ORIGINAL ARTICLE

CARVALHO, Rogério Galvão de [1] LEAL, Cícero Pereira [2] SOUZA, Gabriel Luiz Lino de [3]

CARVALHO, Rogério Galvão de. Et al. Public policy of attracting investments in Brasília: errors and successes. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 06, Ed. 02, Vol. 01, pp. 21-59. February 2021. ISSN: 2448-0959, Access link: https://www.nucleodoconhecimento.com.br/social-sciences/errors-and-successes

SUMMARY

Given a poor socioeconomic scenario, where the historical database of the last decade revealed population growth above the national average, stagnation of production and high rates of income concentration in the Metropolitan Region of Brasília (RMB), there was an urgent need for the implementation of political actions, in order to minimize the impacts arising from the combination of these three regional factors that , in the long run, ceteris paribus, could generate a catastrophe in the region, promoting: scarcity of public services, because of low revenue; and increased poverty, since the concentration of income is high and GDP is stagnant, that is, an expected collapse in the near future. Therefore, this article aimed to present in detail and in detail the preparation and formulation of the District Investment Attraction Plan (PDAI), a specific, appropriate and customized public policy, ongoing in the Government of the Federal District. This is a bibliographic review that allowed us to understand the idea of the formulation of this policy and its contribution to minimize impacts. Thus, it was verified that the PDAI, which aims to transform the RMB, in a national area of destination of productive investments in the next thirty years, through “clustering”, whose essence would be the economic vocation of the Local Productive Arrangements – APLs, identified in the RMB, encourages the development of the APLs of the Federal District, aiming to minimize these negative impacts of the identified socioeconomic problem. Being the same focused on the production of technical and statistical data on attraction of investments, on the identification and mapping of THE APLs (including non-traditional sectors such as: creative economy, solidarity, circular or innovation), the modernization of brazilian legislation to attract investments, the creation of a specific Brazilian agency to capture the best ventures and promote the RMB as an investment destination , in the recursive realization of events (seminars, symposia, business rounds, etc.) on the subject, and in the reformulation and preparation of the institutional environment and governmental organizational culture of Brasília.

Keywords: Public Policy of Attraction of Investments; Local Productive Arrangements; Regional Economic Development; Economy of the Metropolitan Region of Brasília.

1. INTRODUCTION

The socioeconomic scenario observed in the period from 2009 to 2019, in the Metropolitan Region of Brasília, RMB, capital of Brazil, was not promising, since simultaneously: (1) the rate of gdp variation was practically stagnant; (2) the rate of population change had been increasing at an accelerated pace; (3) the concentration of income showed a reasonable growth; and (4) the RMB economy is very susceptible to fiscal crises. In a short time, without an adequate regional public policy, the expectation would be of a socioeconomic collapse.

From the point of view of public services, the consequences would also be bad for the population of this region, since the collection was in decline (because it is a portion of GDP) and the demand for more and better public services are increasing, due to this miscompass: (a) stagnation of GDP; (b) rapid population increase; and (c) increasing concentration of income.

You can imagine how damaging the socioeconomic situation of the Brasília region would be, without assertive public policies for the smoothing of this economic problem in the long run. The State plays an important role in these long-term policies and can establish guidelines to minimize the negative impacts of these problems.

But in recent times the public policies of economic development proposed in the Federal District, have not fulfilled this role. It is believed that the models adopted are exhausted because they are based on the mainstream of the ready solution of granting economic, fiscal or credit benefits, to entrepreneurs, without the effective counterpart of job and income generation, other than the entrepreneur’s own declaration of commitment to generate employment, increase jobs in the RMB.

In 2016, for example, the external control body of the Federal District conducted an audit within the Federal District Government, GDF, having as object two of the government programs related to public policy of economic development. The body assessed both the irregularities and the results of the actions of these programmes, following questions: (1) management from the point of view of legality, efficiency, effectiveness and the public interest; (2) their effective contribution to local economic development; and (3) the compatibility between the results achieved by the programmes and the operational costs to GDF coffers.

Brasília (2016), in the figure of the Federal District Court of Auditors (TCDF) pointed out a series of inconsistencies: (a) in strategic planning and in the definition of guidelines and objectives to guide the implementation of public policies; (b) in the process of monitoring (monitoring, evaluation and adjustments) of public policies. There were also problems in the efficient choice of beneficiaries of government programs, through the analysis of technical, economic and financial feasibility projects – PVTEF.

Another important point of the audit was the empirical results from observations of samples, which demonstrate, according to the agency, the inefficiency of the programs, that is, higher government costs than social benefits (BRASÍLIA, 2016).

Therefore, in case of the region of Brasília, as previously observed, it was necessary to think about alternative solutions to mitigate the bad socioeconomic scenario identified. But this alternative should be consistent, organized, with clear objectives, consistent guidelines, strategically planned, with beginning, middle and end. It is understood that from the socioeconomic problem, and observing the guidelines of the recurrent audits on the formulation, elaboration, implementation and monitoring of public policies, an opportunity arises.

One of the alternatives, pointed out by the GDF, would be the transformation of RMB into a relevant area of attraction of productive investments, for Brazil, from the promotion of Clusterization, with the purpose of increasing GDP at a speed compatible with that of existing population growth, recorded in recent years and promoting a certain distribution of income, with the generation of employment and social welfare.

For decades, state and municipal governments, to attract investments, have followed the mainstream of tax exemption, economic or credit benefits, which has become known as the “federal entities tax war.” The proposal of this public policy of the GDF would be different, this paradigm should be transposed.

The theoretical tooling, which underpinted the PDAI guidelines, were the traditional economic models of regional economy (adapted). In the APLs, whose vocation was identified as of interest, it would be the promotion of new ventures, generating new jobs, increasing and distributing the region’s income, thus positively impacting government revenue and consequently the possibility of providing public services consistent with the accelerated increase of this population, as opposed to the traditional model of economic development.

Brasília is a planned city that is strategically located in the center of Brazil and meets a series of requirements that accredit it as the right destination for business. Therefore, the decision to turn it into a national area of attraction of investments would be the most appropriate, according to the GDF. So, taking as an example the Chinese model of Shenzhen (which transformed a fishing village of China into the largest smart city on the planet in thirty years), with the recommendation of experts that this would be the best specified public policy for the case. Then comes the idea of formulating and elaborating a public policy of attracting investments, here in the region of Brasília.

From 2015, a great opportunity was designed in this direction, in the PROCIDADES-DF program, an international credit operation between the IDB and the Government of the Federal District, one of the components was exactly the attraction of investments to the region of Brasilia. Thus, the negotiations for the elaboration, formulation, implementation and monitoring (monitoring, analysis, evaluation and adjustments) of this specific public policy, called District Investment Attraction Plan – PDAI, would begin.

On the one hand, Brasília would become increasingly, with bad rates of economic development, that is, less and less rich. On the other hand, reflecting on the opportunities, Brasília is the political center of Brazil, the capital of the Republic where decisions affect all Brazilians, is the headquarters of the embassies of countries that maintain diplomatic relations with Brazil. In addition, it is classified as a World Heritage Site by UNESCO, and a number of other items that accredit it as a potential for investment destination.

The choice, of the basis of this public policy of attracting investments, to minimize the socioeconomic problem also came from the fact that the RMB economy revolves around the government economy, because here is the home of the three powers of the federal government, its public companies and mixed economy societies. And with that, either companies focus on government sales (bids), or turn to serve public servants.

According to IBGE, in 2016 services related to public administration account for 44% (forty-four percentage points) of the total GDP of the Federal District. As is aware, the economy of the RMB, for this reason, is more susceptible to fiscal crises, compared to other Metropolitan Regions of Brazil.

This proved to be a problem, looking at the recent fiscal crises. Each time the collection decreases in Brazil, two things happen here in Brasília: public servants (federal and district) are without increase (consume less) and the government promotes spending cuts, that is, also buys less. In this case, Brasília’s economy is doubly hit. And so it has greater losses than the national average. The recommendation, in this case, would be to transform the matrix of this economy so that it is less dependent on the government economy and less susceptible to fiscal crises.

It was of paramount importance, in the early days of the conception of this public policy, to be careful to understand that the success of the idea of a public policy, of this size, with this size, and with this level of innovation for the local government, would begin with: synchrony of economic agents, the synergy of political agents and the internal dissemination of the idea in government agencies.

However, the environment for the formulation and elaboration of the PDAI, in this way, was not conducive, the organizational culture of the government of Brasília did not favor the long-term project, which gathered the necessary information and data, whose time horizon exceeded the 04 (four) years of the Multiannual Plan, or a government mandate. Moreover, the philosophy of this long-term project is not in line with the models of the projects existing in the GDF, apparently exhausted.

The paradigm (of traditional programs, projects and government actions) should be broken: “granting government benefits (credit, tax or economic) without the counterpart”. All of them, without exception, started from this premise, hence one of the technical studies that were part of the scope of this plan, during its formulation and elaboration was the intertemporal evaluation of the performance of the enterprises (through a second census on the Areas of Economic Developments – ADEs) that are part of the Pro-DF Government Program.

The PDAI, in turn, provided for the inversion of the logic of government programs of most subnational governments of Brazil: they would only be able to receive any government benefits those economically viable projects, tested in the Local Productive Arrangements – APLs and when the project matured it would be accredited by the GDF, through technical criteria, to have the right to receive incentives in the implementation of its business , in the most appropriate APLs.

The point is that to attract investments and enterprises the pure and simple granting of benefits, is the common place for all municipalities in Brazil and most cities in the world. The discussion aimed to minimize the risks of government investments when it comes to actions, projects, programs related to the attraction of investments, when it was proposed to inversion of the logic for the granting of these benefits.

The proposal, of the new public policy (PDAI), for the granting of benefits to enterprises is the existence (in each project of each program) of specific processes for accreditation of entrepreneurs. Such processes would go through: (a) recruitment, (b) selection, (c) choice, (d) maturing, (e) accreditation and, finally, (e) financing of good projects, so that they could be tested in the APLs of the Federal District.

With the transformation of the project into a business, the accredited would be able to receive government benefits. In addition, good private projects, accredited to GDF incentives, could also participate in a second stage, which would be the special credit lines with the BRB (and other promotional banks) for those best evaluated projects.

At a later stage, it is also expected that the participants of the programs, related to the PDAI, could obtain consultancies (mentors) from scientists and technicians previously registered in the GDF (for voluntary promotion of knowledge transmission), in addition to participating in business rounds and presentations of projects to investors, in the recursive events promoted by the Permanent Commission for The Attraction of Investments of df (composite group : by government agencies related to Economic Development, representatives of private initiative and civil society).

There were basically 04 (four) premises that led the thinking of this plan: (01) modernization of brazil’s legislation of attraction of investments; (02) preparation, formulation and implementation of the PDAI for the next 30 (thirty) years; (03) creation of a specific Agency for Investment Attraction; (04) recursive promotion, in Brasília, of events on the subject.

Another important issue was the production of specific data on regional economic development, and the production of a diagnosis of the recent economy, so that it was possible to think about the future with the most appropriate strategies regarding the attraction of productive investments in the long term.

A recent study, called The Long-Term Agenda for Attracting Investments in the Federal District, was commissioned by representatives of the productive sector (entrepreneurs of the JK Development Center) to a specialized consulting firm to deal with the government. This investigation was the starting point for establishing the initial discussions on the priorities of the PDAI within the GDF.

A great debate was held, through systematic and periodic meetings, with other sectors of the government and produced some technical studies to support the preparation of the PDAI. This plan, which would be formulated by the government, would count on the collaboration of both the private sector and civil society and would bring the guidelines and fundamental elements to transform Brasília, in the next 30 (thirty) years, in the largest area of attraction of investments in Brazil.

The PDAI focuses on the following axes: (1) adequacy of Brazilian legislation on investment attraction (2) modernization of the business environment (3) adequacy of the logistics structure of the RMB; (4) dissemination of Brasília as a destination for attracting investments, for Brazil and abroad.

To begin the process of this transformation, based on these 04 (four) axes were prioritized with regard to the adequacy of the legislation, the following standards: (1) Draft of the Draft Law of the Creation of the Agency for Attraction of Investments of Brasília; (2) Draft of the PDAI Bill (3) Draft of the normative act of the creation of the commission for the implementation of the public policy of productive and sustainable development, focusing on attracting investments; (4) Draft of the normative act authorizing the Program of Investors and Entrepreneurs; and (5) Draft of the normative act to include APLs mapped as an area of economic interest.

Then, among others, it was identified the need to provide, for the production of primary data, on investment attraction, the following technical studies: a) mapping of APLs; b) identification of the DF’s innovation ecosystem; c) studies on the creative, circular, innovation and traditional sectors of the economy; d) evaluation of the ShenZhen model applied in Brasília; e) studies on the Technical Education of the Federal District; f) A major diagnosis of the local economy; g) Investment attraction indicators in the Federal District; h) Innovative projects that deserve to be implemented in the Brasília region, in order to attract productive investments in the coming years; i) Intertemporal assessment of the performance of government programs, the model of which is supposedly exhausted; and j) Brasília as a smart city.

It is notepoint that for the success of this regional transformation, in a relevant national area to implement the business, it is essential to disclose the attractions of this region, in the rest of the states and abroad: its potentialities, comparative competitive advantages and its peculiarities with regard to the subject. For this, there was the investigation of two points: (1) creation of a specific agency to deal with the subject; and (2) the promotion of systematic and recurrent events in the Region of Brasília for this purpose.

The differential of this Economic Development Plan, when compared to the traditional plans of the Federal District Government, are three aspects: the first is related to decisions based on customized investigations and technical studies; the second, the claim to be drawn up for the long term; and the third is that it intends to modify the economic matrix of the RMB, fostering the lower dependence of the government economy from the economic vocation of the APLs identified in the Federal District.

Therefore, with the idea of state public policy, there was the intention that each of the steps would be implemented and monitored (monitored, evaluated and adjusted) gradually, transposing some government mandates.

And the great challenge is to bring in this context a different method of establishing the elaboration, formulation and implementation of a state public policy, based on scientific diagnoses (on the biggest socioeconomic problem of the decade), technical studies, evaluations and investigations (detailed and detailed), following rigid methodologies (from a technical-scientific point of view) based on a solid economic theory and a model based on a concrete case of success , to minimize the identified problem.

The way of conducting the preparation, formulation and implementation of the PDAI was a challenge, for two crucial reasons: the first, because the custom, in government, are projects and short-term programs that usually last stems from a single mandate; and the second, that these actions, projects and long-term programs, are more sophisticated (often innovative), and therefore traditional norms do not accompany them. The subsuming of the concrete case to the norm was not always smooth. Which brings us another problem, the dilemma between the administrative constitutional principles of legality and efficiency.

But the big challenge is the implementation of this policy, in an unused environment, where the principle of legality in the control of administrative acts overlaps with the principle of efficiency in the management of public resources. Moreover, the governmental organizational culture is not prone to elaborate or formulate long-term public policies, nor is it with good eyes the implementation of a plan that, among other issues, aims to transpose the paradigm of “fiscal war” by challenging the mainstream of the ready solution: the pure granting of economic, fiscal or credit benefits.

2. LITERATURE REVIEW

The economic theory that underpinted the PDAI guidelines were the traditional economic models of regional economy (adapted), Von Thunen and Dixit-Stiglitz, the Central Area Theory and the theoretical framework on APLs.

The concentration of income and the accelerated increase in the population associated with the stagnation of local production, according to data from PDAD (CODEPLAN), in recent years, causes the provision of public services to be affected for two reasons: the first is a consequence of the stagnation of GDP, which causes a stagnation of government revenue; the second is that if there is an increase in the population and a concentration of income, public services will be more demanded by the population. Which, ceteris paribus, would culminate in a socioeconomic collapse.

The class of models created by Von Thunen in the 19th century served to assist in understanding the allocation and relocation of production factors in space, over time, that is, in the way productive spaces are organized. The cities were isolated and supplied by farmers. There was for optimal allocation of resources the problem provided two questions (01) the concern with combined costs of production and transportation; (02) how would the allocation of farms would be if there was unplanned competition among farmers.

In the sixties of the last century, Alonso (1964) replaced these farmers with workers on their way to work and the central commercial area of the city interfering in these routes. This model, likewise, generated concentric rings of land use. As a limitation, these models consider as given the existence of the commercial area, it is not endogenous, but is of great help for the analysis of APLs.

Another important approach, for the Analyses of the PDAI, with regard to both the mapping of APLs, as the study on the innovation ecosystem of the RMB, as well as the surveys of other non-traditional sectors (Creative Economy, Circular, Innovation) was that of Henderson (1974) with an economic model as an urban distribution system with sizes and types of urban areas.

Mills (1967) established, in his modeling, an element that referred to the analyses for this plan, especially with regard to the Local Productive Arrangements mapped by the GDF in the RMB, which was the existence of one side of the tension between external economies associated with the geographical concentration of the city industry and on the other the “uneconomies” (for example, the cost associated with the journey from home to work).

Another important contribution for the PDAI was the understanding of how, in this process of the space economy, transport costs and economy of scale interact, i.e. administration, industrialization, research, development, innovation, etc. Thus, we find solid contributions from Christaller (1933) and Losch (1940), with the theory of the central area and all the argumentation for the formation of the hierarchy between the central and peripheral areas.

Dixit-Stiglitz modeling (1977), demonstrating the need to insert companies (in the APLs, RMB) in a different environment was crucial, because in traditional models there was an assumption that increasing returns of scale were exogenous, that is, external to companies. This model allows us, albeit in a rudimentary way, to deal with the issue by adopting monopolistic competition, which could suggest beautiful alternatives of analysis, for the government.

We can observe, the phenomenon of companies from the same sector that, because of a number of advantages, concentrate in a certain geographical space to produce, is known as Local Productive Arrangement, APL. The best known example is Silicon Valley in southern California, where the headquarters of numerous companies in Information and Communication Technology (ICT) and related areas are located. But there are numerous other APLs, such as those located in the Pearl River Delta in Southern China (Shenzhen, Dongguan, Zhuhai, etc.), or Bangalore in India, or St. Joseph of the Fields in Brazil.

There is no doubt that they are interrelated, which is why it is essential to identify the opportunities for the promotion of these APLs, as a public policy aimed at economic development, both in its regional and national dimensions. The benefits arising from the APLs are related to the increase in productivity resulting from the agglutination of companies and other economic agents in the same geographical location.

According to Pietrobelli (2003) the Local Productive Arrangements, APLs, have 03 (three) modalities: geographic APLs, APLs industrial districts and APLs networks of enterprises. On the one hand the geographical APL has the characteristic of scarcity of cooperation and are generally weakly developed. On the other hand, industrial district APLs have much more robust cooperation practices and more fluid interfirm transactions. The third type, according to the author, the APL network of enterprises, has a form of leadership and organization, which provides strategic services. This view was extremely necessary for mapping the APLs, in order to understand the configurations of each of them in the RMB.

Diniz (1993), introduces theoretical and methodological aspects, which, according to him, for the analysis of the geographical dynamics of Brazilian industry, are vital. The author called “polygonal development” the result of a set of forces, among which five would be the most representative: (1) the emerging agglomeration diseconomies; (2) the role of State; (3) differentiated availability of natural resources; (4) market units and changes in production structure; and (5) concentration of research and income.

According to Cassiolato and Lastres (2003), the success of APLs depends on a synergy between the production, knowledge and regulation of the process. It is essential to articulate and synchronize between the agents participating in the APLs: economic (customers, partners, suppliers and competitors) of knowledge (consultants, universities and research institutes) and regulatory agents (APL management body and government) and social (unions, business associations, support organizations and the 3rd sector). This information will be crucial to the actions, projects, and programs focused on RMB APLs.

Both for Castro (2009), as well as according to Jacometti, Castro, Gonçalves and Costa, (2016) a specific public policy for yhe APLs, should be concerned with some characteristics that are crucial: the Territory, that is, the clipping of the geographical space in which the APL is located; specialization, which in addition to production itself, takes into account the knowledge that people and companies have about the main economic activity; Learning and Innovation, i.e. the systematic exchange of productive, technological and marketing information on the main business of the APL; and productive cooperation, which relates the economy of scale to the optimization of APL production processes.

According to Pitangui et al. (2019), the origin of the discussion on APL in Brazil dates back to studies on sector agglomeration of companies, a phenomenon recognized by Marshall in 1890. Currently the productive dynamics of the agglomeration perfectly describes the interactions of the actors who form them. The identification of the patterns and dynamics of the APLs enables the planning and management of this territory by its actors and contributes to the development and consolidation of these APLs. This work contributed strongly with the methodology in the proposal for the implementation of the plan.

In the case of the PDAI, another aspect that was taken into account for the formulation and elaboration of this public policy of attracting productive investments, in order to transform the RMB, was the identification of the innovation ecosystem of the Brasília region. Moore (1993) defines the concept of business ecosystems, where organizations “co-opt”, that is, work cooperatively and competitively, to sustain new products and meet the needs of consumers incorporating innovations. Later the same author, Moore (2006), refined the concept of Business Ecosystem as an economic community that relies on the interaction of organizations and individuals, considered the organizations of the business world, whose flow of evolution is directed by their leaders, who share expectations, understanding the need for “coopetition” and “co-evolution” to take advantage of environmental opportunities and generate competitive advantage.

In this sense, according to Adner (2006), the ecosystem business logic is even more sophisticated, because the timing of decisions is very important, since the ability to innovate will only be effective when all the actors of the ecosystem are prepared for this. Etzkowitz and Leydesdorff (2000) consider the innovation ecosystem as a network of relationships in which information and talent flow through systems of co-creation of sustained value. With this, studies were carried out to establish a synchrony with the APLs of the Federal District, on the Innovation Ecosystem in the region of Brasília.

According to Arthur (1996) recent technological advances have created, in the enterprises, two branches: (1) high-tech sectors, marked by increasing yields of scale; and (2) traditional sectors, with constant or decreasing yields of scale. Thus, opting for a policy that promotes if especially the high-tech, capital-intensive sectors, seems to us the correct mechanism of state action to compensate for the problems observed, and that underlies our development strategy.

In recent years, the subnationals to attract new investments, according to Alves (2001) and Perius (2002), the incentives are of three types: (1) previous concessions for the beginning of the productive activity: donation of land, works, infrastructure facilities that generate partial or total benefits for the company; (2) credit benefits associated with initial investment and productive operation, offered by investment banking institutions; and (3) tax benefits related to the productive operation: the tax waiver can be caused by the reduction or postponement of collection or, also, by tax exemption. Such incentives gave rise to the phenomenon of the Fiscal War.

The phenomenon of fiscal war consists of public policies based on fiscal, financial, credit or economic benefits, which seek to develop a subnational to the detriment of other federative entities. These actions show that while a subnational benefits, others account for some loss, thus evidencing that the fiscal war is not a great instrument. This “War” generates conflicts in the Federation. In the short term, according to Ferreira (2000), the state that triggers the war benefits. In the long run, the generalization of the conflict causes the initial gains to disappear, because tax incentives lose their stimulus power and become mere waivers of collection.

Another challenge, during the implementation of the PDAI, is the control of the administrative activities of the state, which overlaps, in most cases, with the efficient management of public resources. Here is a review of administrative constitutional principles and their hierarchy.

The concept of efficiency, finally inserted in the Federal Constitution of Brazil, as an administrative principle, for Modesto (2007), should be understood as a requirement of all public management activity, since it is, in essence, aimed at serving the public, in the just proportion of collective needs. In public policies, according to Gico Júnior (2012), the Kaldor-Hicks efficiency criterion is adopted, where a law is said to be efficient if the benefits derived from the norm compensate for the costs imposed by it, that is, the legal norm, when seeking efficiency, should provide a structure of incentives so as not to result in waste of public resources. On the other hand, the principle of legality according to Ferreira Filho (2012), says that the public agent can only act or omit if there is legal provision for the administrative act.

However, according to Silva Júnior (2008), in the case, it can be affirmed that there is no hierarchy between constitutional principles. The author’s caveat would be with respect to the practical analysis of concrete conflicts of this nature, because of the understandings in the operation of the law.

3. DETAILING THE ECONOMIC PROBLEM (2009 – 2019)

The socioeconomic problem would be a long-term reduction in goods and services available to the population, caused by the simultaneous association of 03 (three) recurrent factors, observed in the RMB in the period of ten years (2009 – 2019): (1) an accelerated population growth, above the national average; (2) concentration of income, increasing in this period; and (3) the stagnation of the production of goods and services.

The Region known as RIDE, an integrated development region that is an area analogous to the Brazilian metropolitan regions, however, located in more than one federative unit, in this case, the Federal District (DF), Minas Gerais (MG) and Goiás (GO). It moved from the 8th (eighth) position, in 2000, to the 4th (fourth) position, in 2016, in number of inhabitants of the metropolitan areas of Brazil. RIDE-DF only has less population than the Metropolitan Region of Belo Horizonte (MG), 3rd (third), Rio de Janeiro (RJ), 2nd (second) and São Paulo (SP), 1st (first).

The following is a sequence of 03 (three) tables that visually demonstrate the speed of population increase in RMB:

| Table 01 – Population (year 2000) | ||||||

| Position | Region | Pop | ||||

| 1 | Metropolitan Region of São Paulo | 17.813.234 | ||||

| 2 | Metropolitan Region of Rio de Janeiro | 10.869.255 | ||||

| 3 | Metropolitan Region of Belo Horizonte | 4.177.801 | ||||

| 4 | Metropolitan Region of Porto Alegre | 3 498 322 | ||||

| 5 | Metropolitan Region of Recife | 3 278 284 | ||||

| 6 | Metropolitan Region of Salvador | 2 991 822 | ||||

| 7 | Fortaleza Metropolitan Region | 2 910 490 | ||||

| 8 | Integrated Development Region DF | 2 756 701 | ||||

| 9 | Metropolitan Region of Curitiba | 2 635 436 | ||||

| 10 | Metropolitan Region of Campinas | 2 219 611 | ||||

Source: IBGE elaborated by the authors.

| Table 02 – Population (year 2010) | ||||||

| Position | Region | Pop | ||||

| 1 | Metropolitan Region of São Paulo | 19 683 975 | ||||

| 2 | Metropolitan Region of Rio de Janeiro | 11 835 708 | ||||

| 3 | Metropolitan Region of Belo Horizonte | 5 414 701 | ||||

| 4 | Metropolitan Region of Porto Alegre | 3 958 985 | ||||

| 5 | Integrated Development Region of DF | 3 717 728 | ||||

| 6 | Metropolitan Region of Recife | 3 690 547 | ||||

| 7 | Fortaleza Metropolitan Region | 3 615 767 | ||||

| 8 | Metropolitan Region of Salvador | 3 573 973 | ||||

| 9 | Metropolitan Region of Curitiba | 3 174 201 | ||||

| 10 | Metropolitan Region of Campinas | 2 797 137 | ||||

| Source: IBGE prepared by the authors | ||||||

| Table 03 – Population (year 2016) | ||||||

| Position | Region | Pop | ||||

| 1 | Metropolitan Region of São Paulo | 21 242 939 | ||||

| 2 | Metropolitan Region of Rio de Janeiro | 12 330 186 | ||||

| 3 | Metropolitan Region of Belo Horizonte | 5 873 841 | ||||

| 4 | Integrated Development Region of DF | 4 291 577 | ||||

| 5 | Metropolitan Region of Porto Alegre | 4 276 475 | ||||

| 6 | Metropolitan Region of Recife | 4 019 396 | ||||

| 7 | Fortaleza Metropolitan Region | 4 019 213 | ||||

| 8 | Metropolitan Region of Salvador | 3 984 583 | ||||

| 9 | Metropolitan Region of Curitiba | 3 537 894 | ||||

| 10 | Metropolitan Region of Campinas | 3 131 528 | ||||

| Source: IBGE prepared by the authors | ||||||

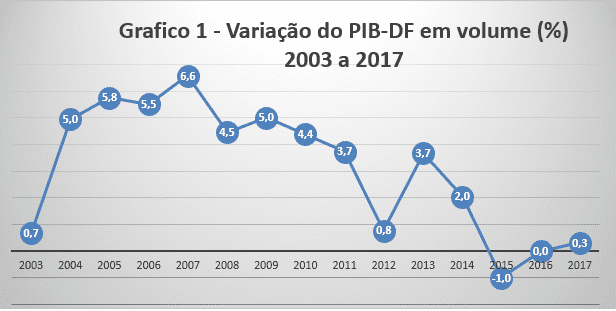

With regard to the production of goods and services, PIB-DF was used as a proxy, since this production corresponds to about 90% (ninety percentage points) of the population of the RMB. The following are the 03 (three) tables that follow from 2003 to 2017 the percentage change in the rate.

Table 4 – Indexes on GDP of the Federal District

| 2003 | 2004 | 2005 | 2006 | 2007 | |

| Var. GDP (%) DF | 0,7 | 5 | 5,8 | 5,5 | 6,6 |

| Real GDP of DF | 54.267,48 | 56.954,72 | 60.237,81 | 63.553,85 | 67.734,57 |

Source: CODEPLAN prepared by the authors

Production in this period (2003 – 2007), with regard to the RATE OF VARIATION OF GDP-DF, was increasing.

Table 5 – Indexes on GDP of the Federal District

| 2008 | 2009 | 2010 | 2011 | 2012 | |

| Var. GDP (%) DF | 4,5 | 5,0 | 4,4 | 3,7 | 0,8 |

| Real GDP of DF | 70.756,26 | 74.297,62 | 77.548,01 | 80.436,90 | 81.048,23 |

Source: CODEPLAN Prepared by the authors

Production in this period (2008 – 2012), with regard to the RATE OF CHANGE OF GDP-DF, behaved in a decreasing way (fall in the rate) from 2009.

Table 6 – Indexes on GDP of the Federal District

| 2013 | 2014 | 2015 | 2016 | 2017 | |

| Var. GDP (%) DF | 3,7 | 2,0 | -1,0 | 0,0 | 0,3 |

| Real GDP of DF | 84.017,54 | 85.728,94 | 84.858,92 | 84.843,66 | 85.136,74 |

Source: CODEPLAN Prepared by the authors

Production in this period (2013 – 2017), with regard to the rate of change of GDP-DF, had a brutal decline (including with negative variation in 2015 and practically stagnation in the last two years). Remembering that in relation to the production of goods and services, PIB-DF was taken as a proxy, since this production corresponds to about 90% (ninety percentage points) of the population of the RMB, as graphed below.

The projections, in this sense, for RIDE-DF, would be catastrophic for the next 10 (ten) years, using the average growth rate of the last years of both the population and GDP, such as the Gini index (which measures the concentration of income) of this region. Here is a table with the variation of the Gini index in recent years.

Table 6 – Indices on GDP of the Federal District.

| Year Gini Index – DF | |

| Gini | |

| 2015 | 0,468 |

| 2016 | 0,578 |

| 2017 | 0,594 |

| 2018 | 0,569 |

| 2019 | 0,552 |

Source: IBGE Prepared by the authors

The Gini Index is an instrument to measure the degree of income concentration in a given group. He points out the difference between the incomes of the poorest and the richest. Numerically, it ranges from zero to one. The value “zero” represents the total distribution and the value “one” to total concentration. In this specific case, the Region of Brasília, with regard to the rate of variation, has been approaching more than 1.0 in recent years.

Another important aspect to be addressed is the local economic matrix, focusing on the government economy, according to IBGE, services related to public administration account for 44% of the total GDP of the Federal District. As is aware, the economy of the RMB, for this reason, is more susceptible to fiscal crises, compared to other Metropolitan Regions of Brazil.

This proved to be a problem, looking at the recent fiscal crises. Each time the collection decreases in Brazil, two things happen here in Brasília: public servants (federal and district) are without increase (consume less) and the government promotes spending cuts, that is, also buys less. In this case, Brasília’s economy is doubly hit. And so it has greater losses than the national average.

Thus, with the simultaneous combination of these 04 (four) factors: accelerated population increase, income concentration, product stagnation, and an economy very susceptible to fiscal crises (government performance), we observed a potential failure of regional economic development, this means an announced socioeconomic collapse, and a foreshadowing of the main need to implement an assertive public policy.

On the other hand, the positive aspects to corroborate the idea of the need for the transformation of the Brasília region into a national area of attraction of investments, can be important and serve as a basis for this transformation of the RMB.

Another point to be considered as positive is the growing interconnection of two metropolitan regions (Brasília and Goiânia) and its surroundings, known as the Goiânia-Anápolis-Brasília axis, which is today, according to IBGE data, one of the fastest growing regions in Brazil, with a population of approximately 7.5 (seven points five) million inhabitants.

There are projections that in the coming decades the conurbation of this region would be completed. The cities are mainly interconnected by the BR-060 highway, there are also direct flights between Brasília and Goiânia and the project of a passenger transport railway from Brasília to Goiânia, whose technical feasibility studies were completed by the National Land Transport Agency, ANTT, in June 2016, with a budgeted value of R$ 7.5 billion reais.

In this context, it is clear the need for a specific, consistent public policy, based on technical studies, investigations and hard-hitting evaluations that ultimately minimize the negative aspects of the combination of these factors. The PDAI presents itself as a viable alternative for this, since it intends to minimize the negative aspects of this combination of factors harmful to regional economic development.

Through the change of the economic matrix in order to depend less and less on the government economy, through smart incentives to APLs in the region, whose vocations were mapped and identified in technical studies, investigations and research. Unlike what is commonly carried out, this plan aims to attract good ventures for RMB and finance good infrastructure projects and improvement in the business environment, to transform it into a relevant area of destination for investments and enterprises

4. PUBLIC POLICY OF ATTRACTING INVESTMENTS

The PDAI aims to transform the RMB, a national area of destination of productive investments, in the coming years, to generate employment, increase and distribute income, through government incentives to the APLs of the Federal District, especially those whose vocation fulfills this role.

The choice of APLs as a starting point for the guidelines of this policy is related to the global trend observed in recent years of the use of clustering policy as the most efficient public policy for local development. The model adopted for the analysis of best practices was applied in Shenzhen, China, with the necessary modifications, customizations and adaptations to the characteristics of Brasília and its region.

Some specific objectives of this public policy would be: (1) modernization of brazil’s legislation to attract investments; (2) production of technical studies and data on the local economy, focusing on attracting productive investments; (3) implementation of programs, projects and actions aimed at attracting investments in the APLs of the RMB; (4) Creation of the Brazilian Investment Attraction Agency; (5) promotion of events to attract investments in this region; and (6) prioritization of the attraction of investments in the Sustainable Productive Development Policy of the Federal District, contained in the law of the ZEE-DF.

For the formulation of the plan, through a questionnaire, we investigated the perception of economic actors (government, private initiative and society) about the relevant aspects, which would be adopted in this public policy, identified by the technical team: (1) the long-term socioeconomic problem; (2) the maturity of the investment attraction policy in the Federal District; and (3) the effectiveness of these guidelines for attracting long-term investments to the Brasília region, that is, we present the initial ideas to know if we were on the right track, according to the thinking of the economic agents involved in the process.

For this, questionnaires were conducted with representatives of the government, the productive sector and civil society of Brasília, with questions related to the PDAI. This questionnaire, conducted with due care under the rigorous methodology of qualitative data analysis, had its result analyzed respecting the limit of its scientific interpretation, that is, all conclusions cannot extrapolate the elective sample, that is, the results only and only only, apply to the members of the sample and serve as a kind of trend, since the chosen sample was composed of representatives of the productive sectors , civil society and the government of Brasília.

The Result revealed that the PDAI is on track for most of the entities that answered the questionnaire. In addition, with the contributions collected in the open part of the questionnaire, the program gained a new component, the perception of representatives of local economic agents (government, entrepreneurs and the population), which allowed adjustments in the formulation and elaboration of the Brazilian public policy of attracting investments.

Another important aspect is the modernization of brazil’s investment attraction legislation, which, in the thesis, attributed to the local government the duty of the application of public resources in Programs, Projects and Actions located in specific areas with the objective of transforming the RMB into a national area of attraction of investments.

This stage of the PDAI consisted of a series of normative proposals that are concatenated, interconnected and value the synchrony of the standards to facilitate the formulation, elaboration and monitoring (monitoring, analysis, evaluation and adjustment) of this public policy efficiently.

The first standard deals with a governmental normative act, which establishes a regional program, located in the mapped APLs, which, in a recursive manner, through a public call, intends to recruit, select, choose, implement and monitor the implementation of the best and most innovative projects, which will be financed by the government through a financing line, with the development banks.

In the course of the implementation of these projects, by becoming businesses of the APLs, generating employment, increase and income distribution, there will be the government certification that accredits them to participate in the receipt of government benefits and incentives: tax exemption, credit lines, economic benefits, etc.

The advantage of this certification to be accredited to receive government benefits, would be the guarantee that these projects (certificates) have undergone a sieve of economic feasibility analysis and testing, during the process of maturing the business, in one of the mapped APLs, that is, there is guaranteed the counterpart of the entrepreneur to receive the benefit, is a strong candidate for the economic success and sustainability of the enterprise. As can be seen, this new methodological practice would be different from the mainstream of existing and supposedly exhausted government programs. This is the breaking of the paradigm.

Another rule is the bill that establishes, within the scope of the RMB, the PDAI and creates a specific and perennial commission, composed of several government agencies, to, with the help of government executives of high performance of strategic public management, take care of the preparation, formulation, implementation and monitoring (monitoring, analysis, evaluation and adjustment) of the specific public policy of attracting investments to Brasília in the next 30 (thirty) years.

This standard also establishes criteria for the participation of the productive sector and civil society in this process, establishing a transversal public policy of attracting investments coordinated by the Secretariat of Economic Development of the Government of the Federal District, with the participation of economic agents in all stages of this public policy.

From the validity of the Law of Ecological and Economic Zoning of the Federal District, ZEE-DF, it was established that there was a specific public policy for the productive and sustainable development of the Federal District. In this sense, the issue of a governmental normative act, synchronizing this policy with the PDAI, would be of paramount importance, not least because in the DNA of this district plan, there is already consonance and synchrony with the spirit of the ZEE-DF law.

In view of the main need to professionalize the dissemination of the Region of Brasília as a destination for investments and businesses to fulfill the role of transforming Brasília into a national area of attraction of productive investments, the bill of the creation of a specific agency for attracting investments is vital for the modernization of Brazil’s legislation to attract investments.

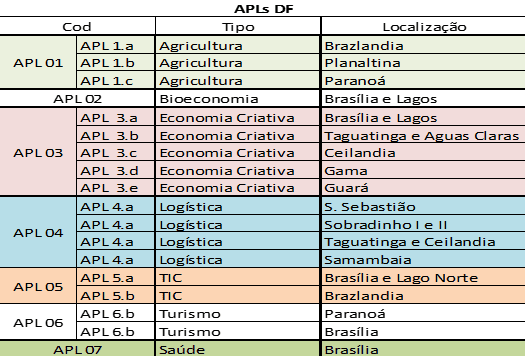

Another important normative act, of the GDF, was that which concerns the mapping of the Local Productive Arrangements of the Federal District, APLs DF, in order to reveal to economic agents (consumers, producers and government) that these areas are of interest to the long-term implementation of the PDAI, that is, to transform the RMB into an area of relevance for the destination of investments and business in Brazil.

The production of data, through technical studies, investigations and research, guarantees governments tools to make more assertive decisions regarding the application of public resources. With the creation of the Investment Attraction Agency, there is a professionalization for the dissemination of this place as a destination for attracting investments, both for other Brazilian states and abroad and the search for new ventures more suitable and customized to the characteristics of the region.

The option to transform the APLs of the Federal District into the center of the discussion on the public policy of attracting investments came from the association of models of regional economy theory, applied to the RMB by technical studies carried out, in the PROCIDADES-DF Program, an international credit operation with the existence of contribution of funds to the specific component that deals with attraction of investments. From this study, a list of APLs most relevant to the implementation of this public policy was elaborated, the PDAI, follows the table that lists these APLs of the Federal District:

Table 1 – APLs/DF

This stage of the district plan consisted in the preparation and realization of technical studies with the purpose of supporting the decisions of formulation and elaboration, in relation to the guidelines of public policy whose primary purpose is the attraction of good and promising private projects for the transformation of the RMB.

The first investigation was to identify and map the most relevant economic activities of the Federal District, focusing on local productive arrangements – APLs, to synchronize the PDAI guidelines with the Shezhen development model in the pearl river valley in China.

The second study, to support decisions regarding the innovation economy, was premised on the existence in Brasília of a vocation for Innovation, based on evidence, projects such as: the Biotic technology park, the research centers of Embrapa, Fiocruz, UnB and UCB and others point out the importance of deepening investigations. In order to get to know the innovation completely, the mapping and georeferencing of the innovation ecosystem of the RMB was carried out.

At the same time, a technical study was conducted on the training of labor, a detailed investigation on the courses in the area of technology, technological education in the Federal District. The systematization of data on professional education encompassing public and private institutions the teaching of technical level and higher level, in this region, a kind of positive externality, in the stage of formulation of the PDAI, will be fundamental to organize the educational public policy and equalize the relationship between the demand and the offer of professional courses especially those of technology.

The data will be crucial with regard to decisions about the directions of the offer in relation: the type of course, programmatic content, number of vacancies, nearest APL, etc. taking into account, including, the programs, projects and actions of the PDAI in an effort to synchronize with other assertive public policies.

An evaluation was also carried out on the Chinese model applied to the RMB. Shenzhen’s recent history begins when the Chinese government instituted China’s first special economic zone, the fishing village with about 25,000 (twenty-five thousand) inhabitants, in 1980, today, according to Global Data, is one of the most important smart city in the world, with a population of 12.5 (twelve point five) million and GDP around US$ 350 billion. The city leads innovation in the Asian country.

The Chinese model of Shenzhen inspired the formulation and elaboration of the PDAI, since the RMB, guarded the appropriate proportions, brings together a number of characteristics as favorable as for the transformation into a relevant center for the destination of productive investments, as we will point out in the following sections.

Other technical studies on non-traditional sectors, such as the creative economy and circular economy, are also part of the Analysis. For example, the preparation of a census for a comparative intertemporal evaluation of the performance of a regional economic development program (which is supposedly exhausted), in relation to the 2008 census, using the same analysis methodology. As discussions on the implementation of the PDAI take place, new technical studies will be included that can sustain the transformation of this region into a national area of attraction of productive investments.

The realization of systematic events, with the participation of the productive sector and civil society, on the economy of the RMB, especially the APLs. The central idea of these recurring events would be to organize, systematize and share data and information about the business of the Brasília region to promote them to other states and abroad. The GDF, in partnership with representatives of the private sector, is organizing, under the PROCIDADES-DF program, from the international credit operation with the IDB, the PARK DAS NAÇÕES – PDAI, a biennial recurrence event, which has the function of disseminating the RMB as a destination for attracting productive investments.

In addition, the events play a fundamental role in improving the export and importculture, in the sophistication of innovation in these sectors, in the production, organization, systematization and sharing of data and information from the productive sector and the government, on the production of goods and services, creating a district network of communication and information about contacts and business.

The attraction of investments for the Region of Brasilia is related to the PDAI, by assisting in the transformation of this region into a significant area of destination of private enterprises and investments in Brazil, to generate employment and income and, at the same time, to meet the needs of economic development resulting from the accelerated population growth of this region.

The creation of the Agency, specific to attract investments, has the purpose of promoting this region as a destination for investments and prospecting, in Brazil and abroad, investment opportunities and customized and appropriate ventures to the region of Brasília.

This region brings together characteristics that can be conducive to transform it in this national area of destination of productive investments. According to IBGE, we have, for example, an average education of the population much higher than the national average, internet access is also much above the national average. In addition, it meets the headquarters of the command of the three powers of the Union and the embassies of the countries that have diplomatic relations with Brazil.

Despite having an above average population growth and currently occupying the 4th place in the list of the most populous Metropolitan Regions, it has one of the lowest demographic densities, of the same list. Another competitive advantage is the proximity of Large Productive Centers (Anápolis, Goiânia, Formosa, Unaí, Catalão, Cristalina, Uberlândia, Uberaba, Araguari, João Pinheiro, Paracatu and others).

There is then a need for Brasília to have a specific agent to act in the prospection of projects and projects appropriate to regional characteristics, to contribute to the solution or minimization of the problem of the imminent economic collapse identified. The creation of the Agency, recurrent in cities around the world, seems to be the best practice to act in this process.

This creation is of paramount importance to effectively contribute to the process of transformation of Brasília into a national area of attraction of productive investments, in the coming years and subsidiary to generate employment, income and sustainability in new enterprises, preferably large, installed in the Federal District.

Based on this dilemma, where the focus was on the creation of a private agency and professionalization of this institutional mission to take care of the dissemination of the RMB, in Brazil and abroad, the 17 (seventeen) most relevant reasons for investing in Brasília were listed:

- Capital of the Republic where decisions affect all Brazilians;

- Geographic center of the country and be able to connect consumer centers to producers;

- Headquarters of embassies of countries that have diplomatic relations with Brazil.

- Classified as a World Cultural Heritage site by UNESCO;

- The International Airport of Brasília was considered the best air terminal in the country in the years 2017 and 2018 (Airports + Brazil Award), being ahead of the airports of Guarulhos (SP), Congonhas (SP) and Galeão (RJ);

- Of the Brazilian Metropolitan Regions, she, with regard to demographic density, is one of the smallest;

- Important pole of scientific research and development;

- The largest number of masters and doctors (52.8 masters and 16.7 doctors) per group of 100,000 residents, according to the Center for Management and Strategic Studies (CGEE);

- Best city to invest in health, in the Midwest region according to ranking (Urban Systems – a company specialized in intelligence and market consulting – and L&M, a consulting firm specialized in health) with 20 (twenty) cities;

- It has 07 Medical Schools, two of which are public, offering approximately 300 vacancies per semester for new medical students, in addition to several schools in the health area (nursing, physiotherapy, biomedicine, dentistry, psychology, nutrition, physical education, pharmacy and biochemistry, etc.).

- Brasília also has several Engineering Schools, and a specific engineering campus of UnB in Gama (Aerospace; Automotive ; Energy; Software; Electronics)

- The grain sector is the strongest point of Agribusiness brasiliense, crops of: soybeans, beans and corn, production reaches almost one million tons per year. In addition, fruit growing is also featured.

- Another competitive advantage is the proximity of Large Productive Centers (Anápolis, Goiânia, Formosa, Unaí, Catalão, Cristalina, Uberlândia, Uberaba, Araguari, João Pinheiro, Paracatu and others);

- Increasing interconnection of two metropolitan regions (Brasília and Goiânia) and its surroundings, known as the Goiânia-Anápolis-Brasília axis, which is today, according to IBGE data, one of the fastest growing regions in Brazil, with a population of approximately 7.5 (seven points five) million inhabitants;

- The Federal District approved in 2019 the Ecological and Economic Zoning Law, ZEE-DF, which establishes areas of productive development, based on ecological risks, and correlates them with the most appropriate economic activities, respecting the current geoeconomic situation;

- Recently, some Local Productive Arrangements APLs have been identified and listed, which are in the process of mapping and georeferencing;

- The GDP per capita of the Federal District is the highest in Brazil, twice the national average. Due to the high local income, Brasília is potential demand for goods and services of high quality and sophistication.

These were the competitive advantages affected by the RMB, identified in an example, so that the programs, projects and government actions of the PDAI, promote good private projects, intensive in capital and that generate employment and income at an even higher speed (due to the increasing returns of scale) than in other federative entities in Brazil, promoting the said transformation, that is, the RMB as a reference in the destination of productive investments.

Another issue that was observed, during the preparation of the PDAI, there was another very recurrent problem, observed from the beginning: “the dilemma between the interpretation of legal aspects and the efficiency of the application of public resources”. For the Public Administration, in the opinion, there is no hierarchy between the constitutional administrative principles.

There is rather a harmony between such principles. In practice, however, the relationship between legality and efficiency is fraught with conflict. There are recursive situations in which the public manager, in complying with the normative precepts, with regard to compliance with the rites and legal proceedings, imputes to the State an inefficiency in the application of resources and the provision of public services.

Sometimes the appropriate normative choice does not present the efficiency necessary for the success of administrative action. In such cases, which choice should prevail: (1) whichever is most efficient; or (2) the one that brings greater legal certainty? What is the margin of interference of internal and external control bodies (PGDF, CGDF, TCDF), within the scope of their judicial control, in cases of conflict of these principles?

We can observe, in the processes related to the PDAI, both in the formulation, and in the elaboration, as in the implementation: of the actions, projects and programs of this public policy (the PDAI), that the questions of the control bodies, on each of them, extrapolated the aspects: legal, accounting, budgetary and normative issues, interfering in the scope of the technical procedures of management and methodological of the public policies themselves , for the realization: of hiring, the preparation of technical studies, investigations, analyses, evaluations, etc.

Such interferences, removed from those that were really inconformity, culminated in the recursive delays of deliveries and procedural rites, generating (at least), loss of time for the transformation of Brasília into a national area of attraction of productive investments. The loss of time, due to the requirements imputed by the control bodies (not always legitimate), in the name of the administrative constitutional principle of legality, would be reflected in extra costs for the value of the loan, since the credit operation, or would be extended, or completed without the correct execution of the actions, projects and programs, related to the attraction of investments of this credit operation , attraction of investments.

This supposed dilemma, there is always a solution obeying the principle of legality, without any punishment for the public agent of the control body, if there is, proven, waste of public resources.

And, if by chance, the agent responsible for the management, act, against what is provided for in the standard, although proven efficiently, in favor of the economy of public resources, aiming at social welfare, the public interest and based on good faith, he will be punished with the rigor of the norm that he has failed.

It should be noted that the international legislation provided for in the international credit operation agreement between the IDB and the GDF, in order for the contracts related to this credit operation to be carried out in a more flexible and rapid manner, never took place, due to the lack of consensus in the application of the international standard. Because of this we have inefficient performance with regard to hiring time.

The suggestions of the GDF, in particular, with regard to the component of attraction of investments, were in the sense of reevaluating the system of internal control over the procedural rite and the applicability directly of the proposed legislation, received and signed in the international credit operation contract. In addition, that the control bodies be limited to the scope of their respective analysis, rather than analially extrapolating the limits of their attributions.

Another issue addressed in the article in this section of the Public Policy of Attraction of Investments, is that the government programs for attracting investments, from the implementation of the PDAI, should adopt the guidelines and consist of the applicant: identification, selection, choice, feasibility of execution and certification, of essentially innovative projects aimed at both the promotion and economic development of local productive arrangements (APLs) or Local Commercial Arrangements (ACLs) of the Federal District , as for attracting productive investments, in these arrangements, or linked to them.

These projects, related to this program, will preferably be low cost, highly efficient, promising and have as scope a related business: the alternative solution of problems, or execution of economic activities complementary to existing ones, that is, observing the efficiency of Kaldor-Hicks (lower costs than the benefits) for APLs (or ACLs).

To ensure the good performance of these projects, in addition to the rigid selection of projects, the government with the support of the productive sector, will monitor for a period, the chosen projects that will undergo a maturation process, that is, through coordinated actions of the government, supporters and mentors, that is, such projects will receive technical support and will be monitored and evaluated pari step , until they are able to receive the program’s certification seal.

On the one hand, the supporting institution will provide the physical structure and technical and scientific support, during the maturation period, for the execution of the selected projects. On the other hand, accredited mentors may, in person or remotely, promote direct advice to assist in fine-tuning the business of each enterprise. The GDF will certify the best designs.

With the implementation of this program, the chance of attracting good projects that aim to generate employment and increase and distribute income, in the Metropolitan Region of Brasília, especially in the APLs of df is increased.

Later, in the process of maturation of these projects, the Makers, whose projects were selected, will execute them with technical support, in an appropriate structure provided by the supporter (contracted by the government) and with the help of the mentors (previously registered in the GDF).

In addition to the periodic holding of events with the purpose of attracting investments and promoting such projects of APLs (or ACLs) and the economy of the Federal District as a destination for attracting productive investments.

Thus, it is intended that the level of attraction of investments to the Federal District, economic sustainability of the region, generation of employment and income, are gradually higher, over the next few years.

Finally, this model intends to be adjusted and disseminated as a public policy of economic development, also to combat the crime economy in those areas that are in a situation of violatibility, with potential reaction by public investments, or in criminal spots.

5. EXPECTED RESULTS

One of the expected results is that the primary production of relevant data and technical information on the Local Economy with a focus on Attraction of Investments that was produced with the realization of relevant studies and investigations on the local and regional economy during the preparation and formulation of the PDAI is incorporated in a hard-hitting way to government knowledge. This information is crucial to emanating the makers of the RMB’s political decisions.

Another expectation is that with the PDAI, the APLs, they would become part of the public policies for attracting investments and from this, any actions, projects, programs, or plans of the Public Policy for Sustainable Productive Development of the Federal District, PPDPS-DF, contained aspects of attracting productive investments to the RMB, especially in the APLs listed.

The PPDPS-DF is provided for in the Law of Ecological and Economic Zoning of the Federal District, district law of the ZEE-DF, the idea of the PDAI would be the obligation of, at least one chapter, of attracting productive investments, to contribute to the transformation of the RMB into an area of national relevance to the destination of productive investments, observing which of the economic activities are more recommended for subzones and areas of productive production.

Thus, it is also expected that the paradigm of public policies of economic development based on the fiscal war is transposed, taking advantage of the economic vocation, with the new ventures and the productive improvement of the APLs, higher level of employment, innovation, governance and sustainability, increase and distribution of income of the RMB, through the smart incentive, the achievement of effective economic development would also be one of the expectations for the coming years.

Since the performance monitoring of this policy will be carried out by government technicians and that this will be configured as a public policy of state, because of the joint effort of the actors (Government, Private Initiative and Civil Society), the expectation is that RMB will be a national area of attraction of productive investments, in the next 30 (thirty years).

6. CONCLUSION

A different conception about the public policy of economic development of the Region of Brasília emerges, with the formulation of the PDAI. It brings the methodology based on economic theory, technical studies, investigations and research and observing a successful model already implemented in China, to promote the elaboration and formulation of this public policy, based on “Clusterization” as proposed by several experts.

This plan has as its central objective, to minimize the socioeconomic problem identified in the RMB, that is, accelerated population growth, increased concentration of income and stagnation of GDP in recent years. With the simultaneous occurrence of these 03 (three) factors, public services are extremely affected. As time went by, the government raised less because there was a drop in production and the poorest population increased, at an even higher rate, because of the high concentration of income.

Taking into account the characteristics and peculiarities of the RMB, the competitive advantages and a series of customized items for this type of analysis this policy, changes and transposes the traditional methods of government public policy to attract productive investments in the Brasília region, which now aims to transform the region into a national area of attraction of productive investments based on shenzhen’s successful model , involving all economic agents in the process (government, private initiative and civil society).

Starting from the modernization of brazil’s investment attraction legislation, conducting a series of technical studies, establishing a permanent commission to elaborate the PDAI, including it in the sustainable productive development policy of the ZEE-DF and promoting actions, projects and programs towards the transformation of this metropolitan area into a national area of attraction of productive investments.

In addition, with the creation of the National Agency for Attraction of Investments and the promotion and realization of recursive events on this in the Region of Brasília, probably in the next 30 (thirty) years the improvements in socioeconomic indexes will be easily noticed.

The greatest difficulties were: (1) the organizational culture of the Federal District government to elaborate and formulate a long-term public policy. It was not customary to do this based on technical studies, investigations, analysis of secondary data, production of primary data and technical debate to gradually define the detailed steps, through a long schedule of implementation and monitoring of this policy; (2) the conflict-riddled relationship between legality and efficiency in recurrent situations where the public manager, in complying with the normative precepts, imputes to the State an inefficiency in the application of resources and the provision of public services; (3) the difficulty of implementing a proposal different from those that state and municipal governments follow as mainstream solutions: exemption from taxes, economic or credit benefits.

However, from the implementation of this district plan, the RMB, is able to become a national area of destination for attraction of investments, because it brings together a series of characteristics and peculiarities favorable to the implementation of large enterprises.

With the PDAI, the APLs that are the epicenter of economic activity can, with the participation of economic agents (entrepreneurs, government and civil society), gradually become large centers of economic activity and business destinations, generating employment, income and sustainability for the region’s economy, minimizing both the socioeconomic problem identified and that related to the matrix of the region’s economy (highly related to the government economy) that makes it susceptible to fiscal crises to a greater degree than other Metropolitan Regions of Brazil.

7.REFERENCES

ADNER, R. Match your innovation strategy to your innovation ecosystem. Harvard Business Review, 2006. v. 84, n. 4, p. 1-12.

ALONSO W. Location and land use. Cambridge: Harvard University Press, 1964.

ALVES, M. A. da S. Guerra fiscal e finanças federativas no Brasil: o caso do setor automotivo. 2001. 111 p. Dissertação (Mestrado em Economia) – Universidade Estadual de Campinas, Campinas, 2001.

ARTHUR, W. B. “Increasing Returns and the Two Worlds of Business”. Harvard Business Review, July-August 1996.

BRASÍLIA. Tribunal de Contas do Distrito Federal. Auditoria Integrada: Programas de Desenvolvimento Econômico (PRÓ-DF II e IDEAS Industrial). Processo TCDF Nº 5018/2015-e. Brasília, DF, Sessão Ordinária Nº 4999, de 09/11/2017, 2016. Disponível em: https://www.tc.df.gov.br/wp- content/uploads/2019/06/Relat%C3%B3rio-Final-e-Decis%C3%A3o-5018-15.pdf . Acesso em: 12/08/2020.

CASSIOLATO J. E.; LASTRES M.H. O foco em arranjos produtivos e inovativos de micro e pequenas empresas. In: Lastres M H; Cassiolato J. E.; Maciel M. L. (Org.) Pequenas Empresas: cooperação e desenvolvimento local. Rio de Janeiro: Relume Dumará. 2003, Pg. 21-34.

CASTRO L H. de. Arranjo Produtivo Local, Brasília, SEBRAE, 2009.

CHRISTALLER, W. Central places in Southern Germany. Jena Alemanha: Fischer (tradução para a língua inglesa por C W Baskin, Londres: Prentice Hall, 1966), 1993.

DINIZ, C. C. Desenvolvimento poligonal no Brasil: nem desconcentração nem contínua polarização. Nova Economia, Belo Horizonte, 1993. v. 3, n. 1, p. 35-64.

DIXITI A. K. E. J. E. STIGLITZ. Monopolistic competition and optimum product diversity American Economic Review 67, 1977. (3): 297-308.

FERREIRA FILHO, M G. Curso de Direito Constitucional. 38. ed. São Paulo: Saraiva, 2012.

FERREIRA, Sérgio G. Reforma tributária Guerra fiscal: competição tributária ou corrida ao fundo do tacho? Informe-se, n. 4, jan. 2000.

GICO JR., I. “Introdução ao Direito e Economia.” In: Timm, L. B. Direito e Economia no Brasil. São Paulo, SP: Editora Atlas, 2012.

HENDERSON J.V. The sizes and types of cities, American Economic Review 64, 1974. 640-656

JACOMETTI, M.; de Castro, M.; GONÇALVES, S. A.; COSTA, M. C. Análise de efetividade das políticas públicas de Arranjo Produtivo Local para o desenvolvimento local a partir da teoria institucional. Revista de Administração Pública-RAP, 2016. v. 50, n. 3, p. 425-454.

LOSCH A. The economics of location. Jena Alemanha. Fischer, 1940. (tradução para a língua inglesa, New Haven, CT: Yale University Press, 1954).

MILLS E. S. An Aggregative model of resource allocation in a metropolitan area. American Economic Review, 57: 197-210, 1967.

MODESTO, Paulo. “Notas para um Debate sobre o Princípio Constitucional da Eficiência”. Revista Eletrônica de Direito Administrativo Econômico, Salvador, Instituto Brasileiro de Direito Público, nº 10, mai/jun/jul, 2007. Disponível no site:

http://www.direitodoestado.com/revista/ . Acessado em 11/6/2013.

MOORE, J. E. Business ecosystems and the view from the firm. The Antitrust Bulletin, 2006. v. 51, n. 1.

MOORE, J. E. Predators and prey: a new ecology of competition. Harvard Business Review, 1993. v. 71, n. 3, p. 75-83.

PERIUS, K. C. G. A concessão de incentivos fiscais estaduais e a nova lei de responsabilidade fiscal no federalismo brasileiro. 2002. 87 p. Monografia (Trabalho de Conclusão de Curso de Direito) – Universidade do Vale do Rio dos Sinos Unisinos, São Leopoldo, 2002.

PIETROBELLI, A. C. A. Evolução de regimes tecnológicos dos distritos industriais: Itália e Taiwan. In: Lastres H M M; Cassiolato J E; Maciel M L; (org) Pequena Empresa: cooperação e desenvolvimento local. Rio de Janeiro Relume Dumará, 2003.

PITANGUI, C.P., TRUZZI, O. M. S., & BARBOSA, A. S. Arranjos produtivos locais: uma análise baseada na participação das organizações locais para o desenvolvimento. Gestão & Produção, 2019. 26(2), e2579. https://doi.org/10.1590/0104-530X-2579-19

SILVA JÚNIOR A. Z. Hierarquia Principiológica Constitucional. Revista Jurídica Unigran, Dourados, 2008. v.10, n.20, p. 55-65.