ORIGINAL ARTICLE

MENEZES, Vinícius dos Santos Gonzaga [1], MONTEIRO, Harrison Lucas [2], ROBERTO, José Carlos Alves [3], SERRA, Meg Rocha da Cunha [4], LOPES, Nelânia Ferreira [5]

MENEZES, Vinícius dos Santos Gonzaga. Et al. Accounting as a management support tool in e-commerce companies. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year. 06, Ed. 11, Vol. 10, pp. 47-71. November 2021. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/accounting/support-tool

ABSTRACT

Accounting is essential for the management system of companies, as it provides detailed information about the assets of a business company. Based on the context of technological innovations, it was noticed that the sophisticated devices generated by advances, modified the mechanisms of companies externally and internally, and this implied the need for continuous updating by the accountant in its way of operating, contributing to the issuance of of improved financial and accounting reports, resulting in a management prepared with the support of managerial accounting for wise decision-making, whether in peaceful situations or even in extreme cases. To help the investigation of the theme, the following problem was addressed: how does accounting as a tool help a digital business with a large volume of information and the measurement of results? The present research aims to present the importance of the accounting instrument for e-commerce companies, demonstrating the corporate nature of a company, the taxation system and all the steps that make up the process of creation, legality and sustainability of companies , aiming to guide the public towards a qualified management. The research was based on bibliographic research in books, articles, scientific journals, from the basic nature. This article presents a rationale that contributes with information generated by financial and accounting reports, and on the role that accounting can aggregate in general, as it channels data established by the transactions and activities of companies, demonstrating that an entity that does not have accounting control, is vulnerable to market changes. It is concluded that accounting as a management tool for physical and virtual companies is essential due to its analytical capacity and its collection of data that express the entire equity situation of companies over a period of time, and this can be monitored by the accountant, as he is the professional qualified to understand and perform functions that help an entity in several ways, directing the company to the best path to be taken.

Keywords: Management Accounting, E-Commerce, Corporate nature, Taxation.

1. INTRODUCTION

This article aims to demonstrate, in view of the bibliographic study, the relevance of accounting as a tool for e-commerce companies, in view of the use of books, magazines, articles, which provide theoretical basis and enrich scientific research, guiding the readers about the functioning of companies due to improved systems for internal and external activities caused by technological advances, presenting the models of the corporate nature, the types of taxation of companies, and verifying the similarities of tax and tax obligations of physical and digital companies.

The digital market has expanded, bringing to light new possibilities for companies, focusing on the production of products specialized in the taste of customers. For the proper performance of such companies, it is necessary to unite trained professionals who keep the companies in a structure of prosperous development (KOTLER, 2017).

Based on the information presented, the problem of the article was conceived due to the contemplation of the growing search and exploration in the digital market, aiming at business and profitability. The general objective of this research is to identify the importance of managing a large volume of information and measuring results, taking into account the valuation of the level of qualified management of a digital business through the usefulness of methods and knowledge from accounting, analyzing the dynamics of the structural relations of the managerial nature of virtual entities, and the result of the processes of the societies in a legalized and sustainable way, intending to allocate the idea of adequate technological management to the public of interest.

In this way, the problem of the investigation indicates the purpose of the study, displaying the content to be verified based on the data obtained through research on accounting, in order to serve as an aid for companies in the virtual branch, highlighting the functioning of companies in accordance with the significant changes generated by innovations in technology. The research problem is a way of outlining the theme, bringing depth and focus to an argument related to the theme, in the form of a question (MAZUCATO, 2018). Therefore, how does accounting as a tool help a digital business with a large volume of information and the measurement of results?

The methodological procedures of the article were carried out through the interest in designating accurate and technical information to the public, using Accounting Sciences as a management tool for e-commerce, with the objective of guiding accounting users to identify adequate methods for the electronic branch, helping to have a good business and financial management. The nature used in the research was strategic, considering that the procedures, tools, means and ends were designed according to the investigation of the theme, demonstrating the relevance of the accounting instrument for e-commerce entities, and collecting data to collaborate with financial and business management within electronic commerce. As for the purposes of the research, it was decided to be descriptive based on documents, books, magazines and articles already published, using existing information that contributed to the theme, characterizing the purpose of using accounting for e-commerce companies. As for the means, this article was based on a bibliographic research, using citations and data that endorsed the theme with the objective of aggregating information that found accounting as a device to regularize a company that operates in the virtual branch, demonstrating the importance of using it for financial and business management, and consequently, maintain the asset health in a positive way.

The specific objectives identified the increase in prospecting in the face of digital businesses due to the uniform and continuous experience, performing an analysis in the transformation of emergencies and improvisations resulting from the activities of virtual companies with the help of the accountant and their knowledge about business management, generating a thriving business.

Therefore, presenting the relevance of the use of the accounting instrument in accordance with the proper application in digital companies through the help of the accountant, all its mechanism will be analyzed and demonstrated, due to the context of technological advances; the way to be followed for the regularization of virtual entities; in addition to the control established in accordance with internal and external obligations with the use of the accounting device for the financial and business management system.

2. THEORETICAL FOUNDATION

The theoretical foundation is the classification of the article that locates the vital points of the investigation carried out by the researcher. It is a structural text that has everything that has already been mentioned or published by other authors that are related to the research topic and problem. Thus, it is through the theoretical framework that it becomes possible to verify the condition of the problem in question, considering the consistency of the study and the direction of the theoretical aspect.

Todo trabalho científico, necessita de um embasamento e suporte teórico, por meio de pesquisas (livros, podcast, artigo…), dessa forma trazendo aprofundamento na área de pesquisa e passando maior qualidade informativa em seus projetos (CARVALHO, 2019).

2.1 ACCOUNTING

Accounting manipulates, interprets and identifies facts and accounting acts that are generated by the transactions and consequences of an entity’s equity. By company equity, it is understood that they are assets and rights plus requirements, which can be represented, generically, by the result obtained by the sum of assets and liabilities. Therefore, accounting seeks to put into practice all accounting understandings through records and income statements for the year, it helps companies in various situations, analyzing facts and acts arising from the operations of companies in a given period.

For Montoto (2018, p. 74) “it is a social science that studies the patrimony of an economic-administrative entity, individual or legal entity, with the objective of obtaining classified and synthesized records of the phenomena that affect its situation”.

A contabilidade atua diretamente ao patrimônio, por meio dela é possível analisar onde recursos estão sendo empregados e o retorno deles para com a lucratividade da entidade. Fiscaliza, filtra e classifica todas as informações financeiras, buscando transparência, credibilidade e instruir (LYRIO, 2015).

Accounting is important for companies, as it is the science that studies the business directly associated with the entity’s assets. Thus, it is essential to stop using it to maintain the financial and economic health of a business.

A good business is recognized by the presentation of profitability and return on investment, in an organized and complete way, and this becomes possible precisely with the help of a professional trained in the area of accounting sciences. The professional qualified to deal with the numbers and information of the company’s assets is the accountant, as he is the specialist in identifying and coding the data generated by transactions and operations that produce effects on the companies’ assets, being responsible for the entire economic area and patrimonial. In addition, it generates reports that generate transparency about the tax information of the activities carried out by the legal entity. Accounting demonstrates the entire financial health of companies, analyzing costs, revenues, expenses, and profitability, that is, it demonstrates the situation of assets and liabilities. In addition, the observations made by accounting go beyond the company’s internal, it identifies external facts that may influence the nature of the company’s performance, in addition to verifying the functioning of the entity.

2.2 E-COMMERCE COMPANIES IN BRAZIL

E-commerce is an e-commerce, a digital commerce platform or it can simply be referred to as a non-face-to-face sale. It is the mechanism of sales made through an electronic instrument, for example, smartphones, computers or tablets. It emerged as a result of the use of the internet, and caused agility and ease in the interactions of producers and consumers. Positive points can be highlighted about the usefulness of technological commerce, such as the practicality provided to users and customers, the fastest way to create ads, and the remarkable observation of procedures based on results, also stimulating the acquisition of customers in compliance with monitoring.

According to Teixeira (2015, p. 22), “it appears that internet access has grown a lot in recent years, which was crucial for the expansion of electronic commerce worldwide, and also significantly in Brazil”.

Com a chegada do acesso à internet, o mundo encontrou-se numa era evolutiva, também conhecida como a era da “revolução digital”, com o passar do tempo, as pessoas passaram a fazer praticamente tudo online ou utilizar a internet como facilitador para tal. O comércio ganhou uma nova perspectiva, além de ter a internet como alavancadora de imagem, foi possível sair do modelo tradicional onde para tudo se era necessário ir à loja física, agora é possível fazer pedidos de produtos e recebê-los na comodidade de seus lares ou estabelecimentos (CLARO, 2013).

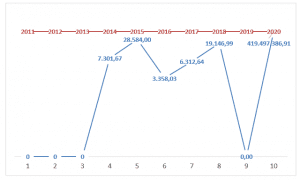

From ancient times to contemporary times, it is possible to notice the exponential growth of technology due to the accelerated pace of innovations, and this also has an influence on the dynamics of the market, although in the past business was highlighted by the performance of physical activities, currently this has changed due to the digital advances. A large part of the customers moved and started to make purchases and orders of products on the internet, and it is precisely at this point that the market also started to become digital, aiming at adapting the operational mode and effectively attracting customers in the operational and economic context of companies. Many societies that operated by virtue of activities carried out in a physical way had to adapt to the virtual branch in order to meet consumer demand. The agility in business operations required significant changes in the business stigma, targeting investments in storage centers, and in the alignment of high acquisition in logistics technology. E-commerce companies in Brazil have shown growth in several ways, where innovation has become, over time, the decisive point for the business.

2.2.2 E-COMMERCE MANAGER PROFILE

The profile of an e-commerce manager is that of a professional who has control of a company’s online store. Also known as an e-commerce manager, he is basically an executive director (CEO – Chief Executive Officer), that is, he has the fundamental characteristics to align an entity and a team to triumph, in addition to having the high authority to make decisions. To be compatible with the profile of an e-commerce manager, it is necessary to have and develop the strategic capacity and demonstrate a global vision, and consequently, analytical. In addition, it should be noted that, as it operates in the virtual environment, one must have an affinity with the internet, mastering digital marketing resources, and having experience with the sale of products per unit or in small quantities. In other words, having considerable knowledge about the retail trade, in addition to presenting leadership skills.

For Ribeiro (2011, p. 15), “in this new reality of globalization and digitalization, whatever the industry, I believe that the players that have greater adaptability and speed in implementing new forms of management will win”.

O gestor e-commerce deve possuir uma série de habilidades e manejo ao utilizá-las, uma das principais é a adaptação, visto que o mercado está em constante atualização, para que uma empresa ou empreendedor autônomo se mantenha relevante em meio ao mercado digital, é necessário que seus produtos sejam modernos e diferenciados, quanto mais atualizado, maior qualidade e melhores preços, maior será a captação de clientes. Outra habilidade a ser observada é a capacidade de controlar estoques, em um ramo tão competitivo qualquer análise equivocada gerará prejuízos a empresa, logo a expertise em administrar a questão “oferta e demanda” se faz bastante essencial para reduzir perdas e ressaltar lucros (CHAFFEY, 2014).

The manager of e-commerce companies has control based on the strategic procedures that will help the company to set its goals, he is responsible for organizing the entire company by virtue of electronic commerce. He handles projects involving products on websites, and visualizes all the logistics focused on delivery and storage in distribution centers located in favorable points, making virtual collections and projecting the delivery of products to his consumers. In addition, he uses research techniques on products to be publicized, and through these researches generates prospecting for new products. The e-commerce manager is able to be creative in their operations.

However, although this position currently appears to be a promising career for those who invest in digital businesses, there are few qualified professionals in the market to fill the vacancy of an electronic commercial manager. The manager has a very important role for technological societies, as he is responsible for gathering relevant data, subject to the analysis of the entire operating system of the companies. Its way of acting in practice is identified through online sales, analysis of information generated by transactions, production of reports, observation of the competitive scenario, and monitoring of suppliers, considering the goals established in the planning of the virtual entity.

2.3 E-COMMERCE COMPANIES AND CORPORATE NATURE

E-commerce companies are companies that operate through electronic commerce and that create a link between the consumer and the producer. Entities in this industry sell the service or product through virtual means, and it is generally known for electronic delivery. E-commerce is associated with the sale made over the internet, caused by both the producer and the reseller, on social networks, or on any other electronic platform.

The corporate nature, also understood as legal nature, is the determination of the entire operational and structural system of a company, whether physical or legal.

According to Schwab (2016, p. 29), “to remain competitive, companies and countries must be on the frontier of innovation in all its forms”.

A natureza societária de uma empresa é responsável pela indicação do caminho a ser seguido por uma empresa, após a devida análise, os sócios saberão em que determinação se encontra a empresa, direitos que passa a possuir e as normas que deverá seguir (SILVA, 2021).

The corporate nature of companies, also called legal nature, is understood as the phase that defines the structure and operating mode of the entity, whether private or public. Therefore, when creating a company it is necessary to know what the legal obligations will be according to the type of structure and business that the company will take. When defining the structural nature and the specific branch of the legal entity, it is necessary to know the obligations that the laws define to be followed, and based on these laws, they will be applied according to the evaluation of the number of partners, by the company’s share capital, and among other identifiable facts.

For the government, the corporate nature is a form of recognition that enables stable control of operations in the national territory, the government applies requirements based on the corporate nature of the company, visualizing the purpose of the legal entity and its membership. Regarding e-commerce companies, it can be said that the types are based on the relationships of digital companies, their goals, and the nature of the business, very similar to the operation of physical companies.

2.3.1 TYPES OF TAXATION

Regarding the interactions and tax applications of e-commerce companies, it is necessary to be aware of the main taxes that are paid by them, such as IRPJ (Corporate Income Tax), PIS (Social Interaction Program), COFINS (Contribution to the Financing of Social Security). The system for collecting companies in the technological field is similar to that of physical companies, however, small differences can be observed in maintaining tax compliance, which is the use of different practices in the accounting and tax procedure of a legal entity, which are aimed at adjustments to current legal obligations.

“There are no differences in relation to the tax burden for the entrepreneur, between a sale made by a physical establishment and a virtual sale”. (BERSELLI, 2016, p. 5).

Com o fortalecimento da internet e a melhora da estabilidade (qualidade), foi perceptível a atenção das pessoas e das empresas para o comércio eletrônico. Dessa forma, uma grande quantidade de dinheiro começou a rodar em circulação, como forma de fiscalização e captação de tributos, foram definidos uma série de impostos condizentes com a modalidade do comércio empregada, tendo o imposto sobre circulação de mercadorias e serviços (ICMS) como o principal (GOMES, 2018).

The form of collection and incidence of taxes are similar between the operations of physical and digital companies, and the ways are given by the increase in revenue from the activities carried out. The IRPJ, ICMS[6], PIS, COFINS, IPI[7], ISS[8], CSLL[9] can be cited as the main taxes collected in companies in the electronic commerce sector, however, what stands out the most due to the sales and commercialization of products carried out by virtual entities is the ICMS.

In this way, it is important to be aware of the obligations to be followed by the legal entity (even if the ways of taxation are similar to those of a company in the physical branch), and it is mandatory to keep the business regular before the competent bodies. Thus, from the perspective of the tax nature, the operations of the company’s assets must be kept within the legal tax obligations, since respecting and proceeding in a harmonious way with the tax requirements, consequently, the complications in the Brazilian Federal Revenue in consideration of the information provided will be alleviated.

2.3.2 TYPES OF MARKETING

Marketing is about improving the profits made through the company’s tactical production, services provided, and merchandise offerings that match the needs of the consumer group. The types of marketing are based on the digital or physical field, where companies operating in these fields use these two channels.

Marketing generates several solutions for the business, in addition to the various strategies that are suitable for the types of operations, conceiving results based on the applied strategy. Marketing models are generally understood by the form of planning, and strategies define the result in attracting customers, and consequently, in the result of the companies’ exercise.

For Brito (2013, p. 19), marketing “is the set of actions aimed at the consumer market (the one in which we want to meet/create need and desire), with a view to achieving results”.

Com a chegada da “era digital”, aumentou o nível de comunicação, avaliação, interação e formação de opinião. O marketing como ferramenta de atração entre as empresas e os clientes, tem como objetivo e desafio atrair mais clientes e aumentar o seu nível de interação com as marcas, mesmo com a internet tão presente no cotidiano, as pessoas ainda são alvejadas por informações de diversas fontes, logo cabe aos gestores de marketing buscar estratégias para melhor captar e atender aos seus clientes. (KOTLER, 2017).

With the arrival of the digital age, companies have new possibilities to leverage their brands, however, they have new obligations in the competitive commercial space. Basically, all companies had to opt for modernizing their operating processes and the way they publicized their brand and products. Previously predicted by technology enthusiasts, companies that did not develop and keep pace with technological growth were left behind, in many cases leading to the company’s closure.

The accessibility promoted by the internet, combined with technological advances to the point that people have “pocket computers”, added new possibilities for the dissemination of products, and through strategies, brought corporations closer to their audience.

Currently, there are several types and models of marketing, however, the most used by those who want to leverage the brand and increase the number of sales are content marketing, digital marketing and personal marketing. The biggest advice from many experts (including Philip Kotler, known as the father of marketing) is to target a brand’s products to a defined audience and invest time and resources in assimilation strategies. Soon, the main objective became more than just selling, and it started to integrate customers as part of the company, where, in addition to promoting its brand and products, it will also defend and leverage it on social networks.

2.3.3 TYPES OF CLIENTS

The types of customers in a company have different profiles, and these profiles make a difference when advertising and selling the product. In the field of digital commerce or even in physical establishments, the most varied profiles are found, which have peculiarities inherent to the choice of the product, the satisfaction of the quality of the product, the service and the services offered by the company.

According to Mehta (2017, p. 11), “each customer and every customer deserves an incredible experience and a tireless commitment to their success, on the part of suppliers”.

Existem diversos tipos de clientes, de maneira simples e direta, do cliente que comprará praticamente tudo o que lhe for sugerido por alguém que lhe transmita credibilidade, ao cliente jogo-duro, que precisará investidas e negociações para que ele talvez se interesse pelo produto divulgado. O processo de captação do cliente começa desde o momento em que foi exposto a uma propaganda, até ao fechar uma compra no caixa, cabe ao bom vendedor se adaptar a cada cliente e lhe conduzir (HSIEH, 2017).

Companies need to keep evolving and make changes their constant reality, attracting attention, arousing interest and bringing people (customers) closer to their goals.

There are several ways of defining the types of customers (target people), their ways of thinking and how to hook them, however, looking for more concise and direct definitions we come across two types of customers “the faithful and the non-faithful”. Regardless of how good the strategy, the reach of the advertisements and the talk of the promoter (or salesperson), it will only serve to attract the customer, not to keep him. When talking about keeping the customer, the keyword is “loyalty”, as the word itself implies, it’s about being faithful and constant.

Adaptation and innovation is what attracts and maintains, loyalty is something that needs constant polishing, this form of positioning is what makes loyal customers or just an occasional customer. While the loyal customer has feelings and links with a certain company(ies), the occasional customer “jumps from branch to branch”, without whereabouts. Therefore, it cannot be accurately counted as the target of a marketing or product development campaign. However, the power of loyal customers not only keeps buyers measurable, it captures new people and uniformly informs future operations and launches.

2.4 ACCOUNTING AS A CHALLENGE FOR ELECTRONIC COMMERCE

Accounting as a challenge for e-commerce is always adapting to the evolving business scenario, regarding technological advances that increase new possibilities in all social media. Constant updating is needed to generate advances in the market and maintain the organization’s patrimonial health, in financial, social and economic aspects. Software, applications, sophisticated systems and solutions based on the activities of the companies, are practices that are part of the entities’ space.

For Marion (2015, p. 28) “general accounting, necessary for all companies, provides basic information to its users and is mandatory for tax purposes”.

A contabilidade atua como ferramenta para a gestão patrimonial, por meio dela se faz possível melhor qualidade nas tomadas de decisões, tanto em questões burocráticas como em questões judiciais, reduzindo prejuízos e levando maior aproveitamento dos recursos da entidade, além de auxiliar diretamente no cumprimento das obrigações fiscais (BRINCKMANN, 2014).

Electronic commerce or e-commerce presents itself as an opportunity for people who want to migrate to the digital market or start their journey in entrepreneurship.

In the digital sphere, the importance of the accountant is as relevant as for the traditional environment (physical companies, face-to-face service). Just as technology has brought innovations and changes, the accounting professional has also changed in the face of opportunities and has responded to market needs. It went from being an inspector to being an indicator of possibilities and assisting in decision-making, with several functions in common with the traditional work environment, with the following main functions:

– Assist the company with tax issues;

– Development of the National Register of Legal Entities (CNPJ);

– Balance sheet control;

– Assist in decision making regarding the company’s and partners’ actions;

As previously mentioned, the accountant started to have the position of consultant (also known as accounting consultant), acting directly in the formation of ideas, in decision making and, often, as the commercial manager within the assisted company.

2.4.1 MANAGEMENT ACCOUNTING

Business management accounting encompasses practices that assist in decision making. Accounting management analyzes and studies the best actions for the company, generating strategies in the broad and specific sense for the entity. Therefore, the managerial role involves analyzing the flow of shares of companies, controlling expenses, the return on investment applied to a share, pricing products and verifying ways to highlight the company in the market. Management accounting is related to the way in which managers will demonstrate and obtain profitability based on planning for the company.

According to Santos (2018, p. 18), “management accounting measures and reports financial information and other types of information that help managers achieve the organization’s goals”.

A contabilidade voltada para o ramo empresarial atua por meio de relatórios contábeis, atuando na apuração do patrimônio e nos resultados da organização. O papel da contabilidade de maneira simplificada é traçar metas cabíveis a empresa e regular, já a contabilidade gerencial atua diretamente com os gerentes das organizações, visto que são grandes responsáveis pelo cumprimento de metas e controlar o andamento da entidade (MONTOTO, 2018).

Management accounting works directly inside the company, where the accountant works through internal analysis, seeking to check all types of reports from the financial and accounting sectors, in addition to analyzing the real dimension of the company’s assets.

Through managerial accounting, detailed internal analysis and market studies, the accountant will be able to present reports with points that must be observed and monitored internally, and will act directly as a consultant for decisions relevant to the company’s development.

2.4.2 TAX ACCOUNTING

Accounting Science has several branches, among which the tax part has become relevant for any business, whether small, medium or large. Tax accounting is based on the operations of companies that make them subject to tax obligations. According to the inspection rules established by law, the tax accounting part is responsible for recording the company’s operations to then present payments and tax returns. All this analysis and all this tax process is carried out by the accountant, who is the appropriate professional to deal with this situation. Therefore, he will be the one who will carry out the organization and complete control of all the entity’s assets, determining tax records and profits.

For Neto (2019, p. 32), “the calculation basis, according to the Federal Constitution, must be defined in a complementary law, and its amendment is subject to the principles of legality”.

A contabilidade fiscal tem por objetivo analisar o patrimônio da empresa, buscando apurar ao máximo seus dados, promovendo maior exatidão em seus relatórios, dessa forma o contador proverá um melhor planejamento tributário, possibilitando que a empresa se encontre em meio a todas as legalidades fiscais. (CREPALDI, 2014).

Tax accounting or tax accounting refers to its main area of activity, which are taxes and knowledge about them, allowing greater accuracy in tax payment.

Every entrepreneur in Brazil needs to pay taxes, in addition to having knowledge about the complications when interpreting laws and properly calculating the amount of taxes to be paid. Bearing this in mind, it is advisable for the entrepreneur to invest in the formation of a good team regarding tax analysis and accountability.

In this process, the accountant who has the proper knowledge of laws and has access to the company’s balance sheets and reports, can act directly in the role of tax accountant, however, there are reservations that errors may occur due to inaccurate calculations or lack of supply of documents relevant to the transaction.

2.4.3 ACCOUNTING REPORTS

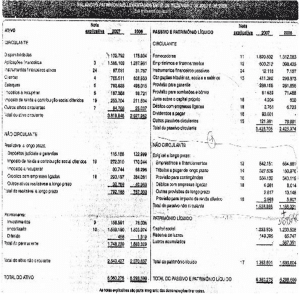

Accounting reports are an important and effective tool for the company’s management system. In this way, it is possible to be notified about the present and future problems of society, elaborating forms of solutions to be verified. The financial statements, report or reports, are accounting documents that are generated by virtue of the data obtained by the financial and economic system of the companies during a certain period, which are important to determine the situation of the assets of the business. In this way, having this tool in the operation of the company, the manager is able to have control of expenses and have access to the profitability of the company, grouping very important information for the organization and reducing even the issue of taxes.

According to Santos (2018, p. 16), “the accounting information system (SIC) consists of manual and computerized, interrelated and interdependent parts, which make use of processes such as collecting, classifying, summarizing, analyzing and managing data”.

Os relatórios contábeis têm por finalidade verificar a realidade patrimonial que uma empresa ou entidade possui, após devida análise e pesquisa interna e externa. Após etapa de pesquisa, o relatório passará a ser informativo, relatando a realidade da empresa de maneira detalhada e transparente, estando sujeito a futuras análises e julgamentos. (SILVA, 2015).

The accounting reports are carried out by the accounting sectors, they seek to transmit technical and relevant information to the company’s financial issues (expenses, inventory, costs…). Such information is collected internally, seeking to pass the largest amount of data for the composition of the reports.

The reports are carried out periodically, varying by the company’s niche, the segment in which it operates, and the size of the production line. In some cases, reports are performed monthly. However, there are reports that are carried out in a longer period of time (quarterly, annually), bringing a new apparatus of information and a new evaluation to the reports produced previously.

There are reports that are mandatory by the company, usually assigned to external issues (accountability, information for investments, balance sheet, …), and there are internal reports, also known as non-mandatory, which have the function of reinforcing the decision-making and previous analyses, emphasizing observation points within an organization.

2.5 FINANCIAL REPORTS

Financial reports are associated with the financial flow that occurs based on the operations of companies, however, in order to have accurate reports, it is necessary to have a whole planning aimed at measurement and objectives. Financial documents, in addition to serving the financial sector for the simple fact of presenting economic data, also present the financial health of a legal entity. That is, financial reports are condensed and descriptive information of the financial facts of a company during a certain period. In this way, it is the main way to conduct the areas of operations of a company, due to the information. By analyzing the reports, it is possible to define and outline short, medium and long-term growth improvement goals.

For Diniz (2015, p. 72), financial reports are “all the financial statements prepared by the organization, which will serve as an information base for the economic-financial analysis”. Sludge, they “encompass everything that has financially relevant information, from technical evaluations, information about cash flow, in addition to the information contained by accounting and administrative sector reports” (GELBCKE, 2018).

Financial reports comprise the studies carried out internally in a company and aim to report in a transparent way how the company is financially.

Normally, financial reports are carried out with the collection of internal information by the various sectors of a company, taking into account the information obtained by the administrative and accounting sector, in addition to the information contained in the report of both sectors to compose a group of information that will be passed on to managers.

The role of financial reports is to analyze the company in detail (balance sheet, expenses, costs, receivables, liquidity) and contribute to the company’s profitability and cost reduction.

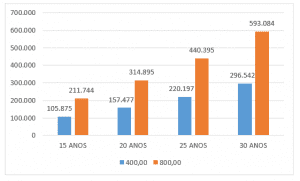

2.5.1 FINANCIAL PLANNING

Financial planning is the document that points the way to be traced by the company, and is essential to generate a good business. This document aims to demonstrate a control that guarantees, through functions, the positive result of the exercise in the health of the cash, and that takes into account the goals of the business plan, and these procedures can be short, medium or long term. In this way, no company can renounce the business plan, regardless of the magnitude of its performance in the market, the entity must be complete, considering the macro and micro field of business, and must be generated with the help of an accountant who is the professional prepared for it.

According to Marion (2015, p. 435), “only by knowing the past (what happened) can you make a good projection of cash flows for the future”.

O corpo de doutrinamento contábil faz uma série de sugestões e normatiza alguns procedimentos, com o intuito de melhor estabelecer o processo de desenvolvimento econômico. O planejamento financeiro está incluído nisso, por meio dos relatórios referentes ao setor financeiro e com base nas metas futuras, é bastante recomendado que o faça para maior desenvolvimento socioeconômico (SILVA, 2021).

Financial planning is essential to generate order in business, as it establishes objectives that the company will have to follow based on strategically defined instructions. It generates control over actions in advance, that is, it makes an entire analysis of goals, whether short, medium or long term.

For this, it is necessary to study the next steps of the business, analyzing possibilities, paying attention to market variables, and having a group of related procedures to understand and organize the management of financial resources, with a view to profitability, improving the well-being of the company, and the visualization of the return of the capital invested in the action. These actions refer to costs, expenses incurred, revenues earned or obtained, and the scenario inherent to market situations. In addition to being a business plan document, it points to the company’s performance, and deals with the use of tools to have control that can ensure the health of the legal entity’s cash flow, considering the goals achieved during the exercise of the society activity.

3. MATERIALS AND METHODS

According to Amorim (2016, p. 139), “the technique and methods to be used in scientific investigation can be chosen from the exposition of the problem, the formatting of the assumption and the limitation of the scientific object”.

The methodology is expressed by the need to use appropriate methods to explain an approach to a certain area of knowledge. It expresses the scientific character of the article, emphasizing each phase of the research. Therefore, the methodology consists of demonstrating the path taken by the researcher to the result of the investigation, presenting the tools, means and ends on the scientific nature of the subject.

3.1 METHODOLOGICAL PROCEDURES

According to Severino (2013, p. 108), “the procedures can be changed and used in different ways or stages. Consistent with the research and compatible methods”.

The methodological procedures of this research were carried out through the interest in allocating accurate and technical information to the public, with the objective of guiding, identifying and assisting.

3.1.1 AS TO NATURE

For Libório and Terra (2015, p. 40), “the structure of a research is shaped according to the nature of the scientific work, by the area of knowledge and the theme addressed by the project”.

For Soares et al. (2018, p. 27), “the technical procedure is conceived through the orderly contemplation of events, research activity, conclusions and the veracity of science in the consequences of scientific study”.

The nature of the research was strategic basic, in view of the approach made through bibliographic research, through investigations carried out in books, articles and journals of a scientific aspect, extracting and using citations that enriched the academic research.

3.1.2 AS TO THE PURPOSES

According to Amorim (2016, p. 134), “a final object is necessary to guide the stages of a study or scientific research”.

According to Vergara (2016, p. 78), “it is understood that a descriptive research aims at the analysis and revelation of information from a methodological part”.

As for the purposes, the research was chosen to be descriptive, based on documents, books, magazines and published scientific articles, using existing information that can collaborate with the theme, organizing the facts and presenting the relevance.

3.1.3 AS TO THE MEANS

For Mazucato et al. (2018, p. 70), “it is evident that it is necessary for the elaboration of a scientific work, the quality of the information that will serve as a basis for the formation of the content contained in the work”.

According to Zanella (2013, p. 36), “the practicality for the research activity, through relevant sources as a tool of informative and auxiliary knowledge, stands out as a privilege”.

As for the means, bibliographic research was chosen, which is the study carried out through the collection of data from articles, books and journals of a scientific nature, using citations that can endorse the theme with the objective of aggregating information that will serve as a foundation in the creation of proposals.

4. FINAL CONSIDERATIONS

This research work aimed to gather information about the role of accounting for companies focused on the digital market, seeking to detail in stages each participation that the accounting professional can have towards the company and its socioeconomic development.

Therefore, this research had the general objective of gathering information necessary to convey the importance of accounting in e-commerce, from the initial creation process to the final step that would be the effective purchase of services or products. This knowledge was passed on in an essay, gathering information from sources such as scientific articles, academic journals, websites and books.

In view of the work problem question: How does accounting as a tool help a digital business with a large volume of information and the measurement of results? This was solved through the information generated by the financial and accounting reports, in addition to the role that accounting can aggregate in general, as it channels data established by the transactions and activities of the companies, demonstrating that an entity that does not have a accounting control, is vulnerable to market changes. The accountant directs the company to the best path to be taken, and is responsible for guiding the company on a strategic basis, using accounting methods and analyzing the company’s assets, in the short, medium and long term, through accounting devices, in order to design economic and financial health benefits for the business, whether physical or digital.

The initial specific objective was met by citing the types of customers and the stages of conquering them. These steps aim to correctly segment each type of customer, from the unstable ones to the most loyal ones who become advocates and propagators of a brand.

The second specific objective reached the goal by explaining the important role of the accountant with regard to the quality of management, in addition to citing the importance of the cooperation of professionals from interconnected areas, working together to solve possible problems, internal and external analysis, as well as the prevention of possible events concerning the company.

The third specific objective was achieved through citations, explanations and examples of the performance of a qualified accountant or a versatile manager in the digital field, thus enriching the reader’s knowledge and bringing him closer to what he is looking for.

The research started from the hypothesis that with the arrival of the new technological era and the increasingly high digital market, a good knowledge base is necessary for better performance in the digital field. Because due to emergency and opportunities, the number of interested parties in this area is increasing, bringing many inexperienced people or even momentarily incompatible with the digital market. Through this question, the work was prepared with the intention of providing information and solving a part of the main issues related to acting in the digital field. During the work, several researches were carried out through books, articles, social networks, websites, among others. And it was found the work in helping the entire process of e-commerce companies. Through this initial research, it was already possible to provide answers and solutions to various problems that affect entrepreneurs and enthusiasts in the digital field.

Therefore, the recommendation for further research is to invest a good amount of time in the development of a way that it is possible to guide people regardless of their social classes, bringing people closer to entrepreneurship and the professionals responsible for its maintenance.

REFERENCES

AMORIM, A. P. A. Metodologia do trabalho científico. Bahia: IMES, Instituto Mantenedor de Ensino Superior Metropolitano S/C Ltda, 2016.

BERSELLI, D. E-commerce: Manual de perguntas e respostas – Tributação e práticas. Brasília: Sebrae, 2016.

BRINCKMANN, R. Contabilidade básica. 3. ed. Florianópolis: Departamento de Ciências da Administração/ UFSC, 2014.

BRITO, A. L. S. Fundamentos de marketing. Aracaju: UNIT, 2013.

CHAFFEY, D. Gestão de e-business e e-commerce: estratégia, implementação e prática. 1. ed. Rio de Janeiro: Elsevier, 2014.

CLARO, A. Comércio eletrônico. São Paulo: Know How, 2013.

COSTA NETO, J. V. Contabilidade tributária I. Salvador: UFBA, Faculdade de Ciências Contábeis; Superintendência de Educação a Distância, 2019.

CREPALDI, S. A.; CREPALDI, G. S. Contabilidade fiscal e tributária: teoria e prática. São Paulo: Saraiva, 2014.

DINIZ, N. Análise das demonstrações financeiras. Rio de Janeiro: SESES, 2015.

GELBCKE, E. R. et al. Manual de contabilidade societária: aplicável a todas as sociedades: de acordo com as normas internacionais e do CPC. 3. ed. São Paulo: Atlas, 2018.

GOMES, M. F.; SOARES, M. C. M. Tributação sustentável no e-commerce: com ênfase no Imposto sobre circulação de mercadorias e serviços. Curitiba: Revista de Direito Econômico e Socioambiental, 2018.

HSIEH, T. Satisfação garantida: aprenda a fazer da felicidade um bom negócio. 2. ed. Rio de Janeiro: HarperColllins, 2017.

KOTLER, P. et al. Marketing 4.0. Rio de Janeiro: Sextante, 2017.

LIBÓRIO, D.; TERRA, L. Metodologia científica. 1. ed. São Paulo: Rede Internacional de Universidades Laureate, 2015.

LYRIO, E. F. Gestão contábil: aspectos introdutórios. Rio de Janeiro: NPG/UERJ, 2015.

MARION, J. C. Contabilidade empresarial. 17. ed. São Paulo: Atlas, 2015.

MAZUCATO, T. et al. (orgs.) Metodologia da pesquisa e do trabalho científico. Penápolis: FUNEPE, 2018.

MEHTA, N. Customer Success: como as empresas inovadoras descobriram que a melhor forma de aumentar a receita é garantir o sucesso dos clientes. 1. ed. São Paulo: Autêntica Business, 2017.

MENEZES, D. et al. (orgs.). Metodologia científica: teoria e aplicação na educação a distância. Petrolina-PE: UNIVASF, 2019.

MONTOTO, E. Contabilidade geral e avançada esquematizado. 5. ed. São Paulo: Saraiva Educação, 2018.

PEREIRA, A. et al. Metodologia da pesquisa científica. 1. ed. Santa Maria, RS: UFSM, 2018.

RIBEIRO, N. Gerir na era digital. Lisboa: Cooperativa de Educação e Reabilitação de Cidadãos Inadaptados, CRL. 2011.

SANTOS, M. A. dos. Contabilidade de custos. Salvador: UFBA, Faculdade de Ciências Contábeis; Superintendência de Educação a Distância, 2018.

SCHWAB, K. A quarta revolução industrial. Geneva: Edipro, 2016.

SEVERINO, A. Metodologia do trabalho científico. 1. ed. São Paulo: Cortez, 2013.

SILVA, C. A. T. Contabilidade geral. 3. ed. Florianópolis: Departamento de Ciências da Administração/ UFSC, 2015.

SILVA, M. Contabilidade societária: 80 anos de procedimentos contábeis no Brasil. São Luís – MA: CBL, 2021.

TEIXEIRA, T. Comércio eletrônico: conforme o marco civil da internet e a regulamentação do e-commerce no Brasil. São Paulo: Saraiva, 2015.

VERGARA, S. C. Projetos e relatórios de pesquisa em administração. 16. ed. São Paulo: Atlas, 2016.

ZAMBELLO, A. V. et al. Metodologia da pesquisa e do trabalho científico. Organizador: Thiago Mazucato, Penápolis: FUNEPE, 2018.

ZANELLA, L. C. H. Metodologia de pesquisa. 2. ed. Florianópolis: Departamento de Ciências da Administração/ UFSC, 2013.

APPENDIX – FOOTNOTE

6. Tax on The Circulation of Goods and Services.

7. Focuses on Industrialized Products.

8. Tax Over Services.

9. Social Contribution on Net Income.

[1] Graduating from the Accounting Sciences course.

[2] Graduating from the Accounting course.

[3] Advisor. Master in Production Engineering. Specialist in Business Logistics. Graduated in Business Administration with Emphasis in Marketing.

[4] Advisor. Master in Industrial Process Engineering from UFPA, specialist in Accounting Control and Auditing from Ciesa, Graduated in Accounting from Centro Universitário do Norte. Graduated in Economic Sciences from Centro Universitário do Norte.

[5] Advisor. Specialist in Accounting, Financial and Tax Auditing and Graduated in Accounting Sciences.

Sent: October, 2021.

Approved: November, 2021.