ORIGINAL article

CHAGAS, Edgar Thiago de Oliveira [1]

CHAGAS, Edgar Thiago de Oliveira. Bitcoin and the New world economy. Multidisciplinary scientific journal Knowledge Nucleus. Year 04, Ed. 01, Vol. 05, pp. 137-168 January 2019. ISSN:2448-0959

Summary

The present study has as its proposal to analyze the nuances of the bitcoin market, where it brought a broad view about cryptocurrencies or virtual currencies. The main concern of the Governments with the transactions with Bitcoins is the possibility of money laundering and tax evasion, this is because, most of the countries have not regulated this modality of currency. There is a specific case of the Pátrio state that can be used as an illustration for this hypothesis. There is a project underway in the National Congress, which regulate this modality of money, however, our Magna Carta is explicit in stating that it is the Union’s competence to issue the currency. As the project of regulation of these, in its virtual modality, is being processed on an ordinary character, can not be affirmed when, how and whether the bitcoins will be regulated in Brazil.

Word (s) keys (s): Bitcoin, cryptocurrencies, money laundering.

Introduction

The present study has as a corollary, offering a vast view of the cryptocurrencies for the world economy, since numerous commercial transactions use this process, named Bitcoins. If not on the whole planet, it is known, at least, by most countries, especially those considered first world, in this sense will make some weighings about this currency.

In Brazil, although there is still no legislation that normatizes transactions in cryptocurrencies, many people and companies use this modality of currency, other than it is worth noting that there exists in the National Congress the Bill No. 2303/2015, which aims to The regulation of transactions in cryptocurrencies, according to the preamble to the bill that is collated:

“It has on the inclusion of virtual currencies and air mileage programs in the definition of” payment arrangements “under the supervision of the Central bank.”

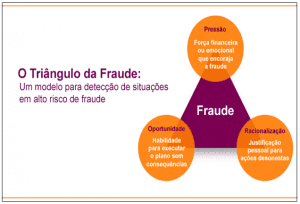

This intent seeks the implementation of the regulation of operationality, as well as reflects on how this procedure will be monitored, as this way, it is possible to avoid fraud and money laundering.

Access to the purchase of Bitcoins is only possible through the technology known as blockchain, in this Toada, Destarte, it is necessary to weave some nuances about this technology.

Many people transact with Bitcoins or cryptocurrencies, without regard to the fact that these transactions, although not yet regulated in the state of Pátrio, are liable to be taxed, so they must be declared with the tax authorities in the declaration of Income.

From the desire to make money laundering impossible, the Government has not measured efforts to avoid the processes made through virtual currencies. Although there is no regulation, the transactional practice in Bitcoins is perennial, since the Securities Commission has issued opinions to the financial market for this type of movement.

For the present study, a holistic view of what is being the Bitcoin, the blockchain, the taxation, the positioning of the Securities Commission and the taxation of these operations has been lost.

1. Bitcoin

Agner (not dated, p. 5) conceptualizes the Bitcoins as:

“Bitcoin is the union of technologies and abstractions that enable the consensus between non-necessarily-known actors to be achieved in a decentralised manner without trust having to be deposited at a central control point or that security The network is subject to a single point of failure. These technologies together form the basis for the existence of a decentralised digital currency and for any other use case that we may abstract for a consensus-based model-such as contracts-independently of central authorities such as Banks or governments. And, it is important to notice that the same term “bitcoin” with uppercase “B” is commonly used to designate the technology as a whole, the P2P bitcoin network or the Bitcoin protocol while bitcoin (s) with lowercase “b” is used to designate the unit of account used in Network “.

In the author’s diction, Bitcoin is a harmony between the operators of digital currencies dissociated so that they do not require centralized control in a single institution, because the technology of Bitcoin uses encryption, in this Deslinde operates Agner (not dated, p. 5-6).

“Bitcoin is a crypto-coin; And this is due to the fact that cryptography is an essential part of its functioning. Cryptography is a branch of mathematics that, in its modern definition, welcomes all the technology created and used to restrict fundamental truths of the nature of information in order to achieve objectives such as: hiding messages, proving the existence of a Secret without the need to reveal the secret, prove authenticity and data integrity, prove computational work etc. At first, in Bitcoin, we are interested in achieving the following objectives with the use of cryptographic algorithms: Integrity assurance and data consistency in the network and proof of computational work using hashes and authenticity of transactions Using public key cryptography digital signatures. “

Encryption is what guarantees the full and inatinability of the entire transactional process of Bitcoin, in this sense, according to the site Atlas Quantum (annex I), the persecutions on Bitcoins propel their respective importance.

By the above diction, it is noticeable that the virtual currency or cryptocurrency is a global trend, and gradually has gained ground to the detriment of the currency in kind from the emergence of credit and debit cards.

As is a trend, there is an increase in the brokers of cryptocurrencies, however, the largest financial institutions in the country have closed their doors to these brokers, since the investment in Biticoins can considerably decrease the profit of Commercial banks, or also, cause the mistrust of the legality originating from the resource applied via digital currency, according to Folha de São Paulo (2018, non-paged).

The nominal value of Bitcoin is determined by the market, since it is the safest method of payment, especially because of its characteristic of being a digital materialization money, however, is not issued by the government. In this sense, he preteaches Ulrich (2014, p. 15).

“… Bitcoin is a form of money, just like the real, the dollar or the euro, with the difference of being purely digital and not being issued by any government. Its value is determined freely by individuals in the market. For online transactions, it is the ideal form of payment, as it is fast, cheap and secure… With Bitcoin you can transfer funds from a to B anywhere in the world without ever having to trust a third party for this simple task. It’s a really innovative technology. “

The control of the Bitcoin transaction takes the issue of a book titled “Ledger”. In it are transcribed the reports of all transactions, called Blockchain, as seat Ulrich (2014, p. 18):

“The invention of Bitcoin is revolutionary because, for the first time, the problem of double spending can be solved without the need for a third party; Bitcoin makes distributing the indispensable historical record to all users of the system via a peer-to-peer network. All transactions occurring in the Bitcoin economy are recorded in a kind of public and distributed ledger called a blockchain (block chain, or simply a public record of transactions), which is nothing more than a large database Public, containing the history of all transactions performed. New transactions are checked against the blockchain in order to ensure that the same bitcoins have not been previously spent, thus eliminating the problem of double spending. The global peer-to-peer network, composed of thousands of users, becomes the intermediary itself. “

By the harbinger of the author, it can be said that, the virtual currency, comes to stay and revolutionize the market in a unique way, since the economy of transactions is perennial. As the bitcoin currency is popularizes, it tends to force the conventional financial institutions to review their service collection policies through search strategies aimed at preserving the customer so that they do not mass migrate to the Cryptocurrencies. Moreover, the digital currencies do not have their nomenclature in the dollar, the euro or another denomination because they are not tied to the government, in this Mister Preteaches Ulrich (20014, p. 18).

“It is important to note that transactions in the Bitcoin network are not denominated in dollars, euros or reais, as they are in PayPal or Mastercard; Instead, they are called Bitcoins. This makes the Bitcoin system not only a decentralised payment network, but also a virtual currency. The value of the currency does not derive from gold or from some government decree, but from the value that people attribute to it. The real value of a bitcoin is determined in an open market, in the same way that the exchange rates between different world currencies are established. “

By having its determined by the market, Bitcoin becomes a public currency whose user has access keys for the transfer of ownership, in this path understands Ulrich (2014, p. 18 – 19).

“Transactions are checked, and double spending is prevented by using intelligent public key cryptography. Such a mechanism requires that each user be assigned two “keys”, a private, which is kept secret, as a password, and another public, which can be shared with all… The transaction – and therefore a transfer of ownership of bitcoins – is recorded, stamped with date and time and exposed in a “block” of the blockchain (the large database, or ledger of the Bitcoin network). Public key cryptography ensures that all computers on the network have a constantly updated and verified record of all transactions within the Bitcoin network, which prevents double spending and any kind of fraud… because Bitcoin is a network Peer-to-peer, there is no central authority in charge of creating monetary units or verifying transactions. This network depends on users who provide the computational force to perform the records and reconciliations of transactions. These users are called “miners” because they are rewarded for their work with newly created bitcoins. Bitcoins are created, or “mined”, as thousands of scattered computers solve complex mathematical problems that verify transactions in the blockchain. “

According to the author, cryptocurrencies are recorded in blockchain or blocks that begin to grind due to their importance within the Bitcoin corollary.

2. Blockchain or blocks

In accordance with the article published on the site Atlas Quantum (annex II) Some nuances regarding the blockchain as its functionality should be considered.

As noted, the system is composed of a technology derived from bitcoins, known by some scholars as the new generation of the Internet, at this threshold based Tapscott (2017, p. 20):

“We’re not talking about social networks, artificial intelligence, big data, robotics or autonomous cars. We’re talking about the blockchain, the technology behind digital currencies like Bitcoin. This technology represents nothing less than the second generation of the Internet and has the potential to transform money, business, government and society. “

In the Delinde of the collated, to obtain the transaction made through the use of Bitcoin, it is not allowed to use intermediaries, since the operations are open, in this Toada understands Tapscott (2017, p. 21):

“Enters the blockchain, a vast global ledger distributed that runs on millions of devices and is open to everyone, where not only information, but anything of value – money, stocks, fixed income securities and other financial assets, scriptures and other Legal instruments, music, art, scientific discoveries, intellectual property, even votes –, can be moved and stored safely and with privacy and in which trust is established not by powerful intermediaries, but through Massively collaboration and cleverly built software.

If the Internet was the first native digital format of the information, then the blockchain is the first native digital format of the value – the new medium for money. It acts as ledger ledger, Database, notary, sentry and clearing, always by consensus. Although the technology is still nascent, it has already detonated a Cambrian explosion of innovations in financial services. For example, “smart contracts” consist basically of lines of code that mimic the logic of paper contracts, with guarantees of execution, fulfillment and payment – and where trust can be established by consensus, not by banks, agents depositories, lawyers and courts.

Hiring is the foundation of the financial services industry. In a sense, every financial asset is a contract that assures the holder of some economic right, such as shareholding in a company or income from a debt bond. The same principle applies to many other types of assets and transactions, from insurance contracts to real estate purchases, initial public offerings (IPOs) and everything between them. The financial sector can leverage this technology to make financial markets radically more efficient, safe, inclusive and transparent. “

The Blockchains have open coding, thus allowing for a cooperative restoration, because this open source is one of its main characteristics, because the more strengthened transparency is the transaction (Mougayar, 2016).

At the same threshold in Tapscott (2017, p. 23-24):

“Today, virtually all major players in the financial services sector, from banks to insurers and auditing firms and professional services, are investing significant resources in the blockchain. According to an estimate, nearly USD 1.4 billion was invested in the blockchain technology only in 2016.

In the past, those who financed the start-ups were the venture capitalists, but now, in addition to these, we can see companies like Goldman Sachs, Alibaba, Barclays and Tencent making this kind of venture investment.

This explains why more than 45 first-line banks, including Credit Suisse, JP Morgan and UBS, decided to participate in the R3CEV consortium to develop a distributed banking infrastructure and why Linux launched the Hyperledger project, associating with IBM, Deutsche Bank, DTCC, London Stock Exchange Group, Wells Fargo and State Street. Recently, we have seen the joint effort of Munich Re, Swiss Re, Aegon, Allianz and Zurich to launch the Blockchain Insurance Industry Initiative (B3I), the first initiative of the type in the insurance sector. Also in the game NASDAQ, NYSE, LSE and other scholarships.

Of course, this flood of money into the ecosystem is driven by fear as much as gluttony. The blockchain can allow traditional players to do more with less, expanding services, reducing risk and cutting costs. But it also radically decreases entry barriers for new players to create alternatives to the conventional banking sector, challenging incumbents in virtually every market they work in. “

From the thought of the author, it is perceived that the technology of the blockchain is not new, because for years it is used by the largest financial institutions around the world. What is important with the use of this feature is the use of the same blockchain technology for bitcoin transactions, which in theory frees the investor from the clutches of the great institutions, because the blockchain is not a threat to large corporations. In this sense, the understanding of Tapscott (2017, p. 24):

“Perhaps the greatest opportunity offered by this technology is to free us from the clutches of a disturbing paradox of prosperity. The economy is growing, but a smaller number of people are benefiting from it.

Instead of trying to solve the problem of the growth of social inequality only through redistribution, we can change the way in which wealth is pre-distributed – and opportunities – at first, since all people, anywhere, from farmers Even musicians, can use this technology to more fully share the wealth they generate.

Smart companies will fully participate in the blockchain economy rather than being victims. In the developing world, the distribution of value generation (through entrepreneurship and talent reserves) and value participation (through distributed property) can help reconcile this paradox.

The blockchain will not be an existential threat to companies that embrace this new technological paradigm because thus they themselves will take possession of their disruptive force. “

According to the author’s explanation, it is noticeable that, the blockchain technology, comes to assist the investor and/or entrepreneur in their commercial and financial transactions, acting in a way contrary to the mentality that defends the system as a threat to the Corporations. This technology is understood as a carrier of innovative properties that corroborate the expansion of systems, according to Greve et al (2018, p. 3-4).

Decentralisation: Applications and systems are implemented in a distributed manner, through the establishment of trust between the parties, without the need for a reliable intermediary entity. This is the main motivator for the growing interest in the blockchain.

Availability and integrity: The entire set of data and transactions are replicated to different nodes in a secure manner, in order to keep the system available and consistent.

Transparency and Auditability: All transactions recorded in the ledger are public and can be verified and audited. In addition, the technology codes are usually open, verifiable.

Immutability and Irrefutability: Transactions recorded in the ledger are immutable. Once registered, they cannot be refuted. Updates are possible from the generation of new transactions and realization of new consensus.

Privacy and anonymity: it is possible to provide users with privacy without the parties involved having access to and control of their data. In technology, each user manages their own keys, and each server node stores only encrypted fragments of user data. Transactions are to some extent anonymous, based on the address of those involved in the blockchain.

Deintermediation: The blockchain enables the integration between several systems in a direct and efficient way. Thus, it is considered a connector of complex systems (systems systems), allowing the elimination of intermediaries in order to simplify the design of systems and processes[Xu et al. 2016].

Cooperation and incentives: offer of a business model based on incentives, in the light of the theory of games. The consensus on demand is now offered as a service at various levels and scopes.

There are countless benefits of the blockchain platform, however this technology “did not” receive approval from the population, because the resistance is very high and, the researches in this environment are many recent, as well as the market is not prepared for the impact Of the blockchain, because, contrary to what the financial market operators think, this new era comes to revolutionize and facilitate transactions. In this sense, Tapscott (annex III), which is collated:

Through the teaching, we observe the numerous advantages of the blockchain for financial operations, including fraud containment, considering that financial monitoring is more effective.

As already in the introduction of this, the state of Pátrio has not yet regulated the cryptocurrencies, with only one bill that, by its relevance, will weave some nuances.

3. Bill 2303/2015

In Brazil, there is the draft law 2303/2015, in a proceeding in the National Congress, it has as objective the regulation of Bitcoins, however, this modifies the law 12.865/2013 as well as the law 9613/1998. One of the main points of the project can be visualized in the wording, as specified:

Art. 1st Modify the item I of art. 9th of the Law 12,865, of October 09, 2013:

Art. 9th………………………………………………………………

I-disciplinary the payment arrangements; Including those based on virtual currencies and air mileage programs; “

Art. 2nd Add the following § 4 to art. 11 of law 9,613, of March 03, 1998:

Art. 11………………………………………………………………

§ 4 the operations mentioned in item I include those involving virtual currencies and air mileage programs “

Art. 3 º “Apply to the transactions conducted in the virtual market of currencies, in what fit, the provisions of the Law no 8,078, of September 11, 1990, and their amendments”.

The author of the bill, pointed out his planning alleging the highlight of the virtual currencies used in financial transactions, below are the words of the proponent of the draft which is collated:

“The so-called” virtual currencies “gain more and more prominence in current financial operations.

Although there is not even a national or international regulation on the matter, there is a growing concern about the effects of transactions carried out by means of these instruments.

The subject deserved a special report from the European Central Bank (ECB) in October 2012, which was updated in February 2015.

Despite the lack of need for the immediate introduction of more active regulation on virtual currencies, this report points to a set of risks that must be adequately monitored.

We will then put a picture with each of the main conclusions of the report and a comment. “

As is to be considered, the imminent proposer of the 2303/2015 bill, takes as its support the report of the Central Bank of Europe. In this, there are a number of recommendations regarding the design of the risks of virtual currencies, for their importance these recommendations are collected below:

| Risks pointed out by the report

On the ECB’s virtual currencies |

Comment |

| It does not impose a risk on price stability, while the creation of currency remains at a low level “ | As well as the effect of virtual currencies on price stability still does not bring concerns as long as these mechanisms do not grow in relation to the economy. Assuming it is inevitable that they really continue to grow along with the increase in internet use, it is up to monitor from what point this premise will cease to be true. |

| They tend to be inherently unstable, but do not have the magic wand to compromise the financial stability of the country given its limited connection to the real economy, its low traded volume and the lack of acceptance so broad among users “ | Once again the ECB report takes due consideration that the lack of immediate regulation depends on the (yet) low range of adoption of these virtual currencies. With the growth of the Internet boosting the virtual currencies there will be a natural increment of connection points with the real economy, and can go on to threaten financial stability. In any case, the report indicates that such schemes are inherently unstable, with high volatility of their exchange relationship with the local currency. |

| It is not regulated at this time and is not supervised or monitored closely by any public authority even though the participation in these schemes exposes users to credit, liquidity, operational and legal risks “ | Here the concern is less systemic and more consumer law. Users of these mechanisms are inadvertently exposed to significant financial risks and no legal protection whatsoever. |

| They can pose a challenge to public authorities, given the legal uncertainty behind these schemes that can be used by criminals, fraudsters and people who launder money to perform their illegal operations “ | Virtual currencies facilitate criminal activities, especially money laundering. |

| They may have a negative effect on the reputation of the central banks, assuming that the use of such systems grows considerably and that in the event of an incident attracting the coverage of the press, the public may perceive the incident as being caused, in part, by the fact that The Central bank not doing its job right “ | A scheme that can be understood as a “pyramid” that ends up collapsing can be interpreted as a “baring” of the Central bank, undermining its credibility. |

| They fall under the responsibility of the central banks as their operation has characteristics shared with the payment systems, which implies the need to examine at least some of its developments and the provision of an evaluation Initial | It is a recognition that virtual currencies constitute payment systems and as such should be monitored closely. |

Source: Bill 2303/2015

In the corollary of the collated is evident the imminent risks pointed out in the report of the European Central Bank, especially through the diction that is extracted from the bill:

“From time to time, Bitcoin is surrounded by controversies. It is sometimes emphasized its potential to become a monetary alternative to drug trafficking and money laundering, as a result of the high degree of anonymity. On other occasions, users have claimed to have suffered a substantial theft of bitcoins through a “Trojan horse” that gained access to their computer. The Electronic Frontier Foundation, which is an organization that seeks to defend freedom in the digital world, has decided not to accept donations in bitcoins anymore. Among the reasons given, they considered “that Bitcoin generates legal concerns not yet tested related to the laws of financial assets, with the” Stamp Payment Act “(legislation prohibiting any payment below in currency, note or cheque below $1), of Tax evasion, consumer protection and money laundering, among others. “

As much as the bitcoins are the high triumph, it has its global operation, as the constant basis, the Bill 2303/2015, which is based on:

“Designed and implemented by Japanese programmer Satoshi Nakamoto in 2009, the scheme is based on a peer-to-peer network similar to Bit Torrent, the famous file sharing protocol like movies, games and music on the Internet. Bitcoin operates globally and can be used as currency for all transaction types (for both goods, and virtual and real services), thus competing with the official currencies such as the euro and the dollar…. Although Bitcoin is a virtual currency scheme, it has some innovations that make it more similar to the conventional currency. “

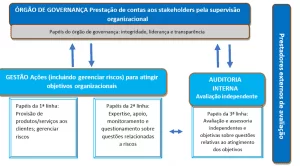

In this way, the tenderer ascertains that the competent bodies have supervisory mechanisms on the transactions of Cryptocurrencies, as is:

“To some extent we believe that both the Central bank and the Financial Activities Control Board (COAF) and the consumer organs already have competence to supervise and regulate virtual currencies. However, we understand that the legislations conferring such attributions may be more transparent in relation to such attributions, which avoids unnecessary judicial questioning.

Thus, we address in the proposed bill three issues related to virtual currencies, one in each article: i) Prudential regulation by the Central Bank, ii) money laundering and other illegal activities and III) consumer protection. We made it clear in art. 1 º that the “payment arrangements” cited in item I of art. 9th of Law 12,865, of October 09, 2013 includes “those based on virtual currencies and air mileage programs“. Besides, we made it clear in art. 2 º that transactions involving virtual currencies are included in the surveillance of the COAF: Finally, we do not leave the doubt that consumer protection legislation applies to the world of virtual currencies in art. 3rd “.

Because it is plausible to monitor the transactions in Bitcoin, the proposer overstates the project for regulating cryptocurrencies to the main regulators in the state of Pátrio.

However, the Rapporteur of the Committee established for the analysis of the bill, the rapporteur, who is responsible for the constitutionality, the juridicity of the same, and expresses a substitutive that strengthens the regulatory proposition, which is seized:

Art. 1st This Law provides for the issuance of digital currencies, virtual currencies and cryptocurrencies; Digital tokens representing goods and rights; Increased penalty for pyramid crime; and regulation of loyalty or reward programs for consumers.

Art. 2 º For the purpose of this law and those modified by it, it is understood by:

I – Digital currency, virtual currency or cryptocurrency – digital representation of value that works as a means of payment, or unit of account, or reserve of value and which has no legal course in the country or abroad;

II – Digital form – digital representation of a good or right, which does not qualify as digital currency, virtual currency or cryptocurrency “.

By the diction of the substitutive to the draft law 2303/2015, the criminalisation of the digital currencies is evident, and other, as this, has not been approved, yet, it can any other congressman manifest against or in favor of the report, remembering that as not has an urgent character the project runs in Ordinary rite, and thus has no deadline for approval.

As it depends on a regulatory process, there is a difficulty in knowing how Bitcoins should be taxed, or emerged in the income tax declaration, in this way, falls into the general rule of taxation that is going to weave some nuances due its Relevance.

4. Bitcoins taxation

In the legal order of the state of Pátrio, any form of income, which is lawfully earned, shall have the appropriate taxes collected, in accordance with the ausst of article 153 of the Magna Carta, as well as, combined as the Article 43 of the National tax code, in Verbis:

“Federal Constitution

Art. 153. It is incumbent on the Union to impose taxes on:

(…)

III – Income and proceeds of any nature;

(…)

National Tax Code

Art. 43-The tax, of the competence of the Union, on the income and proceeds of any nature has as a generator the acquisition of economic or legal availability:

I-income, thus understood the product of the capital, work or combination of both;

II-The proceeds of any kind, thus understood the accruals not included in the preceding paragraph.

§ 1the incidence of the tax is independent of the denomination of revenue or income, location, legal status or nationality of the source, origin and form of perception.

§ 2 in the event of revenue or income from abroad, the law shall establish the conditions and the time when it will be available, for purposes of tax incidence referred to in this article “.

By the legislation that has been collected, transactions with cryptocurrencies will be taxed by the general legislation. In this sense it preteaches Lopes (2016, non-paged).

“In Brazil, according to art. 153, paragraph III, of the Federal Constitution and art. 43 of the national tax code, it focuses on income tax on the acquisition of income, understood in a simplified way as a patrimonial increase observed as the product of the capital, of the work or of the combination of both, or, still, of proceeds from any Nature. Therefore, it is simple to observe that the transactions involving bitcoins, if they mean accruals are liable to charge the income tax.

In this sense, the IRS stipulated that possession and transactions made with bitcoins should be declared by the value of their acquisition in the goods and Rights tab as “other assets” and may be taxed. This is because although it is not a currency, Bitcoin produces financial repercussions and, therefore, can signify a manifestation of wealth, liable to collect tribute.

As explained clearly in the website of the IRS, “the gains obtained from the sale of virtual currencies (bitcoins, for example) whose total alienated in the month exceeds R $35,000, 00 are taxed, as a capital gain, at the rate of 15%, and the Income tax collection shall be made up to the last working day of the month following the transaction. ” The site also indicates that “operations should be proven with skillful and suitable documentation”.

Because it is a good with economic value, it is also possible the incidence of other taxes in the transmission of bitcoins, such as the Itcmd, in the case of free transmission (donations), or also, transmission to heirs (cause mortis). There are also some companies that provide service related to bitcoins, in which case the incidence of ISS on the provision of this service is reasonable. “

As the author settles, bitcoin transactions are taxed by legislation. This, in turn, governs capital gains, because the person who practices the transaction of cryptocurrencies, must account to the lion, at the time of the income tax declaration, however, by the diction of article 21, item VII of the Federal Constitution, in Verbis, only if Considers currency, the one issued by the Union:

Art. 21. The Union is responsible for:

(…)

VII-issuing currency;

(…)”.

In this sense, it preteaches the site of Ibet – Brazilian Institute of Tax Studies that collects:

“In spite of the terminology” virtual currency “, it is the fact that bitcoins, at least until today, cannot be legally treated as currencies. This is because, according to article 21, section VII of our Federal Constitution, the Union is responsible for issuing currency, and it is certain that the competence to issue it will be exercised exclusively by the Central Bank of Brazil (Bacen), in accordance with article 164 of the same Federal Constitution.

Soon, we can conclude, coins are those issued by government authorities.

Bitcoins are not issued or controlled by any governmental authority, they therefore derive from private relations.

The Bill 2.303/2015, in the proceedings in the House of Deputies, provides for the regulation of bitcoins, treating them as payment arrangements under the supervision of the Central bank. But precisely because they are not yet recognized or regulated by the monetary authorities in Brazil, it is common for many people not to worry about declaring them to the IRS, which puts them in a situation of irregularity. “

For not being issued by the competent authority, many coin traders are not concerned about listing the income tax statement, however, the non-declaration of these cryptocurrency transactions is an affront to the tax legislation, and may even Negotiated, respond for tax evasion. To avoid such embarrassment, it is necessary that the buyer/seller of Bitcoins is informed with the IRS to proceed with the income tax statement.

At this threshold, it follows the understanding of the Brazilian Institute of Tax Studies, which is due to its importance:

“… a legal obligation which, if unfulfilled, may lead to the application of fine and tax, if due.

Because it is not legally characterized as “currency”, but as a good, a financial asset arising from private relations, the individual who acquired bitcoins must declare it to the Brazilian Federal revenue by means of the annual adjustment statement. Even in 2017, the Federal revenue itself disclosed guidelines on how to declare bitcoins.

The guideline indicated by the Brazilian Federal revenue is that the bitcoins are declared in the “goods and rights” form as “other assets” for their acquisition value.

Despite the pricing of this asset in the virtual market, as there is no official quotation, there is no obligation to declare it by the value of the quotation on December 31 of each year, simply informing the acquisition value and keeping the documentation evidentiary of the good In order.

In addition, like any asset, Bitcoin is subject to taxation at the time of its sale. For the total values sold in the month exceeding R $35000, the taxpayer must collect the tax on the capital gains under aliquots ranging from 15% to 22.5%, depending on the profit range and present to the IRS the statement of calculation of capital gains.

Note that the absence of Bitcoins declaration can lead the contributor to a future problem in the thin mesh bracket. That is, suppose that one person acquired Bitcoins for R $10000 and Aliena at a later time by R $60000 upon receipt in cash or other kind of good.

The entry of this amount or of the acquired good may not originate in the annual adjustment statement and be the object of questioning and autuation by the IRS “.

Thus, if the taxpayer has acquired bitcoins it is good to be informed about the need for declaration and tax on gains earned in order to avoid future problems with the tax.

As can be said, although there is also no regulation of cryptocurrencies, it is the obligation of those who transact with this type of currency, informing the competent bodies, therefore, the cryptocurrencies, are not issued by the Union as already primacy in this outline.

However, it is worth noting that several world economies have already regulated the cryptocurrencies, expressing themselves in favour of this tendency, in this sense Martins (2016, p. 158), brings to light the fact that the issuance of virtual currencies is planned and intrinsic, because it avoids the Hyperinflation, which causes a growing demand for this modality of currency, especially because it is not part of a centralized control, which enables those who adhere it, escape the high inflationary rates in some countries.

In this Toada seat Fobe (2016, p. 72-73):

“The European Central Bank has already expressed itself in the sense of regulating virtual payment instruments, and that the laws of the Member States will be subject. The main responsibilities of regulating Bitcoin are, to date, the Ministries of finance, financial supervisory bodies, commercial laws and consumer protection laws. Although indirectly, this allocation constitutes a positioning of the countries in order to categorize Bitcoin according to a specific law field, being the most used of the tax law “.

By the teaching of Fobe (2016), it is verified that, in world economies and in countries that have already regulated transactions in virtual currencies, these activities are the competencies of the Ministry of Finance, because what most concerns governments is how to tax these Operations.

In view of the fact that there is no legislation governing the operations of cryptocurrencies, the Brazilian Securities and Exchange Commission (CVM) has issued Circular Craft No. 01/2018, positioning itself in relation to this type of transactional, as it coltriggers:

“Circular Craft No. 1/2018/CVM/SIN

Rio de Janeiro, January 12, 2018

To the directors responsible for the administration and management of investment funds

Subject: Investment funds regulated by CVM Instruction No. 555/14 in cryptocurrencies

Dear Sirs, we refer to the announcements made by CVM in 11/10/2017 and 16/11/2017, related to the operations of Initial Coin Offerings (“ICO”), and to consultations, carried out by several market participants, about the possibility of Investment funds regulated by CVM Instruction No. 555/14, in the currently denominated “cryptocurrencies”.

As known, both in Brazil and in other jurisdictions, the legal and economic nature of these investment modalities has still been discussed, without having, especially in the domestic market and regulation, a conclusion about such conceptualisation.

Thus, based on said Indefinition, the interpretation of this technical area is that cryptocurrencies cannot be qualified as financial assets, for the purposes of article 2, V, of CVM Instruction No. 555/14, and for this reason, their direct acquisition by Regulated investment funds are not allowed.

Other consultations have also reached the CVM with the inquiry into the possibility that investment funds are constituted in Brazil for the specific purpose of investing in other vehicles, consisting of jurisdictions where they are admitted and Regulated, and which in turn have the strategy of investing in cryptocurrencies.

Or, also, derivatives admitted to trading in regulated environments in other jurisdictions.

However, it does not cost to retread, once again, that the existing discussions on the investment in cryptocurrencies, whether directly by the funds or in other ways, are still at a very incipient level, and also coexist with the ongoing bill , no 2.303/2015, which may prevent, restrict or even criminalize the negotiation of such investment modalities.

Thus, in the understanding of the technical area it is undeniable that, in relation to such investment, there are still many other risks associated with its own nature (such as cyber security and private custody risks), or even linked to the future legality of Acquisition or negotiation.

In this way, this superintendence informs that all these variables have been taken into consideration in assessing the possibility of constituting and structuring indirect investment in cryptocurrencies, without having yet reached a conclusion to Respect of that possibility (…) “.

The office forwarded by the Securities and Exchange Commission (annex IV) makes the risks inherent in the transactions with cryptocurrencies unquestionable, without proper regulation. Moreover, in the mid-2018, this same commission edited the letter No. 11/2018, assevering regarding the form of derivatives acquisition with cryptocurrencies. These should be acquired through exchanges calls.

By the way, it is evident that the Government is not measuring efforts to pave the way for virtual currency regulation, however, the major concern is the laundering of financial resources that can occur through virtual currencies, as well as fears Tax evasion by the operators of these numeraries.

5. Conclusion

This essay sought to bring a vast view of the transactions with the virtual currencies or bitcoins, to this end, the main nuances of this modality were crossed.

Although there are countries that have regulation for such transactions, still, most of these nations are reticent about applicability, because the Bitcoins are not considered as an official currency of those places where the government does not Guardianship, as in Brazil, the Constitution prohibits any type of currency that is not by the Union, however, in the day to day, many people use this modality.

The greater fear of the competent organs is the laundering of money supported by cryptocurrencies, as well as by tax evasion, since it is the government who would hold control over the issuance of virtual currencies.

Moreover, it should be noted that this scope did not aim to clarify the problem of the use or not of bitcoins, but rather to bring to the academic community and the general population, a vision about the subject.

Reference

Agner, Marco. Bitcoin for programmers. Rio de Janeiro: ITS. P.5. Available at: Https://legacy.gitbook.com/book/itsriodejaneiro/bitcoin-para-programadores/details. Accessed on: 04/Jan/2019.

QUANTUM ATLAS. Article: Bitcoin: Everything you need to know! Available from: https://blog.atlasquantum.com/o-que-sao-bitcoins-tudo-o-que-voce-precisa-saber/access on 03/Jan/2019

______________ article: Understand what is and how the blockchain works! Available from: https://blog.atlasquantum.com/entenda-o-que-e-e-como-funciona-a-blockchain/access on 03/Jan/2019.

Brazil, Chamber of Deputies. Bill 2303/2015. Available from: https://www.camara.gov.br/proposicoesWeb/fichadetramitacao?idProposicao=1555470 access on 03/Jan/2019.

___________ . Federal Senate. The Federal Constitution of 1988. Available at: https://www.senado.leg.br/atividade/const/con1988/con1988_18.02.2016/art_153_.asp access on 04/Jan/2019.

___________. Plateau. National tax code. Available at: http://www.planalto.gov.br/ccivil_03/LEIS/L5172.htm access on 04/Jan/2019.

__________. Securities and Exchange Commission. Circular Oficio No. 01/2018. Available from: http://www.cvm.gov.br/export/sites/cvm/legislacao/oficios-circulares/sin/anexos/oc-sin-0118.pdf access in 03/Dec/2019.

__________, Securities and Exchange Commission. Circular Oficio No. 11/2018. Available from: http://www.cvm.gov.br/export/sites/cvm/legislacao/oficios-circulares/sin/anexos/oc-sin-0118.pdf access in 03/Dec/2019.

Fobe, Julie Nicole. Bitcoin as parallel currency: an economic vision and the multiplicity of legal developments. São Paulo: São Paulo School of Law of Fundação Getúlio Vargas, 2016. Available in:. Access in: 03/Jan/2019.

FOLHA DE SÃO PAULO ON LINE. Banks close cryptocurrency broker accounts. Available from: https://www1.folha.uol.com.br/mercado/2018/01/1951951-bancos-fecham-contas-de-corretoras-de-criptomoedas.shtml access on 03/Jan2019.

Strike, Fabíola. SAMPAIO, Leobino. Abijaude, Jauberth. COUTINHO, Antonio. Valcy, Ítalo. QUEIROZ, Silvio. Article: Blockchain and the consensus on demand revolution. Available from: http://www.sbrc2018.ufscar.br/wp-content/uploads/2018/04/Capitulo5.pdf access on: 04/Jan/2019.

Brazilian Institute of tributary Studies – Ibet. Article: Bitcoins and the IRS. Available from: https://www.ibet.com.br/bitcoins-e-receita-federal/access on 03/Jan/2019.

LOPES, Simone. Taxation of Bitcoins. Available at: Https://simonerlopes.jusbrasil.com.br/artigos/474837327/tributacao-de-bitcoins access on 04/Jan/2019.

MARTINS, Armando Nogueira da Gama Lamela. Who’s Afraid of Bitcoin? The functioning of encrypted currencies and some perspectives of institutional innovations. RJLB, Year 2 (2016), No. 3, 137-171. Available in: Access on: 03/Jan/219.

Mougayar, William. The Business blockchain: Promise, Practice, and Application of the Next Internet Technology. John Wiley & Sons, 2016.

Tapscott, Don; Tapscott, Alex. Article: The Blockchain Revolution: transforming the foundations of financial services. In Review B3. No. 6 – August. B3 S.A. – Brazil, Bolsa, balcony. São Paulo: 2017.

ULRICH, Fernando. Bitcoin: The currency in the Digital age. Ludwing Von Mises Brasil Institute. São Paulo: 2014.

ATTACHMENTS

Annex I-Specification of Bitcoins

“Bitcoin: Everything you need to know!

What is Bitcoin?

This is a digital currency or monetary unit, also known as cryptocurrency. It works by means of an encryption, that is, a set of techniques that protect information to ensure that it is only decideed by those who know the code, guaranteeing its safety.

However, the digital currency has the code open. This means that access is free to anyone, this being a currency managed by the users themselves and without the need for any intermediary, such as the Central bank or even the card companies.

To simplify the concept, we can say what Bitcoin is: A new means of payment used in online transactions. This technology allows the realization of electronic payments with the same efficiency as those made with the banknotes used in the physical world.

Payments with Bitcoins are fast, inexpensive and with no minimum limit or maximum value. Because transactions are made between the users themselves, a person can pass Bitcoin directly to the other without the need for a bank — as with ordinary money.

Your costs are lower and you can use it in any country without any prerequisites. These are undoubtedly the biggest advantages of Bitcoin.

How does that work?

In practice, Bitcoin is a communication system, that is, a protocol that works through the Internet. This protocol is decentralized point-to-point, without the need for a central server. It can be accessed from any device — phone, computer, or tablet — and from any location, regardless of the country in which you are staying.

The Protocols act as a universal language, allowing different devices to communicate through the Internet to perform various specific tasks.

Being a peer-to-peer or P2P protocol, it cannot be shut down by the authorities — just as there is no company responsible for your email, for example, there is also no one responsible for Bitcoin. Therefore, it is virtually impossible to interrupt its operation, as there is no central server to disable it.

The protocols used so that you can access Web pages or send emails work by exchanging information between the client and the server. For example, when you access a Web site, you are communicating with a server that stores the data and sends it to your computer through the protocol.

However, in the case of P2P, there is no distinction between the client and the server. This is an interesting aspect, because users of this system are at the same time the clients and the servers themselves, with no other intermediary.

A good example of P2P protocol is the Bittorrent, program used primarily for the sharing of movies, series and music files.

The idea is that the file that is stored on your computer can be downloaded by any user by downloading a protocol, in the same way that you can download the files provided by them.

The copyright holders of the songs and films have no way of preventing the operation of this Protocol, as much as they report it to the authorities.

Returning to Bitcoin, each cryptocurrency has a market value per negotiation. There are virtual brokers that create accounts for storing bitcoins, and some work similarly to the stock exchange. I mean, it’s like you’re investing in the stock market. Through these accounts — also known as wallets or portfolios — you can save Bitcoins on your own computer or mobile phone.

To allow the use of your digital currencies, a digital signature is generated, or a specific code that is verified by a mining company. We will talk in detail about the mining companies later, but for now, suffice it to know that this is a process of accounting for transaction records made with Bitcoins.

After a few minutes, the transaction will be approved and incorporated into the blockchain call, which consists of a database that stores the record of all operations performed. Finally, the blockchain proves that the transaction was carried out.

This is the basic technology of digital currencies, responsible for allowing financial transactions to materially and reliably. Therefore, there is no need for intermediation of any institution.

When did the bitcoins emerge?

Bitcoin emerged in 2008, when Satoshi Nakamoto, a pseudonym of his creator — or creators — published a PDF explaining the concept of digital currency.

Its goal was to create an alternative currency that did not depend on the regulation of financial institutions, and can be operated by the users themselves. What no one knows, however, is the true identity of whoever is behind Bitcoin.

The Bitcoin network is based on mathematical principles and cryptography, which ensures total security to the system. This was a project that revolutioned the form of resource management, becoming a milestone of computing for the modern economy.

In a summarized way, Bitcoin is a virtual ballot made of codes. It can be exchanged for virtually any product or service in the negotiations made over the Internet.

It is the same principle of the physical world, where we exchange work for money and money for products and services. On the Internet, however, you can perform small tasks on websites and add fragments of the currency, which can be saved in a virtual wallet.

How are they stored?

As you have seen, Bitcoins are not physical currencies, so you cannot store them in a bank, for example. The cryptocurrency only exists because the network agrees that it exists, and you can only possess them if you register ownership in the blockchain database.

The database has the information of all the addresses that have bitcoins, being identified and maintained by all computers on the network.

Therefore, the only proof of your property is the records performed, and the only way to access them is with an access key. It is worth remembering that if you forget it for some reason, you can never recover your coins.

Once your trading has been validated by the miners, you can access the information and check its validity. This process occurs transparently, because, as we said, it is a free code that can be accessed by anyone.

The most complex part of having bitcoins is without a doubt finding a safe way to store your coins. Trading Sites such as MtGox and Bitfinex have already been hacked, causing injury to their customers and destabilizing the virtual market.

To save and control your investments, therefore, the ideal is to create a Bitcoin portfolio. This wallet is generated through an application stored on your computer or mobile, but there are also sites that provide virtual wallets. Thus, your currencies will be stored in the wallet you choose and files are generated with the records.

It is not recommended to leave your coins on the platform for buying and selling (exchanges). They will be susceptible to the action of hackers and you will risk losing them.

Choose to transfer your bitcoins to a private wallet, as this is the safest way to store your coins. Private wallets are downloaded software that run directly on your computer, allowing you to use Bitcoins on as many sites as you want.

The bitcoins stored in the portfolio will be subject to daily changes in the quotation, functioning as in the stock market. This means that if the market value increases, your currencies will be worth more; If it slows down, they’ll be worth less.

How is Bitcoin mined?

We call Bitcoins mining the process of creating new cryptocurrencies. All the emission of new bitcoins is done through mining, which works as a solution to a mathematical problem.

Miners are computers that rely on specific software capable of generating new currencies when solving mathematical problems.

Mining Bitcoins is nothing more than making computers available to control the digital currency, and these computers are remunerated for the operations they perform. Thus, the mechanism ensures the maintenance and operation of the decentralised structure of Bitcoin.

It is also the responsibility of the miners to check pending transactions in the network minute by minute, grouping each of them into a blockchain block which, in turn, turns into a mathematical algorithm. This generated algorithm is the problem to be solved, which is usually done by high-performance computers.

There is a convention for the solution of the algorithms, which considers the first transaction of each new block special, and should be performed by the miner whose computer can first solve the aforementioned algorithm.

This miner will receive a payment in bitcoins for his service, plus a fee for each transaction occurring within the algorithm he has solved.

It is as if the miner digitally signed a number of transactions that are referenced through the algorithm solution, receiving for each transaction included within it.

This is the main incentive for multiple users to mine bitcoins. Every time these miners receive an amount of cryptocurrency, they allow new Bitcoins emissions to be made without the intervention of a monetary authority.

It works like the Central Bank in Brazil, for example. In parallel, the fact that transactions are processed during cryptocurrency mining gives more security to the system.

Anyone can mine?

Once you get here, the big question you should be asking yourself is: Can I install a program on my computer and start mining?

In theory, yes. In practice, however, the new algorithms created are becoming increasingly difficult, which demands very powerful and specific computers, as well as a lot of electricity.

Therefore, it is quite possible that you spend much more than your gains as a miner could compensate. In addition, the system was created to increase the difficulty of mining in a manner proportional to the increase in the number of computers performing this task.

On the other hand, some mining companies pay small daily values for activities provided to them. This means that you can perform certain tasks and be rewarded with points that in the future can be converted into bitcoins.

How to buy and sell bitcoins?

Bitcoins can be purchased, sold, used as credit, transferred to other people and even traded in specialised exchange houses. If you want to act in this market, you need to have knowledge about the subject and seek experience to be able to administer the cryptocurrency.

The first step to buy Bitcoins is to open an account at a broker specializing in virtual currencies. As we saw earlier, you can also earn currency fragments by working for sites that pay for access.

Because it is a digital currency, the purchase and sale of Bitcoins also occur via the Internet. These transactions are performed through specialized platforms, the exchanges.

In an exchange, you open a kind of current account, transfer a cash amount, and make the purchase of the currency or fractions of it from R $50. It is also possible to participate in the auction of bitcoins, where customers buy and sell coins to other users.

To open an account and perform the transactions, you will need a registration on a purchase and sale site, as well as a computer or mobile phone connected to the Internet.

The operation of the platforms, as we have already seen, is very similar to that of a home broker: Each new transaction, exchange charges a fee, which is similar to the amounts paid by brokerage to the brokerage firms.

It is important to emphasize that, after performing the transactions, you must transfer the money back to your private wallet, since there is no protection of that property in the exchanges. If she goes bankrupt or gets hacked, her money will disappear.

What is the technology used in Bitcoin?

The technology used in Bitcoin is basically the blockchain technology. It works by grouping transactions into block sequences, which are validated on multiple mining computers. These machines, in turn, solve mathematical algorithms for each new block created, receiving incentives for this.

Most importantly, here, it is noteworthy that blockchain technology does not allow one person to control all information.

Transactions cannot be changed because they are directly connected to transactions made before them, which is where the source of the name comes from: “Block” means block, and “chain” means current.

This ensures that records cannot be erased and kept in chronological order. This also means that if you make a transaction, you also cannot undo it and get the money back.

That’s because there are no intermediaries to suppress the operation. In this case, you can only rely on the goodwill of the person with whom you made the deal, the only one who can perform a new transaction and return the money.

By making a simple comparison, blockchain transactions work similarly to sending an email to a group of friends. Even if there is something wrong in the message, it is not possible to cancel the submission.

The only way to reverse the situation is by asking each friend on the list to delete the email, which still does not prevent it from being read before. Another information that should be understood is the anonymity and transparency of operations.

Although all transactions that go through your computer leave a kind of mark on your IP address — the location address of your computer — there’s no way to know who these brands belong to. In this way, the anonymity of transactions is guaranteed.

On the other hand, you can access the history of all transactions that occur by blocks, which ensures the transparency of the entire process. That is, all transactions are fairly clear, but it is not possible to know who made them.

How is Bitcoin security guaranteed?

As contradictory as it may seem at first glance, it is also the blockchain that ensures the safety of operations. As you saw in the above topic, each block has a complex mathematical code that needs a validation, and this is done by several miners who are trying to solve the algorithm.

With each new transaction, it receives a new code that is added to the previous one, making counterfeiting virtually impossible.

This is how the system guarantees the security and integrity of the cryptocurrency, shielding it against hackers. For a hacker to be able to steal a single Bitcoin, it will need to enter all computers on the network simultaneously.

Now that you know the system, understood how the security of transactions in the network and even where you can negotiate, it is time to know a little more about the valuation of Bitcoin to define if it is worth applying your salary in the currency.

We know that there has been an overvaluation in the price of 2009 coins up to the present day. Today, a single coin is worth about 25000 reais and the tendency is that they continue to value themselves more and more.

Understanding Bitcoin Trends

Firstly, the code was developed in such a way as to allow only 21 million of coins to be produced. To date, more than 17 million coins have already been mined, which means that every year it becomes more difficult to produce bitcoins. So the trend is that the currency value even more, making it a great deal.

How can you buy virtually anything with a Bitcoin — a hamburger, a car, a house, pay a boleto, etc. — Bitcoin is a currency with great liquidity and accepted worldwide.

You can also earn some currency fragments by performing tasks for sites that work with mining. Now, it’s up to you to start joining your investment in a private wallet to see your money surrender! “

Annex II-functionality according to the ATLAS QUANTUM SITE

“Understand what is and how the blockchain works!

Understand Blockchain technology

The blockchain is the network of blocks in which all transactions with Bitcoin are registered. From the start of the network operation to the present day, all transactions are kept in the network blocks (hence the name “blockchain” = Block chain).

This block network has two main features: it can be audited by anyone and is virtually inviolable.

Although no transaction has direct identifications of who participated in it (such as name, documents, or email), each has a digital signature, also called a hash.

This signature is unique to each transaction – it is impossible to have two transactions with the same hash. Through it, it is possible to check the blockchain when the operation was done, with complete date and time, how much the transfer was and which addresses participated.

Anyone can check any transaction: Just access sites like Blockchain.info or Blockcypher and enter the hash number. If it is correct, the transaction is checked.

In addition to registering each transaction on the network, the network is also extremely secure. The miners guarantee the protection of the network. This makes the transactions committed within the blockchain become virtually irreversible;

There is no possibility to make a reversal of a purchase or sale in Bitcoin, nor to spend twice the same currency. Once placed in the block, the transaction remains forever.

Blockchain Beyond Bitcoin

Bitcoin and blockchain often come associated with each other. And, in fact, both are inseparable; There is no Bitcoin without blockchain.

But the blockchain does not use only the transfer of funds. Although it is revolutionary, Bitcoin is just a token to use the blockchain. And the network has a lot more utilities than transfers.

Imagine the blockchain as a gigantic ledger, of those that are used in notary records for documents. In these books, the possibility of registration is enormous: real estate, vehicles, brands, music, practically everything can be registered there.

Now imagine an online ledger, auditable for all but extremely secure; That is no one’s property, but still has rules; Fraud, losses, fires, confiscations, forgeries and floods.

Immutable Records, auditable transactions

Blockchain technology can be used as a safe way to store and transact almost any information. And that’s already happening.

A Brazilian startup called Originalmy uses the blockchain to perform records of certain information, such as brands, works of art, music and digital signature of contracts — and the records already have legal validity as proof of authenticity.

In Honduras there is also a large project with the use of blockchain. The country is studying technology to make a registration of properties in a safe and immutable way.

This brings extraordinary implications for countries whose property protection laws are loose and ineffective.

With an immutable, secure and easy-to-audit record, it is difficult for an authoritarian government to carry out confiscated goods indiscriminally, which brings enormous protection to the poorest population.

In addition, the transaction costs in these records are much lower than in traditional notary offices, which again benefits the poorest.

Conclusion

Is Bitcoin revolutionary? No doubt about it. But the uses of the blockchain network can be fascinating and revolutionaries than the currency. And that’s exactly what led Bitcoin to be so well accepted in the last few years.

Many accuse that the Bitcoin currency does not have a ballast or a security. Well, it can be said in response that a very good ballast is the blockchain, the safest, most complex and most computational power network in the world, with the potential to revolutionize the way we deal with the safety of goods and assets. “

Annex III-Types of facility

“Financial intermediaries play ten key roles in our global economy: Identity and reputations authentication, value movement, value storage, credit access, value Exchange, fundraising and investment of Resources, insurance, risk management, auditing and taxation – in addition to acting as central banks responsible for monetary and regulatory policies, among many other things. Each activity can be transformed by means of the blockchain.

1. Identity and reputations authentication: we currently rely on risk rating agencies, financial data analysis firms and retail and wholesale banks to establish trust, verify identities in transactions and decide who deserves Access to the system. In contrast, the blockchain itself assigns reputation. In the blockchain, you are your own creditworthiness rating. Blockchain technology reduces and sometimes even eliminates the need for confidence in certain transactions.

2. Payment system: Pay Card networks and money remittance services solve the problem of double spending, ensuring that no dollar is spent twice during transfer between one person and another. The blockchain does this by consensus in the movement of any values – currencies, stocks, fixed income securities and other financial instruments – regardless of size and distance, dramatically reducing friction and democratizing growth Economic and prosperity.

3. Savings: Retail and wholesale banks, brokers and third-party resource administrators are the value repositories. An ordinary person uses a vault or a savings account or checking account. Large institutions use the so-called risk-free investments, such as money market funds (specialising in short-term fixed-income and low-risk applications) or U.S. Treasury bonds (T-bills). The blockchain technology is designed to replicate all these instruments in the peer-to-peer direct interchange between peers, without intermediaries.

4. Loans: Retail, commercial, and mercantile banks, alongside credit rating and risk agencies, facilitate the issuance of debt from debit cards, mortgages, private fixed income securities and municipal governments, Treasury bonds and Asset-backed securities (ABS or securitization instruments). In the blockchain, anyone can demonstrate their creditworthiness before issuing, negotiating and liquidating traditional debt instruments directly, decreasing friction and increasing transparency. Individuals and corporations will make use of rich data about themselves – verified by the blockchain – to attested to their creditworthiness. Rich data is not just big data, but larger, better and smaller data, with informed consent. Bank Sem-conta and entrepreneurs from all over the world may have access to peer loans.

5. Scholarships: Trading is the exchange of financial instruments for investment purposes, speculation, hedging and arbitrage protection. Includes post-trade clearing and settlement operations. The blockchain cuts the settlement time of transactions to minutes or seconds instead of days or weeks. This will reduce the risk of liquidation, counterparty risk and systemic risk. This efficiency also generates opportunities for Sem-conta to participate in the creation of wealth.

6. Venture Capital and investment: investment in assets or companies gives individuals the opportunity to earn a return, whether in the form of valuing capital, dividends, interest or rent. Fundraising usually requires the assistance of investment banks, venture capital investors and lawyers, to name just a few examples. The blockchain facilitates the capture between peers through globally distributed IPOs. Ethereum, a public blockchain platform based on smart hiring technology, raised USD 18 million in the first “ICO” (“Initial coin offering”, the initial blockchain currency offer) of the story and is now worth more than USD 4 billion. It’s used by dozens of Fortune 500 companies. The distributed Autonomous Organization, or DAO, caused even greater sensation by capturing USD 165 million in a globally distributed cross-pair sale (“Crowdsale”) in the mid-2016. Through the automation of pairing and the expansion of uptake on a global scale, it allows the use of more efficient, transparent and safe models for peer financing. The services will soon include the registration of dividends and the payment of coupons. In the second quarter of 2017, the volume of investment resources captured through ICOs will exceed that of the traditional venture capital investment.

7. Risk management: Risk managers try to protect people and companies from uncertain losses or catastrophes not only through hiring insurance, but also by the use of numerous derivatives created to serve as hedging against unpredictable events or Uncontrollable. With the negotiation of digital derivatives in a blockchain, counterparties and other interested ones, as regulators, will have a much clearer view of how the risk is concentrated in the system.

8. Accounting: Accounting consists of systematic registration and reporting of financial transactions. It is a multibillion-dollar industry controlled by four gigantic companies providing accounting and auditing services. However, traditional accounting practices did not accompany the speed and complexity of modern finances. The distributed ledger of the blockchain aims to make the audit activity transparent, enabling it to be done in real time and that regulators oversee financial actions within companies more easily.

9. Central banks: Consider the roles of central banks. First, they generate monetary policy through the determination of interest rates and the control of the means of payment. Secondly, they try to maintain financial stability by injecting capital into the system and acting as last-instance lenders. Finally, they help regulate and monitor the system, especially the consumer credit and savings sector. For each of these critical functions, the blockchain could act in a truly revolutionary way. Ending money in kind would reduce crime because digital money is more traceable and harder to forge than print versions. Financial regulators could visualize the internal functioning of the world’s largest financial intermediaries, from banks to accounting and auditing firms. Imagine a fully digital fiduciary currency that is based on the blockchain and that allows central banks to manage monetary policy and monitor the risk in the financial system. The advantage would be trade with less fraud, friction and leakage. “

Annex IV: CIRCULAR Oficio 11/2018 of the CVM

“Circular Craft No. 11/2018/CVM/SIN

Rio de Janeiro, September 19, 2018

To the administrators and managers of investment funds regulated by CVM Instruction No. 555/14

Subject: Indirect investment in cryptoassets by investment funds

Dear Sirs,

This circular craft has the objective of complementing the circular office CVM/SIN/n º 1/2018, which dealt with the possibility and conditions for investment in cryptoassets by the investment funds regulated by CVM Instruction No. 555.

CVM Instruction No. 555, in its arts. 98 and following, when dealing with foreign investment, authorizes indirect investment in cryptoassets through, for example, the acquisition of quotas of funds and derivatives, among other assets traded in third jurisdictions, provided that they are admitted and Regulated in those markets.

However, in fulfilling the duties imposed by the regulation, it is up to the independent administrators, managers and auditors to observe certain diligence in the acquisition of these assets.

A first one that stands out is the one already suggested by the most diverse regulators and supervisors in the world regarding the possibility of financing, directly or indirectly, of illegal operations in this market such as money laundering, practices not Performing fraudulent or price manipulation operations, among other similar practices.

In this context, and taking into account the demand for combat and prevention of money laundering imposed by CVM Instruction No. 301, we understand that an appropriate way to meet such concerns is the realization of such investments through platforms of Negotiation (“exchanges”), which are subject, in these jurisdictions, to the supervision of regulatory bodies that have recognized the powers to curb such illegal practices, through, even, the establishment of normative requirements.

While it is recommended that investments be made through these exchanges, as there is no explicit seal to which investments are made otherwise, due to their fiduciary duties administrators and managers should ensure that the structure Be able to fully meet the aforementioned legal and regulatory requirements.

Still on the subject of the normal functioning of the markets in which the cryptoassets and their derivatives are traded, it is important that the manager verify that a certain cryptoactive does not represent a fraud, as, incidentally, has been seen with great recurrence, For example, in recent ICO2 operations around the world.

Thus, it is important that the manager adopts diligence to minimize the risk of fostering the offer of a fraudulent cryptoactive, with the verification of the relevant variables associated with the issuance, management, governance and other characteristics of the cryptoactive. (…)

In the case of Representative cryptoassets, here qualified as those representing another asset, right or underlying contract, it is up to the fund manager to also evaluate other aspects arising from the risk concentration seen in the figure of the issuer of the Cryptoactive in such hypotheses, which requires a particularly rigorous due diligence on this issuer; The risk analyses naturally associated also with the asset, right or underlying contract to which the cryptoactive refers; And finally, if such a cryptoactive should be considered as a furniture value, and if so, it has possible prior registration required.

It is natural that, in the case of indirect investment made by means of investment funds constituted abroad and managed by third parties, the administrator and the manager should assess, under the conditions required by the circumstances, whether the fund manager Invested adopts risk mitigation practices and measures equivalent to those that the Investor fund manager would adopt in his/her position (…) “

[1] Bachelor of Business Administration.

Submitted: January, 2019

Approved: January, 2019