ORIGINAL ARTICLE

OLIVEIRA, Francisco das Chagas [1]

OLIVEIRA, Francisco das Chagas. Informal Market, Economics and Public Policies. Revista Científica Multidisciplinar Núcleo do Conhecimento. Year 05, Ed. 02, Vol. 04, pp. 61-92. February 2020. ISSN: 2448-0959, Access Link: https://www.nucleodoconhecimento.com.br/law/informal-market

SUMMARY

This work aims to present the problem of workers, the market and informal activities as well as their relations of impact on the economy, and consequently in the analysis of public policies already carried out eventually or even those that still need to be implemented in the face of the issues addressed. The main focus of this research is to understand the reality of the informal market focusing mainly on the improvement and formalization of these activities, aiming to point out possible solutions and even possible unnecessary bureaucratizations of the current system and the means of formalization of these activities, also exposing the social and economic benefits, and the various classes of workers involved, as well as a possibility of favoring by the government through the tax authorities. In addition to the above, this research analyzes the informal sector of the economy and some specific professions, its definitions and historical-cultural realities, its viability of legalization and governmental positions throughout history and especially nowadays. The type of research carried out is predominantly bibliographic using the statistical method, which means of research data carried out by various competent agencies considering the last years, based on an argumentative and exploratory descriptive analysis. The result was a survey of the labor market and the informal economy in Brazil in recent years, its current political reality and the public policies applied and which can still be applied in the coming years, whose changes are necessary for better economic and social effectiveness. In the conclusions, it is suggested possible measures and public policies of solutions to the problem of the informal market and the Brazilian economy, focusing mainly on the major urban centers of the country.

Keywords: Informal activities, legalizations, economics, public policies, government positions.

INTRODUCTION

This research begins to reflect on the unusual activities being illegal, however, it is an illegality widely accepted by the society that in turn sustains these activities, consuming its products and even services provided. It is also worth mentioning initially that there is obscurity when it comes to distinguishing this concept and its real activities since some people immediately identify informality as some kind of marginality or even criminal practices such as the sale of illegal products or simply not provided for by law (NORONHA, 2003). On the other hand, the public authorities themselves are quite indifferent to this reality, since it has never been able to contain or even failed to implement public policies that effectively regulate these activities and professions more extensively.

It was mainly analyzed its growth together with the major urban centers of the country and its unfavorable condition since they remain marginalized for decades and even centuries of existence. Therefore, this investigation sought to analyze the different realities and even trajectories of some professionals and activities not yet legalized by the public authorities, highlighting some of them such as so-called street vendors, street vendors, illegal fairers, among others, in order to identify factors that favor and disfavor their existence, as well as the possibilities of formalization before the public authorities or even other public policies that can be implemented.

Thus, in order for the discussion around informality to take place, it was necessary to analyze in its entirety the informal economy, taking into consideration its definitions, causes, effects and contexts, as well as the process of transition from informality to formality (DE SÁ PASCHOAL et al., 2013). Informal work and informal activities in their entirety, despite being outside the legal control, are instruments of movement of goods and values that in a way stimulate certain sectors of the formal production of the economy, moving great values. In view of this reality, the need to facilitate its formalization is highlighted, thus bringing the follow-up and direct participation of the State.

It is also important to highlight that formal work has its origin in informality, because if we consider a historical trajectory, the legalization or formalization itself was based on the need that there was initially something in nonconformity or that needed to be regulated. Added to this reality is the situation of Brazilian workers throughout history, considering the processes of industrialization and growth of large urban centers linked to the regional inequalities that already exist in the country, and also the great process of rural exodus and internal migrations that intensified in the seventies and following that initially focused on the southeast region of the country , but then directed to other urban centers, especially the capitals.

These occupations of the public space for work and for the formal activities took place due to the absence of public policies for these sectors that remained marginalized, because the State was inert, but some workers and liberal professionals decided for the sake of survival, to act in some way to meet their primary needs in the face of the institutionalized economic system.

Therefore, even though these activities are considered illegal before the State, it does not excuse its responsibility to act seeking solutions to the problem that had originated due to other social problems that were also not addressed, such as: education, regional inequalities and distribution of employment and income, whose problems, caused internal migrations, generating even more violence and inequalities in the face of this state inertia over decades. Proving the previous facts, this is revealed by the Monthly Employment Survey (Pme), of the Brazilian Institute of Geography and Statistics – IBGE (2015), that the 1990s were marked by relevant changes in the Brazilian labor market as well as in the economy, generating significant growth in informal trade. Also, along with the changes, the reduction of salaried workers with a signed license and the increase of people without a license, working in an unregulated manner and on their own.

A large and significant percentage of Brazilian workers and entrepreneurs operate to the present day in informality, and this beyond what we can deduce. It is a growing sector, being a reality mainly of the major cities of the country, since they provide this favorable dynamic between sellers and consumers in the face of unemployment and taxes charged.

1. INFORMALITY, STREET TRADE IN GENERAL

Informality is not only a problem for large Brazilian urban centers, but its size is world-class, affecting mainly the poorest and developing countries. According to Castells (1999), a new form of social and economic organization of work emerges with informality, pointing to a decentralizing administration of organizations and individualization of increasingly personalized markets, fragmenting societies and work. In the case of Brazilian workers, once acting in informality, they are not entitled to access mainly to the benefits of labor and social security legislation, in addition to others. Therefore, there is no signed work permit, as there is obviously no employment contract or social security contributions and the FGTS (Service Time Guarantee Fund).

In the case of formal companies, there are no similar contributions for the benefit of their workers, besides the non-payment of several other taxes as they are paid by the formalized companies, which obviously generates a non-gain of revenue to the disfavor of the public office.

In the major urban centers of the country we can find the unusual sellers everywhere. Not only in the streets of the center of the big cities, but, they can be found on public transport, such as: buses, trains and subways, although in public transport a more rigorous supervision is carried; the need is greater than being sanctioned, as it is common for guards working in public transport companies to be seizures.

For these workers, the main advantages of acting in informality is the fact that it is a way that people have to obtain income and at the same time, the possibility of obtaining a better income, besides the fact that they can manage the day-to-day free time, a reality that does not occur working in private and formal initiative. Moreover, in addition, the discounts made on a formal worker’s salary are often so significant that people began to realize that they could have more income by opting for informality, since some of these discounts, as in the case of the social security contribution, the worker can choose to do it autonomously and may have access to any benefits of a formal worker.

There are also disadvantages in working informally, and perhaps the main one being the lack of fixed income, a fact that can result, even, in a lack of access to credits and financing offered by banks and financial institutions, in addition to other government programs for access to credit, which in turn limit this access to workers who have registration in the Work And Social Security Card (CTPS). Even if this class of workers suffers several prejudices, many of them, especially informal employers are true entrepreneurs, and move a significant portion of the economy, even influencing the formal economy, since they are free from the high tax burden imposed by the government.

Unemployment is one of the main factors responsible for the warming of this work option. According to data from DIEESE (Interunion Department of Statistics and Socioeconomic Studies), a survey conducted in 2012, almost half of the population occupied in metropolitan regions of the country is in the condition of informality, understood as a situation of non-social and state protection, because as already addressed, these workers do not have the protection of labor and social security legislation, being outside the public power. (1)

A true history of resistance, informalities and their workers seek survival in the face of unemployment, where many alternatives available in urban centers are the possibility of work without registration (informal), others seek the street trade, not leaving out the trade and sale of drugs, prostitution, garbage recycling, among others. Some seek the difficult path of legality, accepting low wages in domestic services, working on hourly wages or even with a low percentage of commission on sales.[2]

2. PROFILE OF WORKERS WORKING IN THE INFORMAL MARKET

As for the current profile of the formal workers, it is no longer a constant as in previous decades. They are workers who may have a lower or a higher level of education, considering that with formal unemployment on the rise, many somewhat skilled workers have also resorted to this type of work to ensure their livelihood and their families, and there are many types of formal jobs such as: street vendors, street vendors, fairmen, fairmen, car washers, etc. , in addition to workers who have no record, such as: masons, plumbers, electricians, etc. (ALONSO, 2020).

A relevant fact to be mentioned is that the social profile of workers working in the informal market, in its entirety, is strictly linked to a reality of previous exclusion, that is, the current insertion in this reality was derived from another reality of exclusion that had not been previously solved by the public authorities. There is an immense contingent of workers throughout the country whose activities are in informality, that is, stripped of any legal regulation or control by the government, and this group is classified as an informal sector, which in turn occupies a relevant part of the Brazilian and Latin American economy.

Initially, the reality of northeasterners stands out that due to severe and prolonged droughts in the northeast region of Brazil, this is allied to the lack of governmental action, which during the sixties, seventy and following migrated mainly to the large centers of the southeast region of Brazil, mainly to the cities of Rio de Janeiro and São Paulo. Already penalized by the lack of education and professional qualification required in these large urban centers, many of these workers found the way to support their families through informal employment and over the years, some managed to start informal businesses, such as opening a small grocery store in the garage, a bar and so on.

Following the case of northeasterners and relevant similarities, in recent years Brazil has also received several immigrants from various parts of the world, due to political crises in their countries and also due to natural disasters, as in the case of Haiti after the 2010 earthquake, as well as wars and internal conflicts in African and Middle Eastern countries. Coming from some countries in South and Central America, such as Peru and Bolivia, many people migrated in large quantities to large Brazilian urban centers seeking work and a better condition to live. One of the main causes of these migrations is poverty, which is also a political issue. Recently, Venezuela, which had suffered an intense internal crisis followed by a large migratory contingent to Brazil, due to the border between the two countries, resulting in a greater growth of workers who resort to both informal work and informal activities of the most diverse.

A recent survey by IBGE (Brazilian Institute of Geography and Statistics), considering data from 2016, revealed that the category of employees without a signed portfolio (10.8 million people) grew 2.7% compared to the previous quarter, representing an increase of 286,000 people. In relation to the same quarter of the previous year, that is, there was an increase of 5.4% representing 552,000 more people working in formally.

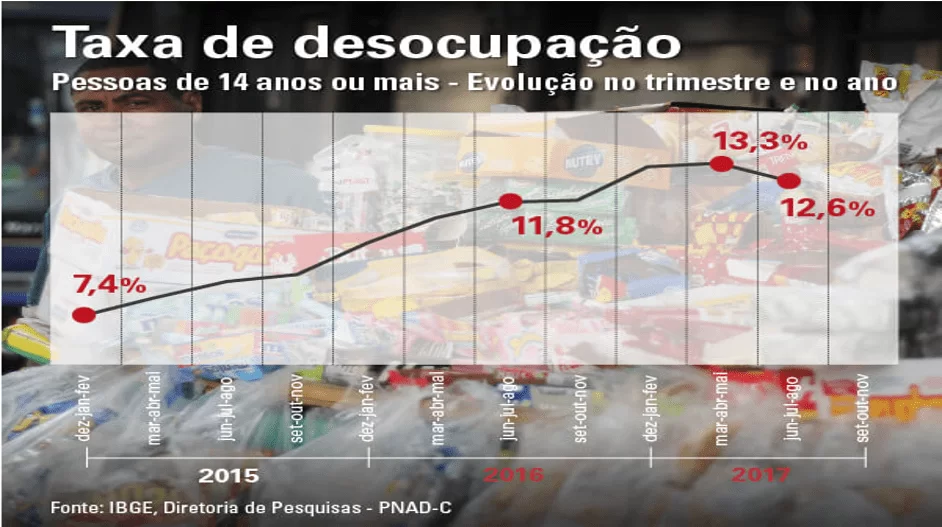

While formal employment remained stable and informal employment grew throughout 2017 and informal employment grew – resulting in a reduction in the unemployment rate over the quarters – the same was not the case in the first months of 2018. The number of employees with a signed work permit (32.7 million) fell 1.7% in the quarter closed in April compared to the previous quarter (November 2017 to January 2018), a reduction of 567,000 people.[3]

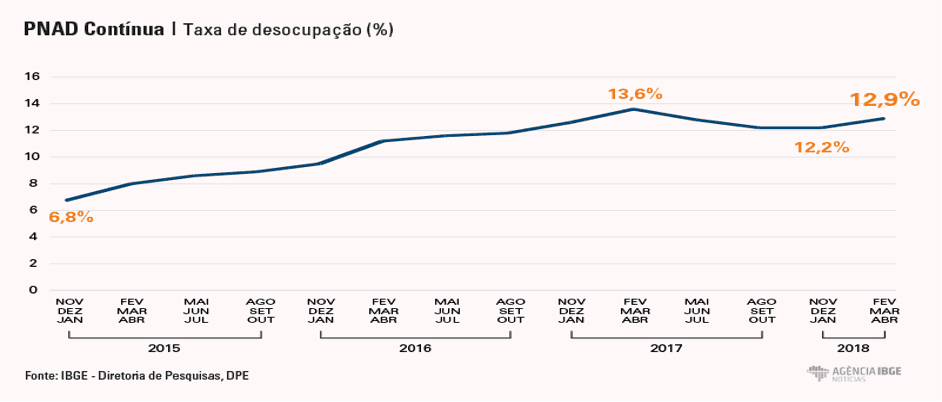

Figure 1: Unemployment rate of persons 14 years and older – Evolution in the quarter and year.

In addition to the previous and even more recent research, a new research, also conducted by IBGE, revealed that there is a progressive growth of informality in Brazil, according to data extracted from the research that is exposed below. In the same comparison, the employed population had a reduction of 969,000 people (-1.1%), with the most significant decrease among employees with a signed license. The negative situation led to an increase in the unemployment rate, which went from 12.2% between November and January to 12.9% in the quarter closed in April. [4]

Figure 2: Unemployment rate %

It is undeniable that the current crisis has contributed significantly to the increase in unemployment and consequently to the search for formal job vacancies and the development of formal activities by some workers. A reality that has further increased the population of these workers, many of them with a high level of qualification, which is a major setback for our country, even disencouraging the search for qualification by many workers.

Workers who currently seek these formal vacancies are those who cannot allocate themselves to other companies with the same salary level. In addition, there is the possibility of salary gains higher than the national minimum wage, since this is one of the main attractiveness offered by indirect employers, because they will not have spending on taxes of a labor nature.

It is certain that these employers decided to take the risks of both the unlegalized activity and a future labor action asking for job recognition, however, the business activity alone already represents a certain risk depending on the nature of the activity, so for these entrepreneurs, these risks are among many others already faced.

The current profile of workers in the Brazilian informal economy is quite diversified in relation to workers in the previous decade. There is a similarity among all these workers, it is in relation to the issue of the reality of social exclusion in the face of inertia or inefficiency of the Brazilian State.

3. SOME UNUSUAL ACTIVITIES AND OCCUPATIONS

There are countless autonomous professions not yet legalized in our country. Not being different from the formal activities regarding the diversity itis. The objective of describing some of them was to convey a greater extent regarding the discussion now dealt with. Moreover, in describing some activities and professions below, it aims to transmit realities perhaps not well known by the population in general. Finally, writing a little about these professions and activities was in order for each of them to represent so many others existing in our country. It is observed that the emergence of new expressions of this phenomenon were responsible for further expanding the number of formal activities, revealing a greater number of them, one that were incorporated into this heterogeneous range of formal activities (KREIN; PRONI, 2010).

3.1 STREET VENDORS

Perhaps this is the broadest of the informal categories, as it covers several other follow-ups. And as previously described, they are found through the streets, avenues and pants of the country’s big cities. They also operate within public transport, such as buses, trains and subways in these major cities.

The goods sold by these workers are as diverse as possible, such as: various foods, soft drinks, juices and mineral water that in turn are loaded in a steam pack or plastic bags. Even electro and electronic products, including news and facilities coming from the “Chinese world”. They are popularly known as street vendors, whether here in Brazil or in the context of Latin America, occurring only a variety of terms used to describe them.

As their own name already translates this idea, these workers have no fixed place of sale, because they move from one place to another seeking the greater turnout of the public in large agglomerations. They are also easily found in major events such as football matches, concert entrances and weekend parties, as well as numerous other events, which they are there working honestly to make their personal and family livelihoods.

This activity is usually associated with marginal groups who cannot or do not want to sell their products by conventional means. Often fought by government authorities, often coming into open conflict with them, these workers have lived a true history of resistance and survival in the struggle for the fundamental right to work.

3.2 CAN PICKERS AND RECYCLABLE MATERIALS

Living in an even more difficult reality and on the margins of society and a possibility of regulation, waste pickers and recyclable materials live at constant risk to their health. This is due to the handling of a large amount of garbage daily, many of the time without proper protection, because the recyclable material sought is always mixed with organic waste. These self-employed workers play a fundamental and important role in the implementation of the National Solid Waste Policy (PNRS), but unfortunately most municipalities and states do not yet have a program or public policies aimed at recycling and reusing the waste produced.

Tin pickers and recyclable materials, in general, operate in the activities of collecting directly from the streets, avenues and even the dumps of the large cities of the country, disparad them from organic waste, classifying and then selling to other small entrepreneurs who in turn buy these materials to resell to the few industries and factories that reuse them. Thus contributing significantly to a small recycling production chain.

What is a responsibility of a nature and public interest is today left to these workers who in turn are forgotten by the State and society. We highlight the precarious working conditions of these workers, which takes place individually, autonomously and under rain or sun, and although this professional activity of waste pickers of recyclable materials is recognized by the Ministry of Labor and Employment, according to the Brazilian Classification of Occupations (CBO), this did not mean an effective improvement in the living conditions of these workers.

They continue to work in extremely precarious conditions, subject to all kinds of contamination and diseases, and often remove their food from the trash and do not have a kind of support the state incentive. These workers sell large quantities of recyclable materials for a very low price, highlighting that this collection is done by both the elderly and children and adolescents, who are often out of school, in addition to so many other forgotten realities and stories.

3.3 IRREGULAR FAIRERS

It doesn’t seem like a big problem, because those who usually go to fairs where they sell fruits, vegetables and vegetables, besides being able to buy the well-known fira pastries and sugarcane juice, may not wonder if those workers are legalized, that is, whether they have a license / permission from the city to work or not. In fact, many shops with fixed establishments are also in a situation of irregularities.

They stand out in the case of irregular fairchildren who mostly market food, often perishable foods, in this case with a greater risk to public health. This is not just an irregular marketing in itself. What exists is an alarming chain of irregularities in this category, not only in these exceptions, because, since trucks transporting fruits, vegetables, vegetables; mainly, fish and birds should also pass through the supervision of the municipality until an almost non-existent inspection. Surveillance is usually an exception that can be easily extorted by those who gain from this type of trade. It is certain that the level of regulation and supervision varies in each municipality of the federation.

The registration, registration, registration, and other rules for the legalization and work of fairgoers are the responsibility of the municipality, but in general in most municipalities requires in a certain way documentary procedures, in addition to the registration of the fairowner, document that gives him the right to work, includes tests that attest to his health condition to handle the food that will go to the table of consumers. As in the cases already mentioned, there is a very strong culture of acceptance of irregularities in our country, both by society and by the managers of the public thing. An example of this is what currently occurs in the Greater Belém capital of the State of Pará. Currently there are approximately 35 free fairs, 20 markets and seven ports where thousands of small sellers and consumers come daily to the marketing of various products.

Photo 1: Free fair in the city of Belém, capital of Pará.

3.4 PROSTITUTES (OS) AND PROSTITUTION HOUSES

So-called prostitution houses are prohibited in the current legal system, however, prostitution is independently permitted by law. The Ministry of Labor and Employment (MTE) recognized through the Brazilian Classification of Occupations (CBO) one of the oldest professions in the world, which is the profession of prostitute, as described below the CBO 5198:

Titles

5198-05 – Sex professional

Call girl, Call boy, Meretriz, Messalina, Michê, Woman of life, Prostitute, Sex worker.

Description Summary

They seek sexual programs; serve and accompany customers; participate in educational actions in the field of sexuality. The activities are carried out following norms and procedures that minimize the vulnerabilities of the profession.

The legislation considers that prostitution houses for using the exploitation of the body of others should not be legalized or minimally regulated as is the case of prostitutes or prostitutes. A current reality of the large and even small cities of Brazil and also of the world, prostitution is a means of survival of many men, women and families. A millennial profession and although always criticized by many, on the other hand, has always been accepted by so many others, besides being present or represented in all regions of the country. Few countries around the world have had enough courage to regulate whether the profession is autonomous, or its commercial activity, as with prostitution houses.

Disregarding the moral and religious issues that evolve the theme, there are countless women and men who earn personal support, and their families through the sale, or rather, describing, through the rental of the body itself offered for various sexual practices. A major issue that brings up the discussion is the fact that a large part of the population, including various authorities often resort to this type of services, but, for moral and religious reasons in the face of a great hypocrisy existing in our society, are rare to the authorities that deal with the subject. Marginalized over the centuries and throughout their lives, it is highlighted that the fact that from a social point of view, it would be more humane and honest if these workers and workers had greater state support.

The main idea in defending the legalization of prostitution houses is with the objective of reducing the existing discrimination, but the regulation of prostitution as an activity would imply, for example, the payment of tax by these establishments, facts that certainly hinder a possible formalization. Another possibility for this class of workers would be the union of these professionals in cooperatives, with the aim of seeking improvements such as safety and health of these workers who work in a certain way at risk to their health and physical integrity.

They are workers who do not receive due respect either from society or even from the state, whose authorities often resort to these services provided, as in the case of so-called “luxury prostitutes.” In addition, there are many entrepreneurs who work exploiting the prostitution of others, since they do not need to pay taxes to the state, leaving it cheaper to pay bribes to the many public agents who should oversee.

Some countries around the world already admit prostitution as a profession, as is the case in the Netherlands. A solution of social protection, in addition to the permission to create cooperatives or unions of this category, would be the payment of taxes by the existing prostitution houses, thus fitting into the philosophy of liberal politics that in turn has not had moral commitments in the standards of the current society itself.

3.5 SO-CALLED BEAK GAMES AND GAMBLING

Used for enrichment of great bicheiros and politicians, both the game of the animal and the so-called gambling have always moved fortunes in the parallel market. It is certain that some countries understood it to be better if these activities were under state monopoly due to the risks of money laundering and the recurrent involvement with organized crime and drug trafficking. These activities are prohibited in our country, as are the houses of prostitution. In the case of Brazil, the same system could be adopted, since it would generate countless wealth for national development rather than the very high tax burden already paid by society.

The truth is that because these activities are prohibited does not mean that they are not in full activity behind the scenes of legality. A reality of public knowledge from the most ordinary people even of the highest authorities in the country who have greater responsibility and possibilities to change these realities.

Although they have already been discussed at various times in the Brazilian National Congress, these bills that would create a Regulatory Framework of the Games in Brazil (MRJB) have not been able to prosper. Perhaps this is due to the actions of so-called “lobbying” that act contrary to the real interests of society.

The games of the animal not different from the so-called gambling end up employing many workers who in turn are exploited and without labor rights. Something evident is that many businessmen and politicians make millions behind the scenes of this business that has so far failed to regulate, however, is accepted and not questioned by the authorities in general.[5]

4. CONSUMERS OF THE INFORMAL ECONOMY

Not only consumers with a low-income profile, but a large part of the population feeds the informal economy seeking to meet their demands with these products, which are mostly cheaper than those found in the common market, even if they are products of lower qualities, such as the cases of electronic electronic products coming mainly from the Chinese market.

What proves this reality of constant consumers in the informal market, in addition to the acquisition and consumption of counterfeit products with some frequency, was the revelation recently brought (2015), by a survey by Ibope (Brazilian Institute of Opinion and Statistics) commissioned by the National Confederation of Industry (CNI). According to this survey, 75% of participants admitted to buying merchandise from street vendors or informal stores, adding to this, 71% reported that they buy pirated products or imitations of famous brands, always, sometimes or rarely.

Among consumers who bought products from street vendors or informal establishments, 13% said they always buy, 37% said that only sometimes and 25% said they only rarely buy. Among consumers who buy pirated products or imitations of famous brands, whether in formal or informal trade, 13% always buy, 34% sometimes and 24% rarely. The survey interviewed 15,414 people in 727 Brazilian municipalities, revealing a reality even preferably of most Brazilian consumers. [6]

There are several products found for sale in the informal market and although the so-called electros and electronics are the most sought after due to the large price difference, we can also find hygiene and beauty products, cleaning products, in addition to the many foods sold freely on the streets. These consumers do not consider low quality to be an impediment to their acquisition, nor the health risk in relation to food purchased and consumed on the street.

It is important to highlight that the products most sought after by consumers of the informal economy, such as electro and electronics, perfumery and beauty, in addition to others, are that have higher taxes in the formal market, hence the reasons why they arrive with a greater increase to consumers. In other words, these consumers are in a way fleeing taxation and the consequent increase in these products. These consumers are attracted by the low prices of these products, since some objects such as: dvds, clothing, perfumes, computer games etc.). have very high values in the common market (FRANCISCO, 2020.)

The economic reality of these consumers is even partly relevant, however, it is pertinent the cultural issue of acceptance by society that does not consider this type of commercialization as something bad or even dangerous to the health and safety of their families. This increase in consumption in the informal market also reveals a government inefficiency, which in turn was unable to solve not only this, but several other social problems linked, including informality.

In recent years there has actually been an appeal from the authorities, through the media, warning mainly about the risk of piracy, however, this only occurred by pressure and intervention of the production industry of these products. Despite this appeal made to consumers not to purchase products from the informal market, it is possible to note according to the figures of the above-mentioned research that this and other possible appeals seem to have no effect. Considering the taxes tied to these products which in turn are exactly the ones with the highest sale on the parallel market, the population does not consider this behavior as something as serious or even immoral. [7]

5. INFORMAIS COMPANIES AND THE CHALLENGES OF THE TAX BURDEN

Not only the informal self-employed workers, we still have the reality of the formal companies, that is, companies that act freely in the market selling their products and services. In the case of informal companies, the main reason is to get rid of the high tax burden, a survival maneuver in the market. It should be noted that many of these informal entrepreneurs first tried the path of formality, however, due to the failure they ended up opting for this modality.

Another reality that deserves to be highlighted is the comodism of the public power, observed in the provisions of the Brazilian Civil Code, which deals with the regulation of business societies. The Brazilian Civil Code recognizes so-called unregulated business societies or non-personified companies. Considering the company not personified the company whose constitutive act has not yet been registered with the competent body, that is, the competent commercial board.

On the other hand, such a lack of legal personality does not imply that those companies cannot be punished for any irregularities committed. This same rule also applies to the members of this company not yet regulated, as treated in Articles 986 to 990 of the Civil Code. That is, this business reality is recognized by the legislator, but due to state inefficiency it was better to provide for a possible punishment for these companies and entrepreneurs, than to accomplish something more efficient to solve these issues.

Acting in this same direction, the consumerlegislator, knowing this reality and the difficulty of resolution by the public authorities, found it better to protect consumers in the face of these non-regular entrepreneurs and dealt with the responsibility of these entities in relations with consumers by conceptualizing the figure of the supplier, specified in the “caput”, of art. 3. of Law 8.078/90 (Consumer Protection Code), providing for its liability in the form of Article 988 of the Civil Code, in cases of malaction committed by these suppliers, even if not regulated by law. In other words, we can say that these companies do not exist effectively because there is no legal entity created, but, it will be considered their activity even if irregular in case of need for punishment.

This state inertia over the years, in addition to leaving these workers and small entrepreneurs adrift, as mentioned earlier, we have the various public health issues regarding the sale of food and so-called pirated products that in addition to causing security risk, many of these goods are also originated from smuggling and cargo thefts.

It is not a question of the absence of laws, but of the fulfillment of laws already created by the government. Many of them extremely modern and with an innovative vision, however, always applied according to the interest of certain groups that are in management. An example of this is the administrative legislation of Article 37 “caput” of the Federal Constitution, as described below:

Art. 37. The direct and indirect public administration of any of the Powers of the Union, the States, the Federal District and the Municipalities shall obey the principles of legality, impersonality, morality, publicity and efficiency and, also, the following (…).

We can say that there is minimal supervision in large cities, because both the city inspectors and the civil, military and even municipal police always make the so-called “trawlers” through the streets, seizing these goods put to sale illegally. However, these are cases of exception and often due to pressure from already legalized merchants who question the payment of taxes and the loss of sales in the face of irregular trade. It is observed that for decades the Brazilian State has acted only as a punisher, predicting and sometimes executing sanctions on those already punished by the current system, instead of acting as a management state and solving these and other issues of order and public interests.

Another frightening study, also conducted by IBGE in 2015, revealed that the extractive and processing industries cut 642,138 jobs, forming a total number of closed companies of 325,277. According to the same survey, these industrial companies employed 8.2 million workers in 2015 in 2014, were 8.8 million employees. [8]

About micro and small companies, which in turn employ a large part of the formal workers in relation to large companies, we have numbers that are not of a recent reality, but are of a continuous reality in Brazil, that is: they are also penalized by the issue of bureaucracy and the tax burden, although these companies have received differentiated tax treatment in recent years , more than half of them still close in the course of less than four years, and according to SEBRAE (Brazilian Service for Support to Micro and Small Enterprises), one of the main reasons is the mismanagement of small entrepreneurs. This study was conducted in 2013 by SEBRAE Nacional and pointed out that 24.4% of these micro and small companies end their activities with less than two years of existence. Another percentage of the same research indicates that this number can reach 50% in establishments with less than four years of activity. [9]

Although the SEBRAE study points severely to the issue of mismanagement of these small entrepreneurs, the system of opening companies still requires excessive bureaucracy, and adding to the opening expenses with the issue of the aforementioned taxes, it is not surprising that many of these companies end up closing, reasons why many of these small and medium entrepreneurs, after trying the formal means provided for in the law , end up giving up and resorting to informal activities.[10]

6. CURRENT SYSTEM OF CREATION AND REGULATION OF COMPANIES

Complementary Law No. 128/2008 that amended the General Law of Micro and Small Enterprise (Complementary Law No. 123/2006) creates the figure of the Individual Microentrepreneur with the object of facilitating and debureaucratizing the work of these small and medium-sized entrepreneurs. Basically the current system of creation and regulations of companies in Brazil is predominantly under the responsibility of municipalities. Still loaded with unnecessary bureaucracies and corruption among many of the public agents, the current system ends up punishing many times those who want to work within the parameters of the law, in addition to those who have no option to work informally, depending on the nature of the activity, considering, for example, the possibility of a future and eventual need to claim the benefits of law 11.101/2005, known as the law of bankruptcies and recovery of companies. In addition to other modalities that are unfeasible to operate in the informal modality, as in the case of large companies.

The bureaucratic process of creating and regulating companies varies according to the type of company and activity that is intended to be exercised. In this case, micro and small enterprises are more favored, in addition to the new modality of micro and small individual entrepreneurs. But this does not mean that these professionals do not have to go through delays and bureaucracies still existing in the current system, whose bureaucracy contributes to the disincentive of formality.

In summary, it is observed that in recent years the legislation regulating so-called micro and small enterprises has been very favorable to micro and small investors, needing only to be improved in terms of implementation mainly in the bureaucracy item. Some of the main benefits achieved were: a simpler and less bureaucratic process of creation and regulation; the possibility of micro and small entrepreneurs access the special court, with exemption of lawyers for actions of up to 20 minimum wages; differentiated taxation in many respects, among many other benefits.

6.1 SOME CHALLENGES FACED BY ENTREPRENEURS

According to Dornelas (2008), “The entrepreneur is the one who makes things happen and anticipates the facts and has a future vision of the organization.” (DORNELAS, 2008, p. 1). However, in the Brazilian scenario, this task is not easy because it is no secret that every entrepreneur is large or small, face many difficulties and challenges both in the process of creation and in the conduct of their business. Being an entrepreneur in Brazil is not an easy task at all. Similarly, one of the major problems for the creation and progress of companies is the initial and continuous bureaucracy of procedures, such as payments of fees and taxes, in addition to the presentation of documents, guides, records in notatories and etc.

The one who tries to work properly ends up being extremely penalized as if he were serving a sentence or penance. This reality does not approach those who decided to act irregularly, as previously demonstrated, because this is the reason why most of these companies have opted for informality.

Another great rival of the entrepreneur is the difficulty in relation to the taxes to be paid even before the company is opened and especially after its opening and operation. The tax and tax legislation in Brazil is extremely severe with those who decided to take the risks of entrepreneurial activity. We have municipal, state and federal taxes that must be paid continuously, and the failure of this payment can lead the enterprise to punishments and crashes. An example of this is the differentiated collection of ICMS in the various states of the federation and that has generated in recent years the so-called fiscal war between States and Municipalities, revealing at another moment our state inefficiency in relation to excessive taxes.

The so-called expensive and also unqualified labor to the competitive market is also one of the main complaints of entrepreneurs. With the current and much questioned labor reform the labor price issue seems not to have been a favorable way out for both workers and employers who are faced with many uncertainties in the current market. The issue of qualification of this workforce is also questioned by those who want to efficiently develop their business in the country, generating a sum of uncertainties, in addition to the risks of the very nature of the business business.

6.2 POSITIVE PRACTICES IN SOME STATES

Some cities because they could not order or contain the wave of informality, they chose to live without major conflicts with the volume of sale and demand for goods sold in the parallel market. An example of this, we have the famous Rua 25 de Março in the capital of São Paulo. In the great Recife, the same occurs on Av. Conde da Boa Vista, although it is not the only point of sale of this city, since it disputes with many other streets, avenues, sidewalks and squares of the same city. Realities like this are common in all the capitals of the country, such as in Rio de Janeiro, Fortaleza, Porto Alegre and many other cities that do not have dominion over this social reality (ROCHA, 2006).

Some cities such as Boa Vista in Roraima and Feira de Santana, Bahia have given up spaces where these entrepreneurial workers can market their goods, and in some cases they are only charged for the rental of the respective space, but charging only a small fee, not exactly in the amount of a commercial rent. In a way, an incentive for these small traders, even if it is not a legalization in short.

One of the small improvements in the case of the city of Boa Vista, brought by venezuelan immigration was the reduction in the value of the daily paid to self-employed professionals in hotels and inns, although it is a small aid, it is highlighted that it is offered by private individuals and not the government itself. However, with a lot of cheap labor available, employers are offering precarious working conditions, with values of R$ 10 for a day’s work on a farm or R$ 20 to R$ 30 for a mason’s daily rate – when the average for this type of service among Brazilians is about R$ 100.

In the case of Rua 25 de Março in the center of são Paulo, its beginning, in the 80’s, when it was still located in Praça da Bandeira and was known as Feira do Rolo, the trade developed, changed places and today is in a prominent position, as it is well known and sought after by thousands of consumers. Considered even a tourist spot in the capital of São Paulo.

Photo 2: Self-employment was the option found by immigrants who cannot get a job in the capital of Roraima.

In addition to the cities of Boa Vista, Fortaleza and São Paulo already mentioned, Manaus and Belém, in the northern region of Brazil concentrate large workers and free fairs that are not regulated. This reality is not different in the other regions of the country, in the capitals and large cities and Brazilian metropolitan centers. In some ways, a culture of informality has been created that is widely accepted by the population who consume these products and services, and by the government that has been inefficient and ineffective over the years of management among the various governments of different political positions that have managed the country in recent decades.

7. PUBLIC POLICIES AND GOVERNMENT POSITIONS

7.1 PUBLIC POLICY

It is initially worth mentioning the concept of public policies that in turn depend on the current management and governmental will, as described by Teixeira (2002, p.2), public policies are:

[…] guidelines, guiding principles of action of the public authorities; rules and procedures for relations between public power and society, mediations between actors of society and the State. In this case, they are explained, systematized or formulated in documents (laws, programs, financing lines), guide actions that normally involve applications of public resources. However, there is no compatibility between interventions and declarations of will and the actions developed.

In view of the great and controversial challenges that deal with the theme addressed and already addressed before, we have had some positive practices such as the legalization of former turkeymen in the city of São Paulo. At the national level, several public policies have been carried out for micro and small entrepreneurs, as expected since the federal constitution promulgated in 1988.

After years of struggle and marginalization, in mid-2003 the municipality of São Paulo finally decided to legalize the turkey men. It is certain that the city faced a major public transportation problem that did not meet the demands needed for the largest city in the country and South America. There were thousands of vans and vans that ran illegally through the city, in addition to buses in precarious conditions that provided these services daily to the population, who in turn found themselves massacred by the regular transportation. In addition to the long interval time between vehicles we were one of the great criticisms of the population.

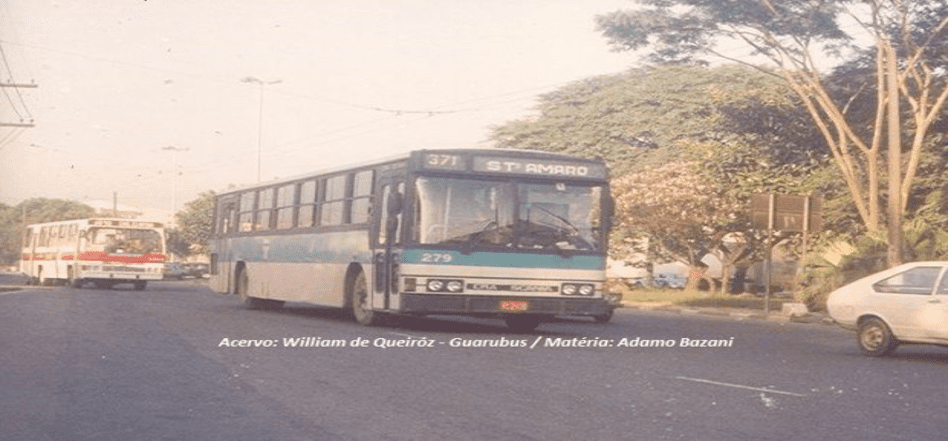

Figure 3: Photo Used vehicles came from regular systems from various regions

The news reports were constant and almost daily, in which they reported accidents involving illegal transport, in addition to the constant social pressure for better means of transport and by the turkeymen themselves who were demanding permission to work regularly in the face of public managers who were under pressure to solve the evident demand.

Many of these turkey men were unemployed, especially those who used to work in the industry and construction, after losing their jobs, used the amount of compensation to buy old vehicles from their own regular companies, and began to try their luck, due to the high demand for transportation from the capital, which eventually had to cede legalization. Although much was questioned in this regard, this category today acts in a legal way and there were many benefits provided both to these workers, as well as to society and also the State itself that has benefited from the proper taxes and a better provision of transport services.

As for micro and small enterprises, the current Federal Constitution already provided for in article 179 a differentiated treatment of micro and small enterprises, but this provision depended on legal regulation, which in turn had only occurred in recent years, as transcribed below the said article:

Art. 179. The Federal Government, the States, the Federal District and the Municipalities will dispense micro enterprises and small businesses, thus defined in law, differentiated legal treatment, aiming to encourage them by simplifying their administrative, tax, social security and credit obligations, or by eliminating or reducing them by law.

Highlighting some significant changes, in 2007 was published complementary law 127/2007 that instituted some improvements in the General Law of Micro and Small Enterprises (LGMPE). One of the positive changes brought by said complementary law was the possibility of certain companies in the service sector collecting taxes in the form of the national simple, in addition to changes such as the exclusion of micro and small companies from the collection of ICMS (Tax on Operations related to the Circulation of Goods and Provision of Interstate and Intermunicipal Transport and Communication Services).

In addition, a differentiated and simplified treatment was finally determined for microenterprises and small companies in public procurement of goods, services and works, within the scope of the federal public administration, among other favorable modifications also implemented with the same law.

Another favorable highlight for micro and small entrepreneurs was the edition of law 139/2011 that adjusted the ceilings of annual gross revenue in favor of the opters to The National Simple; defining that exporting companies could earn revenues in the foreign market up to R$ 3,600,000, without losing the framework. Also in 2011, Law 12.441/2011 was sanctioned, allowing the constitution of the individual limited liability company (EIRELI), a major innovation implemented within the scope of Brazilian business law.

In recent years, the social security contribution of individual microentrepreneurs has been reduced from 11% to 5%; the Crescer Microcredit Program was adjusted, where public banks could offer financing with differentiated interest, among other positive implementations. There is actually an adaptation to these changes, in addition to some bureaucracies that still make it difficult to implement these very innovative laws, both tied to the current crisis that the country has been experiencing.

7.2 OF GOVERNMENT POSITIONS

The State, which has a fundamental role in a country’s economy, has the legislative capacity to intervene in all sectors, especially those that are strategic, through the enactment of laws and regulations (WHAT CONCEPT, 2015). The regulation and facilitation of the creation of micro and small enterprises can be considered an advance of a relevant nature, since it creates several other possibilities for many workers to act on a regular basis, without being stifled by excessive bureaucracy and high tax burden.

It is true that these small traders still face the period of adaptation of the new changes, since we have in the public sectors of our country a true culture of bureaucratizing the public machine, which hinders advances in several other areas of the national economy. The lack of firm posture allied to the corruption existing in the country, added to the current crisis experiences only aggravates the expansion of the informal economy that in turn has often been pointed out as a factor that further harms the economic growth of a country, since informality has become so strong, in turn, it ends up stifling the formal economy that contributes to taxes , pointing to illegality as a more advantageous way out.

The country currently remains without much international credit in the face of major corruption scandals, added to the low public confidence in political leaders. An unsafe scenario and uncertainties that only further increase illegalities and violence throughout the country. All this leads to an unsolidified economy, where illegality seems to be the best way for those who still manage to risk some economic activity. That is, the absence of a government position is indisputable and this contributes to the country’s entire economic political insecurity.

It is indisputable the implementation of positive public policies in favor of these small entrepreneurs and micro entrepreneurs. However, there is great compliance and lack of interest in dealing with informality, this on the part of the authorities. It happens that it has been too long to address this and other economic issues that affect the country and has become something “rooted” that sometimes most governments who assume power prefer not to face the issue in question, although they recognize the importance of giving effective solutions.

FINAL CONSIDERATIONS

In view of the relevant facts presented, several findings could be made, making it possible to make several conclusions and suggestions for improvements that can be applied or even developed on the theme researched. According to Almeida (2013), as much as they are in search of a livelihood for the family, they can also be the result of a choice of these workers, due to some benefits that this type of work presents.

Moreover, the current crisis that the country has been going through in recent years has evidently contributed to the increase in unemployment and consequently by the search for work and the development of activities on the margins of legalization. This reality has also been experienced by several other developing countries. It was observed that the theme of labor market and informality has been occupying more and more space in national and even international discussions, both political and academic discussions, forming a true social complaint, even indirectly.

It was concluded that informality has been present in the history of the country for decades and that this informality and its workers have emerged and has grown to this day, as a result of other social problems not solved by the managing state, whether in Brazil or in other countries from which we receive immigrants, whose workers have also sought informality as a form of survival. That is, in addition to other issues, informality is the result of a state inefficiency over decades.

Even if not justified legally and morally, some employers, due to the high burden of taxes charged by the current system in some regions of the country, it is still common for some formal employers to keep their employees in informality, even knowing that this may lead to labor expenses in court. Some adopt a system of hiring informally and firing frequently, contributing to the high turnover of the workforce or even offering a salary below the national average, under the claim that it has to pass taxes to the tax man. Regarding this issue, it is observed the fact that the average cost of an employee’s salary added to the various taxes (paid by the employer) is almost always double the salary offered.

Occupations such as can pickers and recyclable materials and those of so-called sex workers suffer the most due to social and state marginalization, due to the fact that there are no effective or ongoing public policies for these classes of workers. In both cases we have an effective risk of physical integrity and health risk of these workers.

An important initiative not yet taken and quite interesting would be the possibility of union between these workers, according to their categories, through labor cooperatives. In addition to the union and strengthening of the classes involved, there would be a clear possibility of negotiating improvements in working conditions vis-à-vis the local government. Considering the waste pickers and recyclable materials that in many cities do not yet exist public policies regarding recycling and environmental issues, these workers could become great public partners, as occurred in the case of turkey workers in the city of São Paulo.

As for micro and small enterprises, although in the latter the country has implemented relevant public policies that facilitated the formalization of these micro and small entrepreneurs, the delay over decades without any changes has created a culture of acceptance both by the government and by these informal workers who have adapted to informality. Even with the novelty of paying less taxes in return for not paying anything, it is preferable not to pay anything, since these workers have already “adapted” to informal life for many years, it has become difficult to follow the new rules.

Finally, it is concluded that the current economic political crisis has contributed significantly to the increase in work and informally activities. However, regardless of the crisis now installed, the delay over decades without solving these problems has become something culturally accepted, both by society and by the public power that continues to be inefficient to solve this and other social economic problems in its entirety. Informality has become a rule and formality is an exception.

REFERENCES

ALMEIDA, Maria Goretti; CARMO, Larissa de Andrade; SILVA, Seffra Renata Ramos. O trabalho informal como alternativa no mundo de trabalho atual. In: IV Seminário CETROS Neodesenvolvimentismo, Trabalho e Questão Social, 2. Fortaleza: [s.n.], 2013. p. 1-18. v. 1.

ALONSO, Suelen. “Emprego informal”; Brasil Escola. Disponível em: https://brasilescola.uol.com.br/geografia/empregos-informais.htm. Acesso em 28 de janeiro de 2020.

BRASIL. CONSTITUIÇÃO, 1988.

BAZANI. Adamo. História: Quando os ônibus clandestinos viraram lotação em São Paulo. 22 de janeiro de 2017. Disponível em: <https://diariodotransporte.com.br/2017/01/22/historia-quando-os-onibus-clandestinos-viraram-lotacao-em-sao-paulo/.> Acessado em: 01/07/2018.

BELTRÃO, Myrian Matsuo Affonso. Trabalho informal e desemprego: desigualdades sociais. 2010. Tese (Doutorado em Sociologia) – Faculdade de Filosofia, Letras e Ciências Humanas, Universidade de São Paulo, São Paulo, 2010. doi:10.11606/T.8.2010.tde-05032010-130328. Acesso em: 30/07/2018.

BRASIL. Classificação Brasileira de Ocupações – CBO. Ministério do Trabalho e Emprego. Disponível em: <http://www.mtecbo.gov.br/cbosite/pages/pesquisas/BuscaPorTituloResult. jsf>. Acesso em: 30/06/2018.

BRANCO. Mariana. Agência Brasil. Maioria dos brasileiros recorre ao comércio informal com alguma frequência. Publicado em 08/03/2015 – 15:44hs. Disponível em: <http://agenciabrasil.ebc.com.br/economia/noticia/2015-03/maioria-dos-brasileiros-recorre-ao-comercio-informal-com-alguma-frequencia> acessado em 27/06/2018.

CORREIO BRAZILIESE. IBGE: Em 2015, 8.462 indústrias fecharam e 642 empregos foram eliminados. 28/06/2017 11h27hs. Disponível em: <https://www.correiobraziliense.com.br/app/noticia/economia/2017/06/28/internas_economia,605549/ibge-em-2015-8-462-industrias-fecharam-e-642-empregos-foram-eliminad.shtml.> Acessado em: 28/06/2018.

CAMBRICOLI. Fabiana. Trabalho informal avança em Boa Vista e cria ‘feira’ de imigrantes. 22 Abril 2018 03h00. Disponível em: <https://brasil.estadao.com.br/noticias/geral,trabalho-informal-avanca-em-boa-vista-e-cria-feira-de-imigrantes,70002278479.> Acessado em: 07/07/2017.

COUTINHO, Rafael. A História do Comércio. 2014. Disponível em: <http://cultura.culturamix.com/curiosidades/a-historia-do-comercio>. Acesso em: 28 de janeiro de 2020. DE SÁ PASCHOAL, Andressa et al. ECONOMIA INFORMAL, 2013.

CASTELLS, Manuel. A sociedade em rede. São Paulo: Paz e Terra, 1999.

CAPUCIO, Ricardo. Microempreendedor Individual: Guia Completo com passo a passo para se tornar um MEI. 2017. Disponível em: <https://conta.mobi/blog/guia-completo-para-se-tornar-microempreendedor-individual/> Acesso em: 25/05/2018.

DECRETO-LEI Nº 2.848, DE 7 DE DEZEMBRO DE 1940.

DECRETO-LEI Nº 3.689, DE 3 DE OUTUBRO DE 1941.

DIEESE – Departamento Intersindical de Estatística e Estudos Socioeconômicos. Pesquisa de Emprego e Desemprego (PED). 2018. Disponível em: < https://www.dieese.org.br/analiseped/ped.html>Acesso em: 25/05/2018.

DORNELAS, J. C. A. Transformando idéias em negócios. 3.ed. Rio de Janeiro: Elsevier, 2008.

FRANCISCO, Wagner de Cerqueria e. “Economia informal”; Brasil Escola. Disponível em: https://brasilescola.uol.com.br/brasil/economia-informal.htm. Acesso em 28 de janeiro de 2020.

IPEA. Instituto de pesquisa aplicada. . Rede Globo. Série Brasil informal. Exibido na semana de 23 a 28 de abril de 2007. Disponível em: <http://wwwYotube.com.br/vídeos/trabalho informal. Acesso em 14/02 S/2009>. NORONHA, Eduardo G. “Informal”, Ilegal, Injusto: percepções do mercado de trabalho no Brasil. Revista brasileira de ciências sociais, Vol. 18 nº. 53. 2003, p.111- 129.

IBGE – Istituto Brasileiro de Geografia e Estatística. 2018. Disponível em: <https://www.ibge.gov.br/>. Acesso em: 25/05/2018.

KREIN, J. D.; PRONI, M. W. Economia informal: aspectos conceituais e teóricos. Escritório da OIT no Brasil. Brasília: OIT, 2010.

______. A OIT e a Economia Informal. Escritório da OIT em Lisboa, 2006.

LEI Nº 8.078, DE 11 DE SETEMBRO DE 1990.

LEI Nº 8.934, DE 18 DE NOVEMBRO DE 1994.

LEI Nº 11.101, DE 9 DE FEVEREIRO DE 2005.

LEI Nº 5.172, DE 25 DE OUTUBRO DE 1966.

LEI COMPLEMENTAR Nº 123, DE 14 DE DEZEMBRO DE 2006.

LEI COMPLEMENTAR Nº 127, DE 14 DE AGOSTO DE 2007.

LEI COMPLEMENTAR Nº 139, DE 10 DE NOVEMBRO DE 2011.

LIMA, Edilaneide Justiniano de. Comércio Informal: um estudo sobre possíveis contribuições na Economia e na Renda Familiar. 79 p. Monografia (Bacharel em Administração de Empresas). João Pessoa/PB – Campus I da UFPB, 2017.

O LIBERAL. Belém tem sete grandes feiras irregulares. 19/07/2018 às 07:28. Disponívelem:<http://www.orm.com.br/noticias/regiaometropolitana/MjMxNzM=/Belem-tem-sete-grandes-feiras-irregulares.> Acessado em: 22/07/18.

PAMPLONA, João Batista. Mercado de trabalho, informalidade e comércio ambulante em São Paulo. Rev. bras. estud. popul. [online]. 2013, vol.30, n.1, pp.225-249. ISSN 0102-3098. Disponível em: <http://dx.doi.org/10.1590/S0102-30982013000100011>. Acessado em: 12/12/2018.

PORTAL DO EMPREENDEDOR. Microempreendedor Individual. 2018. Disponível em: <http://www.portaldoempreendedor.gov.br/> Acessado em: 22/05/2017.

QUE CONCEITO. Conceito de Setor privado. 2015. Disponível em: < http://queconceito.com.br/setorprivado>. Acesso em: 12 de Maio de 2017.

ROGERIO DOS SANTOS, Gildo. Mercado de Trabalho, Economia Informal e Políticas Públicas: BRASIL- ANOS 90. Mestrado Profissionalizante da Faculdade de Ciências Econômicas. Universidade Federal do Rio Grande do Sul – UFRGS. Porto Alegre, 2003, Disponível em: <http://hdl.handle.net/10183/5564> Acesso em 12/06/2018.

Revista Carta Capital. Economia e Mercado de Trabalho. Publicado 29/09/2017 13h41. Disponível em: < https://www.cartacapital.com.br/economia/ibge-trabalho-informal-cresce-e-desemprego-cai-para-12-6-em-agosto> Acesso em: 25/05/2018.

ROSA, A.L.T. (Org.) Economia do Ceará em Debate. Fortaleza, Instituto de Pesquisas Econômicas do Ceará (IPECE), 2006, p.136-156.

SITE TODA MATERIA. Trabalho Informal. Disponível em: <https://www.todamateria.com.br/animais-em-extincao-no-brasil/> Acessado em: 22/05/2017.

SEBRAE – Serviço Brasileiro de Apoio às Micro e Pequenas Empresas. PortalSebrae/sebraeaz/Microempreendedor-Individual. 2018. Disponível em:<http://www.sebraepr.com.br/PortalSebrae/sebraeaz/Microempreendedor-Individual> Acesso em: 20/05/2018.

TEIXEIRA, E. C. O papel das políticas públicas no desenvolvimento local e na transformação da realidade. Revista AATR, Salvador, 2002. Disponível em:<http://www.fit.br/home/link/ texto/politicas_publicas. pdf.>. Acesso em: 11 mai. 2017.

APPENDIX – FOOTNOTE REFERENCES

2. DIEESE – Interunion Department of Statistics and Socioeconomic Studies. Employment and Unemployment Survey (PED). 2018. Available in: <https: www.dieese.org.br/analiseped/ped.html=””>.</https:> Accessed: 25/05/2018.

3. Revista Carta Capital. Economy and Labor Market. Published time: 29 09,2017 13:41 Available in: < https://www.cartacapital.com.br/economia/ibge-trabalho-informal-cresce-e-desemprego-cai-para-12-6-em-agosto=””> Accessed: 25/05/2018.

4. Revista Carta Capital. Economy and Labor Market.Published by 05/29/2018 10:26 am. Available in: <https: www.cartacapital.com.br/economia/desemprego-segue-em-alta-e-atinge-12-9-em-abril.=””> Accessed: 25/05/2018.</https:>

5. An English term that literally means “vestibule” or “antessala”, but refers to the organized person or group that seeks to influence procedures and acts of public authorities such as the Executive, the Legislature and the Judiciary. This activity developed particularly in the United States Legislature, where it was regulated in 1946.

6. An English term that literally means “vestibule” or “antessala”, but refers to the organized person or group that seeks to influence procedures and acts of public authorities such as the Executive, the Legislature and the Judiciary. This activity developed particularly in the United States Legislature, where it was regulated in 1946.

7. Published on 08/03/2015 – 15h44min. By Mariana Branco – Reporter at Agência Brasil Brasília <http: agenciabrasil.ebc.com.br/economia/noticia/2015-03/maioria-dos-brasileiros-recorre-ao-comercio-informal-com-alguma-frequencia=””>in accessed 06/27/2018.</http:>

8. SEBRAE – Brazilian Support Service for Micro and Small <http: www.sebrae.com.br/sites/portalsebrae/ufs/sp/bis/entenda-o-motivo-do-sucesso-e-do-fracasso-das-empresas,b1d31ebfe6f5f510vgnvcm1000004c00210arcrd?origem=”estadual&codUf=26.”> Enterprises Accessed on 06/28/18.</http:>

9. SEBRAE – Brazilian Support Service for Micro and Small <http: www.sebrae.com.br/sites/portalsebrae/ufs/sp/bis/entenda-o-motivo-do-sucesso-e-do-fracasso-das-empresas,b1d31ebfe6f5f510vgnvcm1000004c00210arcrd?origem=”estadual&codUf=26.”> Enterprises Accessed on 06/28/18.</http:>

10. State Agency posted on 06/28/2017 11h27min <https: www.correiobraziliense.com.br/app/noticia/economia/2017/06/28/internas_economia,605549/ibge-em-2015-8-462-industrias-fecharam-e-642-empregos-foram-eliminad.shtml=””> Accessed 06/28/18.</https:>

[1] Lawyer; Specialist in Law, Public Policy and External Control; Bachelor of Law.

Sent: December, 2019.

Approved: February, 2020.