REVIEW ARTICLE

CARVALHO, Alcemir da Silva [1], SILVA, Boanerges da Costa e [2], ENCARNAÇÃO, Alex Lopes da [3], FILHO, Daniel Lima da Silva [4]

CARVALHO, Alcemir da Silva. Et al. Supply of Funds and the Responsibility of the Expense Payer. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 05, Ed. 04, Vol. 03, pp. 27-38. April 2020. ISSN: 2448-0959, Access link in: https://www.nucleodoconhecimento.com.br/accounting/funding-supply

SUMMARY

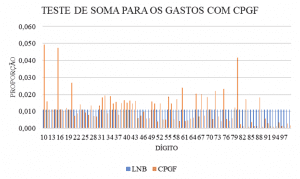

Compliance with all procedures and, as well as compliance with the various legal provisions existing in the Brazilian Legislation are important for the control and execution of the supply of funds within the government, avoiding future restrictions and even penalties by internal audits, Comptroller General of the Union – CGU and Federal Court of Auditors. The objective of this article is to demonstrate these usual procedures used in the Federal Public Administration, which are responsible for the use, use and expenses arising from the supply of funds, how to properly proceed an accountability, contributing to the realization of coherent and rational use of the Payment Card of the Federal Government – CPGF, which is an exceptional form of execution of expenses in the Organs and Entities of the Federal Executive Branch , and for this, a bibliographical research was carried out, through the reading of the legislation in force that deals with the subject, as well as the Manual of the Integrated System of Financial Administration of the Federal Government – SIAFI.

Keywords: supply of funds, expense payer, supplied, payment card of the federal government, proposal to grant the supply of funds.

1. INTRODUCTION

The Federal Public Agencies face every day situations that prevent fully from executing the budget authorized by the Annual Budget Law – LOA, either for lack of revenue collection, contingency of resources by the Federal Government or the fiscal crisis that plagues the country. Federal managers have to use all available tools to meet the increased expenses for the maintenance and administration of public sector administrative units, and the Federal Government Payment Card – CPGF is an option among those available authorized by current legislation, whose responsibility for authorization of use, control of use and approval of accountability falls both on the supplied and for the expense sums. (SECRETARIA DE TESOURO NACIONAL, 2018).

In this article we analyze all aspects related to the granting, use and accountability of the supply of funds, as well as the responsibilities related to the expense payer and the server for the use and use of this, in accordance with the legislation in force.

2. FEDERAL GOVERNMENT PAYMENT CARD – CPGF

The Payment Card of the Federal Government – CPGF is a means of payment that provides managers of public agencies more quickly, management and a current and modern way in the use of public resources, being issued in favor of the Management Unit, containing the name of the server that will carry, after authorization of the Expense Sorpert, and that is intended to cost expenses that can be framed as supply of funds.

The Organs of the Federal Public Administration shall incurred expenses with the Supply of Funds only under the following conditions, in accordance with items I to III of Art. 45 of Decree No. 93,872/1986:

I – to meet incidentals, including travel and special services, which require prompt payment;

II – when the expense is to be made on a confidential basis, as classified in regulation; And

III – to meet small expenses, thus understood those whose value, in each case, does not exceed the limit established in the Ministry of Finance’s Ordinance. (BRASIL, 1986).

The content contained in the articles exhausts the list of cases in which it is possible to provide funds, and other expenses must be submitted to the normal process. These conditions must be observed by the Expense Payer when authorizing the use by the indicated servers.

According to item 3 of the Manual Supply of Funds and Payment Card of the Comptroller General of the Union, the supply of funds is:

[…] advance granted to the server, at the discretion and under the responsibility of the Expense Payer, with a certain time limit for application and proof of expenses. It is a budget and financial execution authorization in a different way than normal, having as means of payment the Payment Card of the Federal Government, always preceded by commitment in the specific budget allocation and nature of own expenditure, in order to make expenses that, by their exceptionality, cannot be subordinated to the normal application process, not being possible the direct commitment to the supplier or provider, in the form of Law No. 4,320/64, preceded by bidding or its waiver, in accordance with Law No. 8,666/93. (CONTROLADORIA GERAL DA UNIÃO, 2015).

The Expense Payer has to keep in mind that the supply of funds applies only to expenses incurred on an exceptional basis, and therefore those that can be planned in advance, otherwise the bidding procedure or exemption from bidding must be obeyed, according to the evaluation of the goods or services to be purchased. This situation should be analyzed at the beginning of the request for the supply of funds, ruling out any incorrect use that is the subject of investigation by the Internal or External Control Bodies of the Federal Government.

Always the Expense Payer, after the act of granting the server for the use of the supply, shall publish in internal bulletin or other means, as well as electronic, and that is easily accessible by the general public, in compliance with the principle of advertising.

It is therefore up to the Expense Sorperator to authorize the granting of The Supply of Funds, in accordance with the request of the head of the Administrative Unit of the Agency, and may be granted to a public servant or occupant of a position in committee with effective exercise in the Agency, and to fulfill the conditions listed in item 25 of the manual Supply of Funds and Payment Card of the CGU , below transcribed:

(a) not be responsible for two supplies of funds in the implementation and/or accountability phase;

b) do not have in charge of the custody of the material to be acquired, unless there is no other server in the office that meets the conditions to receive the Supply of Funds;

c) not be responsible for The Supply of Funds that, after the deadline, is pending accountability;

d) have not been declared in scope, thus understood the one who has committed misappropriation, loss, deviation or lack verified in the accountability, of money or amounts entrusted to his custody;

e) has not had accountability of the application of supply of funds with expenses contested by the Expense Payer or that is in the process of Taking Special Accounts;

f) do not be confused with the person of the Expense Payer; And

g) is not the claimant of the purchase/contracting of service, except on a service trip. (CONTROLADORIA GERAL DA UNIÃO, 2015).

In addition to other obligations established in specific legal provisions and regulations, for the purposes of the use of the CPGF, as stated in Art. 3of Decree No. 5,355 of January 25, 2005, the Expense Payer shall be responsible for:

I. Set the usage limit and value for each cardholder;

II. Change the usage and value limit; And

III. Dispatch the order to make the limits available, electronically, with the banking establishment. (BRASIL, 2005).

The limits of the Management Units and Cost Centers are registered in the relationship agencies of Banco do Brasil, with express authorization signed by the Expense Orator, through a Letter, or, you can register carrier limits by the Public Sector Self-Service – AASP, made available by Banco do Brasil to the Management Units on the online website of this banking institution1.

The Manager of the Management Unit – UG, through the Application AASP, performs management of payment cards of the Federal Government – CPGF, with issuance of statements, change of limits of cardholders, issuance of invoices and second way, in addition to other services, made available for monitoring the use of CPGF within the administrative unit, and the limits established by art. 1of Ordinance No. 95/2002, of the Ministry of Finance, refer to any and all types of supply of funds and not only to those of small size, except for cases expressly authorized by the Minister of State or authority of equivalent hierarchical level, provided that the need in reasoned dispatch, as provided for in § 3 of art. 1st of that normative (BRASIL, 2002).

3. GRANT

The Organs/Entities of the Federal Administration need to have internal regulations, with clear guidelines and procedures, in addition to precise criteria for the permission of the use of the payment card by their servers, in addition to considering the specific singularities of each unit, creating methodologies, imposing limits and restrictions for the modality “withdrawals in kind”, in compliance with the provisions of art. 65 of Law No. 4,320/1964, as well as in art. 45 of Decree No. 93,872/1986, with the wording given by Decree No. 6,370/2008, and art. 4, § 2, of MPOG Ordinance No. 41/2005.

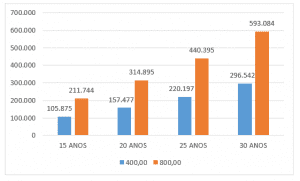

Under the Superintendence of the Manaus Free Trade Zone – Suframa 13 (thirteen) servers are authorized to use the supply of funds in the Payment Card Modality of the Federal Government – CPGF, having as an authorized annual limit for SUFRAMA the amount of R $ 70,000.00 (seventy thousand reais) for movement of this card with The Bank of Brazil, and these cards are exempt from membership fee , maintenance and annuity.

For the inclusion of new servers, the expense payer may increase the value of this limit, which will depend on budget and financial availability, or share the existing amount for use with the new fund supplies.

The procedures for registering, issuing cards and changing limits consist of forwarding the forms of registration of bearer / supplied and change of limits, duly completed, with the joining of copies of the documentation (RG, CPF and proof of address) of the new carriers, by means of a letter, to Banco do Brasil. After this procedure, Banco do Brasil will ask the server to register a password at the self-service terminals or in its branches, so that within 15 (fifteen) days, make and forward the Payment Card of the Federal Government – CPGF.

After this phase, with the CPGF in hand, the servers /supplied will forward the Proposal for Granting of Supply of Funds – PCSF to the Expense Sorperator, duly completed and signed, in which the specific field must be included in the amount necessary for the use of the supply of funds, highlighting the types of expenditure contemplated, which may be: 339030 – consumables, 339036 – individual and 339039 – third-party services, in addition to the detailed type of consumer material or service that will be purchased.

However, if the same management unit, in a given fiscal year, acquires consumer goods or services, through several purchases, through supply, for the same sub-element of expenditure, the sum of which exceeds the limits of items I or II of art. 24 of Law No. 8,666/1993, constitutes a fractionation of expenditure, a situation prohibited by the legislation mentioned, and the Expense Sorperator and the Federal Agency may answer proceedings before the Internal Audit, Comptroller General of the Union – CGU or Federal Court of Auditors – TCU. The realization of expenditures through the supply of funds directed to certain suppliers is an affront to the principle of impersonality, enshrined in art. 37 of the Federal Constitution.

The PCSF is authorized by the Expense Sorperator and forwarded to the budgetary and financial sector of the Agency for issuing commitment and settlement of expenses in the SIAFI system, in the natures of expenses and amounts requested. Then a memorandum is sent to the supplied, with terms of use of up to 90 (days), to start using the CPGF with the acquisition of consumer goods or services.

Monthly, the financial sector, responsible for the Expense Sororator to control the use of CPGF, will issue in the System Self-Service Public Sector – AASP the invoices / statements of the expenses incurred by the supplied, forwarding to the supplied to attest the services or consumer goods purchased in the period and, subsequently, returned to the Orderer of Expenses to authorize the payment of the invoice issued by the Bank of Brazil. This invoice can not be paid after the expiration, which is usually on the 10th of each month, because it will result in the collection by those who gave cause of the delay in the collection of the amount of the fine and interest of the card. The invoices forwarded by Banco do Brasil, Agência Setor Público, must be added to the corresponding accountability process, for the purpose of confrontation with the other documents that prove the expenses incurred in the period.

The attesting of the receipt of material or the provision of service must be carried out by a server other than the person supplied, in compliance with the Macrofunction SIAFI 02.11.21, item 11. With the advent of the Internal System And – SEI, the attestation of invoices are made through a specific form created within the system or the inclusion of the document in PDF duly certified.

When purchasing with the use of cpgf, to meet the principle of transparency, the supplied must make the inclusion of the details of the expenses of invoices in the SIASG system, therefore the payment card holder must have access profile SUPRIDO in said system to access the functionality, must log into the system by secure access SIASG in the System Comprasnet and click on the menu Government Services – Payment Card – Detail Purchase / Loot. This procedure must be monitored daily by the Expense Payer, or by the indicated, in order to comply with the legislation and to publicize the expenses incurred by ug during the term of the supply.

The Expense Sorperator is responsible for controlling and monitoring the application of the Fund Supply, through the CPGF, and can use the Transparency Portal2, the Public Sector Self-Service System – AASP and Invoices and Monthly Statements to verify the transactions carried out by authorized servers/supplies. If it is verified, through these control instruments, that there was some operation discrepant with the conditions established in the Proposal for granting the Grant of Funds authorized, the expense payer will request immediate justifications from the server, without the need to wait for the accountability. In fact, in the invoices and monthly statements, made available in the Public Sector Self-Service System – AASP, of inappropriate and unacceptable transactions, after conference and attest, should proceed as defined in paragraphs 1º, 2 and 3 of art. 8th of Mp Ordinance No. 41/2005:

§ 1 – In case of divergence between the data contained in the monthly account and the proof of sale, the Management Unit shall notify the Contractor to provide the clarifications or make the appropriate adjustments.

§ 2 – The Contractor shall record, at the time of notification, the occurrences that cannot be clarified at that time and shall inform the registration number that must be cited and attached to the payment process.

§ 3 – The amounts disputed and not clarified by the Contractor shall be covered in the corresponding invoice, by the Expense Payer, without prejudice to compliance with the deadline established for payment of the invoice. (BRASIL, 2005).

4. ACCOUNTABILITY

The server, responsible for the supply, must carry out the accountability within the period stipulated at the time of the concession, containing the following documentation:

a) requests for the acquisition/contracting of services;

b) the original supporting documents of the acquisition of the material or the contracted service (Invoices, Receipts), organized by expense element and ordered by date of issue, duly attested by the claimant of the expense;

c) the statement of expenses incurred, together with the respective Proof of Sale, including all the movement that occurred in the period; And

d) invoices provided by the institution that operates the Federal Government’s Payment Card.

This documentation will be forwarded to the expense payer who will review in accordance with the legislation, and may consider fit or not for approval. If the installment is not submitted within the stipulated period or contains improprieties, the Expense Payer shall notify the server to submit the justifications and corrections, or otherwise collect the amount from the National Treasury Account. If there is no correction or return of the value, the necessary arrangements must be adopted, such as the establishment of Special Accounts or the discount of the amount on payroll in accordance with the due importance, being communicated in advance to the causative server, without prejudice to the adoption of a applicable disciplinary measure.

In the analysis of accountability, the expense payer should observe the following points, explained in item 40 in the CGU manual:

a) verify that all expenses were carried out exclusively within the period of application established at the time of the concession;

b) verify that all requests for the acquisition/contracting of service have been attached to the accountability and that they meet the requirements established at the time of the concession;

c) verify that the expenditure carried out falls within the budget classification specified at the time of granting;

d) verify that the payments were made in cash, at their total value and in a single installment;

e) to verify that there was no fractionation of expenditure;

f) to confront the documents supporting the realization of expenses with invoices provided by the operating institution of the Federal Government Payment Card (CPGF);

g) verify that the documents proving the realization of the expense (invoices, receipts and others) are original, are without erasures, on behalf of the body/entity, and whether they present the date, address and breakdown of the expense actually carried out, as well as the declaration of receipt of the amount paid issued by the supplier and, also, the respective attesting to the receipt / execution of the service by the applicant;

h) check the expiry date of the tax document received and whether it is within the period of application;

i) verify that the supplied agent has observed the relevant tax legislation, especially when hiring autonomous service providers;

j) verify whether there was use of the cashout transaction only for the shares duly authorized at the time of the concession;

k) verify whether there was a payment to the National Treasury of any balance in kind perhaps in its possession;

l) to verify whether there was an expense during the vacation of the agent supplied or in his legal absences; And

m) to verify whether there was justification for the realization of expenses on weekends. (CONTROLADORIA GERAL DA UNIÃO, 2015)

The Manager applying these points in the analysis of the provision will help to safeguard and prevent the misuse or diversion of scarce public resources, avoiding that it is the target of processes arising from internal or external audits that may compromise the management of the Agency.

5. FINAL CONSIDERATIONS

Although the subject is complex, in addition to having several interpretations of what is characterized as an exceptional expense, it can be affirmed that the responsibility of the Expense Payer in relation to the Concession, Operationalization and Accountability of Funds Supply, through the use of the Payment Card of the Federal Government, are immense and that if they are not carried out in line and strict compliance with the current legislation , in addition to the adoption of all administrative measures necessary for the faithful fulfillment of all stages and procedures, it may result in the Public Agency and the Expenditure Payer liable to the Internal Audit, Comptroller General of the Union – CGU or Federal Court of Auditors – TCU.

6. REFERENCES

BRASIL. Portaria nº 41, de 07 de março de 2005, e suas alterações (Portarias nº 01 MP de 04 de janeiro de 2006 e Portaria nº 44 MP de 14 de março de 2006). Estabelece normas complementares para utilização do Cartão de Pagamento do Governo Federal – CPGF, pelos órgãos e entidades da Administração Pública Federal direta, autárquica e fundacional. Ministério da Economia. Brasília, DF, 2005.

BRASIL. Constituição (1988). Constituição da República Federativa do Brasil. Brasília, DF: Senado Federal: Centro Gráfico, 1988, 292 p.

BRASIL. Decreto nº 5.355, de 25 de janeiro de 2005. Dispõe sobre a utilização do Cartão de Pagamento do Governo Federal – CPGF, pelos órgãos e entidades da administração pública federal direta, autárquica e fundacional, para pagamento de despesas realizadas nos termos da legislação vigente, e dá outras providências. Brasília, DF, 2005.

BRASIL. Decreto nº 6.370, de 1º de fevereiro de 2007. Altera os Decretos nº 5.355, de 25 de janeiro de 2005, que dispõe sobre a utilização do Cartão de Pagamento do Governo Federal – CPGF, e nº 93.872, de 23 de dezembro de 1986, que dispõe sobre a unificação dos recursos de caixa do Tesouro Nacional, atualiza e consolida a legislação pertinente, e determina o encerramento das contas bancárias destinadas à movimentação de suprimentos de fundos. Brasília, DF, 2005.

BRASIL. Decreto nº 93.872, de 23 de dezembro de 1986. Dispõe sobre a unificação dos recursos de caixa do Tesouro Nacional, atualiza e consolida a legislação pertinente e dá outras providências. Brasília, DF, 1986.

BRASIL. Decreto-Lei nº 200, de 23 de fevereiro de 1967. Dispõe sobre a organização da Administração Federal, estabelece diretrizes para a Reforma Administrativa e dá outras providências. Brasília, DF, 1967.

BRASIL. Lei nº 4.320, de 17 de março de 1964. Estatui Normas Gerais de Direito Financeiro para elaboração e controle dos orçamentos e balanços da União, dos Estados, dos Municípios e do Distrito Federal. Diário Oficial da República Federativa do Brasil, Poder Legislativo, Brasília, DF, v. 23, p. 2745, 1964.

BRASIL. Lei nº 8.666, de 21 de junho de 1993. Regulamenta o art. 37, inciso XXI, da Constituição Federal, institui normas para licitações e contratos da Administração Pública e dá outras providências. Brasília, DF, 1993.

BRASIL. Manual para Instrução de Pleitos – 021121 Suprimento de fundos. Ministério da Economia. Disponível em <https://conteudo.tesouro.gov.br/manuais/index.php?option=com_content&view=article&id=1612:021121-suprimento-de-fundos&catid=755&Itemid=274>. Acesso em 05 de março de 2020.

BRASIL. Portaria nº 95, de 19 de abril de 2002. Fixa os limites para concessão de suprimento de fundos e para os pagamentos individuais de despesas de pequeno vulto. Ministério da Economia. Brasília, DF, 2002.

CONTROLADORIA GERAL DA UNIÃO. Manual Suprimento de Fundos e Cartão de Pagamento. 2015. Disponível em <www.cgu.gov.br>. Acesso em 04 de março de 2020.

SECRETARIA DO TESOURO NACIONAL. Manual de Contabilidade Aplicada Ao Setor Público (MCASP). Portaria Conjunta STN/SOF nº 06, de 18 de dezembro de 2018. Ministério da Economia. 2018.

- Available in: <www.bb.com.br>.</www.bb.com.br>

- Available in <www.portaldatransparecia.gov.br>.</www.portaldatransparecia.gov.br>

[1]Specialist in Accounting Auditing by the Federal University of Amazonas-UFAM, graduated in Accounting Sciences from the Federal University of Amazonas.

[2]Specialist in Foreign Trade from the Federal University of Amazonas-UFAM, graduated in Accounting Sciences from the Federal University of Amazonas.

[3] Specialist in Controllership of Business Management by the Federal University of Amazonas-UFAM, graduated in Accounting Sciences from the Federal University of Amazonas.

[4] Specialist in Public Management at the Federal University of Amazonas-UFAM, graduated in Administration from the Federal University of Amazonas.

Sent: April, 2020.

Approved: April, 2020.