the rules of international taxation, but as it has gained greater centrality in the program it is in the creation of a new model of taxation of multinationals.

The use of tax havens has already been identified in companies such as Google, Starbucks and Amazon:

Amazon’s UK division, for example, recorded sales of more than $8 billion last fiscal year, but paid $18.1 million in taxes.

Google, in turn, achieved revenues of $5.5 billion in 2013, the year it paid $17.6 million in taxes.

But one of the most questioned companies was Starbucks, which in 2012 reported sales of more than $600 million but paid zero corporate taxes. Our Griffin (BBC, 2015)

Such companies move large amounts of money by performing tax maneuvers that circumvent the payment of taxes, and consequently inflate their earnings in tax havens.

To circumvent this framework, the document prepared by ICRICT proposes a seemingly simple resolution, but with great prospects for transformation: recognizing multinationals as unique entities, this change would put an end to this type of practice, no matter if the company has front business esplanade in tax havens, since the company’s profits would be calculated globally.

The Commission aims to promote the reform debate through a broader and more comprehensive discussion of international tax rules than is possible in any other existing forum; consider reforms from a global public interest perspective and not from a national advantage; and seek fair, effective and sustainable tax solutions for development. (IJF, 2020).

Based on this, the idea of economists is to determine what value will be taxed, based on material parameters, such as: sales, number of employees or production plants, and finally the project proposes the creation of a proportional division of taxes collected, the regions that concentrate more activities receive more and the regions that concentrate less activities receive less.

3. METHODOLOGY

The methodology presented has a qualitative approach since the method adopted was through exploratory research of descriptive bibliographic nature in order to demonstrate the problems arising from the use of tax havens by individuals and legal entities.

The bibliographic research was carried out in a synthesized way where articles, periodicals, theses and dissertations were selected that addressed concepts about tax havens contained in electronic databases.

The searches were carried out on Google Scholar and Scientific Electronic Library Online (SciELO), the descriptors used on these bases, in Portuguese, were: “tax havens”, “tax evasion”, “tax avoidance”, “BEPS”, “ICRICT”. The period of publication of the studies was from 2012 to November 2020.

In addition, the collection was carried out in theoretical bases of the academic-scientific literature (books, journals and reports) focused on the theme proposed.

4. DISCUSSIONS ON THE POSITIVE AND NEGATIVE ASPECTS TO THE USE OF TAX HAVENS

Currently in an unprecedented way in our history, 2,153 people hold more wealth than 4.6 billion people, according to data from (OXFAM, 2020), there is no doubt that projects such as BEPS deserve merit for pioneering the focus on fighting tax havens and identifying this problem as one of the main obstacles to reducing social inequalities, but it is agreed in the international community that the urgency for resolving these conflicts requires more incisive policies that strengthen the state collection power and help the process of wealth distribution, without this, the trend is that the coming years maintain the pattern of concentration of income, seen in recent decades, the population pays the accounts of the recession as a powerful minority, surfs on tax benefits, fleeing taxes and omitting their earnings.

On the other hand, the term “tax haven” is commonly seen with a certain aversion by the media, society in general and countries, which often try to maintain strict controls and repression of individuals and legal entities that use these places to carry out investments and market operations, when in fact the term, can be, in a broader perspective, just an operational tool of tax planning , as described (RAMOS, 2019) “Fiscal Haven, in the meaning of the term, does not mean and does not refer us to criminal practice. They also serve as “conduits” in international financial operations and in the assembly of tax planning.”, after all the amounts applied in tax havens are not in their entirety derived from illicit activities and combating their use can represent losses to the progress and expansion of the globalized market, as well as tax, financial and commercial planning:

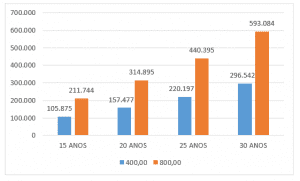

It is worth remembering that, by tax planning, it is understood that set of legal systems that aim to reduce the payment of taxes; thus, any taxpayer has the right to structure his business in the manner that seems most opportune, seeking to reduce costs, including taxes levied on income in his business. If this person or company does this lawfully, the authorities must respect it and cannot be thought of forcing people to pay as much tax as possible to their respective Governments. Moreover, it is known that, with the globalization of the economy, the correct administration of the tax burden has become a matter of survival, with the aim of legally minimizing it. (DE MELLO, 2014).

In other words, the author maintains much of the market and financial transactions carried out in tax havens is permitted by law.

5. FINAL CONSIDERATIONS

The major problem of the outflow of resources from countries with high tax burdens destined to tax havens, is erosion of the tax bases of the states, which can cause loss of state power for the promotion and continuity of basic services and the perishing of investments in public policies that combat social problems, such as hunger, unemployment, crime, health, education, among others.

The difficulty of identifying the route of money and the lack of transparency of companies are major impasses for combating and supervising the use of tax havens, on the other hand, tax haven is not synonymous with illegality, and any citizen or entrepreneur can come to invest in lawfully their assets or their financial assets in other countries usually where their profits can reach new business opportunities , and these businesses can generate more jobs and income for the poorest.

As for Brazil, it should also be highlighted that it is necessary to formulate policies aimed at maintaining financial resources without this importing in offense the Magna Carta (BRASIL, 1988), which clearly allows in its Article 5, XV, the freedom of locomotion in the national territory, enter, remain and leave with their assets, therefore, however much the Tax Office and society in general are harmed with this maneuver there can be no prohibition or limitation in relation to the outflow of resources and financial assets from the national territory, as they constitute a tax planning strategy covered with legality.

6. BIBLIOGRAPHICAL REFERENCES

BARRETO, Paulo Ayres, TAKANO, Caio Augusto. Os desafios do planejamento tributário internacional na era pós-BEPS. In XIII Congresso – 50 anos do código tributário nacional, IBET, 2016. Disponível em https://www.ibet.com.br/wp-content/uploads/2017/09/BEPS.pdf. Acesso em 15 nov. 2020.

BRASIL. Dispõe sobre a obrigatoriedade de prestação das informações da Declaração País-a-País. Instrução Normativa RFB Nº 1681, DE 28 DE DEZEMBRO DE 2016. Disponível em:

http://normas.receita.fazenda.gov.br/sijut2consulta/link.action?idAto=79444. Acesso em 20 nov. 2020.

BRASIL. Constituição (1988). Constituição da República Federativa do Brasil. Disponível em http://www.planalto.gov.br/ccivil_03/constituicao/constituicao.htm. Acesso em 20 nov. 2020.

BBC, World. As pessoas que “deixaram” o País de Gales para evitar o pagamento de impostos no Reino Unido. Notícia de 12 de novembro de 2015. Disponível em https://www.bbc.com/mundo/noticias/2015/11/151112_economia_crickhowell_pueblo_gales_paraiso_fiscal_ch. Acesso em 20 nov. 2020.

DALMOLIN, Luís Carlos. A exploração tributária intermediada pelo estado: dos

mecanismos tributários anestesiantes à fictio juris, Dissertação (Mestrado), Junho de 2016, Disponível em https://lume.ufrgs.br/handle/10183/187387. Acesso em 13 nov. 2020.

DE MELLO, Antônio C. T, Paraísos Fiscais e Estratégias Empresariais: Ensaios sobre Investimentos Offshore. Novembro 2014, Edição do Kindle.

DE SÁ, Daniel Ferreira, Paraísos Fiscais, Corrupção e Crescimento Econômico, Dissertação (Mestrado) Faculdade de Economia do Porto – junho de 2016. Disponível em https://repositorio-aberto.up.pt/bitstream/10216/86744/2/158522.pdf. Acesso em 12 nov. 2020.

GO FURTHER. Declaração país – a país e ação 13 do BEPS no Brasil. In Boletim Informativo, 04 de julho de 2017. Disponível em http://www.gofurthergroup.com.br/declaracao-pais-pais-e-acao-13-do-beps-no-brasil/#:~:text=A%20Declara%C3%A7%C3%A3o%20Pa%C3%ADs%2Da%2DPa%C3%ADs,G%2D20%20e%20pela%20OCDE. Acesso em 14 nov. 2020.

IJF, Instituto Justiça Fiscal. Declaração da ICRICT, 20 de abril de 2016, Disponível em https://ijf.org.br/declaracao-da-icrict/. Acesso em 14 nov. 2020.

IJF, Instituto Justiça Fiscal. ICRICT demanda medidas tributárias internacionais para uma recuperação econômica sustentável, 16 de junho de 2020, Disponível em https://ijf.org.br/icrict-demanda-medidas-tributarias-internacionais-para-uma-recuperacao-economica-sustentavel/. Acesso em 20 nov. 2020.

MÉLO, Luciana Grassano de Gouvêa, PIMENTEL, João Otávio Martins. O plano de ação beps e as mudanças de paradigmas na tributação, Revista Acadêmica Faculdade de Direito do Recife, Volume 88, número 2, julho/dezembro de 2016. Disponível em https://www.periodicos.ufpe.br. Acesso em 10 nov. 2020.

NUNES, André, HALIK, Aline Roberta et al. A redução da evasão fiscal com a adoção do BEPS – Base Erosion and Profit Shifting, dezembro de 2016, Revista Espacios Volume 38, nº 23 Ano 2017, Página 6. Disponível em:

https://www.revistaespacios.com/a17v38n23/a17v38n23p06.pdf. Acesso em 18 nov. 2020.

PRZEPIORKA, Michell. Possibilidade de tributação em bases territoriais no sistema jurídico brasileiro – ofensa ao princípio da universalidade? – Revista Direito Tributário Internacional Atual, n. 4 (2018), Disponível em: https://www.ibdt.org.br/RDTIA/n-4-2018/possibilidade-de-tributacao-em-bases-territoriais-no-sistema-juridico-brasileiro-ofensa-ao-principio-da-universalidade/. Acesso em 16 nov. 2020.

RAMOS, Samuel Ebel Braga. A lavagem de dinheiro por meio de paraísos fiscais como crime transnacional: a cooperação internacional na recuperação de ativos. Revista Jurídica da Escola Superior de Advocacia da OAB-PR Ano 4 – Número 2 – Outubro de 2019. Disponível em http://revistajuridica.esa.oabpr.org.br/wp-content/uploads/2019/10/revista-esa-10-cap-06.pdf. Acesso em 20 nov. 2020.

REIS, Arthur Harder, LOEBENS, João Carlos. A omissão das nomenclaturas tributárias: um breve estudo sobre os “paraísos fiscais. 2019. Disponível em:

https://ijf.org.br/a-omissao-das-nomenclaturas-tributarias-um-breve-estudo-sobre-os-paraisos-fiscais/. Acesso em: 12 nov. 2020.

SNF e GFI, Centro de Pesquisa Aplicada-Escola de Economia da Noruega; Global Financial Integrity et al. Fluxos Financeiros e Paraísos Fiscais: Uma Combinação para Limitar a Vida de Bilhões de Pessoas, dezembro de 2015, Disponível em:

https://www.globaltaxjustice.org/sites/default/files/FluxoFinanceiroFINAL.pdf. Acesso em 17 nov. 2020.

OXFAM. Bilionários do mundo têm mais riqueza do que 60% da população mundial. Documento Informativo da Oxfam Brasil, 19 de janeiro de 2020. Disponível em: https://www.oxfam.org.br/noticias/bilionarios-do-mundo-tem-mais-riqueza-do-que-60-da-populacao-mundial/. Acesso em 21 nov. 2020

[1] Graduated in Accounting Sciences (2011) and Law (2018), with specialization in Public Management area of concentration in Public Administration (2019).

Submitted: November, 2020.

Approved: December, 2020.